Posts

Sustainability reporting: The New Normal

/0 Comments/in Corporate Laws, Sustainability /by Vinod Kothari– Vinod Kothari and Payal Agarwal | corplaw@vinodkothari.com

Readers of financial statements get to know the performance of the company in terms of its financial accomplishments, asset values, etc. However, in a world where sustainability of business models in not very long run will be impacted by environment, climate change, social factors, etc., readers of financial statements also need to be informed about the sustainability aspects of a company’s business model.

Over time, sustainability reporting, either on voluntary basis or as a part of listed company reporting, has become a widely accepted practice, at least by large companies. A KMPG Survey of 2022 states that “rates of sustainability reporting among the world’s leading 250 companies are at an impressive 96 percent”.

While there have been various voluntary sustainability reporting standards such as GRI Standards, SASB Standards, CDP Standards, IIRF, GHG protocol etc, the most recent development in the field of sustainability reporting standards is the IFRS Sustainability Standards, prepared as a consolidation of various major sustainability reporting standards around the world. Further, various countries, mostly through the stock exchanges, have formulated their own mandatory sustainability reporting requirements in full or partial adoption of such voluntary standards.

Currently, the sheer multiplicity of standards is baffling. In mid-2019, the NYSCPA ran an article titled As Sustainability Frameworks Multiply, Navigating Them Becomes a Concern. It quoted the-then chair of IASB saying: “There are simply too many standards and initiatives in the space of sustainability reporting”. The situation is seemingly leading to some consolidation, as the various standards bodies are collaborating. However, even as of now, there is no clear sense of direction, as the requirements of mandated sustainability reporting quite often differ from those of voluntary standards such as GRI.

Read more →Getting ready to implement BRSR from FY 2022-23 (Part-II)

/0 Comments/in Corporate Laws, LODR, SEBI, Sustainability, Sustainability /by Staff- Payal Agarwal, Senior Executive, Corporate Law Division (corplaw@vinodkothari.com)

Having dealt with the detailed actionable required under each of the NGRBC principles, in our article Getting ready to implement BRSR from FY 2022-23 (Part-I), in this article, we aim at guiding the management at “how” the reporting entity needs to prepare itself for the successful BRSR implementation.

While a company prepares itself for principle-wise disclosures, the general, management and process disclosures are also very significant in terms of providing an overview of the entity’s take on ESG and sustainability.

Section A: General disclosures

This part deals with the basic details of the reporting entity, the products and services it provides, locations and markets it operates in, types of customers it serves, details of employees, board and KMP and the group structure. Part VII of this Section is of much relevance and attracts some preparatory actions on part of the reporting company.

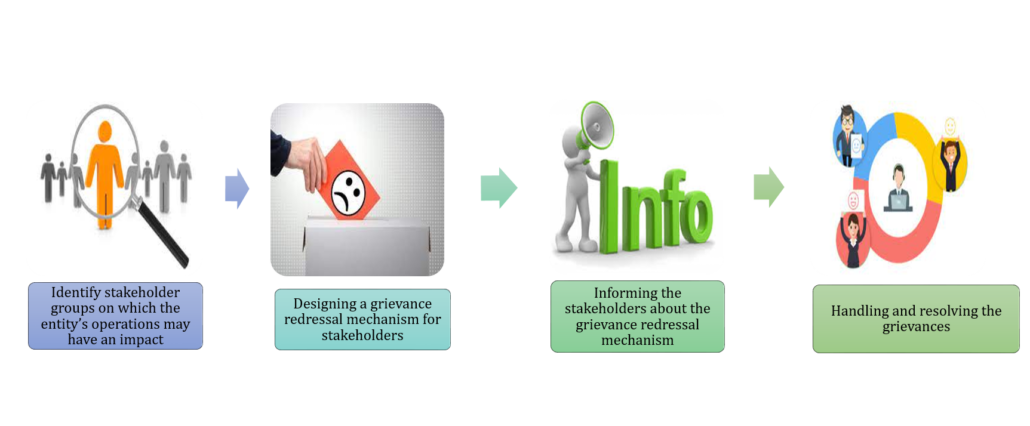

Grievance Redressal Mechanism

Clause 23 of Part VII of Section A requires disclosure on the complaints/ grievances received on any of the nine principles on which the BRSR is based. It requires a company to –

Identification of the stakeholder group

BRSR requires identification of the stakeholder group since the company is required to report on the complaints received by them. While the format lists out some stakeholder groups such as community, investors (other than shareholders), shareholders, employees and workers, customers and value chain partners, it is an inclusive list and retains scope for identification and inclusion of other stakeholder groups. The term “stakeholder” has been defined in the Guidance Note as –

Stakeholders are individuals or groups concerned or interested with or impacted by the activities of the businesses and vice-versa, now or in the future. Typically, stakeholders of a business include, but are not limited to, its investors, shareholders, employees and workers (and their families), customers, communities, value chain members and other business partners, regulators, civil society actors, and media.

| Therefore, any individual or group impacted or having the potential to be impacted by the operations of the entity at any point in time may be identified as the stakeholder group for the company. This includes government, regulators, media, NGOs, public trusts and charitable societies, apart from the direct stakeholders listed in the format itself. | ‘impact’ refers to the effect an organization has on the economy, the environment, and/or society, which in turn can indicate its contribution (positive or negative) to sustainable development.[1] |

Identification of stakeholders is particularly relevant for P4 which requires business to respect the interests of and be responsive to all stakeholders.

Meaning of community

The term community has not been defined in the Guidance Note as well as NGRBC principles. The GRI Standards Glossary defines local community to mean “persons or groups of persons living and/or working in any areas that are economically, socially or environmentally impacted (positively or negatively) by an organization’s operations.” In the context of a listed entity, people from all around the country, as well as other parts of the world where the entity operates, or receives investments from, will be included in the meaning of community and construed likewise.

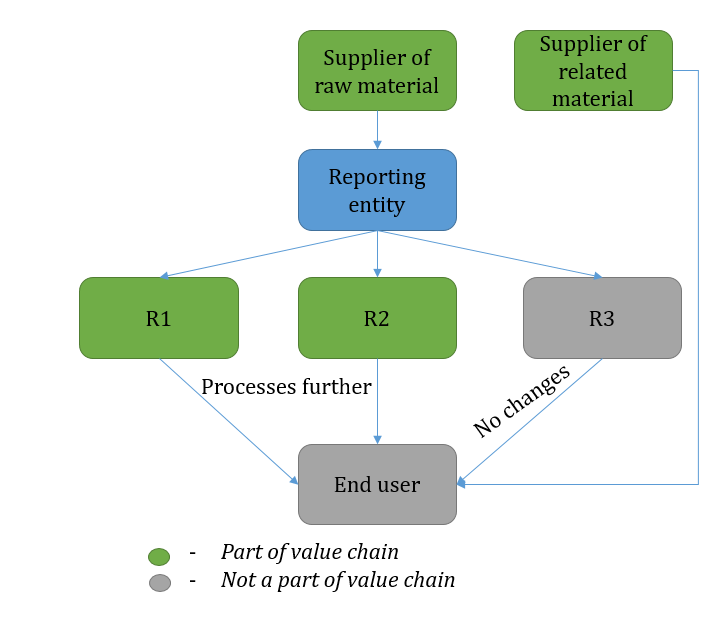

Meaning of Value Chain Partner (VCP)

[1] GRI Standards Glossary – (Page 12)

As specified in the Guidance Note –

An organization’s value chain encompasses the full range of an organization’s upstream and downstream activities that convert input into output by adding value. It includes entities with which the organization has a direct or indirect business relationship and which either –

(a) supply products or services that contribute to the organization’s own products or services, or

(b)receive products or services from the organization.

Therefore, addition of value is important for identifying an entity as a value chain partner. For example, in the case of a car manufacturing entity, the suppliers of raw materials such as steel, aluminium etc are value chain partners. Similarly, the supplier of related material such as fuel for cars, may also be identified as a VCP, considering they have a role in adding value for the ultimate user. Products manufactured by the reporting entity may further be re-processed (R1 and R2) by the recipients or be sold as such. In case no further value is added before selling it to the end user, such downstream recipient (R3) cannot be identified as a VCP.

The reference to VCP can be found under P1 (ethics, integrity and transparency), P3 (employee well-being) and P5 (human rights).

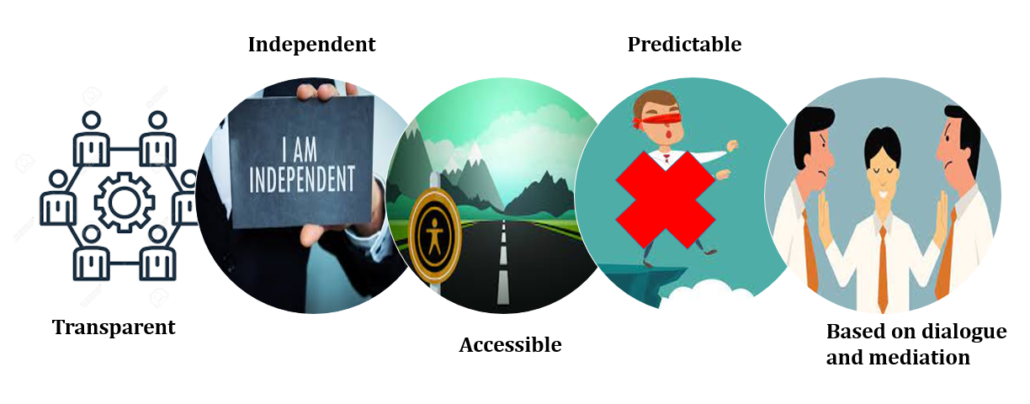

Features of grievance redressal mechanism

The NGRBC defines grievance redressal mechanism to mean, “Mechanism for any stakeholder individually or collectively to raise and resolve reasonable concerns affecting them without impeding access to other judicial or administrative remedies.”

BRSR requires reporting of grievance redressal mechanisms in respect of employees (P3), human rights concerns (P5) and community (P8).

The objective of providing a grievance redressal mechanism serves various purpose:

- to expedite the legal actions that may be taken against the wrongdoings of the reporting entity,

- to provide an opportunity to the company to be informed, understand and address the grievances of the stakeholders and take remedial action for the same.

- Lay down measures to protect the complainant against any harassment etc

Features of effective grievance redressal mechanism –

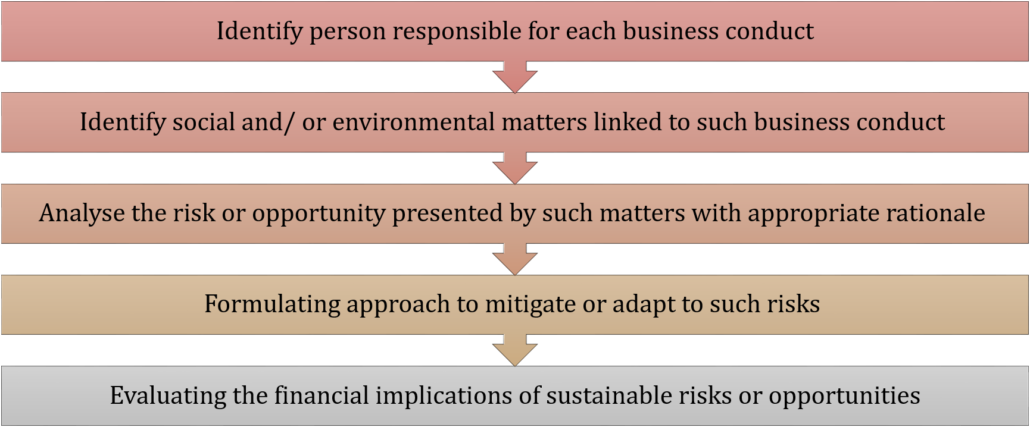

Overview of the entity’s material responsible business conduct issues

This is yet another significant clause of reporting. The reporting entity is required to indicate the material responsible business conduct of the entity, and sustainability issues pertaining to the social and environmental matters that present a risk or an opportunity to the business of the entity. In order to report on this clause, the reporting entity needs to have a well-defined system in place. It involves the following –

Section B: Management and process disclosures

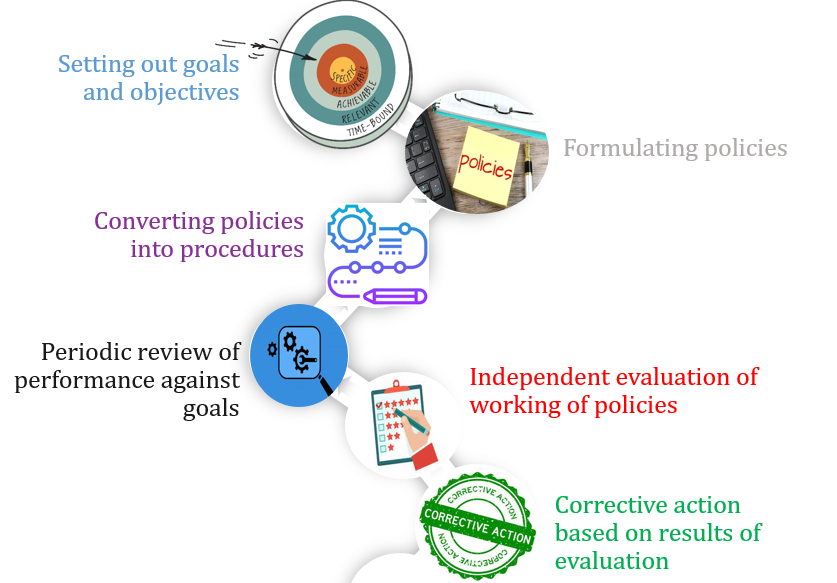

For the purpose of proper implementation of BRSR, one needs to know what is to be done, how the same has to be done and who is the ultimate authority to be reported to. Therefore, this Section aims at setting out goals and objectives, formulating policies on how the same should be achieved and converting the same into procedures, performance on stated goals and review by relevant responsible authorities. Furthermore, the performance against goals needs to be evaluated independently, and based on the “maker-checker” concept, it is always advisable to get the same evaluated by an external agency.

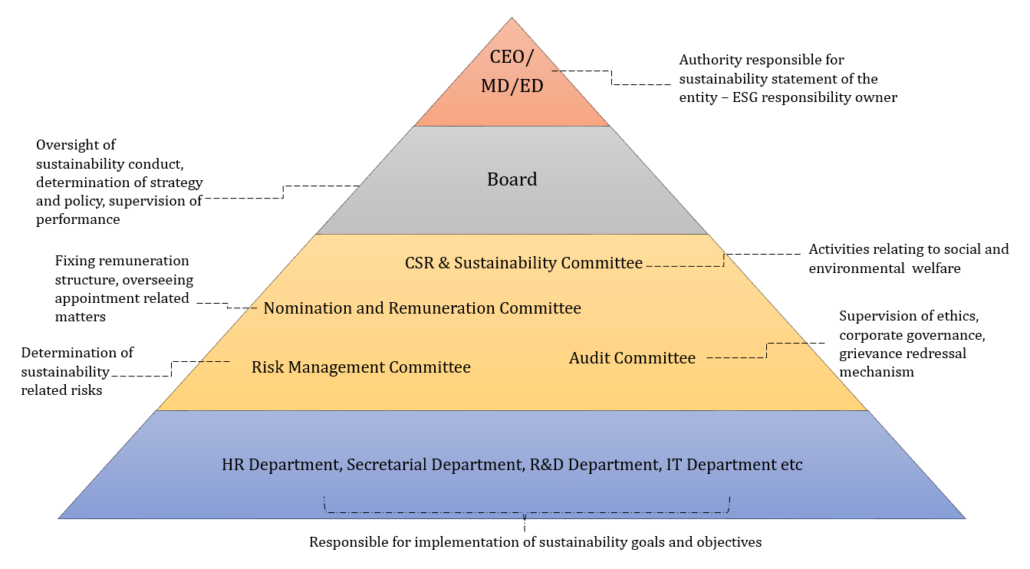

Governance of BRSR implementation

Implementing BRSR requires a comprehensive approach starting from setting up of goals and ending with review of corrective actions taken based on the assessment. While it is the call of the reporting entity to decide the governance outlook of BRSR, given below is an indicative governance structure for BRSR –

Please note that the above is, but only an indicative structure towards the BRSR governance. Companies may, on the basis of their size and nature, adopt different governance structures towards BRSR implementation and supervision.

Guiding Policies and laws relating to each principles

Section C deals with the principle-wise disclosures, dealing with each of the nine principles of NGRBCs. Below, we provide the indicative contents of the policies that a reporting entity may be required to frame and the laws relating to the theme of each of the principles. Please note that the laws are not generic and their applicability may vary on the basis of the nature of operations of the reporting entity.

| Principle 1 – Businesses should conduct and govern themselves with integrity, and in a manner that is ethical, transparent, and accountable | |

| Policy to be framed | Broad contents of the policy |

| Code of Conduct and Ethics | ● Specify the values and ethics of the company ● of the employees, workers, board and management of the company ● Define responsibilities of board ● Designate authority responsible for governance of ethical conduct and receiving complaints on same ● Ethical conduct includes respect for stakeholders, equitable treatment, fair dealings, transparency of information, exercise independent judgement ● Identification and managing potential of conflicts of interests |

| Suppliers’ Code of Conduct | |

| Anti-Corruption and Anti-Bribery Policy | ● Incidents that amount to corruption ● Zero retaliation against bribery ● Legitimate vs prohibited gifts and hospitality ● Means for reporting instances of corruption and bribery ● Actions taken against the alleged or accused |

| Code of Conduct under Insider Trading | The same is a statutory requirement under SEBI (Prohibition of Insider Trading) Regulations, 2011 |

| Whistle blower Policy | Statutory requirement in terms of Section 177 of the Companies Act, 2013 read with Regulation 18 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 |

| Laws relevant to the Principles | Compliances required to be ensured |

| The Prevention of Corruption Act, 1988 | ● Prohibition on payment of gratification to public servant ● Prohibition on taking gratification for exercise of personal influence with public servant |

| Prevention of Money Laundering Act, 2002 (‘PMLA’) | ● Identifying principal officer having access to top management for ensuring compliance with PMLA provisions ● Maintain record of potentially suspicious transactions as specified in relevant rules ● Evolving internal mechanism for proper maintenance and preservation of records and quick retrieval of data ● Formulate and review at regular intervals, policies and procedures on prevention of money-laundering and terrorist financing |

| The Companies Act, 2013 | ● Obtaining requisite approvals before entering into Related Party Transactions ● Obtaining requisite approvals before entering into contracts/ arrangements in which the director is interested ● Establishment of vigil mechanism to enable people to report genuine concerns before audit committee |

| SEBI (Prohibition of Insider Trading) Regulations, 2011 | ● Prohibition of trading on the basis of unpublished price sensitive information ● Fair disclosure of information by Designated Persons and insiders |

| Principle 2- Business should provide goods and services in a manner that is sustainable and safe. | |

| Policy to be framed | Broad contents of the policy |

| Responsible Sourcing Policy | ● Ensuring sustainable utilization of natural resources ● Complying with all applicable regulatory requirements pertaining to the products and/ or services ● Identify, assess and incorporate environmental and social considerations in product/ service development ● Encourage minimum/ no use of non renewable natural resources ● Encourage minimum/ no use of hazardous or toxic substances ● Implementation of Extended Producer Responsibility, wherever possible for buyback of non-degradable components of products |

| Laws relevant to the Principles | Compliances required to be ensured |

| Environment(Protection) Act, 1986 | ● Monitoring pollution discharge in excess of prescribed limits ● Comply with procedural safeguards in handling of hazardous substance |

| Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016 | ● Ensuring proper treatment and disposal of the hazardous waste generated in the establishment ● Holding valid authorisation (application/renewal) for handling such hazardous and other wastes ● Maintenance of proper records for hazardous and other wastes stored |

| E-waste (Management and Handling) Rules, 2016[2] | ● Plan for management of the equipment after its end of life ● Designing an appropriate collection or product take back system such that it facilitates channelization of EWaste for environmentally sound management ● Creating awareness about the product offered in the market ● Publicize and periodically update the contact details of the authorized collection centers and collection points or their collection mechanism |

| Principle 3 – Businesses should respect and promote the well-being of all employees, including those in their value chains. | |

| Policy to be framed | Broad contents of the policy |

| Employee Rights Policy | ● Respect and recognition for employee rights ● Provision for parental leave ● Periodic training and skill development ● Consideration of occupational health and safety of workers and employees ● Criteria for payment of remuneration Observing practice of non-discrimination and harrasment |

| Equal Opportunity Policy | Statutory requirement under Section 21 of the Rights of Persons with Disabilities Act, 2016[3]. It broadly covers the manner of appointment, provision of assistance and facilities provided to persons with disability |

| Prevention of Sexual Harrassment at Workplace Policy | Statutory requirement in terms of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 |

| Laws relevant to the Principles | Compliances required to be ensured |

| Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 | ● Constitution of Internal Complaints Committee ● Rendering assistance to the aggrieved making the complaint ● Filing a report with the findings of the inquiry and taking necessary action ● Abiding by the minimum duties of employer as prescribed therein |

| Public Liability Insurance Act, 1991 | ● Obtaining insurance policies of specified value before handling any hazardous substances ● Ensuring timely renewal of the insurance policies taken ● Make timely payment of the insurance premium |

| Workmen’s Compensation Act, 1923 | ● Payment of compensation in case of work related injuries ● Maintenance of records for settlement of compensation in periodic payments by way of an agreement |

| Children (Pledging of Labour) Act, 1933 | ● Prohibition on employment of a child by way of pledge of labour |

| Industrial Employment (Standing Orders) Act, 1946 | ● Submission of draft standing orders (related to working conditions) ● Publication of certified standing order in the industrial establishment in languages known to workmen ● Maintenance of register of certified standing orders ● Payment of subsistence allowance in case of suspension of a workman pending investigation or inquiry |

| Payment of Wages Act, 1936 | ● Designate a person responsible for payment of wages ● Periodic payment wages within stipulated time ● Monitor that only authorised deductions are made from the wages ● Maintenance of registers and records of persons employed, the work performed by them, the wages paid to them, the deductions made from their wages, the receipts given by them and such other particulars |

| Minimum Wages Act, 1948 | ● Payment of wages to every employee engaged in a scheduled employment under him wages at a rate not less than the minimum rate of wages as prescribed ● Maintenance of registers and records giving such particulars of employees employed by him, the work performed by them, the wages paid to them, the receipts given by them and such other particulars |

| Employees Provident Fund and Miscellaneous Provisions Act, 1952 | ● Contribution of the prescribed amount to the provident fund established ● Contribution to the Deposit-linked Insurance Fund in pursuance of the Insurance Scheme as applicable |

| Maternity Benefits Act, 1961 | ● Payment of maternity benefit at the prescribed rate of average daily wages ● Prohibition of employment of a woman during the six weeks immediately following the day of her delivery or her miscarriage ● Prohibition of imposing any work which is of an arduous nature or which involves long hours of standing or which in any way is likely to interfere with the pregnancy or the normal development of the foetus, or is likely to cause miscarriage or otherwise to adversely affect the health of a woman who has made a request in this regard |

| Payment of Bonus Act, 1965 | ● Payment of minimum bonus at the prescribed rate of salary or wage earned by the employee |

| Contract Labour (Regulation & Abolition) Act, 1970 | ● Registration of establishment employing contract labour ● Appointment of representative to be present at the time of disbursement of wages by the contractor ● Display of notices in the prescribed form containing particulars about the hours of work, nature of duty and such other information |

| Payment of Gratuity Act,1972 | ● Payment of gratuity at the prescribed rate of wages based on the wages last drawn by the employee ● Obtaining insurance in the manner prescribed, for his liability for payment towards the gratuity under the Act |

| Bonded Labour System (Abolition) Act, 1976 | ● Prohibition on acceptance of any bonded debt from bonded labourer |

| Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act,1979 | ● Prohibition on employment of an inter-State migrant workmen unless registration certificate has been established ● Appointment of representative to be present at the time of disbursement of wages by the contractor |

| Child Labour (Prohibition & Regulation) Act, 1986 | ● Prohibition on employment of child except for some specified purposes ● Prohibition on employment of adolescents to hazardous processes ● Designing working hours and days in compliance with the requirements under the Act ● Compliance with rules relating to health and safety in workplace |

| Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act,1996 | ● Fixation of working hours in compliance with the provisions ● Provision for overtime wages ● Exhibit notice containing particulars of working hours and overtime wages in working areas ● Prohibition on employment of persons with disabilities in places that involve risk of accident for him/ her ● Maintenance of register of workers employed, hours worked, wages paid etc |

| Rights of Persons with Disabilities Act, 2016 | ● Prohibition on discrimination on grounds of disability, unless legitimate cause shown ● Maintenance of records of persons with disabilities employed in the entity ● Observance of accessibility norms in the infrastructure of the premises |

| Principle 4- Businesses should respect the interests of and be responsive to all its stakeholders. | |

| Policy to be framed | Broad contents of the policy |

| Stakeholder Engagement Policy | ● Means of identifying stakeholder relevant to the operations and structure of the entity ● Understanding and addressing genuine concerns of the stakeholders ● Engaging with the stakeholders in a responsible manner |

| Laws relevant to the Principles | Compliances required to be ensured |

| Public Liability Insurance Act, 1961 | Refer under Principle 3 |

| Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 | ● Preparation of Social Impact Assessment study in consultation with appropriate government ● Obtaining approvals from Government for proposed land acquisition ● Providing public notice to enable them to raise objections and/ or register claims ● Prohibition on acquisition of multi-crop irrigated land except under exceptional circumstances ● Compliance of conditions specified in the Rehabilitation and Resettlement Award |

| The Scheduled Castes And The Scheduled Tribes (Prevention Of Atrocities) Act, 1989 | ● Prohibition on discrimination and harrassment to any person who is a member of Scheduled Caste or Scheduled Tribe |

| Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 | Refer under Principle 3 |

| Principle 5- Businesses should respect and promote human rights | |

| Policy to be framed | Broad contents of the policy |

| Human Rights Policy | ● Human rights recognised by the entity[1] ● Grievance mechanisms for addressing concerns on human rights ● Consequences of breach of human rights policy |

| Laws relevant to the Principles | Compliances required to be ensured |

| All laws relating to Principle 3 (Employee well-being) and Principle 4 (Stakeholder Engagement) |

| Principle 6- Businesses should respect and make efforts to protect and restore the environment | |

| Policy to be framed | Broad contents of the policy |

| Environmental Policy | ● Adopting best practices in its operations in an environmentally conducive manner ● Conduct environmental impact assessment study periodically ● Maintenance of proper compliance with applicable environmental laws ● Monitoring use of carbon in operations ● Minimisation of use of carbon-intensive technology ● Setting of objectives and goals towards climate change |

| Laws relevant to the Principles | Compliances required to be ensured |

| Environment(Protection) Act, 1986 | Refer under Principle 2 |

| Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016 | |

| E-waste (Management), Rules, 2016 | |

| Public Liability Insurance Act, 1991 | Refer under Principle 3 |

| Biological Diversity Act 2002 | ● Prohibition on obtaining biological resource for research or commercial utilisation etc without approval of National Biodiversity Authority (‘Authority’) ● Restriction on application for Intellectual Property Rights without requisite approvals from Authority Prior intimation to Authority for use/ research etc on biological resource where prior approval is not required |

| Wildlife Protection Act, 1972 | ● Prohibition on hunting of specified wild animals ● Holding valid permit for hunting of wild animals ● Prohibition on dealing in specified plants in any manner ● Holding valid permit for dealing in such plants for purposes such as education, scientific research etc ● Prohibition on cultivation of specified plants |

| Water (Prevention and Control of Pollution) Act, 1974 | ● Restriction on new establishments resulting in new discharge of sewage ● Access to government officer for periodic assessment of existing sewage and discharge of effluents |

| Water (Prevention and Control of Pollution) Cess Act, 1977 | ● Payment of cess for use of water in the operations and industries |

| Air (Prevention and Control of Pollution) Act, 1981 | ● Identifying whether any industrial plant is/ proposed to be set up in air pollution control area ● Obtaining permission before establishment of industrial plant in air pollution control area ● Prohibition on emission of air pollutant in air pollution control area |

| National Environment Tribunal Act, 1995 | ● Liability to pay compensation in case of death of, or injury to, any person (other than a workman) or damage to any property or environment has resulted from an accident as specified in the Schedule thereto |

| Energy Conservation Act, 2001 | ● Ensuring that the equipment or appliances that consume, generates, transmits or supply energy is in line with the energy consumption standards ● Ensure display of specified particulars on the label on such equipment or appliance ● Get energy audit conducted by the accredited energy auditor ● Appoint energy manager with such qualification as prescribed ● Arrange and organise training of personnel and specialists in the techniques for efficient use of energy and its conservation |

| Principle 7 – Businesses, when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent | |

| Policy to be framed | Broad contents of the policy |

| Policy on Responsible Advocacy | ● Recognise the values and principles advocated by the entity ● Identify the means of advocacy ● Adopting a collaborative approach in influencing public ● Designate authorities responsible to oversee implementation of the Policy |

| Fair Competition Policy | ● Define fair competition vs anti-competition Pledge not to indulge in anti-competitive practices ● Define fair competition vs anti-competition ● Pledge not to indulge in anti-competitive practices ● Consequences upon persons found to be indulged in anti-competitive practices ● Incidents that amount to abuse of dominant position |

| Laws relevant to the Principles | Compliances required to be ensured |

| Competition Act, 2002 | ● Identify whether any contract/ arrangement entered into by the company involves an appreciable adverse impact on the fair competition ● Obtain appropriate approvals before entering into any combination arrangements ● Do not indulge in activities that amount to abuse of dominant position or anti-competitive practices |

| All laws relating to Principle 3 (Employee well-being) and Principle 4 (Stakeholder Engagement) |

| Principle 8 – Business should promote inclusive growth and equitable development | |

| Policy to be framed | Broad contents of the policy |

| Inclusion & Diversity Policy | ● Recognition of diversity in workplace ● Meaning of inclusion and diversity in the context of the reporting entity ● Approach of the entity towards ensuring diversity ● Ways adopted to promote inclusion of diversity in workforce ● Extent of inclusion and diversity – does it extends to value chain etc ● Providing accessibility to all in absence of any valid reasons behind restricting the same |

| Preferential Procurement Policy | ● Give preference to small producers, farmers, MSME etc ● Allocating a percentage of raw materials to be sources from such suppliers ● Manner and responsibility of persons reviewing actual procurement against budgeted allocation |

| Corporate Social Responsibility Policy | Statutory requirement under Section 135 of the Companies Act, 2013 |

| Laws relevant to the Principles | Compliances required to be ensured |

| Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 | Refer under Principle 4 |

| The Scheduled Castes And The Scheduled Tribes (Prevention Of Atrocities) Act, 1989 | |

| Public Liability Insurance Act, 1991 | Refer under Principle 3 |

| Biological Diversity Act 2002 | Refer under Principle 6 |

| Essential Commodities Act, 1955 | ● Dealing with essential commodities only with a valid permit from Government ● Dealing with essential commodities at prices fixed by Government ● Abstain from withholding supply of essential commodities |

| The Companies Act, 2013 | Spending on projects and activities in line with Schedule VII for the benefit of one or more classes of the society |

| Principle 9 – Businesses should engage with and provide value to their consumers in a responsible manner | |

| Policy to be framed | Broad contents of the policy |

| Cyber Security and Data Privacy Policy | ● Define legitimate use vs misuse of information ● Ensure proper access and usage of information ● Prevent misuse of information ● Maintain confidentiality of personal information of clients, suppliers, consumers and employees ● Undertaking that any information shared can be done only with prior consent of the concerned ● Policy for non-retention of personal information beyond specified use |

| Laws relevant to the Principles | Compliances required to be ensured |

| Consumer Protection Act | ● Prohibition of unfair trade practice and/or restrictive trade practice ● Removal of defect/ replacement of defective goods ● Abstain/ discontinue offering hazardous goods for sale ● Payment of adequate compensation against the damage caused due to the products/ services of the entity |

| Competition Act, 2002 | Refer under Principle 7 |

| Consumer Protection (E-Commerce) Rules, 2020 | ● Appointment of nodal officer to ensure compliance with applicable laws and regulations ● Abstain from adoption of any unfair trade practice ● Establish and maintain grievance redressal mechanism ● Abstain from any sort of price manipulation, discrimination among consumers ● Display of necessary information prominently such as contact details, location, payment modes etc ● Ensure that all advertisements are consistent with the actual characteristics of the products/ services |

| Food Safety and Standards (Packaging and labelling) Regulations, 2011 | ● Minimum information required to be specified in the label of pre-packaged products ● Use of specified types of containers for various pre-packaged products |

| Recycled Plastics Manufacture and Usage Rules, 1999 | ● Recycling of plastic products in line with the prescribed standards ● Abstain from using single-use plastics ● Appropriate marking/ codification of the plastic products used |

Concluding Remarks

It is apparent that the reporting entities need to ensure that a lot of policies, processes and systems are in place in order to demonstrate a positive ESG position. While it seems to be a very rigorous exercise, companies making to the top in the country in respect of their ESG conduct should already be having much of it in place. For them, BRSR will give a way to demonstrate their commitment towards ESG and their responsible business practices. Considering the growing importance given to the adoption of NGRBC principles across the group entities and value chain partners, the impact of implementing BRSR will not fall only on the top 1000 listed entities on which the same is applicable, but extends far beyond the legal scope.

[1] GRI Standards Glossary – (Page 12)

[2] These rules shall apply to every producer, consumer or bulk consumer, collection centre, dismantler and recycler of e-waste involved in the manufacture, sale, purchase and processing of electrical and electronic equipment or components

[3] Rule 6(3) of the Rights of Persons with Disabilities Rules, 2017 specifies the following information to be made part of the Policy –

(3) The equal opportunity policy of a private establishment having twenty or more employees and the Government establishments shall inter alia, contain the following, namely:-

(a) facility and amenity to be provided to the persons with disabilities to enable them to effectively discharge

their duties in the establishment;

(b) list of posts identified suitable for persons with disabilities in the establishment;

(c) the manner of selection of persons with disabilities for various posts, post-recruitment and pre-promotion

training, preference in transfer and posting, special leave, preference in allotment of residential accommodation if any, and other facilities;

(d) provisions for assistive devices, barrier-free accessibility and other provisions for persons with disabilities;

(e) appointment of liaison officer by the establishment to look after the recruitment of persons with disabilities and provisions of facilities and amenities for such employees.

(4) The equal opportunity policy of the private establishment having less than twenty employees shall contain facilities and amenities to be provided to the persons with disabilities to enable them to effectively discharge their duties in the establishment.

[4] Minimum components of human rights should include rights as specified under the Constitution of India, International Bill on Human Rights, United Nations Guiding Principles for Business and Human Rights

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

Getting ready to implement BRSR from FY 2022-23 (Part-I)

/3 Comments/in Corporate Laws, LODR, SEBI, Sustainability, Sustainability /by Staff- Team Vinod Kothari & Company, Corporate Law Division (corplaw@vinodkothari.com)

Business Responsibility & Sustainability Reporting (‘BRSR’), which was voluntary as a part of the regulatory provisions for the top 1000 listed entities (by market capitalization) for FY 2021 – 22, is now all set to become mandatory from FY 2022–23 onwards. BRSR is intended to serve as a single focal point for all non-financial disclosures relating to the company that will enable the stakeholders to understand the approach of the company on different issues such as sustainability, responsible business conduct, manner of dealing with stakeholders, etc. With only a few weeks left for the onset of FY 22-23, it is time for companies to get into immediate action, as there is evidently a lot of work to be done.

Based on the nine principles of National Guidelines on Responsible Business Conduct (‘NGRBCs’), BRSR in the real sense is actually an expanded and improved version to the existing BRR format. Our article on the additional cartload of details in BRSR as compared to BRR had given a firsthand of the additionalities involved in moving to BRSR. Although based on the same principles, BRSR is much more comprehensive as compared to its former counterpart. . Further, it is notable that as one of the universally accepted sustainability standards, Global Reporting Initiative Standards (‘GRI Standards’) can be closely referred for the enhanced requirements under BRSR and therefore, serve as a guidance for reporting under BRSR.

Having understood that the set-up of the overall framework for the reporting requirements under BRSR is likely to be a challenge to the corporates, this article has been prepared to aid in understanding the additional requirements as well as adopt an appropriate approach for preparing the same. This write up contains an inclusive guidance from the GRI Standards as well as several actionables. We have another comprehensive article dealing with the MCA recommendations on making BRR a fully loaded electronic form.

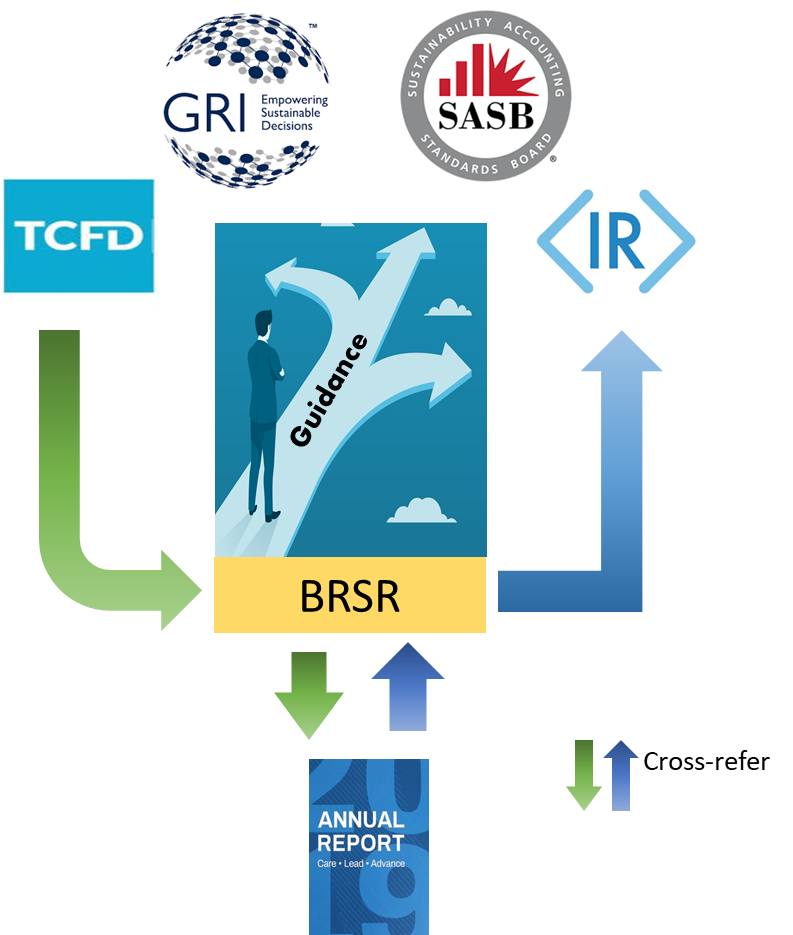

Interoperability of reporting and sector specific issues:

There are some entities which may have adopted various international sustainability reporting standards such as GRI, SASB, Integrated Reporting etc. To avoid repetition of information, SEBI vide its Guidance note has clarified that the reporting entities may provide a cross-referencing of the disclosures made by it based on the internationally accepted framework while making the relevant disclosures under the BRSR format. Also, for that matter if the required information has been disclosed in the annual report, cross reference to the same can also be provided.

Further, there might be disclosures under the BRSR format which are irrelevant for companies operating under specific sectors. In order to address such issues, it has been clarified by SEBI that the format of BRSR is generic and hence it is absolutely possible that some of the disclosures provided in the BRSR format may not be relevant to an entity belonging to a particular sector. In such a case, the entity may mention that the disclosure is not applicable along-with reasons for the same.

Guiding through the principle-wise disclosures

BRSR is a notable extension of BRR which provides not just for quantitative but also qualitative disclosures. The disclosure requirements under BRSR and its format is expected to bring in more standardization which in turn will help in effective comparability across companies.

Further, the disclosures provided under BRSR bear a close resemblance to the GRI standards and hence, the guidance for reporting under various criteria provided in the BRSR format can be taken from the relevant GRI standards as and when required.

The principle-wise guidance from GRI and additional actionable involved under BRSR are discussed below:

Principle 1: Business conduct to be ethical, transparent and accountable

Owing to heightened scrutiny from investors regarding corporate governance practices in an organization, it is imperative that business houses conduct their operations in a transparent manner and redress grievances of stakeholders, if any. The first principle under the BRSR reporting regime is based on the above premise and requires companies to report on such practices.

| Actionable involved under BRSR |

| Training and awareness programmes 1. Conducting training and awareness programmes for directors/KMPs/employees/workers ( ‘Participants’) ● Reviewing the manner for imparting training to each category of the Participant. ● Identification of codes and policies to be framed or updated for training purposes. Penalties and Fines 2. Providing details of fines / penalties /punishment/ award/ compounding fees/ settlement amount paid in proceedings by the entity or by directors / KMPs in the financial year. 3. Providing details of appeal/ revision preferred in cases where monetary or non-monetary action has been appealed ● Identification of laws under which the fine/ penalty/ awarded/ compounding fees etc. are to be considered under point (2) ● Fixation of thumb rule for ascertaining the specific cases under the above which requires reporting in terms of being material under Regulation 30 of the Listing Regulations. Framework for Anti-Bribery Cases (‘ABC’) 4. Forming an anti-corruption/anti-bribery policy. The disclosure on the anti-corruption or anti-bribery policy may include the following: ● Set -up or review of the risk assessment procedures and internal controls ■ Mechanism to deal with complaints on bribery / corruption ■ Coverage of trainings on anti-corruption issues ● Providing details of number of Directors/KMPs/employees/workers against whom disciplinary action was taken by any law enforcement agency for the charges of bribery/ corruption. ■ Bifurcation of the roles and responsibility of the officers of the company in case of identification and dealing with ABC Conflicts of Interest 5. Providing details of number of complaints received in relation to issues of Conflict of Interest of the Directors/KMPs ● Identifying the level of conflict of interest that requires reporting ● Defining conflict of interest at each reportable level 6. Providing details of any corrective action taken or underway on issues related to fines / penalties / action taken by regulators/ law enforcement agencies/ judicial institutions, on cases of corruption and conflicts of interest Value Chain Partners (‘VCPs’) 7. Conducting awareness programmes for value chain partners (‘VCPs’) with respect to any of the nine principles. ● Identifying and defining VCPs ● Framing policies and framework for efficient communication with them 8. Defining the processes undertaken for managing conflict of interest involving Board members. |

| Taking guidance from GRI in implementation |

| 1. Description of reporting entity’s values, principles, standards, and norms of behaviour. 2. Training on identified ethics to new and existing governance body, workers and business partners 3. Responsibility of executive-level positions and highest level of governance body. 4. Use of internal and external mechanisms for seeking advice on ethical behaviour and reporting concerns on adverse behaviour. (i) Availability and accessibility of the mechanisms and independence of same 5. Presence of a non-retaliation policy towards unethical behaviour and corruption. 6. Identifying incidents of corruption – meaning and impact. 7. Procedure and criteria of risk-assessment for corruption and significant risks identified. 8. Business operations that have been assessed for risk of corruption. 9. Extent and stage of training and communication on anti-corruption. 10. Collective action taken to combat corruption like proactive collaboration with peers, governments and the wider public sector, trade unions and civil society organizations. 11. Designing board structure and employee-incentives in a manner to avoid adverse instances of conflict of interest. |

Principle 2: Goods and services to be safe and sustainable

Owing to an increase in demand from consumers for sustainable and safe products, it has become important for companies to incorporate such sustainability practices while designing and manufacturing their products. Principle 2 on BRSR mandates certain disclosure requirements from companies with an aim of ensuring that they are responsive to such requirements.

| Actionables involved under BRSR |

| R&D for improvement of product-related impact on the environment 1. Apportioning a percentage of the R&D budget and capital expenditure investments towards improving the environmental and social impacts of the company’s products. ● Categorizing the products of the company with respect to the probable impact to the society and the environment ● Formulate a policy for measuring and mitigating the negative impact of the company’s products, if any, on the environment and the society at large. ● Fixation of the budget for R&D including the extent, manner, and other modalities for conducting such R&D (including capex). Sustainable sourcing of inputs and reclamation of products 2. Sustainable sourcing of inputs for production. ● Identifying the sustainable sourcing of inputs ● Segregate the products obtained sustainably and otherwise for the purpose of reporting. 3. Processes undertaken for reclaiming products for reusing, recycling and disposing at the end of life. ● Identification of the products that require reclamation exercise by the Company ● Devising the framework for reclaiming products and its management. ● Quantity of reclaimed products that has been reused, recycled and safely disposed of. ● Bifurcate the products reclaimed into different pre-formed categories for ease of reporting. ● Quantity of the products/ packaging material that has been reclaimed as percentage of products sold. EPR[1] 4. Submission of waste collection plan to the Pollution Control Board if Extended Producer Responsibility (‘EPR”) is applicable to the company. ● Identify whether EPR is applicable to the reporting entity. ● Formulation of waste collection plan. Life Cycle Assessment (‘LCA’) 5. Conducting LCA. ● Decide the product line as well as level upto which LCA shall be conducted. 6. Social or environmental concerns arising from the production/ disposal of the products. ● Actions to be taken to address the concerns based on the outcome of assessment conducted in (5). 7. Disclosure of the use of recycled input material used to the total material used in production. ● Setting up the procedures for collecting data from each factory outlet on the quantum of recycled inputs used |

| Taking guidance from GRI in implementation |

| 1. While compiling the information to be reported, the entity shall use the total weight or volume of materials. 2. Exclusion of rejects and recalls of products while compiling information to be disclosed. 3. The processes used to collect and monitor waste-related data. 4. Recycling or reusing of products may be separately disclosed. 5. Recycling of input materials for manufacturing primary products. |

Principle 3: Well-being of employees and employees of value chains

It is a well-recognized fact that employees are a vital part of any business organization. In line with this, the BRSR framework also covers disclosing the welfare and well-being of the employees and VCPs via Principle 3.

| Actionable under BRSR |

| Well-being of employees and workers 1. Measures taken for the well-being of employees and workers. ● Identifying the policies to be framed (Such policies can include health/medical/accident insurance, maternity/paternity benefits, day care facilities etc.) Providing details of retirement benefits provided to employees/workers for the current and the previous financial year. ● Identify the applicable laws on the entity for providing retirement benefits. Plant and office assessment 2. Ensuring that the premises/offices of the entity are accessible to differently abled employees and workers ● Identify the steps to be taken for making the premise of the entity accessible to differently abled workers and employees. This may include wheelchair ramps, signage braille etc. 4. Forming an equal opportunity policy as per Right of Persons with Disabilities Act, 2016. 5. Providing details of Return to work and Retention rates of permanent employees and workers that took parental leave. 6. Forming a mechanism to receive and redress grievances for permanent and other employees and permanent and other workers. 7. Providing details of membership of employees and worker in association(s) or Unions recognised by the company 8. Providing training to employees and workers on health & safety measures and skill upgradation. 9. Conducting performance and career development reviews of employees and workers. ● Deciding the frequency of such reviews. 10. Implementing a health and safety management system ● Laying down processes to be undertaken for identifying work-related hazards and assessing risks on a routine basis. ● Laying down processes for reporting work related hazards for workers. ● Providing access to non-occupational medical and healthcare services to employees and workers 11. Providing details of safety related incidents that occurred in the current as well as previous financial year. 12. Implementing measures to ensure a safe and healthy workplace 13. Providing details of complaints made by employees and workers on working conditions and health & safety. ● Appointment of person/ committee (‘authority’) for looking into the complaints received. ● Action taken by the authority on the complaints received. 14. Conducting assessments on whether the plants and offices of the company and reporting on the following metrics: ● Health and safety practices ● Working conditions ● Appoint the person who is to conduct the assessment (it can be carried out by the company/statutory authority/third party). 15. Providing details of any corrective action taken or underway to address safety-related incidents. 16. Extending life insurance or compensatory package in the event of death of employees or workers. 17. Providing details of the number of employees / workers having suffered high consequence work related injury / ill-health / fatalities, who have been rehabilitated and placed in suitable employment or whose family members have been placed in suitable employment. 18. Providing transition assistance programs to facilitate continued employability and the management of career endings resulting from retirement or termination of employment. ● Formulation of the program based on the requirements of the reporting entity. ● Decide the frequency of such programs. Well-being of VCPs 19. Implementing measures to ensure that statutory dues have been deducted and deposited by the value chain partners. 20. Conducting assessment of value chain partners with respect to the following : ● Health and safety practices ● Working conditions 21. Providing details of any corrective actions taken or underway to address significant risks / concerns arising from assessments of health and safety practices and working conditions of value chain partners. |

| Taking guidance from GRI in implementation |

| 1. Performance and career development review based on criteria known to the employees and superiors. 2. Grievance Mechanisms can be industry, multi-stakeholder or other collaborative initiatives. 3. Describing type of occupational health and safety professionals responsible for the management system. 4. Defining worker and benefit for the purpose of this principle 5. Formula to calculate return rate and retention rate 6. Contents of Transition assistance programs provided to support employees who are retiring or who have been terminated 7. Definition of value chain 8. Definition of high consequence work related injury |

Principle 4: Responsiveness to Stakeholders’ interests

The stakeholder group of a company is diverse and large. Each stakeholder has a different expectation from the company. It is important for companies to take the interests of all stakeholders into consideration while simultaneously pursuing its business objectives of growth and development. Principle 4 of BRSR asks companies to report about their stakeholders and the engagement practices with such stakeholders.

| Actionable under BRSR |

| Identifying stakeholders, key stakeholders and marginalized stakeholders 1. Process for identification of key stakeholders. ● Stakeholders include investors, shareholders, employees and workers (and their families), customers, communities, value chain members and other business partners, regulators, civil society actors, and media. ● Basis of determining the stakeholders of the entity. ● Based on the total number of stakeholders identified, categorize it into the groups to identify with whom to engage and not to engage. ● Understanding the level of and extent of engagement required with each category of stakeholder. 2. Listing of the stakeholders identified as key stakeholders. ● Identify whether the stakeholder is identified as a vulnerable/marginalized group. ● Establishing the channels for communication with stakeholders. 3. Providing the processes for consultation between stakeholders and the Board on economic, environmental and social topics. ● Formulation of process for providing feedback obtained to the Board. 4. Laying down the framework for incorporating the inputs obtained in (3) in formulation of policies. ● Identify the arrangements necessary for addressing the concerns. 5. Identify the arrangements necessary for addressing the concerns of vulnerable/ marginalized stakeholders. |

| Taking guidance from GRI in implementation |

| 1. Definition of stakeholders 2. Principles for effective stakeholder consultation ● Aligning with international standards ● Collective bargaining, ● Genuine consultation involves proper dialogue between parties ● Affected parties to understand the impact of change. 3. Definition of vulnerable/marginalized groups |

Principle 5: Promotion of Human Rights

It is quite common for companies to indulge in abusive practices, leading to exploitation of workers. While it is seemingly difficult for even the strictest of regulations to put a complete end to such abusive practices, the regulators’ approach has been that of requiring companies to report on the practices adopted by them to curb such violations and the remedy provided to employees who report such instances of human rights issues at the workplace. The new BRSR framework aims to mandate certain additional disclosures to ensure that companies respect and properly report on their human rights practices.

| Actionable under BRSR |

| Training and awareness on human rights issue 1. Providing training to employees/workers on human rights issues and policies of the company 2. Providing details of minimum wages paid to employees and workers. ● Computation of the minimum wages to be paid as per the provisions of Labour Code. 3. Providing details of salary/remuneration/wages paid to directors/KMPs/employees/workers ● Computation of median salary/remuneration/wage paid for the purpose of reporting. 4.Constituting a focal point (Individual/ Committee) responsible for addressing human rights impacts or issues caused or contributed to by the entity in conducting its business. Internal mechanism to combat human rights concerns 5. Implementing an internal mechanism to redress grievances related to human rights issues. ● Identifying the relevant laws under which the human rights concern can be raised ● Taking preventive actions under respective departments 6. Providing details on the number of complaints made by employees/workers during the year and pending resolution as at the end of the year for the current financial year and the previous financial year wrt the following issues: ● Sexual Harassment ● Discrimination at workplace ● Child Labour ● Forced Labour/Involuntary Labour ● Wages ● Other human rights related issues 7. Implementing mechanisms to prevent adverse consequences to the complainant in discrimination and harassment cases. ● Familiarization of the workforce on the protective policies available in the company to protect them against harassment and discrimination 8. Incorporating human rights requirements as part of the business agreements/contracts 9. Providing details on the % of plants and offices of the company that were assessed for : ● Child labour ● Forced/involuntary labour ● Sexual harassment ● Discrimination at workplace ● Wages ● Others 10. Providing details of any corrective actions taken or underway to address significant risks / concerns arising from the assessments at point 9 above 11. Providing details of a business process being modified / introduced as a result of addressing human rights grievances/complaints. 12. Conducting human rights due diligence ● Identifying the scope and coverage of such due diligence 13. Ensuring that the office/premises of the company are accessible to differently abled visitors ● Identifying the requirements for such visitors as given in the Rights of Persons with Disabilities Act, 2016 14. Conducting assessment of VCPs on the following issues: ● Sexual Harassment ● Discrimination at workplace ● Child Labour ● Forced Labour/Involuntary Labour ● Wages ● Others 15. Providing details of any corrective actions taken or underway to address significant risks / concerns arising from the assessments at point 14 above. |

| Taking guidance from GRI in implementation |

| 1. Reporting entities should also provide additional information about its values, principles, standards, and norms of behavior. 2. Total hours during the reporting period devoted to training on human rights policies. 3. Training of employees for making them aware of human rights. 4. Employees of third- party organisations who have also been included in calculation of the total employees trained during the reporting period. 5. Total contracts that include human rights clauses. 6. Operations of the entity that has undergone human rights impact assessment. 7. Suppliers assessed for social impacts. 8. Social impacts identified in the supply chain. |

Principle 6: Protection and restoration of environment

Considering the ever growing concerns around issues such as climate change and sustainable use of resources, it has become imperative for companies to factor in such concerns in the way they operate and plan for the future. Principle 6 aims to ensure that companies are transparent about their sustainability practices and make adequate disclosures on their usage of the shared natural resources.

| Actionable under BRSR |

| Energy consumption data 1. Computing total energy consumption and total energy intensity of the company in the current financial year and the previous financial year ● Identifying the sites for energy consumption ● Reviewing the green energy scheme beneficiaries 2. Identifying whether the company has any sites/facilities identified as designated consumers under the Perform, Achieve & Trade (PAT) Scheme of the Govt. of India. Details of water, air, liquid and hazardous waste discharge 3. Providing details of water usage and treatment 4. Implementing a mechanism for zero liquid discharge 5. Providing details of air emissions (other than GHG emissions) and greenhouse gas emissions of the company for the current financial year and the previous financial year 6. Implementing a project related to reducing greenhouse gas emissions 7. Implementing waste management practices in the company. It shall cover dealing with the following types of waste : ● Plastic waste ● E-waste ● Bio-medical waste ● Construction and demolition waste ● Battery waste ● Radioactive waste ● Other Hazardous waste ● Other Non-hazardous waste generated 8. Implementing a strategy to reduce usage of hazardous and toxic chemicals in the company’s products and processes and the practices adopted to manage such wastes. 9. Obtaining environmental approvals/clearances if the company has operations/offices in/around ecologically sensitive areas ● Ecologically sensitive areas include national parks, wildlife sanctuaries, biosphere reserves, wetlands, biodiversity hotspots, forests, coastal regulation zones etc. 10. Conducting environmental impact assessment of projects undertaken by the company based on applicable laws in the current financial year ● The assessment may be conducted by an independent external agency ● The results of such assessment shall be communicated in public domain. 11. Ensuring compliance with the applicable environmental law/regulations/guidelines in India ● The company shall identify all the environmental law/regulations/guidelines the provisions of which are applicable on the company ● Provide details of non-compliance and the fines/penalties/action taken by regulatory authorities such as pollution control boards or by courts 12. Forming a business continuity and disaster management plan 13. Assessing any significant adverse impact that was caused to the environment which arose from the value chain of the company ● The company shall form mitigation or adaptation measures to minimize such adverse impact |

| Taking guidance from GRI in implementation |

| 1. Report management approach for computing emissions 2. Methodologies adopted to report different emissions under this principle 3. While computing the information required under this principle, the reporting organization should, if subject to different standards and methodologies, describe the approach to selecting them. |

Climate change has been an area of increasing concern and for obvious reasons, dealing with the same is a responsibility of the corporates as well, as dealt with in our article Corporate Responsibility towards Climate Change.

Principle 7: Engagement with public and regulatory policy making

Large companies, owing to their multinational presence have the potential to impact and influence regulatory policy, which eventually results in defining the growth trajectory of the economy. Hence, they should ensure that they exercise their responsibility in a transparent manner keeping in mind the interests of the larger economy.

| Actionable under BRSR |

| 1. Affiliations with trade and industry chambers/ associations. ● Identifying the chambers/ associations for associating based on the sector in which the entity operates. 2. Corrective actions taken or underway on issues relating to anti-competitive conduct based on adverse orders from regulators. ● Pre-deciding the appropriate frequency for review of the actions taken. ● Appoint the person to be responsible for review. 3. Public policy positions advocated by the entity. |

| Taking guidance from GRI in implementation |

| 1. Include memberships at the organizational level in associations 2. Anti-competitive behavior – actions that can result in collusion with potential competitors, with the purpose of limiting the effects of market competition, such as – ● fixing prices or coordinating bids; ● creating market or output restrictions; ● imposing geographic quotas; ● allocating customers, suppliers, geographic areas, or product lines. |

Principle 8: Inclusive growth and equitable development

Owing to the prevalent inequalities & imbalances in the society, it is a moral obligation of all individuals and corporations to contribute towards building a more equitable and prosperous nation. Companies are also required to disclose their practices towards accomplishing such an objective, thus enabling the stakeholders to identify whether such an organization fulfills its social responsibility or not.

| Actionable under BRSR |

| Social Impact Assessments (SIA) 1. Ascertaining the applicability of SIA of projects undertaken by the reporting entity. ● Deciding the frequency of assessment to be conducted during the reporting period. ● Evaluation of the outcome of the assessment for taking up corrective actions if required. Rehabilitation and Resettlement (R&R) exercise 2. Projects of the reporting entity taken up for R&R . ● Understand the meaning the of R&R and its relevance with respect to the company ● Pre-deciding the basis based upon which it shall be taken up for R&R. 3. Redressal of the grievances of the local community. ● Defining the local community. 4. Input materials directly sourced from the MSME/ small producers. ● Identify the materials to be procured from MSMEs and small producers. 5. Actions taken to mitigate the negative impacts identified in the SIA. ● Fixation of the steps to be undertaken for identifying the impacts as negative or positive. CSR Projects and its impact 6. CSR projects undertaken in the aspirational districts identified by the government bodies. 7. Formulation of Preferential procurement policy. ● Bifurcation of the procurement made from marginalized /vulnerable groups and other suppliers. 8. Benefits derived from intellectual property based on traditional knowledge. ● Identify the intellectual properties of the reporting entity that is based on traditional knowledge. 9. Providing details of corrective actions taken in any adverse order relating to intellectual property involving traditional knowledge. 10. Identify the beneficiaries of the CSR projects carried out by the company. |

| Taking guidance from GRI in implementation |

| 1. Social Impact Assessment (SIA) projects undertaken during the reporting period. 2. Public disclosure of results of the assessment. 3. Formulation of local community grievance processes. 4. Formulation of effective stakeholders’ engagement plans. 5. Reporting of negative impacts on communities because of business conduct by the reporting entity. 6. Senior management personnel hired from the local community. |

Principle 9: Engagement with consumers

Over the years, businesses have gravitated towards becoming completely consumer centric, thus leading to consumers deciding the success or failure of the organization. Hence, it is essential that consumers make safe and informed choices while procuring goods and services. Principle 9 is intended to ensure that companies provide relevant information to consumers and redress their grievances, if any, thus improving the overall consumer experience.

| Actionable under BRSR |

| Significance of consumer complaints and feedback 1. Implementing mechanisms to receive and respond to consumer complaints and feedbacks Informing the consumer on the probable environmental impact. 2. Providing details on turnover of products and/ services as a percentage of turnover from all products/service that carry information about: ● Environmental and social parameters relevant to the product ● Safe and responsible usage ● Recycling and/or safe disposal 3. Providing details of number of consumer complaints received during the year and pending resolution as at the end of the year for the current financial year and the previous financial year wrt the following : ● Data privacy ● Advertising ● Cyber-security ● Delivery of essential services ● Restrictive Trade Practices ● Unfair Trade Practices ● Others 4. Product recalled on account of safety issues ● Provide a bifurcation between voluntary recalls and forced recalls. 5. Forming a framework/ policy on cyber security and risks related to data privacy. ● Defining cyber security and understanding its probable impact on the company ● Identifying the cyber related risk to the data privacy 6. Providing details of any corrective actions taken or underway on issues relating to advertising, and delivery of essential services; cyber security and data privacy of customers; re-occurrence of instances of product recalls; penalty / action taken by regulatory authorities on safety of products / services. 7. Providing information on products and services of the company on different channels/platforms 8. Informing and educating consumers about safe and responsible usage of products and/or services. 9. Devising mechanisms to inform consumers of any risk of disruption/discontinuation of essential services. 10. Displaying product information on the product over and above what is mandated as per local laws. 11. Carrying out surveys with regard to consumer satisfaction relating to the major products /services of the entity. 12. Details of data breaches. ● Identify the impact of such breaches. ● Identify the information involved. |

| Taking guidance from GRI in implementation |

| 1. Products and services for which health and safety impacts are assessed for improvement. 2. Non-compliances relating to health and safety impacts of products and services. 3. Complaints received concerning the breach of consumer privacy. 4. Measures taken to ensure security of personal data of the consumers collected by the entity. |

Conclusion

While it is important for businesses to remain financially sound and report on the financials in a transparent and effective manner, it is equally important for them to be cautious about the way their operations affect the environment and the society at large; and factor in sustainability practices in their day to day business operations. Looking at the vast contents of the BRSR format, companies are expected to initiate the actions at the earliest so that they are in a position to appropriately report on the same at the end of FY 2022-2023. As discussed in this article, while the GRI Standards are one of the guiding factors to interpret and report, there are several other international reporting standards which serve the same purpose.

BRSR is a crucial step taken in this direction as it will make the companies focus to a great extent on the reporting of such sustainability practices in a bid to ensure that companies fulfill their obligations towards the surroundings in which they operate and there is a more inclusive and sustainable economic growth.

While we discuss the “what to do” part of implementing BRSR in this article, the “how to do” part of the same has been dealt with in the Part II of this article.

[1] Uniform Framework for EPR under Plastic Waste Management Rules

EPR under e-waste management rules

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

Business Responsibility and Sustainability Reporting

/0 Comments/in Corporate Laws, LODR, MCA, SEBI /by StaffBusiness Responsibility and Sustainability Reporting

Other ‘I am the best’ presentations can be viewed here

Our other resources on related topics –

- https://vinodkothari.com/2021/06/brsr-reporting-actions-and-disclosures-required-for-business-sustainability/

- https://vinodkothari.com/wp-content/uploads/2020/08/Cartload-of-details-in-BRSR.pdf

- https://vinodkothari.com/2020/08/brr-in-process-to-become-a-fully-loaded-electronic-form/

- https://vinodkothari.com/2016/01/global-overview-of-business-responsibility-reporting/

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

Corporate responsibility towards climate change: UK leads regulatory measures

/0 Comments/in Corporate Laws, SEBI, Sustainability /by Staff- Other countries may follow Task Force on Climate-related Financial Disclosures

Payal Agarwal and Aanchal Kaur Nagpal ( corplaw@vinodkothari.com)

Introduction

It will be ironic to the extent of being harsh to say that the Covid outbreak is a brutal reminder that mankind needs to ensure a balance between economic growth and environmental conservation. Environmental, Social and Governance (“ESG”) concerns have sharply risen globally, underscoring the financial relevance of various non-financial elements impacting business in several ways. In this scenario, one of the key areas of concern has been climate change. The United Kingdom (“UK”) recently proposed[1] significant changes in the regulatory framework in order to include mandatory climate-related financial disclosures in the regulatory regime. This article discusses the legislative measures proposed in the UK, and takes a look at what other countries are doing in this regard.

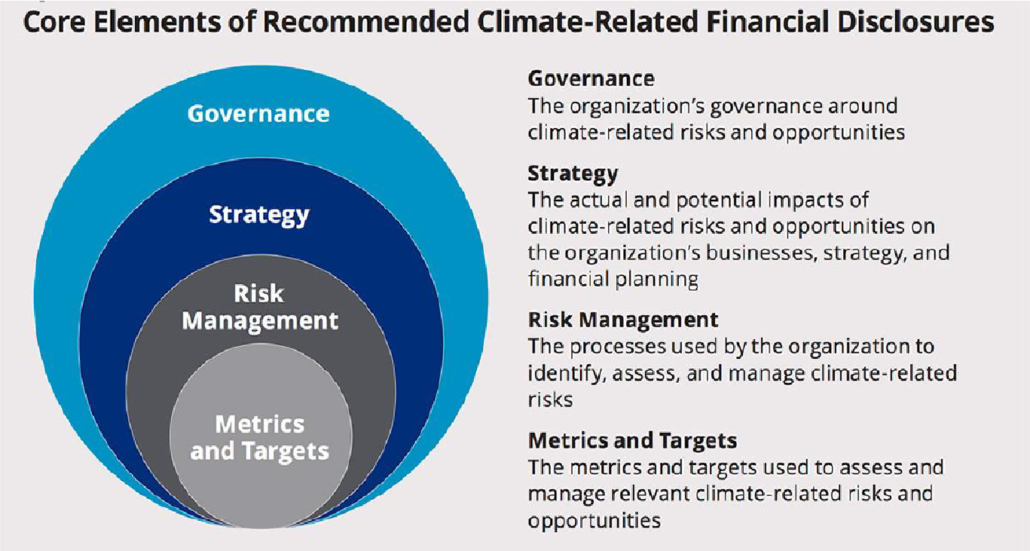

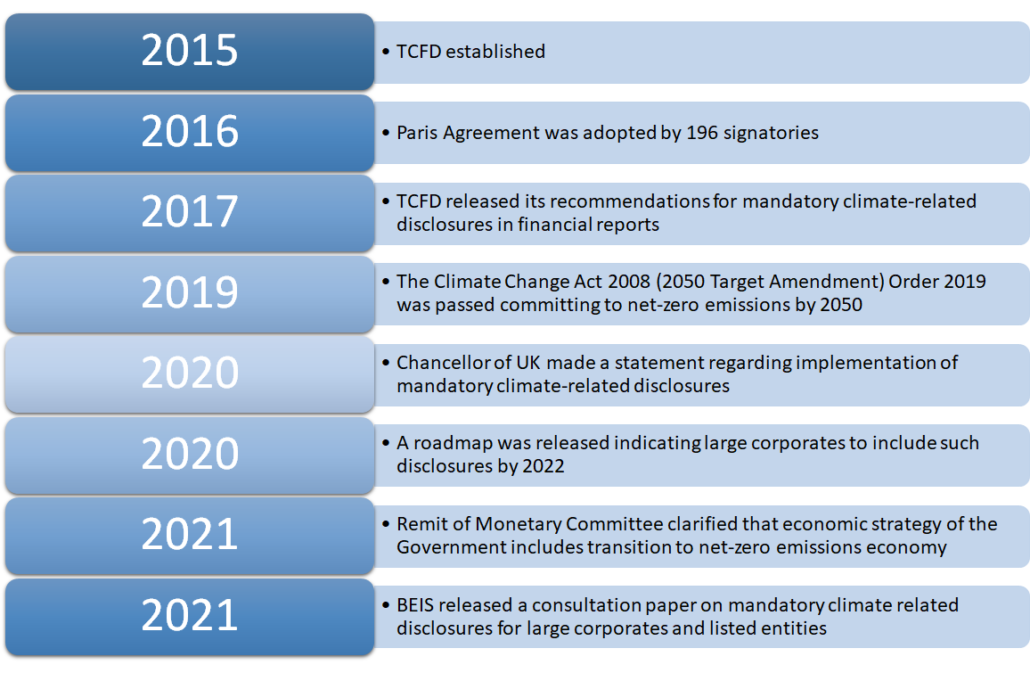

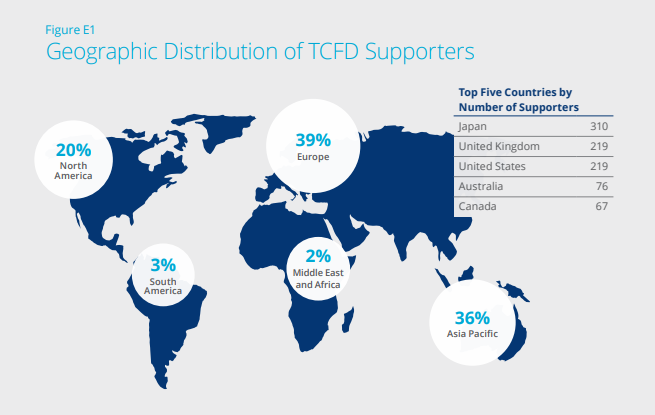

Introduction to TCFD

Task Force on Climate-related Financial Disclosures or (“TCFD”), as the name suggests, was established in 2015 with the main aim of providing recommendations as to how the climate-related disclosures can be brought to the mainstream financial reports. Established by the former Chairman of the Bank of England, UK, it is an internationally recognised body. It published its recommendations in the year 2017 highlighting what all should be included in the climate-related financial disclosures and how the companies and other corporate organisations can approach the climate related disclosures in its financial reports.

Climate change and economies:

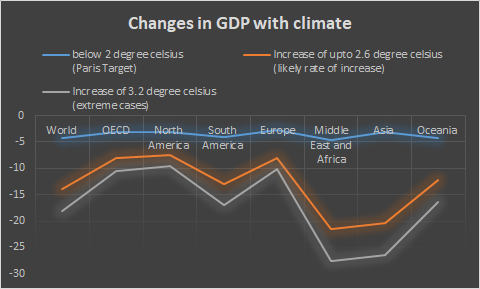

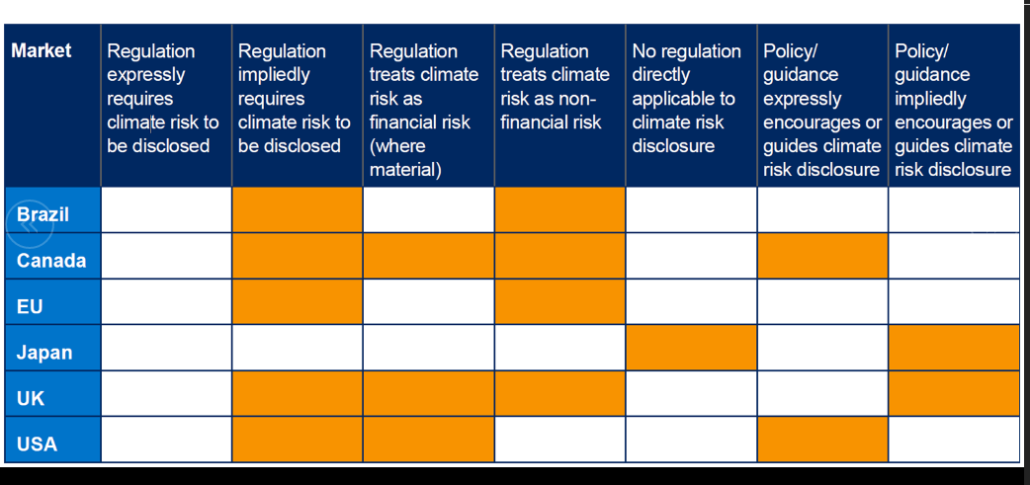

Studies have shown that global temperature rises will negatively impact GDP in all regions by 2050 whereas economies in southeast Asia (ASEAN) countries would be hit hardest. If climate risks are not properly managed, the Intergovernmental Panel on Climate Change estimates $69 trillion in global financial losses by 2100 from a 2-degree warming scenario. The Paris Agreement of 2016 was the first integrated approach towards recognizing the impact of climatic change and the need for taking an ambitious approach towards combating its ill effects. It is a legally binding international treaty on climate change adopted by 196 signatory countries around the world, India being one of them. Achieving targets set under the Agreement may prevent a significant global GDP loss while crossing these limits may drag the global economy to a doom. The below table shows the significant impact of global temperatures on global GDP.

Where countries around the world have a rather limited approach to climate disclosure, UK[2] has gone one step further, proposing mandatory reporting by companies on climate changes and becoming the first country to do so. It won’t be long before market regulators across the globe, including India, take steps to adopt the same in their homeland. In this background, let us understand the scope of reporting proposed by the UK, compared to the scope of climatic disclosures covered by India’s BRSR and the global reporting framework.

Background of the UK Proposal

The Consultation Paper with respect to climatic disclosures are based on the recommendations of the Global Task Force on Climate-related Financial Disclosure (TCFD), which recommended economy-wide mandatory climate-related financial disclosure. These recommendations are based on four basic pillars, which have also been proposed under the UK Consultation Paper as well.  The financial impact of climatic changes may not be apparent but their implications on financial performance are far and wide. It is important that companies ensure to include the potential impact of climate change in its major decisions. It is essential that climate-induced behaviours are embedded into the company’s culture so that climate change is considered at all levels of an organisation, which these disclosures intend to capture.

The financial impact of climatic changes may not be apparent but their implications on financial performance are far and wide. It is important that companies ensure to include the potential impact of climate change in its major decisions. It is essential that climate-induced behaviours are embedded into the company’s culture so that climate change is considered at all levels of an organisation, which these disclosures intend to capture.

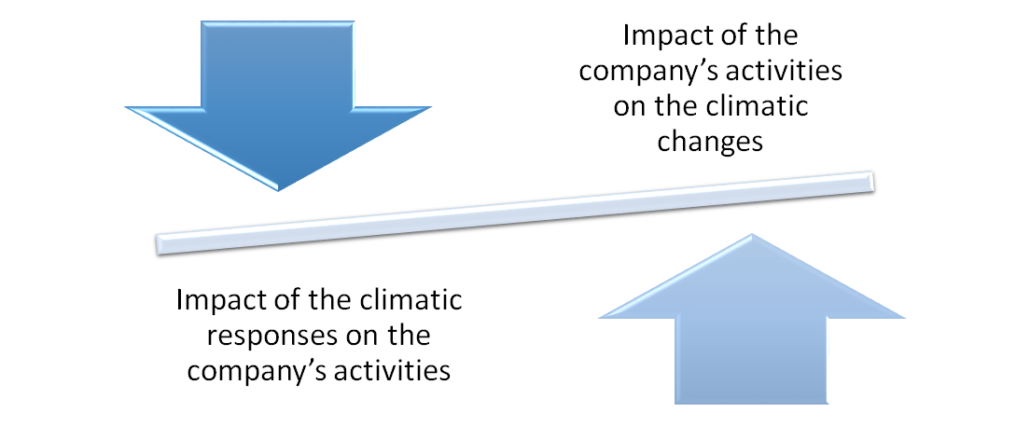

Dual disclosure approach –

The most peculiar feature of the UK Consultation Paper is that apart from the obvious impact company operations have on the environment, it recognizes that climate change would also bring about various risks (and opportunities) on company operations too. For doing so, the Consultation Paper seeks impact of climatic responses on the company as well, thereby giving rise to dual disclosure format.

Companies requiring mandatory disclosure

The UK Government released a roadmap aiming to mandate climate-related disclosures throughout the UK economy by 2025 in a gradual manner. The consultation paper was developed to bring the TCFD’s recommendations based climatic disclosures within the purview of the regulatory obligations by the end of 2021 to come into effect from the year 2022 onwards for large companies and LLPs such as –

- Publicly traded companies

- Large private companies

- Large LLPs

Note – Large private companies and LLPs mean one having more than 500 employees and turnover being more than 500 million dollars. However, entities in the UK, like the Bank of England, have already started implementing such disclosures as per their Annual Report for 2021, thereby setting a benchmark for reporting by other companies. Large corporates have been targeted as it is likely that the larger the company or LLP, the greater their impact on the environment and subsequent climate risk. Further, larger corporates are also interconnected with various other companies and stakeholders. It becomes all the more important that climate risk is well understood and disclosed by them to avoid systemic risks due to climate changes.

Aim behind such climatic disclosures

The need for climatic disclosures has been motivated by the aim of transitioning to a net-zero emissions economy. Net-zero emissions refers to an overall balance between the green-house gases (GHG) emitted and absorbed so that the net effect of such emissions is ultimately zero or nil. This can be achieved by either reducing the GHG emissions or taking steps that help in absorption of such GHG emissions. Owing to the above, the UK Government intends to ensure that companies with a material economic or environmental impact or exposure assess, disclose and ultimately take actions against climate-related risks and opportunities. This will not only induce companies to take action but also provide investors with the needed information to adequately understand and manage climate-related financial risks. The disclosures aim to achieve the following –

- Encourage more informed pricing and capital allocation by companies to manage material financial risks and opportunities due to climate change

- Support investment decisions of Companies for aligning with our transition to a low-carbon economy.

- Influence behaviours of companies and their stakeholders

- Investors will be better equipped to incorporate climate-related risks and opportunities into their investment and business decisions,

- Greater information to other stakeholders for relevant decisions.

- Help companies think about what they need to do to address climate change as an important risk and opportunity for their organisation, operations and people.

The idea behind the mandatory disclosures was also put forth by the Chancellor[3], ‘this new chapter means putting the full weight of private sector innovation, expertise and capital behind the critical global effort to tackle climate change and protect the environment. We’re announcing the UK’s intention to mandate climate disclosures by large companies and financial institutions across our economy, by 2025. Going further than recommended by the Taskforce on Climate-related Financial Disclosures. And the first G20 country to do so.

Climatic disclosures made by the Bank of England

The Bank of England has become the first entity in the world to publish climate disclosures in its Annual Report in June, 2020, continuing the legacy in this year as well. These disclosures may act as a guidance to other entities in the UK as well in other countries to report on TCFD’s recommendations.

Development of climatic-related disclosures – How UK takes a lead?

The development of climate-related financial disclosures and contribution of the UK in same can be presented by the following timelines –

Regulatory measures in India:

In India, SEBI has recently released the Business Responsibility and Sustainability Reporting (BRSR) framework, applicable on the selected listed companies[4] of the country, which includes of various environment related disclosures covering aspects such as resource usage (energy and water), air pollutant emissions, green-house (GHG) emissions, transitioning to circular economy, waste generated and waste management practices, bio-diversity etc. In India, the BRSR is currently the only sustainability report in force by means of regulatory provisions. The BRSR is required to be disclosed in the Annual Report of listed companies. A detailed analysis of the same can be referred to in our article.

What disclosures are covered under the BRSR with respect to climate change?

The BRSR requires the companies to give the following disclosures with regards to climate-

- Details of GHG emissions –