The triumphs and tribulations of being a promoter in listed entities

– Team Corplaw | corplaw@vinodkothari.com

Introduction

The classic rule of Solomon, that the shareholders are different and the company that they promote is different, and that the liabilities of the company cannot be passed over to the shareholders, seems to be getting constantly indented, particularly as courts and regulators realize that companies are inanimate; it is the controlling heads who actually run companies. Therefore, if there is a vice in the schematics of a company, it must rope in the promoters too. Securities regulator, and our own SEBI too, has been fastening several obligations of listed entities on the promoters, including the recent ‘Consultation paper on strengthening corporate governance at listed entities by empowering shareholders’ proposal to block the personal shareholdings of the promoters for continued lapses by the listed entity.

There are several other implications of being a promoter or promoter group entity, transactions by such entities with the listed entity are mandatorily treated as related party transactions, public disclosures on sale of shares. There are several sections of the Companies Act, 2013 (“Act”) as well, which impose liabilities, including criminal liabilities, on promoters. Some of these provisions are section 7 (imposing criminal liability for incorporation related offenses), of the Act, if it is found that the company has been incorporated by furnishing any false information or representation or by suppression of any material information, the promoters would be held liable for action under section 447. Further, section 34 elaborates that if any statement in the prospectus is untrue or misleading, the promoter will be held criminally liable under Section 447. On the same lines, section 35 (imposing civil liability for public issue related mis-statements), section 42 (imposing penalty for contravening the provisions w.r.t private placement including default in filing of return of allotment), section 102 (imposing penalty for non-disclosure / wrongful disclosure in the explanatory statement), 284 (liability with respect to non-cooperation with liquidator) to list a few.

This article focuses on who is a promoter/promoter group entity (PGE), what are the implications of being either, how does one get out of the classification, having been into either, both in case of listed and unlisted companies.

Who is a promoter?

Intuitively, the literal meaning of the term seems to be suggesting the idea of a founder, proponent, or someone who moots the idea of a company, brings all the stakeholders together and brings the company on its feet. Old English rulings, such as Erlanger v New Sombrero Phosphate Co (1878) 3 App Cas 1218 refer to this meaning. Further, in Halsbury’s Laws of England, vol. 6, promoters are described thus: “ It is a short and convenient way of designating those who set in motion the machinery by which the Companies Act, 1948, enables them to create an incorporated company. It involves the idea of exertion for the purpose of getting up and starting a company, or what is called ‘floating’ it, and also the idea of some duty towards the company imposed by, or arising from, the position which the so-called promoter assumes towards it.”

Can a promoter be likened to a parent to a living being? In a limited sense, yes, but a parent is a parent forever. However, in the case of companies, the relationship between promoter and promotee is clearly not eternal. It is quite common that companies, over time, may suffer changes in ownership, and to the extent the law fastens responsibilities on promoters, it will be futile to continue to refer to the founding fathers of a company. Therefore, the expression takes its color based on the context – in relation to incorporation, public offers, etc., it refers to the person to the founding father, who is named in the offer documents. However, once the company has matured and is up and running, it refers to the persons who are in control.

Thus, the definition of “promoter” in the Act [sec. 2 (69)] has 3 limbs:

1. Promoter by proclamation: that is, the person who is named as promoter in the offer documents or the annual return.

2. Promoter by control: that is, a person having control over affairs, whether as shareholder, director or otherwise, directly or indirectly.

3. Promoter by absentee control: that is, by orchestrating the affairs of the company by giving instructions to the board of directors, which the latter is accustomed to adhere to.

However, when it comes to ICDR Regulations, the definition of the term, otherwise aligned with the above definition, has an additional element – deemed promoter. This tacitly comes from the language of the second proviso to Reg 2 (1) (oo), which is worded so as to exclude several categories of institutional investors specified therein, from being deemed as promoters, merely because of their holding of 20% or more of the equity share capital. Explicitly, there is nothing in the proviso that attributes deemed promoter status on a shareholder holding 20% or more; however, such is the implication of the proviso.

In case of unlisted companies, or companies whose equity shares are not listed, the relevant definition to apply will be that under the Act. In case of companies who have listed equity or convertible securities, the relevant definition is given in the ICDR Regulations.

What is the meaning of promoter group (PG)?

It may be noted that the term “promoter group” is not used or defined in the Act. The same is defined in Regulation 2(1)(pp) of ICDR Regulations. Likewise promoters, the promoter group can also be said to have 3 limbs.

1. PG by admission: that is, a person whose shareholding has been aggregated under “shareholding of promoter group”.

2. PG being significantly influenced by the promoter: that is, an entity whose affairs are being significantly influenced by the promoter through shareholding.

3. PG significantly influencing the promoter: that is, an entity having significant influence over affairs of the promoter through shareholding.

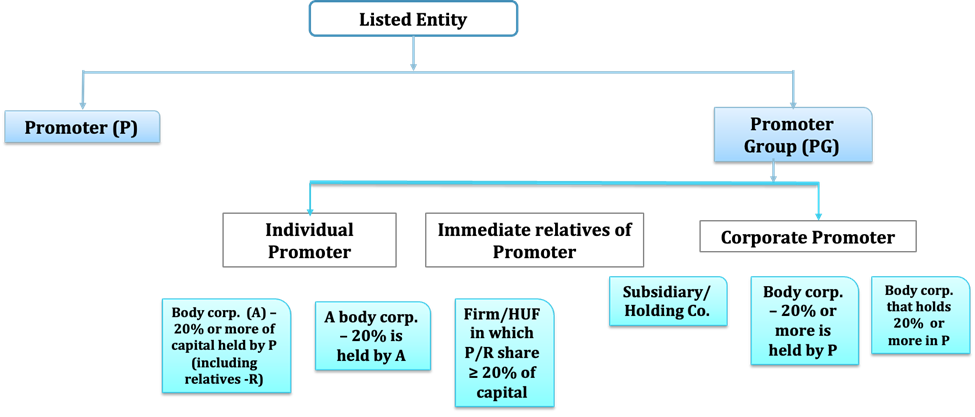

The term broadly includes the (i) promoters and (ii) such entities where either the promoter can exercise significant interest or (iii) entities which can exercise significant interest over the promoter (in case promoter is a body corporate), (iv) person whose shareholding has been aggregated under “shareholding of promoter group”. We try to break the definition for simpler understand below:

2. Immediate relative of the promoter (spouse, parent, sibling, child of promoter or spouse);

- Entities which can have significant influence on the promoter:

- Where promoter is a body corporate

- Holding company;

- body corporate which holds atleast 20% equity capital of the promoter

- Where promoter is an individual

- Where promoter is a body corporate

- Entities over which the promoter can have significant influence:

- Where promoter is a body corporate

- Subsidiary company’;

- Associate company or any other body corporate where promoter holds 20% or more equity capital

- Where promoter is an individual

- Body corporate where the following holds holds atleast 20% equity capital

- Promoter

- Immediate relative

- Firm where promoter or his immediate relative is a member

- HUF where promoter or his immediate relative is a member

- Body corporate where (4)(b)(i) holds atleast 20% of equity capital[3]

- HUF where promoter and his immediate relative holds atleast 20% of capital in aggregate

- Firm where promoter and his immediate relative holds atleast 20% of capital in aggregate

- Body corporate where the following holds holds atleast 20% equity capital

- Where promoter is a body corporate

5. person whose shareholding has been aggregated under “shareholding of promoter group”

It is pertinent to note that by virtue of a proviso to the definition of promoter group, identical exemption, as in the definition of promoters, is carved out for several categories of institutional investors, unless the company in question is a subsidiary or companies infact promoted by such institutional investor.

The definition of promoter group given under the ICDR Regulations is referred to in various SEBI regulations as in the case of the definition of the promoter. The definition also intends to capture individuals / entities that, due to their proximity with the promoter, can be termed as interested parties. While it is quite evident that a person having control over the affairs of a company would be classified as a promoter in the first instance, however, the interested parties may not even have any shareholding in the company, let alone having any control.

Graphical presentation of the definition of “promoter group” as in ICDR Regulations:

Implications on promoters and entities forming part of the promoter group

Quite often, the term “promoter and promoter group” is being used as a single term, however, the below table of compliances applicable on each of the two – “promoter” and “promoter group” clearly shows that the “promoters” are required to adhere to comparatively more compliances than the “promoter group”.

| Issue of Capital – ICDR Regulations | |||

| Particulars | Promoter | Promoter group | Remarks |

| Continuous holding requirement | Required – 20% of the post-issue capital | Not required | This is done to ensure that promoters exhibit skin in the game and do not exhibit the company after receipt of IPO proceeds. |

| Disclosures in prospectus as per Schedule VI | Required | Required | Details of the promoter are to be given in the prospectus as per Schedule VI which exposes the promoters to public scrutiny. |

| Lock-in post listing | Required | Required | This is done to ensure that promoters exhibit skin in the game and do not exit the company after receival of IPO proceeds. |

| Takeover provisions – SAST Regulations Also, as per Regulation 2(1)(s) of SEBI (SAST) Regulations, 2011, the term ‘promoter’ also includes members of the promoter group. | |||

| Annual disclosure of shareholding – though this is now covered under System Driven Disclosure (SDD) | Required | Required | The public invests at the behest of the promoters, hence, the public should be aware of the promoter shareholding in the company. |

| Disclosure on sale/purchase of shares | Required | Required | |

| Disclosure on encumbrance of shares | Required | Required | |

| Insider Trading provisions – PIT Regulations | |||

| Continuous disclosures – this is also now covered under SDD | Required | Required | The public invests at the behest of the promoters and hence, should be aware of any significant changes in the promoter shareholding of the company. |

| Classified as designated persons (DPs) and therefore trading in securities of the promotee company is subject to the Code of Conduct which entails several restrictions – preclearance, contra trade, trading window closure etc | Yes | No | The promoters are deemed to be persons generally holding unpublished price sensitive information and therefore any trading in securities of the promotee company by them is regulated. |

| Listing Regulations – LODR Regulations | |||

| Freezing of shareholding in case of contravention. | Yes | Yes | Promoters need to ensure that the entity is in compliance with all the rules & regulations even if they are not involved in the day-to-day management of the entity, this adds up to the responsibility of promoter / promoter group. |

| Shareholding pattern on the website of all stock exchanges. | Required | Required | The public invests at the behest of the promoters, hence, the promoters should be aware of the promoter shareholding in the company. |

| Fees or remuneration payable to promoters is subject to approval of shareholders, if it is above the specified threshold | Required | Required | This is done to ensure that the promoters do not misuse the funds of the shareholders. |

| Common terms for reclassification of promoter and promoter group under Regulation 31A | Yes | Yes | If the promoter of the listed entity changes by virtue of any acquisition or otherwise, it would not be feasible for persons belonging to the promoter group to continue to be such. |

| Ambit of related party transactions | Yes | Yes | Promoter and promoter group both are included within the ambit of related parties to ensure that there is no misuse of the funds of the shareholders. |

Promoter declassification in case of unlisted companies

In case of unlisted companies, the first limb of the definition allows the company the liberty to name a person as a promoter in the annual return (prospectus is obviously not relevant in case of unlisted companies). A company may or may not name a promoter in its annual return. The third limb, relating to promoters having absentee control, is more a matter of fact, and is mostly a result of active concealment of true control, detected by appropriate investigation. Therefore, the commonest way to identify promoters in case of unlisted entities will be by identification of the persons holding control over the company.

The definition of “control” in sec. 2 (27) of the Act is an inclusive one: it does not define control, but extends the meaning of the term to include management control or the right to appoint majority directors. The more common mode of control is voting control. The expression “control” has been subject matter of several leading rulings such as Arcelormittal India Private V. Satish Kumar Gupta, in which the Supreme Court defined the expression “control” in 2 parts; de jure control or the right to appoint a majority of the directors of a company; and de facto control or the power of a person or persons acting in concert, directly or indirectly, in any manner, can positively influence management or policy decisions.

In Shubhkam Ventures V. SEBI , the meaning of control was extensively discussed by the SAT, it was held that the test is to see who is in the driving seat, the question would be whether he controls the steering, the gears and the brakes. If the answer to this question is affirmative, then alone would he be in control of the company. In other words, the question to be asked in each case would be whether he is the driving force behind the company and whether he is the one providing motion to the organization. If yes, he is in control but not otherwise.

Control is dynamic – it may shift from hand to hand, as controlling block of the company’s equity may be transferred. In such a situation, is it possible for erstwhile promoters to move out of the promoter classification? Clearly, no objective is served by continuing to classify the founding fathers of the company as promoters, after several years of the formation of the company, and after the reins of control have been relayed to new hands. The appropriate forum for establishing control, or taking cognizance of cessation of control, is the general meeting. Therefore, both assertion by someone that he has control, backed by shareholder vote, and declassification from promoter category, should be possible by shareholders’ franchise.

Promoter reclassification in case of listed entities

Regulation 31A of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 lays down conditions pursuant to which promoters/ person belonging to promoter group of a listed entity can be reclassified as public shareholders. The deductive reasoning around re-classification is that the promoter and promoter group needs to comply with a lot of regulations even in cases in which they have no control over the affairs of the company. There could be other multiple reasons for the same, refer to our article https://vinodkothari.com/2021/09/making-ones-way-out-promoter-promoter-group/ for more information on this.

Conclusion

The recognition of significant shareholders as promoters, and the fastening of several liabilities on such promoters, is an important facet of corporate governance and the act of attribution of the obligations towards the company on its controlling shareholders. Therefore, identification of promoters is as important as cessation of someone’s existing classification. The continuity of kingdoms requires that a new king comes in, when the old king dies. Succession and continuity are important aspects of promoter recognition as well.

[3] It is a debatable topic as to how the promoter exercise significant interest in such body corporate without holding control in the first level body corporate.

Leave a Reply

Want to join the discussion?Feel free to contribute!