Private sector banks to continuously monitor major shareholders

RBI Directions, 2023 require banks to have a mechanism to detect violation w.r.t. RBI prior approval and ‘fit and proper’ status

– Vinita Nair, Senior Partner | corplaw@vinodkothari.com

Given their systemic significance, ensuring that ownership of banks neither gets concentrated, nor falls into wrong hands, has always been important. Therefore, acquisition of shares or voting rights (‘S/VR’) is strictly regulated by Section 12B of Banking Regulation Act, 1949 (‘BR Act’), supplemented by RBI Directions issued from time to time. In the case of public sector banks, there is a ceiling of 10% of the total voting rights for shareholders other than the Central Government.

Section 12B of BR Act prescribes the requirement of prior approval of RBI in case of a person intending to become a “major shareholder”, that is, a holder with 5% of the S/VR in a banking company. The requirement is applicable where a person acquires or agrees to acquire S/VR, which could be (a) either directly or indirectly, and (b) whether alone, or by acting in concert with any other person. Hence, there is a need to do both horizontal aggregation [that is, relatives[1] and persons acting in concert (PAC)[2]], as well as vertical aggregation (that is, indirect acquisition through controlled entities or “associated enterprises[3]”.

This article discusses the possible pain points likely to be faced by the banks, other requirements under the new regime and actionable arising therefrom.

New RBI Directions

The present regime, effective from January 16, 2023 comprises of RBI (Acquisition and Holding of Shares or Voting Rights in Banking Companies) Directions, 2023 (‘Directions, 2023’) along with the Guidelines, which is applicable to all banking companies including Local Area Banks (LABs), Small Finance Banks (SFBs) and Payments Banks (PBs) operating in India. The Directions are not applicable to foreign banks operating either through branch mode or Wholly Owned Subsidiary (WOS) mode.

The present regime incorporates the recommendations made in the report by the Internal Working Group (IWG) constituted by Reserve Bank on June 12, 2020 to review the extant guidelines on ownership and corporate structure for Indian private sector banks.

Directions, 2023 repeal and supersede following three directions (‘Erstwhile Directions’):

- RBI (Prior approval for acquisition of shares or voting rights in private sector banks) Directions, 2015;

- RBI (Ownership in Private Sector Banks) Directions, 2016;

- RBI (Issue and Pricing of Shares by Private Sector Banks) Directions, 2016.

Fit and Proper (F&P) Criteria

The most crucial requirement for granting the approval is based on the major shareholder meeting the F&P criteria. The Erstwhile Directions provided the illustrative list of F&P criteria to be considered by RBI while considering applications for acquisition of 5 per cent or more upto 10 per cent in the bank and for acquisition in excess of 10 per cent in the bank. Directions, 2023 require banking companies to put in place a board-approved F&P criteria for major shareholders, after considering the minimum illustrative F&P criteria provided therein. The illustrative F&P criteria remains the same as Erstwhile Directions with no substantial amendment. Accordingly, banking companies have an actionable to frame a policy and in case of an existing policy, if any, align the F&P requirements as per Directions, 2023.

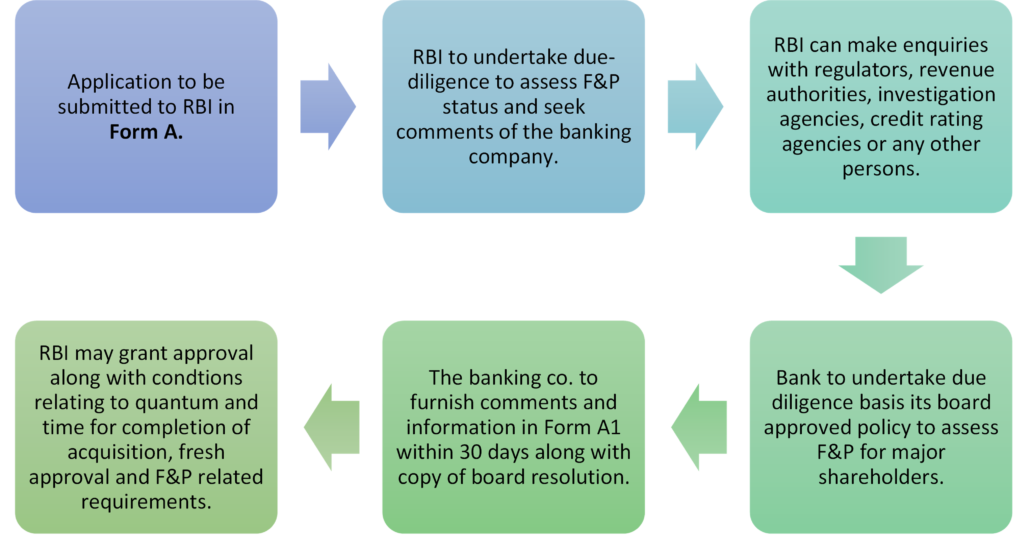

The bank is required to monitor F&P status of existing major shareholders as well as applicants that are in the process of becoming a major shareholder[4]. The assessment is required at two stages – first, at the time of initial acquisition, which is done by RBI, after getting inputs from the bank (refer Figure 1 below) and second, there is a continuous monitoring by the bank, to see that there is no slippage from the F&P conditions. This is where the real pain may lie.

The criteria for determining F&P status has several abstractions, for e.g., how will the bank evaluate the requirement of integrity, reputation and track record in financial/non-financial matters and compliance with tax laws or the soundness and feasibility of the plans of the applicant for the future conduct and development of the business of the banking company. The board approved policy will have to indicate the manner of evaluating the shareholder by way of specific objective criterias.

Due diligence and monitoring related requirements

The bank is entrusted with the responsibility of monitoring the information submitted, change in SBO, potential breach of the aggregate holding threshold by shareholders without RBI approval, and also adherence to the shareholding limits/ ceiling on voting rights by the shareholders in accordance with Directions, 2023 as discussed hereunder. Even in case of fresh issue and allotment, the Bank is required to ensure that the aggregate holding is not breached, where prior approval of RBI has not been obtained.

In order to ascertain whether the shareholder is a major shareholder, as discussed above, the bank is required to consider possible aggregation horizontally and vertically, which may require a roving enquiry by the bank for reasons discussed below.

Monitoring potential violation of Section 12B of BR Act

This seems the most critical and difficult requirement where the bank is required to detect instances where major shareholders would try to circumvent statutory requirements by avoiding RBI prior approval. The requirement prevailed under the Erstwhile Directions too. The bank is required to place such instances before its board and then inform RBI.

While the intent is clear, the mechanism may be cumbersome, reason being aggregate holding comprises of a. direct or indirect, b. beneficial or otherwise, c. by person along with relatives, associated enterprises and PAC i.e. horizontal and vertical aggregation. Directions, 2013 indicates the relationship which may be considered for identifying PACs, which is similar (not entirely same) to the list provided in SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011. Additionally, the list in the Directions, 2023 includes acquisition by any other person having control over the person and acquisition by proxy voters (other than Corporate representative and relatives of the registered members) without any specific mandate on manner of voting.

Where the holding is fragmented, it will be a mammoth task for the banks to look at the list of shareholders and attempt identifying the indirect holdings through PACs. The questions that would arise include what should be the periodicity of such an exercise given that the benpos is received weekly? How should the bank obtain such information? Whether the bank should obtain declaration from shareholders holding beyond a particular threshold – say 0.5% or 1%?

The bank is required to submit periodical reports on the continuous monitoring arrangements to its own board including compliance with the RBI approval requirement under BR Act.

Monitoring the information submitted in Form A for RBI approval

The bank is required to continuously monitor changes, if any, in the information provided in Form A by the major shareholders and ascertain if it impacts the F&P status and in case of any concern, furnish a report to RBI immediately.

On an annual basis, the bank is required to seek confirmation on changes, if any, from the major shareholder by April 30 and undertake assessment of F&P status, place the information before its Board and forward its comments to RBI latest by September 30.

Monitoring change in SBO

This is a new requirement under Directions, 2023. The bank is required to obtain information on any change in SBO or acquisition of 10 per cent or more of paid-up equity share capital of the major shareholder. Identification of SBO is in the manner stated in Companies (Significant Beneficial Owners) Rules, 2013. Upon receipt of details, the bank is required to re-evaluate the F&P status of the shareholder and place the same before its Board and thereafter, submit to RBI along with the board note and resolution passed. Timeline to ensure this is 30 days from the date of receipt of information.

RBI approval related requirement

The brief process for obtaining prior approval of RBI under the present regime is as under:

Figure 1: Procedure for prior approval of RBI[5]

The process remains the same under Erstwhile Directions and the present regime. The timeline for the bank to respond to RBI with its comments has been expressly provided. The format for providing comments by the bank remains similar.

The details to be provided in the Form A to be submitted by the applicant requires furnishing of additional details viz.

- Significant Beneficial Owner (SBO)of the applicant (refer discussion in the latter part);

- timeline by which the applicant intends to complete the proposed acquisition of shareholding in the bank;

- Where there are more than two layers between the applicant and the ultimate beneficial owners, the reasons for such layering;

- Whether the proposed investment is from or through FATF non-compliant jurisdictions.

The reason for seeking details relating to FATF compliance is that persons from FATF non-compliant jurisdictions will not be permitted to acquire major shareholding in a banking company. The Directions, 2023 permit existing shareholders from such jurisdictions to continue with their investment, however, empowers RBI to consider fitness of such persons and pass appropriate orders where necessary, on permissible voting rights.

RBI will grant an approval only if it is in the interest of public or banking policy or banking company or banking and financial system in India and has the power to impose conditions, including that the applicant continues to remain an F&P person to hold S/VR. Otherwise, RBI has the powers to restrict exercise of voting rights.

S/ VR related ceiling, lock in requirements

The IWG report revisited the thresholds and decided to increase the threshold for promoter shareholding in the long run and reduce the maximum shareholding by non-promoters in case of regulated, well diversified and listed / supranational institution / public sector undertaking / Government. The pre and post scenario with respective to ceiling on shareholding is tabulated as under:

|

Category |

Erstwhile Regime |

Directions, 2023 |

||

|

|

Promoter |

Non-Promoter |

Promoter |

Non-Promoter |

|

a. Natural Person |

15% (in the long run) |

10% |

26% (in the long run i.e. after the completion of 15 years from commencement of business of the banking company.) |

10% |

|

Legal Person |

|

|

||

|

b. Non-financial institution/ entities |

10% |

10% |

||

|

c. financial institutions directly or indirectly connected with Large Industrial Houses[6] and financial institutions that are owned to the extent of 50 per cent or more or controlled by individuals (including the relatives and persons acting in concert) |

15%[7] |

15% |

||

|

d. financial institutions (excluding those mentioned above), supranational institutions, public sector undertaking and central/state government. |

40% |

15% |

||

The initial holding is under lock-in for 5 years subject to a maximum of 40% of paid up equity share capital of the bank held by such person. As per Directions, 2023 the shares under lock-in cannot be encumbered as it may adversely impact the investor’s perception and creates a pressure in case of a falling market scenario.

Initially, the promoters are required to hold as per the licensing conditions and are required to achieve the 26% threshold in the long run. In the interim, i.e. after expiry of initial 5 years till 15 years, the holding can fall below or move above the 26% threshold.

Even where the shareholding is above 26% threshold initially, the voting rights on poll will be limited to 26% of total voting rights. As per Section 12 (2) of BR Act read with notification dated July 21, 2016 no shareholder can exercise voting rights on poll in excess of 26 per cent of total voting rights of all the shareholders of the banking company.

Further, voting rights can be exercised by beneficial owners[8] or any person on behalf of registered shareholders only where the aggregate voting rights held is in conformity with Section 12B of BR Act.

Exercise of voting rights in case of ADR/ GDRs

In case of voting rights exercised by depository on behalf of holders of depository receipts, under the Erstwhile Regime, the Banks were required to enter into Depositories Agreement, pursuant to which the depository would be entitled to exercise voting rights only upon the express instruction of the Board of the Bank, without which no cognizance would be given to the voting done. Also, any changes in the voting agreement required prior approval of the Bank.

As indicated in the IWG report, the need was to align with the present requirement under Companies (Issue of GDR) Rules, 2014, the Depository Receipts Scheme, 2014 and Framework for issue of Depository Receipts issued by SEBI in 2019. Accordingly, Directions, 2023 specify that the depository can exercise voting rights only pursuant to the voting instructions of the DR holder, provided the shareholding is compliant of limits and requirement under Section 12B of the BR Act.

Reporting requirements

Reporting requirement under the Erstwhile Regime was limited to intimation in case of issue/allotment of shares, which continues under the present regime. The format of reporting has been simplified[9] and is required to be filed within 14 days of completion of the allotment process.

Basis the recommendation of IWG report, reporting requirement in case of pledge has been inserted as discussed hereunder.

Figure 2: Reporting in case of pledge by promoter and promoter group[10]

Conclusion

Directions, 2023 require banks to ensure revisiting the existing F&P requirement and have a board approved policy, establish mechanism for continuous monitoring, seeking information from shareholders, place requisite information before its Board and submit the same to RBI from time to time within the timeline prescribed. The challenge lies in the manner of monitoring the shareholders to identify potential major shareholders and framing of objective criteria to ascertain the F&P status of major shareholders.

Further, where the aggregate holding of a person in the banking companies (excluding Payments Banks) operational as on January 16, 2023 is not in conformance with the Directions, 2023, the persons will be required to submit a shareholding dilution plan to RBI by July 15, 2023.

[1] As per the meaning assigned in Companies Act, 2013

[2] Means persons who, for a common objective or purpose of acquisition of S/VR in excess of 5%, pursuant to an agreement or understanding (formal or informal), directly or indirectly cooperate by acquiring or agreeing to acquire S/VR in the banking company.

[3] means a company, whether incorporated or not, which, (i) is a holding company or a subsidiary company of the applicant; or (ii) is a joint venture of the applicant; or (iii) controls the composition of the Board of Directors or other body governing the applicant; or (iv) exercises, in the opinion of the Reserve Bank, significant influence on the applicant in taking financial or policy decisions; or (v) is able to obtain economic benefits from the activities of the applicant;

[4] Means those who have applied and for whom comments have been provided by the bank to RBI and those who have obtained prior approval but are yet to complete the acquisition.

[6] a Group with assets of Rs. 50 billion or more with the non-financial business of the group accounting for 40 per cent or more in terms of total assets / in terms of gross income, is treated as a large industrial house in terms of RBI Guidelines of August, 2016 for ‘on tap’ Licensing of Universal Banks in the Private Sector

[7] Category under the Erstwhile regime was- non-regulated or non-diversified or non-listed financial institutions

[8] As per Section 89 of CA, 2013

Leave a Reply

Want to join the discussion?Feel free to contribute!