Pledge as transfer: Several SEBI Regulations may require review post SC Ruling

– Vinita Nair | Senior Partner, Vinod Kothari & Co. | corplaw@vinodkothari.com

Hon’ble Supreme Court, in the matter of PTC India Financial Services Limited v. Venkateshwar Kari and Another (‘PTC India ruling’), brought out a very important distinction between the meaning of ‘beneficial owner’ under the Depository law, and the right of the pledgee/ pawnee/ security interest holder) to cause the sale of goods pledged by pledgor/ pawnor in terms of the rights arising under the pledge[1]. The PTC India ruling inter-alia holds that “beneficial ownership” in the context of the Depositories Act should not be confused with beneficial ownership in law. Getting registered as a “beneficial owner” in terms of Section 10 of Depositories Act, 1996 read with Regulation 58 (8) of the SEBI (Depositories and the Participants) Regulations, 1996[2] (‘Depository law’) does not amount to any transfer of title to the pawnee – it is merely a procedural precondition to sale by the pawnee. It further stipulates that there is no concept of ‘sale to self’ by the pledgee and that the pledgee is bound by the two options provided under Section 176 of the Indian Contract Act, 1872 (‘ICA, 1872’), viz., right to bring a suit against the pawnor and retain the goods pledged as collateral security, or sell the thing pledged on giving reasonable notice to the pawnor and sue for the balance, if any. This ruling triggers the need to review current practice followed by companies and also validity of orders pronounced by Securities Appellate Tribunal (‘SAT’) and SEBI from time to time w.r.t. pledge.

The Apex Court referred to the decision of Securities Appellate Tribunal (‘SAT’) in the matter of Liquid Holdings Private Limited v. The Securities Exchange Board of India[3] where SAT held that the banks being recorded as beneficial owners of the shares pursuant to invocation of pledge became the members of the target company and subsequent transfer of the said shares by the banks back to the appellants resulted in purchase by the appellants attracting the open offer obligations under SEBI (Substantial Acquisition and Takeovers) Regulations, 1997 [Repealed by SEBI (Substantial Acquisition and Takeovers) Regulations, 2011] (‘Takeover Code’). The Apex Court observed that SEBI should examine the provisions of Depository law and the Takeover Code to avoid discord or ambiguity resulting in instability or confusion especially on applicability of Takeover Code when the pawnee exercises his right to be recorded as a ‘beneficial owner’, while reserving his right to sell the pledge. Additionally, in the author’s view, there is an equal need to examine the applicability of SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) in the context of pledges[4], for reasons discussed in the latter part of this article.

Procedure and different stages in case of Pledge

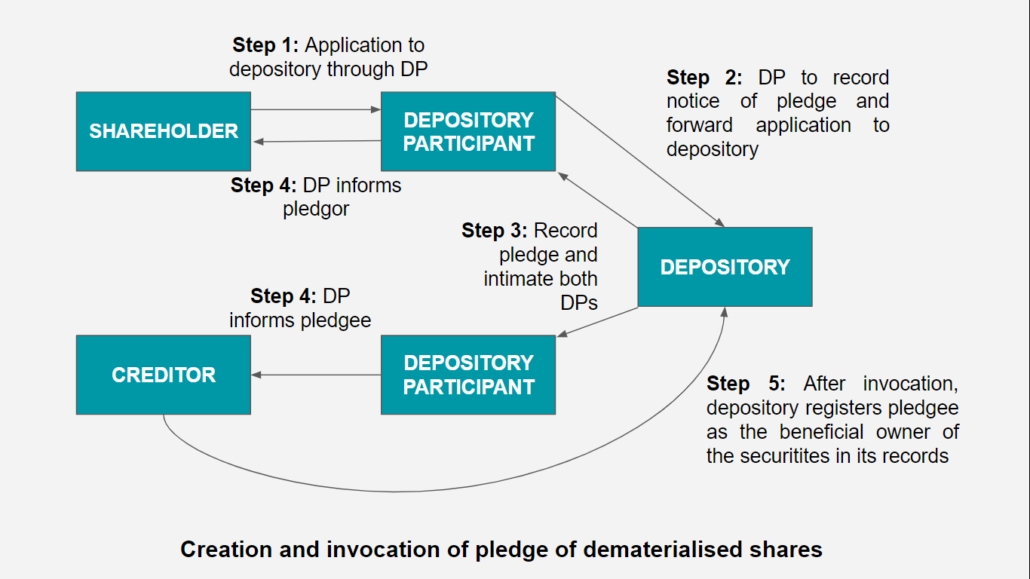

The following diagram provided in the article ‘Broken Pledge? Apex Court reviews the law on pledges’, explains the procedure of pledge in case of dematerialised securities in a nutshell:

There are various stages in case of pledge, as discussed hereunder:

- Creation of pledge: Pledge is created by the pledgor placing the goods in the physical possession or control of the pledgee, with the intent of creating a security interest therein, usually accompanied by execution of a pledge agreement. In case of securities held in dematerialized form (‘demat’), this entails making of an application to the depository through the depository participant who has the account of the pledgor for notice of pledge and getting the securities moved from ‘Free balances’ or ‘Lock-in’ as applicable to ‘Pledged balances’ account and the depository intimating the pledgor and the pledgee to this effect. There is no change of hands/ transfer at this stage and the pledgor continues to remain the legal and the beneficial owner. The pledged goods are, however, now encumbered.

- Release of pledge: Upon satisfaction of the debt, the pledgee is required to return the pledged goods to the pledgor. In case of demat securities, an application for closure of pledge is required to be made to the depository through the depository participant. Upon verifying the same, the depository is required to move the securities from ‘Pledged balances’ to ‘Free balances’ or ‘Lock-in’ as applicable and inform the pledgor and the pledgee. There is no change of hands/ transfer at this stage, as there wasn’t any stage 1. The encumbrance is removed.

- Notice of invocation of pledge: Upon event of default, the pledgee is required to serve reasonable notice on the pledgor in terms of Section 176 of the ICA, 1872 about the intention to invoke the pledge and cause sale of the pledged goods. There is no change of hands/ transfer at this stage and the pledgor continues to remain the legal and the beneficial owner.

- Invocation of pledge: Where the possession of the pledged property is with the pledgee, there is no separate step to be taken for invocation of pledge. However, in case of demat securities, as the securities are held in the demat account of the pledgor, the pledgee is required to undertake the process of informing the depository through the participant about the invocation of pledge. In terms of Reg. 79 (8) of the DP Regulations, the depository registers the pledgee as the “beneficial owner” and the securities move to the demat account of the pledgee. It is important to note at this stage that while there is change of hands/ transfer of securities from one demat to another, in view of the rationale provided in the PTC India ruling, the registration of the pledgee as a beneficial owner is only to enable the pledgee to exercise the right under Section 176 of ICA, 1872. If a pawnee wants to exercise his right to sell dematerialized security, it is mandatory for the pawnee first to get himself recorded as a ‘beneficial owner’ in the depository’s records, in terms of express requirement under Reg. 79 (8) of the DP Regulations, as only a beneficial owner can cause sale of securities.

- Redemption of pledged goods by the pledgor: In terms of Section 177 of ICA, 1872 the pledgor, subsequent to invocation of pledge and at any time before the actual sale of the goods, has the option to repay the amounts and redeem the pledged goods. In case of demat securities, this results in transfer of securities from the pledgee’s account to the pledgor’s account, however, it cannot be regarded as a sale or transfer given the rationale provided in PTC India ruling, as the earlier transfer of demat shares to the beneficial account of the pledgee was not a case of transfer in law. If the pledgee was not the transferee of the shares, the release of the pledge does not amount to transfer from pledgee to the pledgor.

- Sale of pledged goods by the pledgee: While the pledgee does not have the title to the pledged securities, ICA, 1872 empowers the pledgee to cause the sale and convey good title to the buyer. Upon sale of the pledged goods by the pledgee, there is a change in the beneficial owner of the pledged property and the third party purchases becomes the legal and beneficial owner. At this stage, various obligations under SEBI Regulations, as discussed in the latter part, get attracted. It would appear from the movement in demat accounts as if the shares have been transferred from the demat account of the pledgee to that of the buyer; however, in legal parlance, the sale has happened from the pledgor to the buyer.

Impact of pledge under Takeover Code[5]

Overview of the provisions w.r.t disclosures and open offer

“Pledge” is covered within the meaning of ‘encumbrance’ under the Takeover Code. This, obviously, refers to the creation of the pledge. A release of pledge will be a case of removal of the encumbrance.

Pledge of their holdings by promoters of listed entities has received SEBI’s attention for a long time. In terms of Reg. 31 of the Takeover Code, the promoter is required to disclose every detail of shares encumbered by him or the persons acting in concert, to the target company and the stock exchange. In August, 2019 SEBI mandated disclosure of reasons for encumbrance of shares of the listed entity by the promoter along with persons acting in concert if it exceeded a) 50% of their shareholding in the company or 20% of share capital of the listed entity. Further, Reg. 31 also mandates disclosure of any invocation or release of such pledge in the prescribed format.

While Reg. 31 deals with disclosure requirements for the promoters, Reg. 29 deals with the disclosure requirements for the acquirer, including the pledgee, basis prescribed thresholds. Initial disclosure, under Reg. 29 (1), gets triggered upon acquisition of shares or voting rights in a target company which taken together with shares or voting rights, if any, held by him and by persons acting in concert with him in such target company, aggregates to five per cent or more of the shares of such target company. Thereafter, change in shareholding or voting rights, even if such change results in shareholding falling below five per cent, is required to be made in prescribed format if there has been change in such holdings from the last disclosure made under sub-regulations (1) or (2); and such change exceeds two per cent of total shareholding or voting rights in the target company. For the purpose of disclosure under Reg. 29, shares taken by way of encumbrance are treated as an acquisition and shares given upon release of encumbrance are treated as a disposal. The exemption in terms of disclosure by pledgee under Reg. 29 is provided only to a scheduled commercial bank, public financial institution, housing finance company and a systemically important non-banking financial company as pledgee in connection with a pledge of shares for securing indebtedness in the ordinary course of business.

The requirement of open offer gets triggered under Reg. 3 upon acquisition of 25% or more of the voting rights in such target company. In case of an acquirer already holding 25% or more of the voting rights in the target company but less than the maximum permissible non-public shareholding, the open offer obligation gets triggered in case of creeping acquisition in a financial year entitling the acquirer to exercise more than 5% of the voting rights. Further, in terms of Reg. 4 of the Takeover Code, open offer obligation is also attracted in case of acquiring direct or indirect control over the target company. Reg. 10 of the Takeover Code provides the exemptions from the open offer obligations. Presently, if the open offer obligation gets triggered pursuant to invocation of pledge by the pledgee, the exemption is provided only to scheduled commercial banks and public financial institutions. In all other cases, where thresholds are breached pursuant to the invocation of pledge, the open offer obligation gets attracted to the pledgee.

Conflicting compliance requirements in view of PTC India ruling

In view of PTC India ruling, the pledgee is registered as a beneficial owner upon invocation of pledge only to be able to exercise the rights available under Section 176 of the ICA, 1872 and not to own the pledged property by itself as the pledgee is not permitted to own the pledged property. Accordingly, the acquisition by the pledgee is only to be able to cause sale of the pledged securities to third parties or redeeming the pledged securities back to the pledgor, in terms of Section 177 of ICA, 1872 where the pledgor settles the amounts before sale of pledged goods by the pledgee to the third party. In such a case, the exemption under Reg.10 of the Takeover Code extended to scheduled commercial banks and public financial institutions becomes redundant as invocation of pledge will not result in an acquisition of beneficial ownership by a pledgee. Similarly, redemption of pledged property to the pawnor will also have the effect of release of pledge and cannot be regarded as a fresh transaction resulting in disposal by the pledgee and acquisition by the pledgor as the pledgee is not entitled to retain title in the pledged securities. While the rationale provided by SAT in the case of Liquid holdings (supra) has not been overruled by the SC, it must effectively be taken as redundant. If the retention of shares by the lender is not a transfer, then the release post payment by the borrower cannot be a case of acquisition by the borrower/ pledgor. Hence, the question of any open offer does not arise.

Applicability of Takeover Code to various stages of pledge, post PTC India ruling

- Creation of pledge: Will attract disclosure obligations under Reg. 29 in case the thresholds are breached and Reg. 31 in case of pledge by promoters and PACs;

- Release of pledge: Will attract disclosure obligations under Reg. 29 in case the thresholds are breached and Reg. 31 in case of pledge by promoters and PACs;

- Notice of invocation of pledge: No compliance requirement under Takeover Code as it neither results in acquisition nor disposal.

- Invocation of pledge: Will attract disclosure obligations under Reg. 29 in case the thresholds are breached and Reg. 31 in case of pledge by promoters and PACs. In view of the rationale provided in PTC India ruling, it will not attract open offer obligations even if the acquisition attracts Reg. 3 or Reg. 4 as registration of the pledgee as a beneficial owner in terms of Depository Law is only to enable sale of the pledged securities in terms of Section 176 of ICA, 1872.

- Redemption of pledged securities: Will attract disclosure obligations under Reg. 29 in case the thresholds are breached and Reg. 31 in case of settlement of pledge by promoters and PACs. However, in view of rationale provided in the PTC India ruling, re-transfer of pledged securities upon settlement of dues by the pledgor should not attract open offer obligations even if the redemption of pledged securities attracts Reg. 3 or Reg 4 as the pledgee derived the right to acquire beneficial ownership only to exercise its remedy under ICA, 1872 and the upon settlement of the dues, the said right stood terminated.

- Sale of pledged securities: Sale of pledged securities by the pledgee to the third party will attract disclosure requirements under Reg. 29 for the acquisition by the said third party in case the thresholds are breached. It will also attract open offer obligations for the third party in case the acquisition attracts Reg. 3 or Reg. 4.

Impact of pledge under PIT Regulations

Overview of the provisions

Erstwhile SEBI (Prohibition of Insider Trading) Regulations 1993 prohibited dealing in securities[6] while in possession of Unpublished Price Sensitive Information (‘UPSI’). Pledge was not expressly covered in the definition. At the time of finalization of PIT Regulations, as stated in the N.K. Sodhi Committee Report, the Committee was of the following view w.r.t pledges, however, agreed that if one were to construct a pledge or an encumbrance as a device to get around the prohibition on insider trading, the provisions of Section 12A of the SEBI Act would adequately empower enforcement:

“36. On the other hand, using a vague and open-ended phrase like “dealing” could result in outlawing routine bona fide transactions that have no nexus with the objective of the Regulations. For example, a prohibition in “dealing” when in possession of UPSI would result in a prohibition on pledging of shares by any person in possession of UPSI. In the ordinary course of lending activity, substantial shareholders in listed companies are routinely required to provide third party security for borrowings by them or by the companies whose shares they hold. Such encumbrances are but provision of security for loans advanced and as such cannot be justified as being the mischief sought to be suppressed by these regulations. If “dealing in securities” were to be prohibited when in possession of UPSI, all such acts of providing security would become illegal. Such a prohibition would bring the activity of taking a pledge or encumbrance on listed securities to a standstill for the banking and finance industry with no real corresponding benefit to the market.”

As per the draft PIT Regulations, trade pursuant to invocation of pledge was proposed to be covered under the carve out where the trades of the insider were made by another person authorised to so trade on the insider’s behalf without reference to and without prior knowledge of the insider and that other person who traded was not in possession of the unpublished price sensitive information and appropriate and adequate arrangements were in place to ensure that these regulations are not violated. The provision was inter-alia intended to protect an insider from a violation of the provisions when a lender or trustee to whom the insider has pledged or encumbered securities, transacted in exercise of his enforcement rights.

However, the notified PIT Regulations provided a reference of pledge in the legislative note provided under the definition of ‘trade’ stating that such a construction was intended to curb the activities based on UPSI which are strictly not buying, selling or subscribing, such as pledging etc. when in possession of UPSI. In this manner, pledge is regarded to be included in the definition of ‘trade’ as it results in dealing in securities. SEBI, in its Guidance Note of 2015 regarded pledge as covered in the definition of trade and in the Comprehensive FAQS on PIT Regulations, clarified a step further covering the stages of pledge to the effect that trading would include creation/invocation/revocation of pledge.

Consequently, every restriction and compliance requirement applicable to a trade undertaken by a Designated Person (‘DP’) is equally applied in case of pledge of listed securities. The PIT Regulations only provide a carve out from the applicability of trading window restrictions in respect of pledge of shares for a bonafide purpose such as raising of funds, subject to pre-clearance by the compliance officer and compliance with the respective regulations. The onus to demonstrate bonafide intention behind such transactions lies with the pledgor/pledgee. Apart from this, the requirement of seeking pre-clearance, disclosure requirement, contra – trade restrictions, etc. are all made applicable in case of creation, invocation and release of pledge, which seems quite counterintuitive for reasons explained hereunder.

Conflicting compliance requirements in view of PTC India ruling

The Takeover Code regards taking of shares by way of encumbrance as an acquisition and giving of shares upon release of encumbrance as a disposal for the pledgee, only for disclosure purpose. However, SEBI’s inclusion of pledge as “trade” for the purpose of PIT Regulations has the effect of regarding pledge of shares as disposal, and release of shares as acquisition, by the DP. Further, as per the contra trade restrictions under PIT Regulations, when a trade is undertaken by a DP, such DP or immediate relative of DP cannot enter into an opposite trade within six months of the original trade. Applying this in the context of pledges, listed entities stipulate the DPs that if the shares of the listed entity are pledged by the DP, there can be no release in next six months. ICSI Guidance note on PIT Regulations also provides that if a DP pledges his shares, he cannot de-pledge the shares in next 6 months and that he cannot even change the banker with whom the shares are pledged as it will amount to de-pledge of shares and again pledge of shares[7]. This is, obviously, impractical, as there is no reason for a DP who has pledged his securities for taking a loan, not to release the pledge having repaid the loan within 6 months. In fact, there is no reason to regard the release of a pledge as a trade at all. We have discussed the same even in our FAQs on PIT Regulations.

Applicability of PIT Regulations to various stages of pledge, post PTC India ruling

- Creation of pledge: There is no change of beneficial owner upon creation of pledge. The securities remain in the demat account of the pledgor and are simply locked by the depository, in order to avoid dealing in the said securities by the holder. In case the DP has sold certain securities, the contra trade restrictions should not get attracted upon creation of pledge within 6 months from last sale transaction as it is merely creation of a security interest. The requirement of pre-clearance for creation of pledge also seems a perfunctory requirement, especially where the law permits creation of pledge even during trading window closure period. The disclosure requirement is anyways system driven and will get captured pursuant to the record of the Depository.

- Release of pledge: Release of the pledge is, truly speaking, a satisfaction of the pledge. The specific property that the pawnee had expires on satisfaction of the purpose for which the pledge was created. Neither does the pawnee, on satisfaction, have the right to retain the goods (Section 174 of the ICA, 1872) nor does he have any right to cause a sale. Hence, this amounts to an automatic termination of the rights contractually conferred by the pawnor. One cannot contend that on release of the pledge, there is a re-transfer of the specific property back to the pledgor. The securities in the demat account of the holder is simply unlocked by the depository and added to the free balance. If the pawnor is releasing his property by satisfying the debt, he cannot be intending to do so to gain an advantage merely by release. If the DP was to cause a sale of the released securities, that in any case will constitute a trade, but it is wrong to contend that a mere release of pledge is a trade. Therefore, the requirement of seeking pre-clearance as well as contra trade restrictions should not apply in this case.

- Notice of invocation of pledge: There is no dealing in securities at this stage and no compliance requirement under PIT Regulations is involved as it neither results in acquisition nor disposal.

- Invocation of pledge: The right to invoke a pledge remains with the pawnee of the property and a pledge can be invoked only when there is a default on the part of the pawnor. This certainly cannot attract contra trade restrictions as the pawnor cannot control invocation of pledge and therefore, the requirement of seeking a pre-clearance from the Compliance Officer seems a perfunctory requirement. On invocation of the pledge, the pawnee attains the right to cause a sale of the property, as per Section 176 of the ICA, 1872. The pawnee does not become absolute owner of the property on invocation of the pledge and is simply registered as a beneficial owner under DP Laws in order to cause a sale of the pledged article. The disclosure requirement is anyways system driven and will get captured pursuant to the record of the Depository.

- Redemption of pledged securities: Section 177 of the ICA, 1872 gives the pawnor a right to redeem even after the stipulated time for payment and before the sale of the invoked securities. Naturally, upon settlement of entire dues, it will result in re-transfer of the pledged securities to the pawnor. In the author’s view, the restriction of contra trade and the requirement of pre-clearance should not apply even in that case as the re-transfer is consequential to settlement of outstanding amounts by the pawnor and has similar effect of release of pledge. It has been clarified in the PTC India ruling that registration of the pledgee as a beneficial owner is only to enable the pledgee to cause a sale while exercising the right as per Section 176 of ICA, 1872.

- Sale of pledged securities: This is the stage that results in disposal of the securities by the DP. However, it can be contended that the individuals who were in possession of such UPSI were different from the individuals taking trading decisions and such decision-making individuals were not in possession of such UPSI when they took the decision to trade. Accordingly, the requirement of pre-clearance and contra-trade restrictions should not apply even in the instant case as the sale is done by the pledgee in the course of enforcement of security interest. Ideally, the disclosure requirement should also get triggered at this stage as the transfer to the demat account of the pledgee is merely to enable the pledgee to cause a sale.

Conclusion

PTC India ruling reiterates the need to align the exemptions and compliance requirements under the Takeover Code and PIT Regulations with the governing provisions of ICA, 1872, keeping in view the various stages involved in a pledge transaction and to avoid discord or ambiguity resulting in instability or confusion. Regarding the pledgee as the beneficial owner, treating re-transfer of pledged securities as an acquisition by the pledgor, applying contra-trade restrictions at different stages of pledge is resulting in deviation from the underlying principles of pledge as detailed in ICA,1872.

[1] Refer complete analysis of the SC Ruling in the article Broken Pledge? Apex Court reviews the law on pledges.

[2] Corresponding to Regulation 79 (8) of SEBI (Depositories and Participants) Regulations, 2018 (‘DP Regulations’).

[3] (2011) SCC Online SAT 40. We have discussed the validity of this ruling in the light of PTC India ruling in the latter part.

[4] Refer our article Pledges in the Context of Insider Trading Regulations.

[5] Refer our article Pledge under SEBI Takeover Regulations, 2011.

[6] Defined to mean means an act of subscribing, buying, selling or agreeing to subscribe, buy, sell or deal in any securities by any person either as principal or agent;

[7] Page 145 of the Guidance Note.

Leave a Reply

Want to join the discussion?Feel free to contribute!