Easing Delisting of Equity Shares

-Shreya Masalia and Anushka Vohra

In order to make the existing delisting Regulations robust, efficient, transparent and investorfriendly, the Securities Exchange Board of India (‘SEBI’) has issued the SEBI (Delisting of Equity Shares) Regulations, 2021[1] (‘Delisting Regulations, 2021’) on June 11, 2021, thereby superseding the erstwhile SEBI (Delisting of Equity Shares) Regulations, 2009[2] (‘Erstwhile Regulations’). The Erstwhile Regulations were notified on June 10, 2009. Thereafter, several amendments have been carried out in the delisting regulations according to the changing need and developments in the securities market. Thus, to further streamline and strengthen the process to be followed for delisting, the Delisting Regulations have been introduced.

In India, a large number of entities are listed on regional stock exchanges, serving no public interest at all. In fact, over the years, most of them have become non-compliant. However, given the cumbersome process of delisting, these companies have chosen to remain listed. The Delisting Regulation, 2021 has made the path of exit for these entities comparatively easier.

In this article, the authors have made an attempt to discuss the changes in the delisting procedure as introduced vide the Delisting Regulations, 2021.

Background

Listing of shares at stock exchanges provides for free transferability and ready marketability to the shares of a company. In contrast to that, when a public company chooses to go private, it has to delist from the stock exchanges – which means that the shares of that company will no longer be available for trading on the platform provided by the stock exchange.

The Companies choose to list themselves to grab the advantages of listing viz; lower cost of capital, greater shareholder base, liquidity in trading of shares, prestige etc. But the companies need to be contended that the benefits of listing outweigh the listing costs, the compliance requirements do not overburden the companies and do not expose them to disciplinary actions.

Initially, there existed 21 regional stock exchanges (‘RSE’) in India of which 20 such RSEs have shut down over the years due course due to their lack of financial viability, exchanges becoming defunct, usage of archaic technology and subsequent derecognition of the exchanges by SEBI. The lone-standing regional stock exchange is the Calcutta Stock Exchange (‘CSE’), which is also at its verge of getting shut. Various companies continue to be listed on CSE, however the economic viability of the same is still questionable. The Delisting Regulations provide for an easy exit opportunity to these companies by significantly reducing the time-period of the delisting process and streamlining the same.

Also with the relisting bar of 5 years in case of voluntary delisting having been reduced to 3 years will now allow the companies to relist in a comparatively lesser period of time and raise funds for their new venture.

Why do companies opt for delisting?

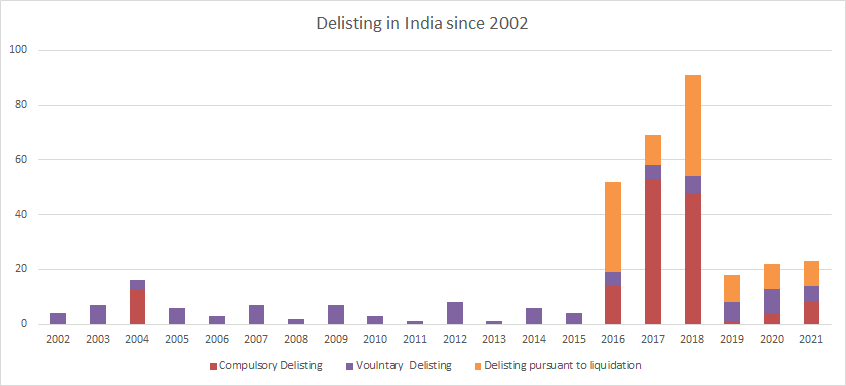

The statistics given below show that there has been a tremendous increase in the number of companies being delisted from the stock exchange. Delisting from the stock exchanges could either be undertaken voluntarily, or compulsory delisting by the Stock Exchanges or delisting pursuant to liquidation.

(Source: NSE)

Understanding compulsory and voluntary delisting

Compulsory delisting generally, is caused due to procedural and compliance lapses by the companies. Amongst other causes, the major causes for compulsory delisting include non-payment of listing fee, reduction in public shareholding and failure to meet the same, unfair trade practices at the behest of the management/promoters etc.

While compulsory delisting is at the precept of the Stock Exchanges, companies opt to voluntarily delist themselves.

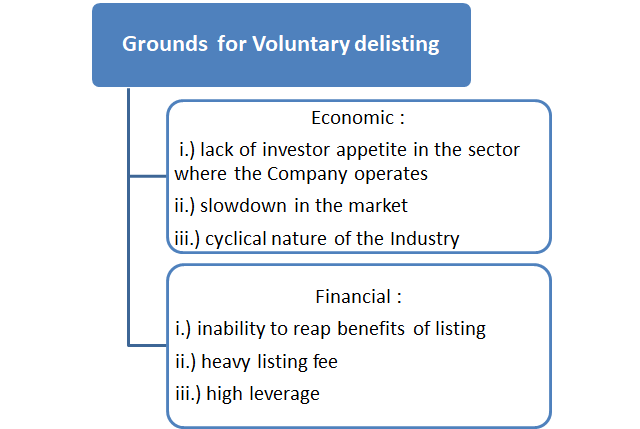

The most common rationale for companies to opt for voluntary delisting in the recent time has been;

- To obtain full ownership of the company by the promoter & promoter group which will in turn provide increased financial flexibility to support the Company’s business and financial needs;

- To explore new financing structures including financial support from the Promoter Group;

- To help in cost savings and allow the management to dedicate more time and focus on the core business;

- To provide easy exit to shareholders because of thin trading volume.

Modes of Exit via Delisting

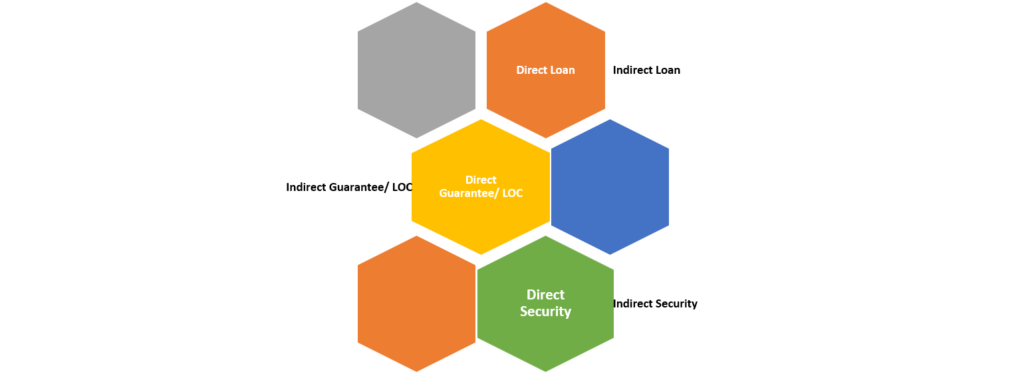

The Delisting Regulations, as laid down by SEBI provides two modes of delisting of equity shares viz; (a) Compulsory and (b) Voluntary:

Further, in the case of voluntary delisting, companies have the following options:

- delisting from all the recognised stock exchanges ;

- delisting from any but not all the recognised stock exchanges, including delisting from Stock Exchange having nationwide trading terminal;

- delisting from any but not all the recognised stock exchanges, while remaining listed on the Recognised Stock Exchange having nationwide trading terminal.

In the case of 1 and 2 above, the companies have an obligation to provide an exit opportunity to the existing shareholders.

While the process in case of iii. above remains the same, changes have been brought about in the way a company has to manage the delisting offer pursuant to provision of exit opportunity. The gist of the changes introduced by the Delisting Regulations have been discussed below.

Overview of the Key Changes

- Disclosure by the Acquirer / Promoter[3]–

In the Erstwhile Regulations, the process flow was that the acquirer used to intimate their intention to delist the Company to the Board and the Board would then intimate the same to the Stock Exchanges before granting its approval.

Now the Delisting Regulations, 2021, cast an obligation on the acquirer to intimate to the Stock Exchanges, their intention to delist the Company first and within one working day of its intimation shall also inform the Company at its Registered Office, this is termed as the Initial Public Announcement.

Comments: An intention to delist a company is a price sensitive event and can have a major impact on the market. Hence, its immediate disclosure to the public is warranted. Therefore, to fill the lacunae on information being made available to the public, intimation by the acquirer has been made mandatory.

2.Time-bound mechanism

The delisting procedure involves intricacies requiring approvals at various stages.Unlike the t new regulations specify the timelines for the entire process, making it less cumbersome and time-bound, as shown in the table below:

| Event / compliance | Existing Timeline | Revised Timeline |

| Board resolution | None specified | Within 21 days from the date the acquirer expresses his intention |

| Special resolution | None specified | Within 45 days from the date of approval of the board |

| Escrow Account | Before making public announcement | Not later than 7 working days from the date of obtaining the shareholder’s approval. |

| In-principle approval | None specified | Within 15 working days from the date of obtaining shareholders approval or receipt of any statutory or regulatory approval; whichever is later. |

| Outcome of Reverse Book Building (‘RBB’) | None specified | To be announced within 2 hours from the closure of the bidding period. The same is also required to be published in the same newspapers as the newspapers in which the detailed public announcement was made within 2 working days from closure of the tendering period. |

| Release of shares in case of failure of offer | Within 10 working days from the closure of the offer, where bids were not accepted | In case of failure due to

90% of the shares are not tendered: on the date of disclosure of the outcome of the RBB process

Discovered price being rejected by acquirer: on the date of making public announcement for the failure of the delisting |

| Payment on successful delisting | Within 10 working days from closure of offer | Discovered price same as floor price: payment through secondary market settlement mechanism

Discovered price higher than floor price: within 5 working days from the date of making the payment to the public shareholders |

| Final application to the stock exchanges after successful delisting | Within a period of 1 year from the date of passing of special resolution | Within 5 working days from the date of making the payment to the public shareholders

|

3.Due diligence by Peer Reviewed Company Secretary

Before making the public announcement in case of voluntary delisting, the board had to appoint a Merchant Banker for carrying out the due diligence and then on obtaining the in-principle approval, the acquirer had to appoint a Merchant Banker to act as manager to the issue. The Regulations provided that the Merchant Banker appointed by the board could act as manager to the offer.

Comments: Realising that this could probably result in conflict of interest, the new regulations provide that the board shall appoint a Peer Reviewed Company Secretary, who shall be independent of the promoter/ acquirer/Merchant Banker/or their Associates before the board meeting for granting approval and the Company Secretary shall carry out the necessary due diligence. Further, the acquirer shall before making the initial public announcement, appoint a Merchant Banker to act as manager to the offer. This has also opened up a new avenue for the Company Secretaries in Practice.

4.Escrow Account

Under the Erstwhile Regulation, the acquirer was required to deposit the consideration amount in the Escrow account after getting in-principle approval from SE however before making the PA. The new regulations make it obligatory on the acquirer to open an escrow account even before applying for in-principle approval. The acquirer has to deposit an amount equivalent to 25% of the total consideration at the time of opening the escrow account and the remaining consideration amount of 75% shall be deposited in the escrow account prior to the detailed public announcement.

Comments: Because of stringent timelines, surety is provided that the acquirer has the financial stability and has earmarked funds for the proposed delisting. Moreover, since this is an interest-bearing account, there would be no loss of interest, even if the delisting offer fails at the end.

5.Enhanced responsibility on the Board of Directors

The new regulations intend to be more robust as far as the responsibility of the board is concerned. The erstwhile regulations required that the board shall before granting its approval certify that the proposed delisting is in the interest of the shareholders. And this certification was mere infructuous because there was no disclosure of the same and no reasonable justification, for that matter.

Comments: Considering a situation, where the Expression of Interest is received from an amicable acquirer i.e. the case of friendly takeover, there is a possibility of collusion between the acquirer and the management and in that case the interest of shareholders’ might take a back seat. However, to avoid the same, Regulation 28 has been added into the new regulations which provides that upon receipt of the detailed public statement the Board of Directors shall constitute a committee of independent directors to provide written reasoned recommendations on the delisting offer and the same shall also be disclosed by the Company in the newspapers where the detailed public statement was published, at least 2 working days before the bidding period.

6.Investor friendly regulations

SEBI, being the watchdog of the Securities Market, had been established to protect the interest of investors as one of its main objectives, amongst others.

The Delisting Regulations provide that the public shareholders who could not participate in the RBB process could further tender their shares upto 1 year from the date of delisting and the promoter shall accept the tendered shares at the price which was finalised through RBB.

In addition to that, the new regulations now require the promoter/acquirer/Merchant Banker to comply with the following on a quarterly basis for 1 year from the date of delisting:

- Submit quarterly reports to the Stock Exchanges specifying details of shareholders at the beginning and end of the quarter and shareholders who availed the offer during the quarter;

- To send follow up communications to remaining shareholders;

- Publishing advertisement to invite the remaining shareholders to avail the offer

Comments: While the shareholders were given a time of upto 1 year, it was observed that the promoters did not take active steps to bail out the remaining shareholders.

7.Indicative Price

The new regulations have unraveled the concept of Indicative Price. As a general practice, some companies with a view to wriggle out of the complexities of remaining listed on the bourses, used to mention the terms indicative price or attractive price in the letter of offer. This price being higher than the floor price, was used to lure the shareholders to tender their shares.

The new regulations have defined Indicative Price as being a price higher than the floor price.

Comments: Even though the word has found its place in the regulations, in our view, SEBI should place a capping on the indicative price so as to ensure that the Companies do not offer lucrative price to the shareholders.

Changes in addition to the above

Special provisions for delisting of shares already existed for small companies in the erstwhile regulations. SEBI has further prescribed the following special provisions for delisting:

1.Special provisions for delisting of shares on Innovators Growth Platform

These provisions are similar to the provisions for delisting of shares from the main board however, these provisions require that shares tendered reach 75% of the total issued shares of that class and at least 50% shares of the public shareholders as on date of the board meeting in which such delisting is approved are tendered and accepted instead of the 90% requirement.

2. Special provisions for a subsidiary company getting delisted through scheme of arrangement wherein the listed holding entity and subsidiary company are in the same line of business

Transactions covered under the given head will not attract provisions of these Regulations provided the various conditions mentioned in regulation 37(2) have been complied with.

SEBI, vide notifcation dated July 09, 2021 has exempted the listed subsidiary companies, getting delisted through scheme of arrangement, that are –

– in the ‘same line of business’ as of its holding company;

– the subsidiary shall be a listed subsidiary of a listed holding company for a period of 3 years.

Further, vide said notification, SEBI has also laid down the following criteria for ascertaining whether the listed holding entity and subsidiary are in the ‘same line of business’:

3. Special provisions for delisting by operation of law

These provisions shall be applicable in case of winding up of a company and recognition of a stock exchange by SEBI. In the former, the process of winding up shall be as prescribed by the prevalent regulatory framework. However, the latter seems highly unlikely.

Some Miscellaneous Changes

- The erstwhile regulations identified only peer reviewed chartered accountants and merchant bankers as valuers, however the same has now been defined with reference to section 247 of the Companies Act, 2013 which widens the scope of the definition. Therefore, any individual with a post-diploma/postgraduate degree or a bachelor’s degree with 3 and 5 years experience respectively in the specified field or having membership of a professional institute established by an Act of Parliament enacted for the purpose of regulation of a profession with at least 3 years’ experience after such membership shall also be considered as eligible valuers.

- The detailed public announcement, amongst other details, is now also required to provide the indicative price if any given by the acquirer and a list of documents copies which shall be available for inspection by public shareholders at the registered office of the manager during the working days.

- The copy of the letter of offer shall be made available on the website of the company as well as that of the manager to the offer. The order copy of the stock exchange ordering compulsory delisting of the entity shall be uploaded on the website of the stock exchanges.

- As a pre-condition to voluntary delisting, the erstwhile regulations provided that the Companies cannot apply for delisting pursuant to buyback/preferential allotment offer being made. But there was lack of cohesiveness on when the buyback/preferential allotment offer being made by the Company would restrict delisting offer. Therefore, the new regulations specify that voluntary delisting shall not be permitted unless a period of 6 months has elapsed from the date of completion of last buyback/preferential allotment.

- For counting minimum 90% of the issued shares of a class, shares held by custodian of depository receipts, by Trust under SEBI (Share Based Employee Benefit) Regulations, by inactive shareholders such as vanishing and struck off companies have been excluded aiding the acquirer to achieve the minimum share tendering criteria with greater ease.

Effect of the instant changes

The new regulations have eased the earlier complex procedure of voluntary delisting. The enhanced disclosures and transparency will help to instil confidence among the shareholders. The business environment is dynamic and the time-bound procedure would help the companies to avail exit from the Stock Exchanges and explore their business opportunities by going private.

Concluding Remarks

In India, “Delisting” process has seen very less success as compared to the global market. The new regulations irrefutably addresses some core aspects and also emphasizes on incremental improvements by plugging some of the gaps in the Erstwhile Regulations, as the new Regulations inter alia provide for delisting of equity shares of a subsidiary company (having the same line of business), delisting pursuant to a scheme of arrangement and delisting due to operation of law such as due to winding up of a company or de-recognition of a stock exchange. However, in view of the authors, the cautious approach taken by the SEBI in the New Regulations may still narrow its applications. The impact of the changes brought in through New Delisting Regulations on the success rate of the delisting process is yet to be seen.

[1] https://egazette.nic.in/WriteReadData/2021/227507.pdf

[2] https://www.sebi.gov.in/legal/regulations/jun-2009/sebi-delisting-of-equity-shares-regulations-2009-last-amended-on-march-6-2017-_34625.html

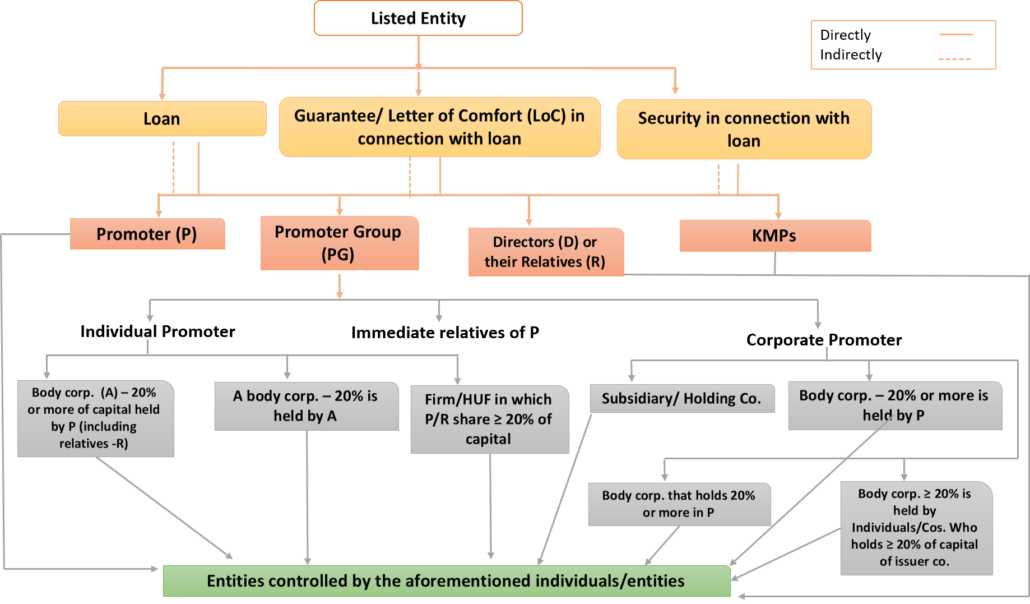

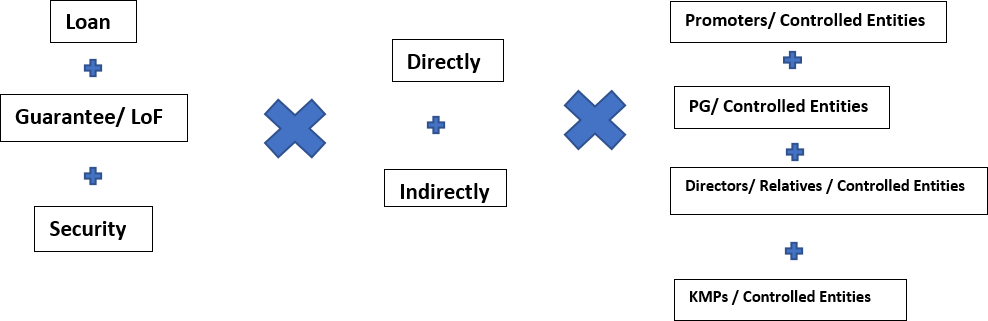

[3] “acquirer” includes a person –

(i) who decides to make an offer for delisting of equity shares of the company along with the persons

acting in concert in accordance with regulation 5A of the Takeover Regulations as amended from

time to time ; or

(ii) who is the promoter or part of the promoter group along with the persons acting in concert.

Ourresources on the topic:-