Archive for month: June, 2021

SEBI revisits the concept of Promoter and Promoter Group

/0 Comments/in SEBI /by StaffProposes shift from ‘promoter’ to ‘persons in control’

Ajay Kumar K V | Manager (corplaw@vinodkothari.com)

Introduction

The capital market watchdog, Securities and Exchange Board of India (‘SEBI’) has come out with a consultation paper on changing the concept of company ‘promoters’, and moving towards the idea of ‘person in control’. The proposal has come in the light of a drift from the conventional Indian ownership structure to the contemporary ownership structure where more than one person or persons controls an entity. The start-up ventures and the most celebrated ‘unicorns’ of the industry have substantial investment from Institutional investors and Private Equity players (‘PE firms’) who exercises control over the decision-making process through board representation and other means.

Further, SEBI has also proposed changes to the existing lock-in period requirements, streamlining disclosures of group companies, and rationalising the ‘Promoter Group’ definition in SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘ICDR’).

In this write-up, we have made an analysis of the concept of Promoter and Promoter Group, various obligations of the Promoter under SEBI Regulations, and the rationale for the shift from ‘Promoter and Promoter Group to ‘Person in Control’

Who is a Promoter?

Generally, any person who plays a major part in forming a company or establishing its business usually the prospective owners or directors of the company is regarded as a Promoter. They bring the business idea into existence and sets the vision and growth targets.

Promoter under Companies Act, 2013

Under the Companies Act, 2013, a promoter is a person who has been named as such in the prospectus or is identified by the company in the annual return filed every year. The definition also covers person(s) who has control over the affairs of the company, directly or indirectly whether in the capacity of a shareholder, director, or otherwise. Further, those person(s) in accordance with whose advice, directions, or instructions the Board of Directors of the company is accustomed to act, except in case of a person acting in a professional capacity, would also be considered as a promoter of a company.

Promoter under SEBI Regulations

The term ‘Promoter’ is defined under ICDR and various other SEBI regulations has the reference to the definition as given in ICDR.

Promoter under ICDR

The Regulation 2 (1) (oo) of ICDR defines the term ‘promoter’. The definition is similar to the definition in the Companies Act, 2013 and provides that a financial institution, scheduled commercial bank, foreign portfolio investor other than individuals, and the other specified body corporates shall not be deemed to be a promoter merely by holding 20% or more of the equity share capital of the issuer unless such person satisfies other requirements prescribed under the regulations.

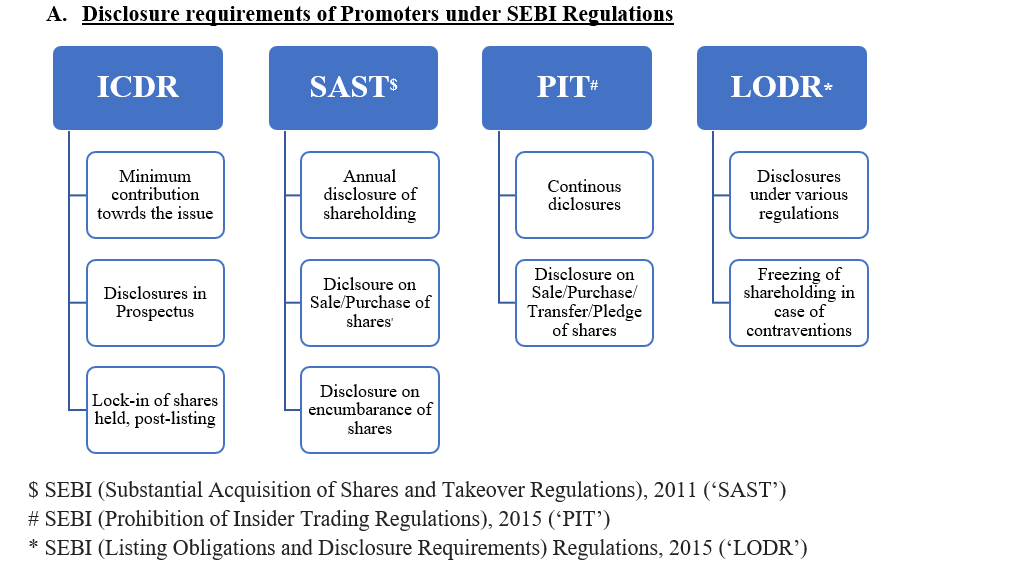

Obligations on Promoters under SEBI Regulations

The identification of promoters is crucial in the listing process as the ICDR places substantial responsibilities on the Promoters. To ensure their ‘skin in the game’ after the IPO, the ICDR place various obligations on the promoters such as a 20% minimum shareholding in the post-issue share capital of the company and lock-in restriction of three years on such shareholding. There are also onerous disclosure requirements on promoters with respect to disclosures in the prospectus so that the general public has adequate information on the company for deciding whether to invest in the IPO or not.

However, being classified as a promoter of an investee company (Company) may not be favourable for a PE investor especially for those investors targeting the IPO as an exit route from the company. Therefore, it is vital for a PE investor to understand the key responsibilities and continuous disclosure requirements when classified as a promoter under the ICDR, including disclosure requirements relating to members of promoter group entities.

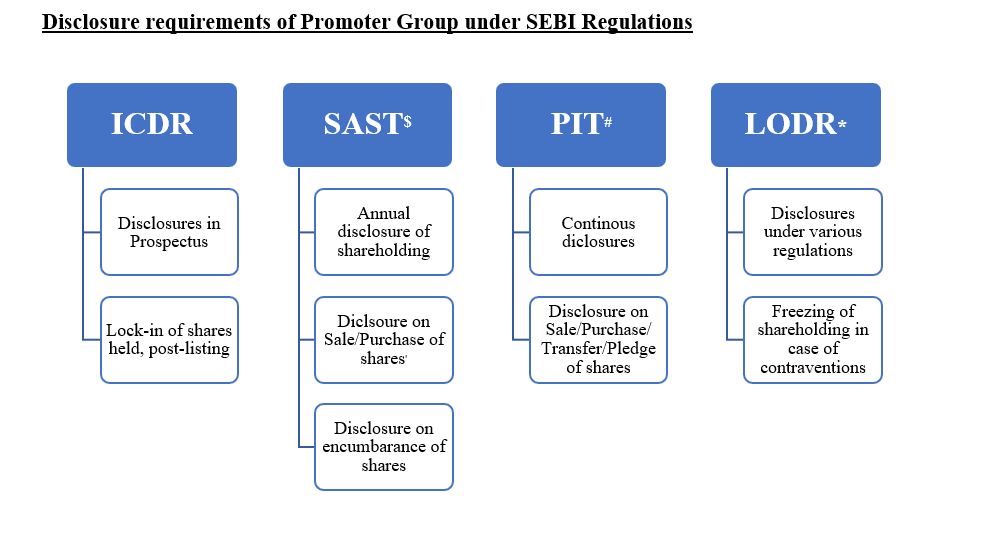

Figure – 1

Freezing of Promoter holding in case of default

Freezing of Promoter holding in case of default

Under Chapter XI, Regulation 98 of LODR provides that in case of contraventions of the provisions of LODR, the shareholding of promoter/promoter group may be frozen by the respective stock exchange(s), in the manner specified in circulars or guidelines issued by the Board in coordination with depositories.

Thus, the promoters are subject to such action by the SEBI or the stock exchange in case of contraventions which adds up to the responsibilities of the promoter/promoter group. They need to ensure that the entity is in compliance with all the rules & regulations even if they are not involved in the day-to-day management of the entity.

The concept of Promoter Group

Regulation 2 (1) (pp) of ICDR defines Promoter Group (‘PG’) based on the nature of the promoter i.e. if the promoter is an individual and if the promoter is a body corporate. The definition, essentially, includes the promoter and the relatives of the promoter (spouse, parents, brother, sister, or child of the person or of the spouse).

| PG, if the promoter is an individual | PG, if the promoter is a body corporate |

| · a body corporate in which 20% or more of the equity share capital is held by the promoter or an immediate relative of the promoter and

· a firm or Hindu Undivided Family in which the promoter or any one or more of their relative is a member would fall under the promoter group category. · a body corporate in which a body corporate as mentioned above holds 20% or more, of the equity share capital and · a Hindu Undivided Family (HUF) or firm in which the aggregate share of the promoter and their relatives is equal to or more than 20% of the total capital of the company.

|

· a subsidiary or holding company of such body corporate

· a body corporate in which the promoter holds 20% or more of the equity share capital; and/or · a body corporate which holds 20% or more of the equity share capital of the promoter · a body corporate in which a group of individuals or companies or combinations thereof acting in concert, which hold 20% or more of the equity share capital in that body corporate and such group of individuals or companies or combinations thereof also holds 20% or more of the equity share capital of the issuer and are also acting in concert |

The promoter group will also include all persons whose shareholding is aggregated under the heading “shareholding of the promoter group” in the shareholding pattern of the company.

It should be noted that, under the proviso to the definition of the promoter group, financial institutions, scheduled bank, foreign portfolio investor other than individuals, mutual funds, and such other body corporates as provided, are not deemed to be promoter group merely by virtue of the fact that 20% or more of the equity share capital of the promoter is held by such person or entity. However, such entities will be treated as promoter group for the subsidiaries or companies promoted by them or for the mutual fund sponsored by them.

The SEBI has proposed to delete Regulation 2(1) (pp)(iii)(c) from the definition of prompter group in the case of a promoter being a body corporate. The sub-clause covers those entities in which a group of individuals or companies or a combination thereof holds 20% or more who are also holding 20% or more of the equity in the issuer. These entities could be unrelated and the financial objectives of the investors can also be different. Since the only factor connecting the two entities is the common financial investors, the data captured under the said sub-clause may not be a piece of fruitful information to the investors and in turn, adds up the compliance & disclosure burden on the listed entity.

There arises a situation where persons who are not involved with the business of the issuer are covered by the definition and are required to make disclosures merely by falling within the ambit of the definition. The said proposal of deletion of the clause will bring in much more meaningful data to the investors for better analysis and will also help the issuer in reducing its compliance burden.

The definition of promoter group under ICDR is referred to in various SEBI regulations as in the case of the definition of the promoter. The obligations of the promoter group are similar to those of the promoters in terms of continuous disclosures and compliances under various SEBI regulations.

Figure 2

The need for re-visiting the concept of Promoter

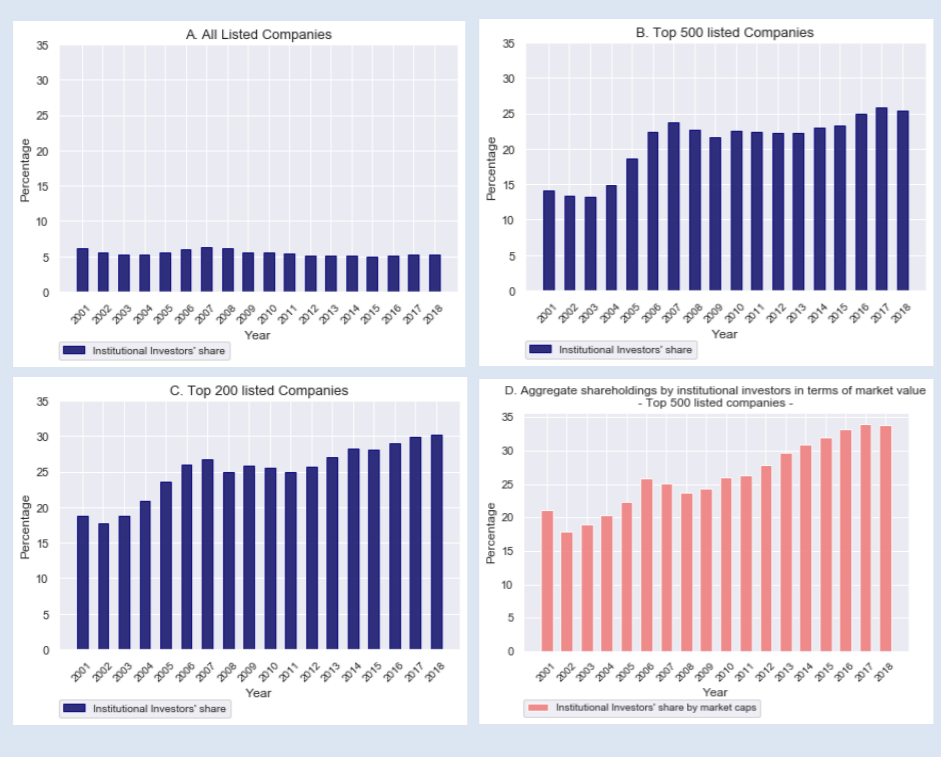

The recent studies show that institutional investors are gaining a notable share in the Indian capital market, especially in the space of Top 500 listed companies by market capitalisation. The OECD report[1] shows that institutional investors represent an estimated investment of close to USD 400 billion in the public equity market, which is around 30% of total market capitalisation in India. In the year 2018, the institutional investors held almost 34% of equity holding of the top 500 Indian listed companies by market capitalization[2].

Among the top 500 listed entities by market cap, there is a sharp increase in the shareholding by the institutional investors from 14% in 2001 to 26% in 2018.

The current growth of the Indian primary and secondary markets is also due to the growing number of foreign institutional investors who have made considerable investments in the listed and unlisted space.

Institutional ownership in Indian listed companies (2001-2018)[3]

The data shows that there is a considerable shareholding in listed companies that may not fall under the ‘promoter/promoter group’ instead appears under the ‘public’ category but is in a position to influence the management and the decision-making process.

Thus, to bring such entities and persons who are now outside the umbrella of the promoters for the benefit of the retail investors as well as to have better governance over such entities to be accountable under the various provision of the SEBI Regulations, a re-visit to the very definition of the promoter is necessary.

A paradigm shift from promoter to the person in control is essential because several businesses, including new age and tech companies, are non-family owned and/or do not have a distinctly identifiable promoter group. The typical Indian family-owned companies are slowly moving away from their “once a promoter, always a promoter” status with the change in their leadership.

Shifts in the pledge of Promoters’ shares (2001-2018)[4]

In India, the promoters of listed entities pledge their shares as collateral to secure finance from banks & financial institutions. The underlying risk factor on the pledging of promoter stake is that an instance of default would significantly affect the share prices thereby putting the market as well as the retail individual investors at potential losses.

The number of shares pledged shows an upward trend until 2016 across all listed companies. However, the market value of shares pledged has remained stable while the number of pledged shares shows a slight downward trend since 2013.

In the Financial Stability Report, December 2014” (2014), RBI stated, “a typical Indian company, the promoters pledge shares not for funding outside business ventures but for the company itself. Given the vulnerabilities in some promoter-led companies, pledging of promoters’ shares could pose risks to the financial stability.”

SEBI has made the disclosure framework in respect of pledge of shares as collateral more stringent through the SAST regulations and has also provided strict timelines for such disclosures by promoters and promoter group. The data is disseminated through the stock exchange for the benefit of the investors.

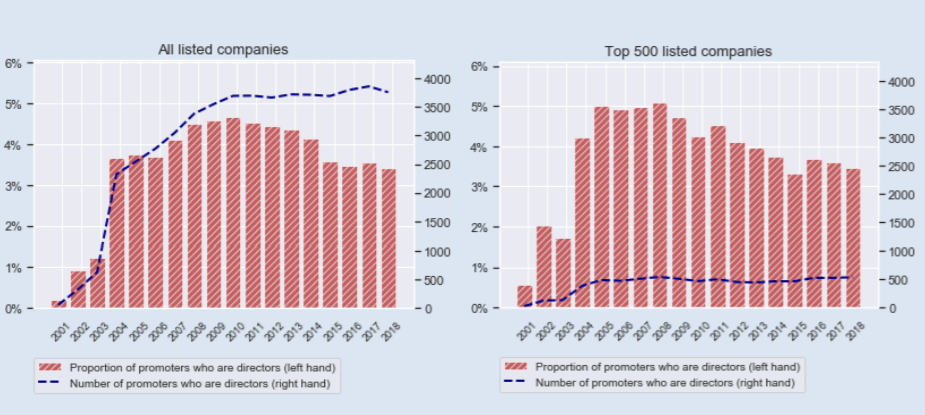

Shifts in directors who are Promoters (2001-2018)[5]

Due to the traditional family-owned business setup, the promoters also get a seat on the board of directors of the company. The above figure shows the paradigm shift in the board participation by promoters and the average proportion between promoter directors and non-promoter directors during the period 2001- 2018.

The SEBI has brought safeguards to protect the minority shareholders’ rights especially to cover the companies with promoters holding board positions. The Regulation 17 of the LODR provides that;

- Where a regular non-executive chairperson of a listed entity is a promoter of the listed entity or is related to any promoter, at least half of the board of directors of the listed entity shall consist of independent directors.

- The fees or compensation payable to executive directors who are promoters or members of the promoter group shall be subject to the approval of the shareholders by special resolution in the general meeting of the members where such fees or compensation exceeds the limits prescribed therein.

These are a few measures to ensure that the promoter directors do not get an undue advantage due to their ability to influence the decision-making process by the Board of directors of the company and an element of independence is involved in the Board process.

However, it is pertinent to note that, the restrictions are only attracted to the ‘promoters’ and persons ‘related to promoter’ of the company. A shift from ‘promoter’ to ‘person in control’ may cover those persons who are currently outside the ambit of the definition of ‘promoter’ but enjoys an element of influence on the entities.

SEBI discussion paper on Brightline Tests for the acquisition of ‘Control’[6]

The SEBI had issued a discussion paper on Brightline Tests for Acquisition of ‘Control’ under SEBI Takeover Regulations in 2016, with the intent to decide whether a numerical threshold as the current practice or a principle-based test can be conducted to determine whether a person is in control of a listed entity.

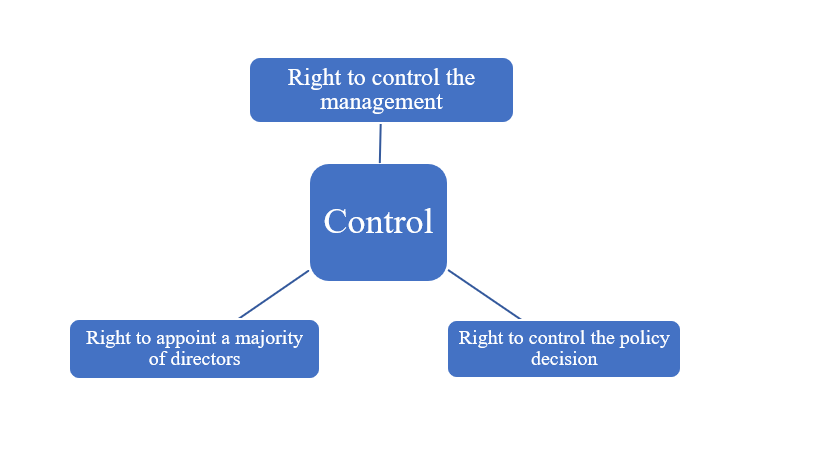

The term ‘control’ implies the ability of a person or a group of persons acting with a common objective to influence the management and policy-making process of an entity. It can be said that such person(s) is(are) in the ‘driving seat’ with a substantial influence over the key business decision making, even without involving in the day-to-day affairs of the company.

The identification of control is undemanding in the instances where the rights arise from the shareholding/voting rights in the company. The real test of control in the cases of contractual agreements becomes complex and demands elaborate consideration of facts and circumstances of the case.

Therefore, the nature of the definition of control in such cases has to be based on a set of defined principles rather than the rules. In the matter of Subhkam Ventures (I) Pvt. Ltd.[7] the Hon’ble SAT, in its judgment dated January 15, 2010, rejected SEBI’s view stating that none of the clauses of the agreements, individually or collectively, demonstrated control in the hands of the acquirer wherein SEBI argued that the rights conferred upon the acquirer, through the agreements, amounted to ‘control’ over the target company.

The essence of the order was, control, according to the definition, is a proactive and not a reactive power. The test is whether the acquirer is in the ‘driving seat’.

The SEBI’s proposal for replacing the term ‘promoter’ with ‘person in control’ would change the current regulatory framework and will align with what was intended to be amended under SAST. However, the amended definition should exclude protective rights/ veto exercised by the acquirer that are participative in nature.

The concept of Control under various other Acts, Rules & Circulars

-The Insurance Laws (Amendment) Act, 2015 provides that control shall include the right to appoint a majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders agreements or voting agreements. Thus, the ambit of coverage of promoter under the Act is wide enough to include various types of business ownership structures.

-Consolidated FDI Policy Circular of 2020 has a similar definition as provided in the Insurance Laws (Amendment) Act, 2015.

-In Competition Act 2002, the concept of control includes controlling the affairs or management by one or more enterprises,

(a)either jointly or singly, over another enterprise or group;

(b)one or more groups, either jointly or singly, over another group or enterprise

-International Financial Reporting Standard (IFRS) also defines the principle of control and establishes control as the basis of determining which entities are consolidated in the consolidated financial statements. Under IFRS, the principle of control sets out the following three elements of control:

(a) power over the investee;

(b) exposure, or rights, to variable returns from involvement with the investee; and

(c) the ability to use power over the investee to affect the amount of the investor’s returns.

Whether test applied for identifying SBO under CA, 2013 is of any relevance here?

The MCA vide its Notification dated June 13, 2018,[8] has enforced the provisions of amended Section 90 of the Companies Act, 2013 and also issued the Companies (Beneficial Interest and Significant Beneficial Interest) Rules, 2018 concerning Significant Beneficial Ownership (‘SBO’).

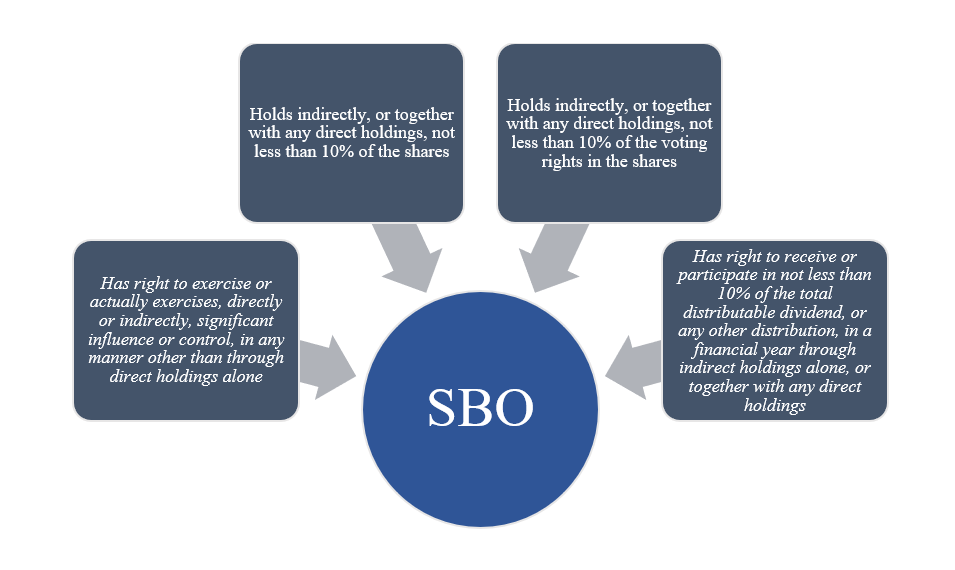

Meaning of SBO

The Significant Beneficial Owner is an individual who alone or together with or through one or more persons or trust, holds a beneficial interest (as prescribed under the SBO Rules) in the shares of a company or has the right to exercise, or the actual exercising of significant influence or control as defined in clause (27) of section 2 of the Companies Act, 2013.

The revised SBO rules have prescribed the following definition to SBO;

Often when it comes to investments the PE investors structure their investments into a Company through multi-layered entities, with the immediate holding entity of the Company will merely act as an investment vehicle and not a substantive entity.

The premise of SBO rules is to identify the natural person behind the entity. Therefore, to identify such natural persons exercising ultimate control over the Company, the SBO rules can be applied. However, the persons in control of the entity may be a natural person or a body corporate as mentioned above. Hence, the basic principle of SBO may not be useful to identify the latter, as the SBO rules have the primary objective of identifying money-laundering activities and their related provisions under the Prevention of Money Laundering Act of 2002.

The SEBI Board meeting held on 6th August 2021, accepted the changes proposed in the consultation paper on ‘Review of regulatory framework for promoter, promoter group and group companies’. The table showing the proposals and the SEBI Board decision on the same is tabulated below:

| Proposal | SEBI Consultation paper | SEBI Board decision |

| Reduction in lock-in periods for minimum promoter’s contribution and other shareholders for public issuance on the Main Board

|

The lock-in of promoters’ shareholding to the extent of minimum promoters’ contribution (i.e. 20% of post issue capital) shall be for a period of 18 months from the date of allotment in initial public offering (IPO)/further public offering (FPO) instead of existing 3 years, in the following cases:

a) If the object of the issue involves only offer for sale b) If the object of the issue involves only raising of funds for other than for capital expenditure* for a project (more than 50% of the fresh issue size) c) In case of combined offering (Fresh Issue + offer for sale), the object of the issue involves financing for other than capital expenditure for a project (more than 50% of the issue size excluding OFS portion) * The term capital expenditure shall be clarified to include purchase of land, building and civil work, plant and machinery, miscellaneous fixed assets, technology etc. |

Accepted |

| Lock-in of Promoter holding in excess of minimum promoter contribution | Further, in all the above-mentioned cases, the promoter shareholding in excess of minimum promoter contribution shall be locked-in for a period of 6 months instead of existing 1 year. | Accepted |

| Reduction in lock-in periods for other shareholders for public issuance | The entire pre-issue capital held by persons other than the promoters shall be locked-in for a period of 6 months from the date of allotment in the initial public offer as opposed to the existing requirement of 1 year. | The lock-in of pre-IPO securities held by persons other than promoters shall be locked-in for a period of 6 months from the date of allotment in IPO instead of existing 1 year. The period of holding of equity shares for Venture Capital Fund or Alternative Investment Fund (AIF) of category or Category II or a Foreign Venture Capital Investor shall be reduced to 6 months from the date of their acquisition of such equity shares instead of existing 1 year. |

| Rationalization of the definition of ‘Promoter Group’ | Deletion of Regulation 2(1) (pp)(iii)(c) in the definition of promoter group | The definition of promoter group shall be rationalized, in case where the promoter of the issuer company is corporate body, to exclude companies having common financial investors |

| Streamlining the disclosures of group companies | Only the names and registered office address of all the Group Companies should be disclosed in the Offer Document. All other disclosure requirements like financials of top 5 listed/unlisted group companies, litigation etc., presently done in the Draft Red Herring Prospectus can be done away. However, these disclosures may continue to be made available on the websites of the listed companies. | The disclosure requirements in the offer documents, in respect of Group Companies of the issuer company, shall be rationalized to, inter-alia, exclude disclosure of financials of top 5 listed/unlisted group companies. These disclosures will continue to be made available on the website of the group companies. |

| Shifting from concept of ‘promoter’ to concept of ‘person in control’ | To revisit the concept of promoter and shift to the concept of ‘person in control’ or ‘controlling shareholders’. | Agreed in-principle.

To this effect, the Board, advised SEBI to:

a) engage with other regulators to ascertain and resolve regulatory hurdles, if any.

b) prepare draft amendments to securities market regulations and analyse impact of the same.

c) further deliberate at the PMAC and develop a roadmap for implementation of the proposed transition. |

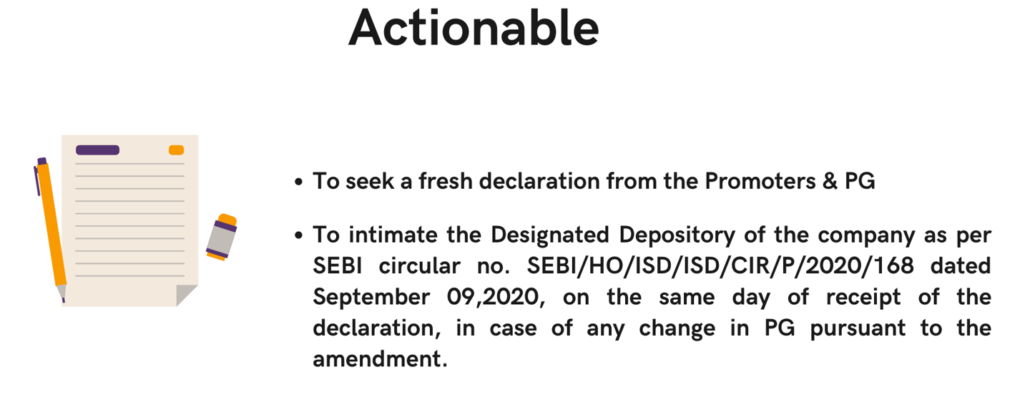

The FAQs of CDSL on System Driven Disclosure in Securities Market also provides that In case of any subsequent update in the information about Promoters, members of the promoter group, director(s), designated persons, the listed company shall update the information with the designated depository on the same day.

Conclusion

The Indian investor perception is evolving at a faster pace and the regulatory framework needs to align at the same pace. The move of SEBI in bringing a paradigm shift from ‘Promoter/Promoter group to ‘Person in control’ will have a substantial effect in the capital market as it would bring in considerable changes in various SEBI regulations like ICDR, LODR, SAST, PIT, etc., and would pave the way for the introduction of a more comprehensive framework for IPOs.

How will the regulator define the term ‘person in control’? Whether the existing framework in respect of SEBI SAST would be re-designed with a rule-based as well as a principle-based test of control as discussed in the discussion paper on ‘Brightline test’? these questions could interest us as we dig deeper into SEBI’s proposal.

[1] https://www.oecd.org/corporate/ownership-structure-listed-companies-india.pdf

[2] OECD (2019), OECD Equity Market Review of Asia 2019

[3] https://www.oecd.org/corporate/ownership-structure-listed-companies-india.pdf

[4] https://www.oecd.org/corporate/ownership-structure-listed-companies-india.pdf

[5] https://www.oecd.org/corporate/ownership-structure-listed-companies-india.pdf

[6] https://www.sebi.gov.in/sebi_data/attachdocs/1457945258522.pdf

[7] https://www.sebi.gov.in/satorders/subhkamventures.pdf

[8] https://www.mca.gov.in/Ministry/pdf/CompaniesSignificantBeneficial1306_14062018.pdf

Our other article on the relevant article can be read here – http://vinodkothari.com/2020/12/sebi-proposes-liberal-provisions-for-promoter-reclassification/

Gov’s Attempt to Make Slump Sale ‘Fair’

/0 Comments/in Accounting and Taxation, Direct Taxes /by Staff-Yutika Lohia ( finserv@vinodkothari.com )

Introduction

The income tax laws of the country has been witnessing dynamic changes over the years. The tax authorities are understanding the bottlenecks within their current tax system and proposing changes to mobilize revenue, promote investments and also to cope up with the present gaps.

On the other hand, with such dynamicity in laws, income tax or otherwise, companies often find themselves struggling to keep at par with the economy, and hence taking the restructuring route – slump sale being one option. The authorities are identifying the areas where there has been loss of revenue to the government and accordingly making changes in the tax laws.

Slump sale is one of the modes of business restructuring process and attracts capital gain under section 50B of the IT Act. Prior to Finance Act 2021, full value of consideration was the lumpsum value agreed between the buyer and seller considered while computing capital gains. Post Finance Act 2021, a new clause was inserted in sub section 2 of section 50B of the IT Act, where “Fair market value of the capital assets as on the date of transfer, calculated in the prescribed manner, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of such capital asset.”

The IT Department has introduced new rule for computation of fair market value of capital assets which shall be the full value of consideration while computing capital gains in case of a slump sale. The rules are an anti abuse measures to restrict the practice of sale of business at under value.

In this write up, we shall discuss the changes made by Finance Act 2021 in case of a slump sale, new rule for computation of fair market value of capital asset and its implications.

Widening the scope of slump sale by Finance Act 2021

Definition of slump sale

Prior to Finance Act 2021, the Indian Tax Law defined slump sale as transfer of one or more undertaking as a result of sale for a lump sum consideration without values being assigned to individual assets and liabilities.

However, the Finance Act 2021, extended the scope of “slump sale” under section 2(42C) of the IT Act and inserted an Explanation to the said section so as to provide that the word “transfer” shall have the same meaning assigned to in section 2(47) of the IT Act.

Earlier the definition of “slump sale” considered only those transfer where there was monetary consideration and transfer like exchange with property or shares were not covered under the scope of slump sale. Therefore, to widen the definition, the Finance Act 2021 covered those transactions which were just not restricted to sale and but also covered all kinds of transfer.

Fair Market value Computation

Earlier for computing capital gains in case of a slump sale, net worth of the undertaking was reduced from full value of consideration. The Finance Act 2021, amended the capital gain computation provision and introduced the Fair Market Value approach. To say, full value of consideration shall be replaced by the fair market value of the undertaking.

Net worth Computation

For computation of net worth, a new clause has been added where cost of goodwill which has not been acquired by the taxpayer by purchase from previous owner has to be taken at NIL

Notification issued by CBDT

The Central Board of Direct Taxes vide its Notification dated 24th May, 2021 has notified a new rule i.e., Rule 11UAE of the Income Tax Rules 1962, for computation of fair market of capital assets in case of a slump sale.

Rule 11UAE has introduced two methods of fair market value calculation i.e., FMV1 and FMV2 and higher among the two shall be considered while computing capital gains for slump sale transaction.

- FMV1 shall be the fair market value of the capital assets transferred by way of slump sale

- FMV2 shall be the fair market value of the consideration received or accruing as a result of transfer by way of slump sale

The fair market value of the capital assets under sub-rule (2) and sub-rule (3) shall be determined on the date of slump sale and for this purpose valuation date referred to in rule 11UA shall also mean the date of slump sale

The two FMVs shall be determined in accordance with the formula discussed below.

FMV1 approach

As per sub rule (2) of Rule 11UAE, we may call it adjusted NAV approach where book value of all assets other than jewellery, artistic work, shares, securities and immovable property shall be considered.

FMV1 = A+B+C+D-L, where,

A= book value of all the assets (other than jewellery, artistic work, shares, securities and immovable property) as appearing in the books of accounts of the undertaking or the division transferred by way of slump sale as reduced by the following amount which relate to such undertaking or the division, —

- any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any; and

- any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asset;

B = the price which the jewellery and artistic work would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer;

C = fair market value of shares and securities as determined in the manner provided in sub-rule (1) of rule 11UA;

D = the value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property; L= book value of liabilities as appearing in the books of accounts of the undertaking or the division transferred by way of slump sale, but not including the following amounts which relates to such undertaking or division, namely: —

- the paid-up capital in respect of equity shares;

- the amount set apart for payment of dividends on preference shares and equity shares where such dividends have not been declared before the date of transfer at a general body meeting of the company;

- reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

- any amount representing provision for taxation, other than amount of income-tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

- any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

- any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares.

FMV2 approach

As per sub rule (3) of Rule 11UAE, FMV2 i.e. shall be the fair market value of the consideration received or accruing as a result of transfer by way of slump sale determined in accordance with the formula-

FMV2 = E+F+G+H, where,

E = value of the monetary consideration received or accruing as a result of the transfer;

F = fair market value of non-monetary consideration received or accruing as a result of the transfer represented by property referred to in sub-rule (1) of rule 11UA determined in the manner provided in sub-rule (1) of rule 11UA for the property covered in that sub-rule;

G = the price which the non-monetary consideration received or accruing as a result of the transfer represented by property, other than immovable property, which is not referred to in sub-rule (1) of rule 11UA would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer, in respect of property;

H = the value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property in case the non-monetary consideration received or accruing as a result of the transfer is represented by the immovable property.

Further the expression “registered valuer” and “securities” shall have the same meaning as per Rule 11U of the Income Tax Rules.

Conclusion

This new Rule 11UAE will not only capture monetary consideration but also non-monetary consideration received for transfer of undertaking. Also, the new rule considers revaluation of assets and liabilities made in the books.

Prior to Finance Act 2021, the consideration of slump sale was the amount agreed between the buyer and the seller. Since the consideration was not based on any mechanism, the transfer would take place at a lower price and this often resulted in tax leakage.

To curb all the tax loop holes and prevent tax leakage in merger and acquisition transactions, the income tax laws has been modified and a new concept has been introduced where fair market value for capital assets shall computed as per Rule 11UAE for consideration value in case of a slump sale.

Now the seller will have to pay tax on the fair market value as computed as per Rule 11UAE even if the actual consideration received is less than the fair market value of capital assets. Also, this rule will put a challenge where the undertaking is transferred at a true sale value.

Assessing the Viability of a Gold Spot Exchange in India

/0 Comments/in Financial Services, SEBI /by Staff-Megha Mittal

The Securities and Exchange Board of India (‘SEBI’) has issued a consultation paper dated 19th May, 2021, on proposed framework for Gold Exchange in India and draft SEBI (Vault Managers) Regulations, 2021 (‘Consultation Paper’), thereby seeking public comments on the framework for operationalising gold exchange and the regulation of intermediaries inter-alia Vault Managers.

While the idea of setting up a regulated gold exchange was highlighted in the Union Budget 2018-19 as well as in the Budget 2021-22, the Consultation Paper comes as the first concrete step towards bringing into operation a gold exchange for the Indian market. This comes in the backdrop of the fact that despite being the second largest consumer and importer of gold, India continues to be a price-taker – India does not play any significant role in influencing the global price-setting for the commodity. As such, the Consultation Paper envisages an entire ecosystem of trading and physical delivery of gold so as to create a transparent and robust market which paves the way for India to become a global price setter.

That being said, before delving into the procedural aspect, it is important to understand the fundamentals as to what are the objectives being aimed, what would the target market look like, and if at all the proposed framework would put the investors, the parties and the nation in a better place that is today.