Assessing the Viability of a Gold Spot Exchange in India

-Megha Mittal

The Securities and Exchange Board of India (‘SEBI’) has issued a consultation paper dated 19th May, 2021, on proposed framework for Gold Exchange in India and draft SEBI (Vault Managers) Regulations, 2021 (‘Consultation Paper’), thereby seeking public comments on the framework for operationalising gold exchange and the regulation of intermediaries inter-alia Vault Managers.

While the idea of setting up a regulated gold exchange was highlighted in the Union Budget 2018-19 as well as in the Budget 2021-22, the Consultation Paper comes as the first concrete step towards bringing into operation a gold exchange for the Indian market. This comes in the backdrop of the fact that despite being the second largest consumer and importer of gold, India continues to be a price-taker – India does not play any significant role in influencing the global price-setting for the commodity. As such, the Consultation Paper envisages an entire ecosystem of trading and physical delivery of gold so as to create a transparent and robust market which paves the way for India to become a global price setter.

That being said, before delving into the procedural aspect, it is important to understand the fundamentals as to what are the objectives being aimed, what would the target market look like, and if at all the proposed framework would put the investors, the parties and the nation in a better place that is today.

In our note below, we discuss the following –

Contents

Gold Exchange and the Indian Economy –. 4

Present Gold Investment Options in India. 5

India’s Gold Derivative Market 7

Need for an Indian Gold Spot Exchange. 7

Comments on the Consultation Paper. 9

Proposed Flow of Transaction. 9

Introducing Gold Exchange

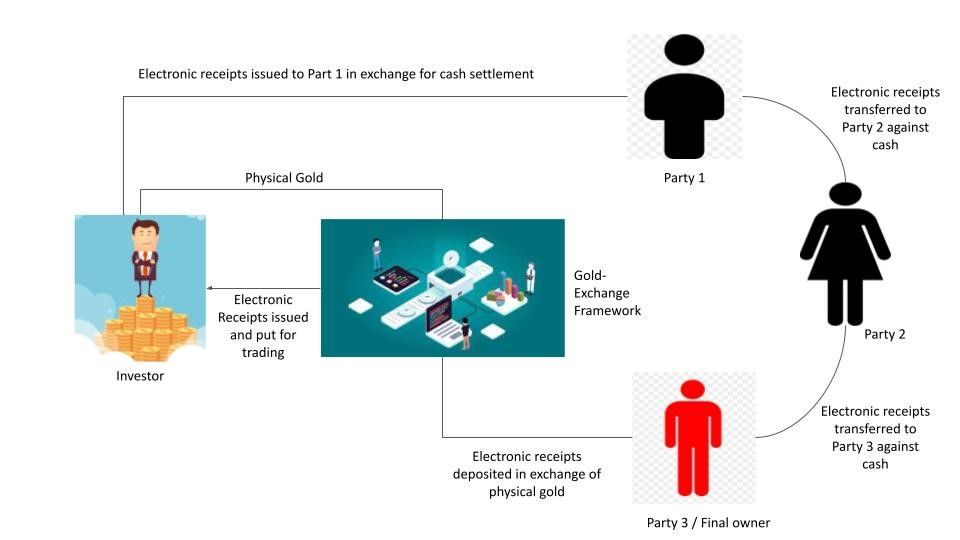

India’s long history and social connect with gold makes it one of the world’s largest consumers of the yellow metal and while an entire ecosystem has developed in the country around gold, including a sound derivatives market, the key element missing in the gold ecosystem is an electronic spot exchange. But what is a Gold Exchange? Think stocks. Proposed to be built on a structure similar to the stock exchanges, the Gold Exchange, simply put, will allow parties to trade gold, represented by electronic receipts, the holder of which can get it encashed for physical gold.

Those will surplus inject physical gold in the exchanges’ framework, which are represented by electronic receipts. These receipts in turn are tradeable on the Gold Exchange. Transactions between parties take place in the normal course (in exchange of monetary payments) until any recipient/ holder of the electronic receipts decides to obtain delivery of the physical gold equivalent to the receipts held.

The rapid technological development over the last few decades has augmented the shift across asset classes from over-the-counter (OTC) to electronic platform – thus moving towards better price discovery as well as transparency. Thus, as natural consequence, the Gold Exchanges too enable better price discovery, driven by market forces with counterparty risks being transferred to the central counterparty through the process of clearing.

Later in the note we discuss and suggest improvements to the framework proposed by SEBI vide its Consultation Paper.

Gold Exchanges Globally

Internationally, the presence of a vibrant spot market with a derivatives market has led to product innovation and left a deep impact on the commodity value chain – The landscape for wholesale gold trading is quite complex and constantly evolving. Below we highlight some specific jurisdictions where gold exchanges have flourished –

The Shanghai Gold Exchange (SGE) is a leading example of a robust gold exchange market. It offers gold leasing solutions along with gold spot trading. The move aimed at establishing a yuan-denominated price fix on gold, was part of efforts to increase the country’s influence in the pricing of the precious metal.

The SGE, established in 2002, offers a number of physical gold contracts (products) specifically designed for international gold investors are listed and traded. By 2004, private citizens were allowed to trade on the platform against gold bullions. Since these products are physically delivered gold contracts, the SGE infrastructure also encompasses a certified precious metals vault where the physical metal backing this gold trading is stored. Finally in 2016, the SGE introduced the Shanghai Gold Price Benchmark to establish itself as a price-setter.

It must be noted that similar to India, China also has a sound futures market, where gold futures are prominently traded; and even though the SGE and Futures market are not directly linked, the gold spot exchange is complemented by the very active futures trading. It is thus expected that the well-established Gold Derivatives’ Market (discussed below) should also play a crucial role in giving a boost to the Indian Gold Spot Exchange. Further, the operational aspect of SGE also is seemingly similar to the framework proposed in the Consultation Paper – the physical gold is managed in vaults to and from which the gold is deposited and withdrawn, and trading is done though the physical gold contracts issued against the physical gold. The settlement on the other hand is done by a distinct body colloquially known as the ‘settlement bank’

Other jurisdictions like US, London, Singapore, UAE, Turkey etc. also boast sound gold exchanges, enabling them to have a role in efficient price making rather than price taking. – Turkey for instance, has a very cultural inclination towards gold, like in India- it is used as gifts, for jewellery and investment as well. However, it also faces a shortage vis-à-vis demand. Thus, from 2011 Turkey started to monetize its gold so as to integrate it into the financial system. It was then combined with the Istanbul Securities Exchange (IMKB) and Futures and Options Exchange to form the Borsa Istanbul (BIST) which currently acts a sound financial centre where gold is actively traded.

Similarly, the Singapore Gold Exchange, established in 2014, offers gold contracts for physical settlement with the aim to attract industrial users and institutions including central banks, to set a transparent price benchmark for physical delivery in Asia[1]

A separate gold exchange in these countries has led to[2]–

- Active retail participation and use of gold bars and coins for investment instead of jewellery.

- Substitution of investment physical gold with gold linked financial products

- Greater integration with other segments of financial markets through gold leasing and lending

- Acting as a channel for gold recycling by working through accredited refineries. The recycled gold finds its way into the market through the gold exchange.

The Asian countries which have emerged as major gold hubs largely seem to have the following in common[3]:

- A cultural affinity with gold and the use of gold as an investment vehicle by households. A vibrant jewellery sector is present in most of the countries

- Active spot and derivative contracts in gold.

- A well-functioning financial system and its integration with the gold markets.

- High quality gold infrastructure for refining, vaulting, and transportation

- Favourable tax regime.

Thus, the success of gold spot exchanges globally emphasizes the need for an existing liquid platform in India, with the participation of diverse stakeholders offering multiple products.

Gold Exchange and the Indian Economy –

An Overview

As mentioned above, India is the second largest importer of gold in the world, which together with China account for almost 50% of the world’s gold consumption. Evidently, India has an ambivalent relationship with gold – it is prized, both as an adornment and as an investment. However, it is also possibly the idlest form of investment held by thousands – thus becoming a liability of the country, despite being a valuable possession for an individual. This is exactly why the need to move gold within the domestic market becomes important – because it not only imparts liquidity but also brings along the benefit of arbitrage.

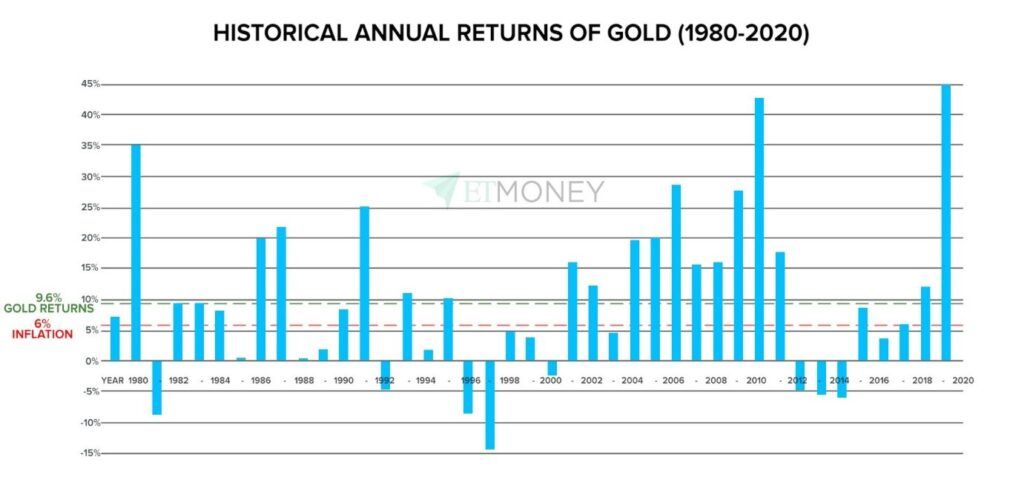

In its Report titled ‘Why India Needs Gold Policy[4]’ the Wold Gold Council stated that demand for gold remains strong and enduring, whatever the macro-economic, fiscal or political circumstances. An overwhelming majority of respondents said they would buy gold in good times and in bad. A fitting example supporting the same would be the rising prices of the gold during the first wave of COVID-19 – while economies around the globe were falling, the price of gold saw a continuous rise as more and more people wanted to deploy their funds in the ‘safe’ gold. The graph below is clearly evident of the same –

Given such appetite and potential for a sound gold exchange, the Indian gold market is currently characterised by (a) physical purchase of retail gold; (b) Purchase of gold derivatives on the Multi-Commodity Exchange; (c) Gold Sovereign Bonds; (d) Gold Exchange Traded Funds (ETFs) and Derivatives Exchange. Hence, a key question is if at all India requires a gold spot exchange. Further, in our discussion, we assess this question and suggest answers.

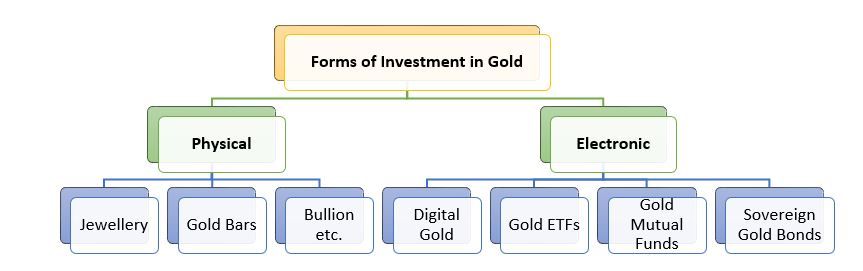

Present Gold Investment Options in India

The current Indian market allows investment in gold in physical as well as digital form. For the purpose of our discussion, we shall focus on the digital forms of investment.

- Digital Gold –

Digital gold works in a fashion similar to online shopping, the difference being that here you get the yellow metal. Retail investors can purchase gold online through various apps/ platforms which then connect the retailers to the digital gold providers[5]. The parties can buy as well as sell the gold on such platforms, as well as request for a physical delivery of gold at their doorsteps.

Now before you already question the need for a gold exchange in light of the already established digital gold, it is important to note that transactions in digital gold are subject to certain limitations like absence of a regulatory body (say, SEBI or RBI), maximum cap on the limit of investments etc.

- Gold ETFs

Gold Exchange Traded Funds (ETFs) are passive investment instruments that are based on gold prices – simply put, they are units representing physical gold which may be in paper or dematerialised form. They are traded on the cash segment of NSE and BSE – and as such ensure liquidity. However, the major backdrop is that on redemption of ETFs the holder does not get physical gold – instead they get the gold’s value in cash.

Hence, the ETFs do not actually determine or play a crucial role in determining the price of gold – in fact its own value is based on the price of the gold determined by other market forces.

- Gold Mutual Funds

Investment in Gold Mutual Funds is an indirect investment in ETFs via the mutual funds. Thus, even though such investment in regulated – holding the mutual fund units would not entitle physical receipt of gold.

- Sovereign Gold Bonds

Sovereign Gold Bonds (SBGs) are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India.

SBGs are an attractive mode of investment as the quantity of gold for which the investor pays is protected, since s/he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form, thereby eliminating risk of loss of scrip etc. The SBGs further bear interest at the rate of 2.50% (fixed rate) per annum on the amount of initial investment, as such providing an economic benefit over and above benefit accruing from appreciation in the value of gold.

However, the SBGs too, upon redemption, offer the cash value of the SBGs held and not physical gold – As such, the holder is not literally holding gold, but an equivalent of gold.

India’s Gold Derivative Market

Currently, there are two commodity exchanges in India – the Multi Commodity Exchange (MCX) and the National Commodity and Derivative Exchanges (NCDEX). Our discussion shall focus on MCX as the latter is related to agri commodities, which MCX deals with Metals and Energy Commodities.

Gold is very actively traded in MCX, and is traded in several variant – the value of all the variants is derived from the same underlying, that is, gold. The increasing trade volumes of such trade derivatives, coupled with the variety of options in terms of variant of derivative, the tenure of derivative contracts etc, accord significant liquidity to gold contracts. Additionally, unlike stocks or ETFs, Mutual Funds and SGBs, derivatives are settled by physical delivery. Thus, if an investor holds 10 lots of gold, and opts for delivery, then the investor shall be entitled to receive equivalent quantity of physical gold.

It must be noted that electronic receipts to be issued in exchange of a gold implies conversion of gold into security. Derivatives on the other hand are instruments that gives rise to some right or even obligation in an asset at a future point, such as the right to buy an asset at a set price, or the commitment to sell on a set date.

Derivatives are essentially just standard contracts that are traded off the back of underlying assets (such as shares) and therefore respond more sensitively to underlying price fluctuations – in other words, they tend to be more volatile than the assets to which they relate, an build a component of leverage into the transaction.

As such, it may not be fit to state that the derivatives market could meet the requirement or problem statements of a spot exchange

Need for an Indian Gold Spot Exchange

Having understood the current scenario of the gold market – the question left to answer is whether India needs a Gold Spot Exchange, and if yes, why?

Significant Import Volumes

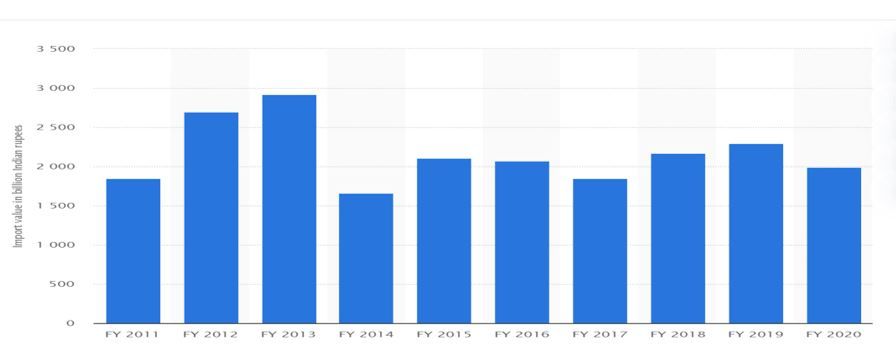

As discussed above, India is the second largest consumer of gold, with a relatively tiny volume of domestic production, India is largely dependent on imports for meeting the domestic demand. This lopsided demand vs. production makes India the largest importer of gold –

Fig 4: Value of Gold Import in India from FY. 2011 to F.Y. 2020[6];

It is interesting to note that by virtue of gold recycling and trading on the Shanghai Gold Exchange, China witnessed annual withdrawals from vaults being equal to the wholesale gold demand for the entire year in 2007[7], that is, merely within 5 years of its inception. Thus is it expected that movement of gold within the market on need basis shall take an upper hand over import on need basis – gold imports levels may be lowered by only specific/ permitted entities importing gold, such that the gold so imported is directly injected in the Exchange system for trading and withdrawal as and when required.

Disparity in Domestic Prices & Better Price Discovery

Further, in the physical market, different locations have different prices. Thus, even though the window of the price of gold may be rather narrow, the prices are not uniform. Hence, so as to ensure that a common price prevails pan-India, and that such price is arrived by using the market forces warrants that a spot exchange should be operative.

Transparency in Transactions & Assurance of Quality

The proposed Gold Exchange would lead to efficient and transparent domestic spot price discovery, assurance in the quality of gold, promotion of India good delivery standard with active retail participation, greater integration with financial markets, and augment greater gold recycling in the country.

Market Expectations

In this context, with a view to understand the scope for a Gold Spot Exchange in India, the India Gold Policy Centre and the Indian Institute of Management-Ahmedabad conducted a field survey which yielded the following key conclusions –

- As gold does not have a standard price in India, a national-level spot exchange would benefit all stakeholders by ensuring transparency in pricing and standardisation;

- It would also help India evolve as a gold trading hub.

- Such exchange shall prove to be feasible with improved regulatory environment to create liquidity in the contracts

- It would be ideal to have gold vaulting facilities set up by experienced promoters; develop a distribution network to achieve T +1 delivery across 21 major locations in India and empanel refineries for quality assurance of gold and standardization.

Further, the World Gold Council, in its Report ‘Why India Needs a Gold Policy’ (supra) has identified key prerequisites to setting up an effective gold exchange, viz. clear regulatory architecture; policy reforms; incentives; partnership with existing institution and collaborations.

Comments on the Consultation Paper

In consideration of the rationale and reasons stated above, the Consultation Paper has proposed the framework to operationalise the Gold Spot Exchange in India and has issued Draft Regulations for Vault Managers, who shall be registered as intermediary under SEBI.

Highlights of the Framework are –

Key Terms–

| Term | Meaning |

| Electronic Gold Receipt (EGR) | Refers to security issued against the physical gold, which shall be traded on the Gold Exchange. The terms shall be defined in the Securities Contract (Regulation) Act, 1956 |

| Assayers | Refers to the person engaged in the process of measuring the purity or quality of gold; |

| Depositories | Refers to the person who owns the gold deposited with the vault for storage and creation of Electronic Gold Receipt and its trading on recognized stock exchange |

| Settlement Cycle | Refers to the T+1 day window in which the settlement of trades |

| Vault Managers (VM) | Refers to the custodian of the physical gold being deposited in exchange of EGRs |

Proposed Flow of Transaction

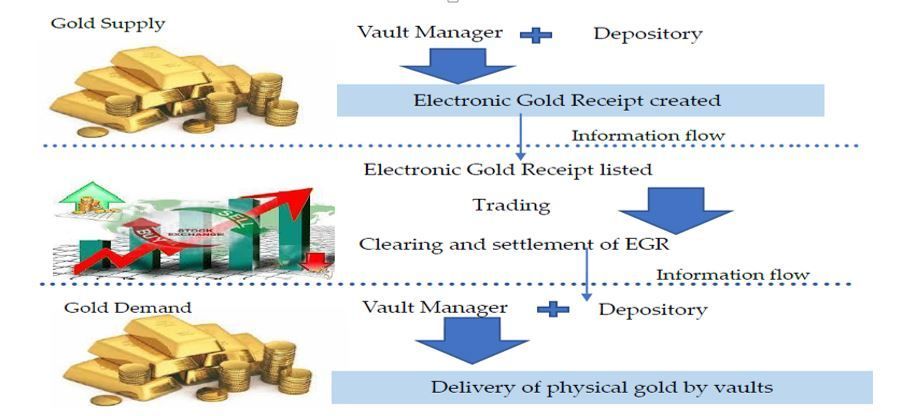

The Consultation Paper proposed a three-phased flow of transactions as follows –

- First Tranche: Conversion from Physical Gold to Electronic Gold Receipt

- Second Tranche: Trading of Electronic Gold Receipt on stock exchange/s

- Third Tranche: Conversion from Electronic Gold Receipt to Physical Gold

The three tranches involve a common interface between Vault Managers, Depositories, Stock Exchanges and clearing corporations, and the participants. The depositor (or owner of the gold) intending to convert his/her physical gold into EGR and trade on the stock exchange/s, shall ensure delivery of such gold to the Vault Manager.

The Vault Manager then shall record relevant information, in the common interface and shall create the EGR; the Depository shall assign appropriate ISIN to EGR to make it tradeable on the stock exchanges and the Clearing Corporation shall inform the Depository and the stock exchange, regarding the change in beneficial owner of the EGR at the end of the trading day.

The Beneficial owner intending to obtain physical gold against the EGR/s shall be required to surrender the EGR/s.

Salient Features

In addition to the tranche-wise flow of events, other salient features are as follows –

- Product Denomination –

The EGR of 1 kg, 100 grams and 50 grams denomination may be available with the stock exchange/s with same denomination for trading of EGR and conversion of EGR into physical gold. In order to attract more players to this market, EGR with smaller denominations such as 10grams and 5 grams may also be allowed, for trading purposes.

However, for conversion purposes considering delivery and logistics aspects, conversion of such smaller denomination of EGR/s into physical gold, may be permitted only when the beneficial owner has accumulated, say, at least 50 grams (or multiples thereof) of physical gold in the form of EGR/s.

- Fungibility and Inter-operability–

The EGRs are proposed to be fungible and the VMs have been enabled to allow interoperability. Such fungibility and inter-operability between Vault Managers would allow the Depository to facilitate withdrawal of physical gold from the preferred location of the buyer, to the extent possible.

- Store Vault and Delivery Charges –

The storage or vaulting charges, as levied by the Vault Managers, shall be paid by the beneficial owner of the EGR as at the end of the trading day, whereas the Delivery Charges shall be borne by the beneficial owner of EGR opting for withdrawal of the physical gold.

- Taxation-

Securities Transaction Tax (STT) will be applicable to trading of EGR on stock exchange platform as it is applicable to trading of any other “securities”. Further, Goods & Services Tax (GST) may also be applicable during the conversion of EGR to physical gold i.e., at the time of withdrawal of physical gold from the vaults.

It must however be noted that in order to promote the gold spot exchange, jurisdictions like China and Turkey, also provide tax incentives by waiving off respective tax implications (like VAT in China) on transactions done on the exchange. Thus, a similar incentive could be considered to promote more retail participation in the exchange.

Analysis and Suggestion –

An essential element which is probably missing in the Consultation Paper is a clear identification of the target market. While it is understood that the framework would allow trading and clearance of smaller denominations, enabling fungibility would wash out a larger base of gold owners who own gold in the form of jewellery and intend to obtain back the physical possession in the same form – not as gold bars – which would evidently not be possible with fungibility.

Further, while the larger idea of replacing the scattered yet substantial imports from India with a few identified importers (the Vault Managers) seems to be achievable, the concern lies in the role bestowed upon the VMs. It is important to note that unless the VMs are entitled to rent/ lease out the gold kept in its custody, the valuable asset would continue to be an idle investment. Thus, along with the objectives of domestic parity in prices, reduced imports and price-making on account of market forces, it is imperative that gold is seen as an active investment tool and not a dormant one. It is suggested that the regulations be amended to explicitly allow the VMs to rent/ lease the gold deposited their custody. Further leasing of Gold, like China, may also be conducive in reducing gold import levels.

Furthermore, it is suggested that similar to SBGs, EGRs must also provide an economic addition in value in addition to the appreciation in value of gold. In the given framework, the EGR holders are required to pay daily maintenance charges and well as transaction tax, in addition of delivery charges and GST to be paid by the owners who seeks physical possession in exchange of the EGRs. The said expenses and costs stand against only one benefit (appreciation in value of gold), which too is dependent on several factors and is not certain. Thus, this could act as a demotivator for investors who would rather have to give out of their pockets in case the value of gold does not appreciate.

Concluding Remarks

Thus, while a dedicated spot exchange could prove to be effective from a macro perspective, active retail participation would warrant significant structural tweaks and changes vis-à-vis operational changes, in the proposed framework as discussed above.

[1] Singapore to launch gold contract, Financial Times, June 25, 2014.

[2] Viability of a Gold Exchange in India, by India Gold Policy Centre and IIM-Ahmedabad by Prof. Joshy Jacob and Prof Jayanth R Verma – https://web.iima.ac.in/users/webrequest/files/IGPC/Viability-of-gold-exchange-report-final-edited.pdf

[3] Ibid

[4] https://www.gold.org/goldhub/research/why-india-needs-gold-policy

[5] As on November, 2020, there were three companies offering Digital Gold in India – (i) Augmont Gold Limited; (ii) MMTC-PAMP India Pvt. Ltd. and Digital Gold India Private Limited.

[6] Source: https://www.statista.com/statistics/625818/import-value-of-gold-india/

[7] 2007 China Gold Association (CGA) Gold Yearbook – source: https://www.bullionstar.com/gold-university/the-mechanics-of-the-chinese-domestic-gold-market

Leave a Reply

Want to join the discussion?Feel free to contribute!