-Team Vinod Kothari Consultants P. Ltd. (finserv@vinodkothari.com)

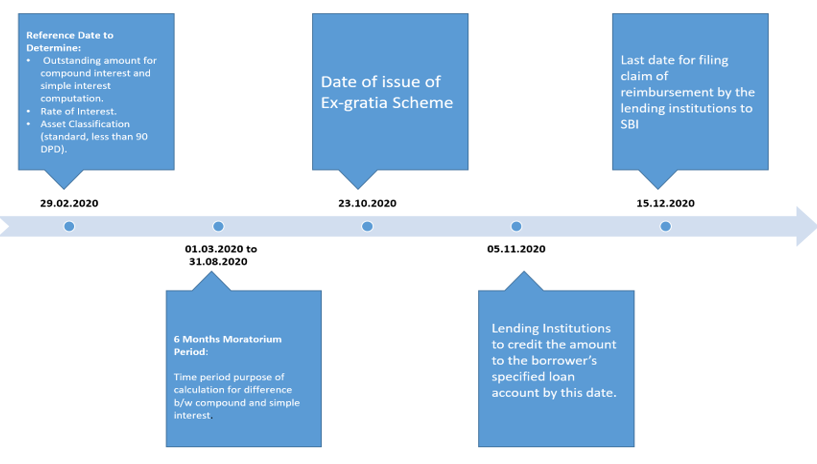

While compound interest is the unquestionable reality of the world of banking and finance, somehow, courts have always been disapproving of the idea of “interest on interest”. After some months of litigation in the Apex Court and a lot of confusion surrounding interest on interest being charged by the lenders on loan accounts whose payments were deferred under the Covid-induced moratoriums, the Central Government (CG) has come up with a scheme whereby the CG will take over the differential interest, that is, difference between compound interest and simple interest during the 6 month period starting 01.03.2020. The lending institutions will have to pass on this benefit to the borrowers. Of course, the scheme, called Scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (1.3.2020 to 31.8.2020) [Ex-Gratia Scheme or EGS] is limited only to smaller borrowers, that is, borrowers falling under the specified category loan accounts, classified as standard and having an aggregate exposure of not exceeding Rupees 2 (two) crores as on 01.03.2020.

We have earlier submitted that the government is best placed to provide any relief to borrowers on issues concerning interest on interest.[1] The issue has finally been addressed via Notification dated 23.10.2020 providing the “Scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (1.3.2020 to 31.8.2020)”.[2]

This ex-gratia payment scheme is another COVID-19 related relief and incentive by the Government to bear additional interest on certain small specified loan accounts. The total estimated burden on the exchequer by virtue of the Scheme may be about Rs 7500 crores.

The Ministry of Finance (MoF), GOI has also issued four clarifications to date on EGS via FAQs dated 26.10.2020, 29.10.2020, 03.11.2020, and 04.11.2020 respectively.[3]

In this write-up, we have highlighted some of the important aspects of the scheme in form of FAQs below:

Objective/Nature and Scope of the Scheme

- What is the objective of this Ex-gratia Scheme?

This Ex-gratia Scheme seems to be the CG’s answer to the resentment that was quite obvious in the Supreme Court proceedings in the matter of Gajendra Sharma Vs Union of India.[4] The Scheme says it clearly that the payment under EGS is not a contractual, legal or equitable liability of the CG and is only an only an ex-gratia payment to the following designated class of borrowers in view of the COVID-19 pandemic.

The essential idea of the EGS is to provide the benefit of having to pay simple interest by the borrowers covered under the Scheme. The period covered by the two moratoriums is to be taken into consideration under this Ex-gratia Scheme, that is the period from 01.03. 2020 to 31.05.2020[5] and 01.06.2020 to 31.08.2020[6]. The underlying philosophy of the EGS seems that the central purpose of the moratorium was to grant relief to smaller borrowers whose business/earnings were disrupted by the Pandemic. However, the grant of moratorium did not provide any relief from payment of interest. Thus, interest continued to be compound even while the borrower availed of the moratorium. In many cases, thus, the moratorium hardly helped, as it resulted in mounting of interest burden, which may have even worsened the situation of the borrower.

The Scheme now transforms compound interest into simple interest during the Moratorium Period, that is, the period commencing from 01.03.2020 to 31.08.2020 (‘Moratorium Period’).

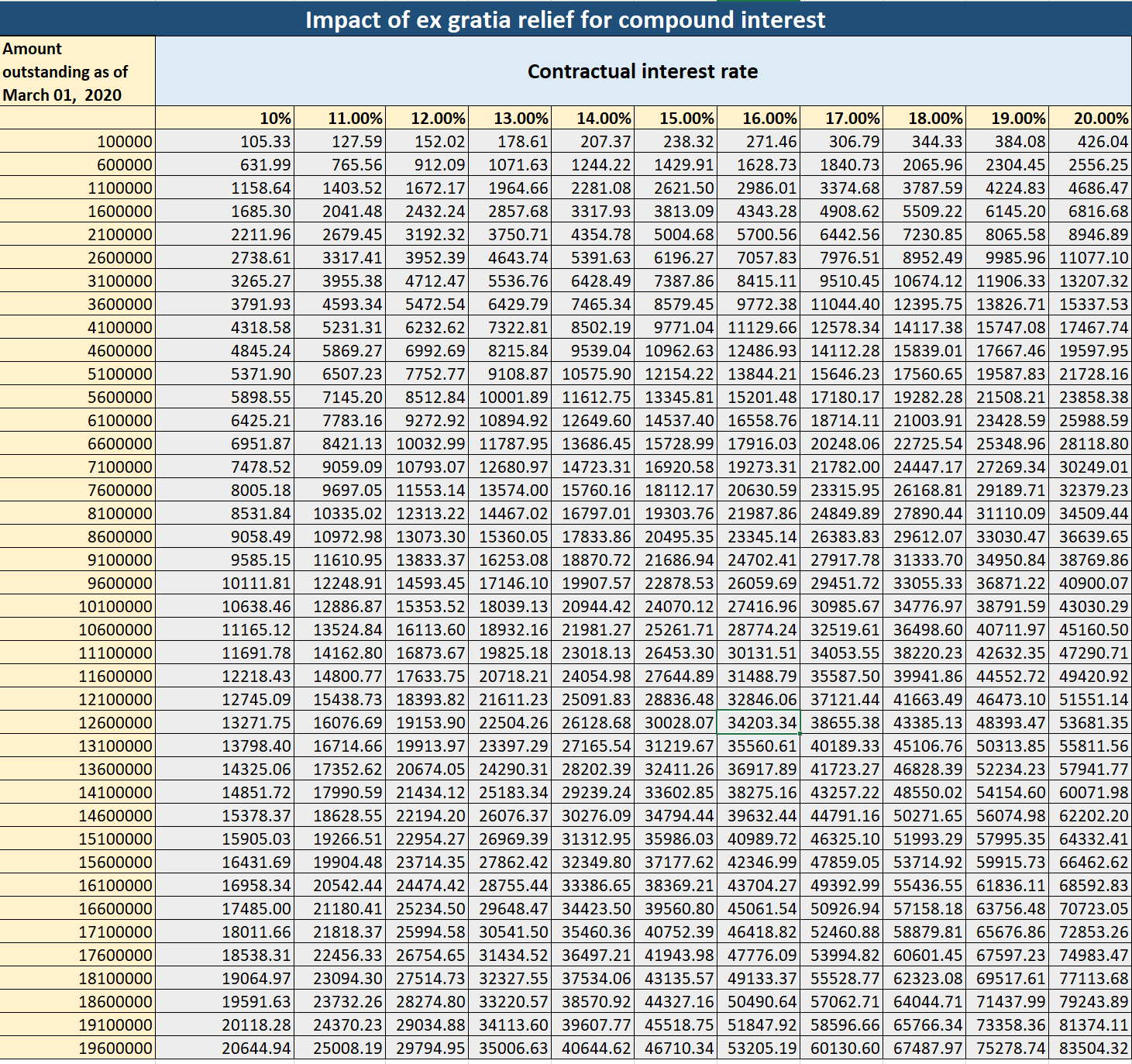

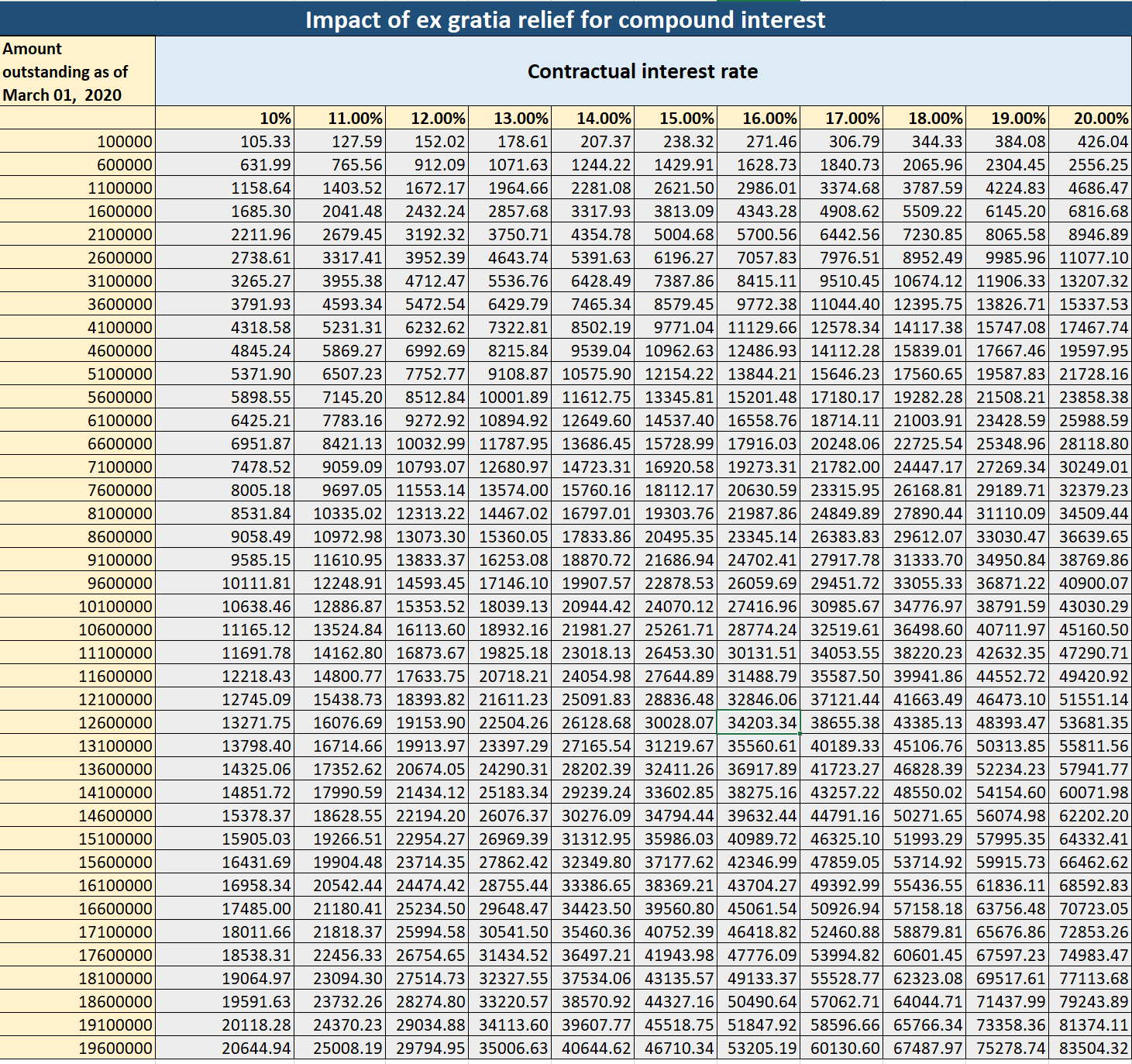

As our workings (See in next question) have demonstrated the impact of the EGS on the borrower depends on two factors – (a) the rate of interest on the facility; and (b) the size of the funded facility.

- How will the Ex-gratia payment be impacted with varying interest rates and outstanding amounts?

Please refer to the table at the end of this write-up.

- Is the payment of the ex gratia amount under the scheme, optional for lending institutions or the same has to be complied mandatorily by the lending Institutions?

The payment to the specified loan accounts of eligible borrowers is mandatory under the Scheme. The language of Ex-gratia Scheme clearly provides that the lending institutions shall credit the difference between simple interest and compound interest for a period between 1,03,2020 to 31.08.2020 in specified loan accounts of eligible borrowers.

Further the RBI notification dated 26.10.2020 clearly advises the lending institutions to be guided by the provisions of the scheme and take necessary action within stipulated timeline.

- Can a Lending Institution be selective in terms of granting the benefit or denying it to certain Borrowers?

The applicability of the scheme is not optional. As per the RBI notification, all lending institutions are advised to be guided by the provisions of the Scheme and take necessary action within the stipulated timeline. Hence, the lending institution is obligated to extend the benefit of the EGS to all the eligible borrowers. See below for the meaning of “eligible borrowers.”

Scope of “Lending Institutions”

- Which Lending Institutions have to pass the benefits to borrowers under this Scheme?

The following is the list of the lenders have to comply with the operational guidelines of the scheme (“Lending Institutions”) :

- Banking Companies

- Public Sector Banks (PSB)

- Co-operative Banks – Urban Co-operative Banks,or a State Co-operative Bank, or a District Co-operative Bank

- Regional Rural Banks (RRB)

- All India Financial Institutions

- Non-Banking Financial Companies registered with the RBI

- Non-Banking Finance Company being a Micro Finance Institution, also a member of Self Regulatory Organisation (SRO) registered with RBI

- Housing Finance Companies registered with RBI, or National Housing Bank

- Are all types of NBFCs covered under the Scheme irrespective of the asset size?

The Government intends to pass on the benefit of the Scheme through the Lending Institutions including all NBFCs involved in lending to the specified category of borrowers irrespective of the asset size of the NBFCs.

- Is this scheme applicable on co-lending?

The EGS scheme does not exclude loans originated by two or more Lending Institutions. The objective of the scheme is to pass the benefit of the EGS to eligible borrowers. Therefore, in case the borrower is eligible, the benefit under the EGS shall be extended taking blended rate of interest as the reference rate for differential computation of CI and SI during the moratorium period. The rates of interest charged by the respective lenders may be different inter-se; however, the benefit of interest differential will be given to the borrower based on the blended interest rate.

- In case of co-lending, what if there is one eligible Lending Institution, and one who is not eligible?

Current guidelines of the RBI on co-lending do not seem to be extending to co-lending arrangements between one lender who is in the list of Lending Institutions above, and one who is not. It will be difficult to think of one of co-lenders passing on the benefit, while the other does not.

- Does this Scheme cover the loans which have been securitised?

The fact that a specified loan account has been securitized does not deny the borrower from availing the benefit under this Scheme. Therefore, the servicer/originator should pass the benefit of ex-gratia payment to the eligible borrower even in case of securitised loans. The interest rate differential is essentially credited to the account of the Eligible Borrower – therefore, it is treated as if it is a cash inflow from the borrower, and should accordingly become a part of the waterfall, as and when the same is received from SBI.

9A. In case of securitisation, the original lender is simply a servicer. Is it envisaged that the servicer will still be empowered/required to pass on the benefit of the Scheme to the borrower, and claim the same from the Govt, even though technically the loan is not on the books of the lender?

Given the benevolent and borrower-centric intent of the Scheme, we are of the view that the benefit of the Scheme cannot be denied to a borrower whose loans have been assigned. Technically, whether the originator is still holding the loan or has sold it away to an SPV or other assignee should not matter. The benefit can easily be passed on as a payment from the customer.

- Does this scheme include specified loan accounts which have been subject to direct assignment?

The same treatment as in case of securitisation should apply in case of direct assignments as well. The benefit of interest differential should be given to the borrower. The amount received from the CG through SBI should be treated as a payment received from the borrower, and should be shared between the assignor/assignee in their ratio of sharing the inflows.

A subsequent clarification in MoF FAQs dated 03.11.2020 in FAQ No. 2, specifies the eligibility of loans under EGS which have been bought as part of pool buyouts by one lending institution from another. [Updated on 04.11.2020]

- The amount received from the CG by way of interest differential may be treated as payment made by the borrower. Should it be treated as payment of principal, payment of interest, or payment of any other dues from the borrower?

In our view, the contractual appropriation rules should be applicable to the amount received from the CG. The amount received from the CG is essentially the amount received from the borrower. Hence, appropriation rules as contained in the loan agreement should apply to this amount as well.

- Does this Scheme cover Core Investment Companies?

Question does not arise as CICs are intended to provide financial support to “group companies only.

Scope of “Eligible Borrowers”

- Which all borrowers are eligible to be benefitted under the Scheme?

The borrowers falling under any or more of the “Facilities” (see below) are eligible under Ex-gratia Scheme “Eligible Borrower”. However, such facilities need to satisfy the following conditions:

- Such borrower should not have sanctioned limit and the outstanding amount exceeding Rs. 2 (two) crores in aggregate with all the lending institutions as on 29.02.2020. That is, the sum of borrowings of such a borrower from specified loan accounts and borrowings other than that under specified loan account shall also be taken into account while arriving at aggregate exposure of Rs. 2 Crores.

For computation of the borrowing cap, see further questions below.

- Such an eligible category loan account should be standard (less than 90 DPD) as on 29.02.2020.

- Whether such borrower availed complete moratorium, partial moratorium, or did not avail any moratorium benefit in respect of such eligible category loan account is irrelevant for the purpose of extending benefit under the Ex-gratia Scheme.

- Will the Non Fund Based Limits as on 29.02.2020 be included for arriving at the borrower eligibility of amount upto Rs. 2 crore?

No, the fund based limits shall not be included for arriving at the eligibility criteria for the purpose under EGS. The same has also been clarified by the MoF in its FAQs.

- Whether the Rs. 2 crore limit applies for borrowings across all lending institutions?

Yes, the 2 crore limit shall be considered across all the lending institutions.

- In case of working capital facility, for the purpose of limit of Rs 2 crores, the lending institution shall consider the actual amount availed or the sanctioned limit?

The language and intent of the EGS is very clear that the aggregate of sanctioned and outstanding amount of loan in respect of a particular eligible borrower is to be considered. Hence, the sanction limit shall be considered.

- As on 29.02. 2020, a borrower is standard with one lender, but is not standard with another. What will be the eligibility of the borrower in such a case?

In our view, the condition for eligibility for the benefit is that the borrower is standard as on the reference date. Additionally, we need to aggregate the facilities enjoyed by the borrower with other lending institutions. We do not have to read any further conditions. That is, if the borrower is not standard with a particular lending institution, then such lending institution shall not grant the benefit to the borrower. However, the lending institution with which the borrower is standard should not be precluded from granting the benefit of the Scheme.

The same has also been subsequently clarified in MoF FAQs dated 03.11.2020 in FAQ No. 1. [Updated on 04.11.2020]

- How does a lending institution get to know how much facilities a borrower is availing from other lending institutions, in order to arrive at the borrowing cap?

Lending institutions are to assess this on the basis of information available with them as well as information accessible from credit bureaus. This has also been clarified by the MoF in its FAQs.

- A borrower has availed a loan of Rs 1 crore from an NBFC. Additionally, the borrower has taken a home loan of Rs 1.50 crores from the company where he is currently working. Is he eligible?

We need to aggregate the borrowings from Lending Institutions. Employee loan taken from the company where the borrower is working does not fall under the list of facilities for the purpose of the Scheme. Hence, no question of aggregating the same.

- A borrower satisfies all other conditions but is classified as NPA as on 29.02.2020 and subsequently becomes standard. Will the borrower be eligible under the Scheme?

The subsequent movement of the NPA to standard will not make the account eligible under the scheme. As per the eligibility conditions, the loan account must be classified as standard as on 29.02.2020.

- A borrower account was standard as on 29.02.2020 and also satisfies all the other eligibility conditions under the scheme, but as on date is an NPA. Can the benefit still be availed?

Yes, the benefit shall still be given to the borrower based on the fact that the loan account was eligible as on 29.02.2020.

- A borrower under a specified loan account is having a sanctioned limit of Rs. 2.5 Crores as on 29.02.2020, however its aggregate outstanding borrowing with respect to such loan account as on 29.02.2020 is less than 2 crore, will such borrower be eligible under the Ex-gratia Scheme?

The Ex-gratia Scheme clearly specifies that the ‘sanctioned limit’ and ‘outstanding amount’ with respect to loan accounts should not exceed Rs. 2 Crore. The aggregate of the borrower’s sanctioned limit and outstanding loan amount from all lending institutions to such a borrower should be less than Rs. 2 Crores. Hence, in our view, the borrower shall not be eligible.

- A borrower under specified loan account has an aggregate outstanding loan facility as on 29.02.2020 less than Rs. 2 Crores with a lending institution. Additionally it also has a Bank Guarantee in its favour with the same or any other lending institution. Will such a borrower be eligible under the Ex-gratia Scheme?

The FAQs issued by the Department of Financial Services clearly states that non fund based limits will not be included for arriving at the eligibility. Accordingly, the borrower shall be eligible under the EGS.

23A. A borrower availed a sanctioned loan facility of Rs. 2.5 Crore and as of 29.02.2020, the principal outstanding is Rs. 1.80 Crore, will such a borrower be eligible under the Scheme?

Yes. As per the FAQs issued by the Department of Financial Services (FAQ 10), the sanctioned and outstanding amounts have to be seen as on 29.02.2020. In the question above if the sanctioned loan facility has been completely availed, i.e. borrower cannot make further drawdowns from such sanctioned facility of 2.5 crore, then such borrower account should be eligible under the Scheme.

- Is there any requirement for eligible borrowers under specified loan accounts which needs to be fulfilled for the purpose of availing ex-gratia payment benefit?

No, as per the ex-gratia scheme guidelines all lending institutions under the scheme have to credit the difference between compound interest and simple interest in specified loan accounts of the eligible borrowers.

However, it is always prudent on part of borrowers and the lending institutions to exchange confirmation about the credit of such payment under the scheme.

- Will the eligibility be determined as on the date of this scheme or as on 29.02.2020?

The borrower account must fall in the category of specified loan account as on 29.02.2020. For example, a loan account was classified as an MSME as on 29.02.2020 and later on a subsequent change in definition has moved it out of the category of MSME, the benefit under the scheme shall still be given to the said borrower account, subject to fulfilment of the eligibility conditions.

Scope of “Facility”

- Which all classes or categories of loans/facilities are eligible under this Scheme?

The loans falling under any of the categories mentioned below are ‘specified loan accounts’ under this Ex-gratia Scheme.

- MSME loans

- Education loans

- Consumer durable loans

- Credit Card Dues

- Automobile loans

- Personal loans to professionals

- Consumption loans

- Housing Loans

- Does the specified loan account also include all personal loans, or personal loans given only to professionals?

RBI has defined the term “personal loans” in its circular dated 04.01.2018 as follows:

“Personal loans refers to loans given to individuals and consist of (a) consumer credit, (b) education loan, (c) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), and (d) loans given for investment in financial assets (shares, debentures, etc.).”

The circular dated 04.01.208 also defines “consumer credit”, and the extant definition is as follows:

Consumer credit refers to the loans given to individuals, which consists of (a) loans for consumer durables, (b) credit card receivables, (c) auto loans (other than loans for commercial use), (d) personal loans secured by gold, gold jewellery, immovable property, fixed deposits (including FCNR(B)), shares and bonds, etc., (other than for business / commercial purposes), (e) personal loans to professionals (excluding loans for business purposes), and (f) loans given for other consumptions purposes (e.g., social ceremonies, etc.). However, it excludes (a) education loans, (b) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), (c) loans given for investment in financial assets (shares, debentures, etc.), and (d) consumption loans given to farmers under KCC.

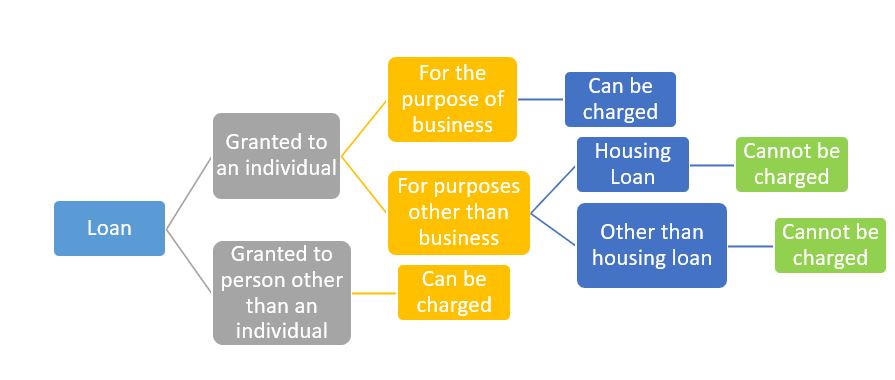

Therefore, from conjoining the above two definitions and comparing it with the list of specified loan accounts under the Scheme, we understand that Personal Loans given to individuals in respect to; a) education loans, b) credit cards dues, c) loans for consumer durables, d) auto loans, e) Personal loans to professionals, f) loans for consumption purposes g) Housing Loans shall qualify as specified loan accounts from personal loan category for the purpose under the scheme.

The expression “consumption loan” is quite wide. A loan which is not for business purposes, or for purchase of any specific asset or durable, may qualify as a “consumption loan”.

27A. Whether loans given to doctors for business purposes are covered under the head ‘personal loan to professional’?

Going by the literal interpretation it seems that personal loans to professionals shall not include loans given for business purposes. The same is also specified in the definition of ‘consumer credit’ provided hereinabove. However, consumption loans are also not for business purposes and a personal loan by any person, including a professional, will be classified as a consumption loan. Hence, in essence there would not be a difference between the category ‘personal loan for professionals’ and ‘consumption loans’, the later being a broader term. Such an interpretation would reder this category as meaningless.

Further, restricting the meaning to only personal loan would mean that a loan given to a professional, for the profession, will disqualify on the ground that it is not a “personal loan. However, in our view, the intent seems to be cover loans to professionals. The word ‘personal’ loan seems to be a surplusage and should not be taken restrictively.

- A salaried employee / self-employed professional had availed of a personal loan from bank which has some amount outstanding as on 29.02.2020. Is the loan eligible for ex-gratia payment under the scheme?

Yes. Loans for consumption purposes (e.g., social ceremonies, personal expenditure, etc.) are also eligible for coverage under the scheme, besides other specified categories of loans like consumer durables, automobiles, education, credit card dues, housing and personal loans to professionals.

28 A. In case of education loans where students pay part of the interest and the remaining interest gets capitalised. Will such cases also qualify under this scheme?

In case of education loans, generally, the repayment starts after a deferment or moratorium period (say 1 or 2 years). EGS covers education loan under specified loan category, however it does not specify, whether the status of the loan account of repayment under such loans have commenced or not, or has been partially paid or not as of 29.02.2020. Therefore, in our view, education loan accounts have to be given benefit under EGS irrespective of the fact whether loan is under deferred period, or the re-payment has commenced or loan is partially being re-paid. Further, the reference date to be borne in mind for determining the outstanding amount on such loan account shall be 29.02.2020.

28B. Will loans to Education Institutes be eligible under education loans?

No, loans given to education institutes will not be covered under the head ‘education loans’.

- Is there a distinction between secured loans and unsecured loans for the purpose of the Scheme?

No. There is no such distinction. As long as the loan is covered by the list of “facilities” above, it does not matter whether the loan is secured or unsecured.

- A business loan has been given to an MSME (private limited company), and is secured by pledge over shares of the company? Will this loan be eligible?

As per FAQ no. 20 of the FAQs issued by MoF, loans against shares shall not qualify for the Scheme. However, in our view, the intent of the MoF is to exclude loans against the financial assets, that is, loans where the intent is to use the proceeds of the loan for investing in financial assets. In the instant case, the loan is a loan taken for business purposes. The mere fact that the loan has been collateralised by pledge over shares, whether of the entity in question or any other shares, should not matter. This is our view.

- Will a loan taken for business purposes by a non-MSME qualify?

Loans to non- MSME for business purpose is not falling under any eligible category of Facilities, and hence not covered under the Scheme

- A borrower falls under the MSME category as per the new MSME classification. But such a borrower has not availed Udyam Registration, will it be eligible under the scheme?

The borrower must be classified as an MSME on 29.02.2020 irrespective of the classification under the new definition. Further, it is recommended that in case the borrower continues to be classified as an MSME, it may submit its proof of Udyam registration to the lending institution.

32.A Is Udhyam Registration mandatory for MSME classification?

As per the eligibility conditions, the lender has to ensure that the borrower account was a classified as MSME loan as on 29.02.2020. Further, on the said reference date, obtaining udhyam registration was not mandatory for the purpose of MSME classification. However, a declaration may be sought from the borrower in this regard that they were eligible to be classified as an MSME on such reference date.

- What if an auto loan for commercial use has been given by a Lending Institution? Does it mean that such auto loan is not covered under the specified loan account category?

All automobile loans are covered by the Scheme, whether the vehicle in question is used for personal or for business purposes.

Therefore, auto loans for commercial use shall also qualify as eligible “facility” for the purpose of the scheme.

A similar clarification has been issued subsequently in MoF FAQs dated 03.11.2020 in FAQ No. 3. [Updated on 04.11.2020]

- Will lease transactions be included under the purview of this scheme?

Financial leases or operating leases are not covered under the Scheme.

- Will the loan against property (LAP) to individuals qualify as a specified loan account under the scheme?

Loan against property (LAP) is a market term, implying the nature of the security in case of the loan. For the purpose of determining whether the loan is an eligible facility or not, we are not concerned with the nature of the collateral or security. We are concerned with the end-use of the money. Hence, a LAP loan may be a consumption loan, or a business loan to an MSME, or a personal loan to a professional. Therefore, merely because the loan is a LAP, we cannot judge whether it is a qualifying facility or not.

On the other hand, a LAP loan may be given as a business purpose loan to an entity which may not be qualifying as an MSME. In that case, the facility will not qualify.

35A. Whether loans availed against term deposits are eligible for ex-gratia payment?

Lenders have to consider that the loan account should fall under the specified loan category based on the end use of the loan as well as the type of borrower. The collateral securing such loan is irrelevant.

35B. Whether micro loans guaranteed by Joint Liability Group (JLG) are covered under the Scheme?

Individual loans from the eight eligible categories of borrowers, including those categorised as Micro, Small and Medium Enterprises (MSME) by the lending institution, are covered under the scheme irrespective of the nature of

guarantee. [Mof FAQs dated 04.11.2020]

- What is the meaning of the word “professionals” in case of personal loans?

In technical parlance, the word “profession” has a narrow meaning. It mostly means those regulated professions where there is a professional body for the purpose of a recognised profession which entitles the professional to practice the same. Examples may be doctors, chartered accountants, architects, etc. However, in the context of the Scheme, it appears that the word “profession” has been used in the wider sense of a profession, vocation or calling, not being in the nature of business. Such a wide meaning is prevalent under taxation laws for recognition of income under the head “business” or “profession”. There does not seem to be sufficient reason for restricting the meaning of the word “profession” for the purpose of the Scheme to only regulated professions.

Hence, there are two types of loans – business loans, and personal loans. Business loans will qualify for the Scheme if the same is extended to MSMEs. Personal loans, to entities other than those engaged in businesses, may either be a personal loan given to a professional, or a consumption loan to a salaried employee. In our view, both the latter categories will qualify.

- A large number of NBFC loans are given to retail and wholesale traders. Do they qualify?

The fact that retail and wholesale traders are excluded from the definition of MSME would imply that they shall not fall under the category of ‘MSME loans’. However, in case the end use of the loan is for consumption by the trader, the same can qualify as ‘consumption loans’

- Will a loan given to a practising CA or CS firm qualify as a personal loan to professionals? Can it be classified under the head “MSME loans” in case the firm is registered as MSME?

The loan given to a practicing CA or CS (for purposes other than business) shall qualify as a personal loan to professionals. Further, a loan given to a practising CA/CS firm for business purposes can be classified as ‘MSME loan’ provided the firm is registered as an MSME.

- Will the gold loans to individuals fall under the specified loan account category?

The answer to this question is far from clear. On one hand, it is possible to contend that most of the gold loans are, in fact, consumption loans. We have discussed above that what should matter for the purpose of the Scheme is the end use of the loan and not the nature of the collateral. On the other hand, the MoF FAQs have specifically excluded loans taken for investment in financial assets. Gold is not one of the financial assets referred to in the FAQs. However, if the underlying philosophy of the Scheme is considered, gold loans do not seem to be those which were disrupted by the Covid pandemic. In most of the gold loans, there are no periodic payments too – therefore, if the underlying spirit of the Scheme is to relieve the borrower from the burden of compound interest for availing the moratorium, one may have a divergent view in case of gold loans.

Please also see our FAQs on the Covid Moratorium for further discussion about gold loans- http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

Nevertheless, the ministry has also clarified in its FAQs dated 04.11.2020 that Consumptions loans, including those backed by gold as collateral, are eligible under the scheme. [updated on 05.11.2020]

- Will agri loans/ tractor loans be covered?

Our initial view was that agricultural loan is not specified in the category of specified loans under EGS. However, tractor loans may qualify under the head ‘automobile loans’.

However, FAQs issued by the MoF dated 29.10.2020 has clarified that crop loans and tractor loans etc. are agriculture and allied activities loans and are not part of specified loan accounts. Hence will not qualify under EGS. The ministry’s view seems to be on the presumption that tractors are used for agricultural purposes, whereas it can be used for transport as well. [Revised answer on 30th October 2020].

40A. Will a tractor loan always be considered as agri loan?

A tractor has dual usage- both for cultivation as well as for travelling. In case a farmer has availed tractor loan and same has been categorised as auto loan considering the end use to be for travelling, there is no reason to exclude such loans from ambit of the Scheme. However, the MoF in its FAQs seems to have taken a view that tractor loans, irrespective of the end use shall not qualify under the Scheme.

- Are loans for construction equipment falling under the specified loan account category?

In case the construction equipment loan is availed by an MSME, the same may be categorised under the head ‘MSME loans’. Further, in case the equipment is wheel mounted, the same may be classified as ‘Automobile loans’. Apart from the aforesaid, loan for construction equipment shall not be covered under the Scheme.

- What should be the meaning of the term “automobile loans”? Should the word “automobile” be read in the same sense as a vehicle under the Motor Vehicles Act?

In typical industry parlance, the word “automobile loan” or “auto loan” is read in the sense of a loan to purchase a motor vehicle. Hence, for want of a better definition, the word “motor vehicle” as defined in sec. 2 (28) of the Motor Vehicles Act may guide the meaning.

- Are working capital loans getting covered under any category?

To the extent the WC loan is to an MSME, the same shall be eligible, otherwise it may not fall in specified loan category under EGS.

- Does the specified loan accounts cover unsecured loans given by fintech entities?

Loans given by Fintech entities or Micro Finance Institutions (MFI) may qualify under the EGS as they may be classified as specified loans under ‘consumption loans’ category.

- Does EGS cover loans against securities or other movable properties?

As clarified by the MoF in its FAQs, loans against fixed deposits [including Foreign Currency Non-Resident (Bank) {(FCNR(B)} account, bonds and other interest bearing instruments], and shares etc., and loans given for investment in financial assets (shares, debentures etc.) are not eligible for coverage under the EGS.

- Will Inter Corporate Deposits (ICD) qualify as specified loan accounts for the purpose of the scheme?

Inter Corporate Deposits made by the lending Institutions to MSMEs shall qualify as specified loan accounts under the Scheme. Any other ICD to non-MSME entity shall not be eligible under EGS.

Other qualifying conditions

- A borrower was having standard account classification as on 01.03.2020, but is currently an NPA and the Lending Institution has initiated a recovery mechanism. Is the Lending Institution still required to pass on the benefit of the EGS to such Borrower?

While the benefit of the Scheme is applicable, it does not imply that the ex gratia payment is an outflow to the borrower. That is, the Lending Institution may retain the amount as a payment received from the borrower. Hence, even in case of initiation of recovery proceedings against an eligible borrower, the ex-gratia payment can be retained by the lender and such credit amount could be set off from such lender’s claim.

- Assume a borrower had not opted for the moratorium or the moratorium was not granted to the borrower. Hence, EMIs continued to become payable during the Reference Period. The CI is now replaced by SI. Does that mean retrospectively, the CI will have to be replaced by SI, so that the overdue interest or other consequences for default during the Reference Period will also have to be recomputed?

There is no provision for recomputation of the loan obligations. The benefit by the CI shall be provided to the eligible borrowers by transferring their burden of paying interest on interest during the Reference Period only. However, the computation of overdue interest or other consequence based on the then prevailing EMIs will not be reversed.

- If a Lending Institution has not charged compound interest on the loan, is it still possible to compute CI and avail of the benefit of the Scheme?

If the terms of the loan are clear that the interest shall be simple interest, then the benefit under the Scheme is not even called for.

- In case of EMI-based loans, where there is no formal declaration or disclosure of a compound interest, but an IRR or effective interest rate is computed, can it be implied that there is a compound interest? In essence, can it be contended that IRR and compound interest are the same?

In the cases where an IRR or effective rate is charged from the borrower, the EMI computation already factors the interest compounded over the loan tenure. In case the borrower has availed moratorium, the amount is accrued but not payable.Therefore, interest charged over the interest component of the amount accrued during moratorium period shall be the ex-gratia amount and the same will be credited to borrowers account. In case the borrower has not availed moratorium, the borrower pays the amount on its accrual. The EMI computation however, already considered the compounding effect of the interest. Hence, the ex-gratia amount shall be the interest compounded during the Reference Period.

- In several forms of lending, it is a common practice for lenders to charge a “flat rate”, that is, a rate of interest computed with reference to the original loan, even though the borrower continues to pay the EMIs over time. In such a case, is the EGS applicable?

The RBI specifically instructs the lenders to disclose an annualised rate of interest, irrespective of the payment terms. The annualised rate is the IRR which is the contractual term agreed between the parties. Hence, the EGS benefit shall be applicable and the computation of simple interest and compound interest shall be based on such IRR.

51A. What if the contractual rate is 0%, will benefit under the Scheme still be provided?

In case the contractual rate is NIL or 0%, there is no question of granting any benefit to the borrower, given that the borrower has not paid any interest at all. However, in case the loan account falls under the category of consumer durable loan and no interest is charged for a specified period, then lender’s base rate or marginal cost of funds based Lending Rate (MCLR) whichever is applicable shall be considered as on 29.02.2020 to calculate the differential amount of interest. [Updated as of 02.11.2020]

- The Scheme provides that in case of consumer loans where there is no interest, there may still be an imputed interest based on the lender’s base rate / MCLR whichever is applicable. Can the same principle be applied in case of loans where only simple interest is charged?

The EGS specifically mentions the treatment in case of consumer durable loans where there is no interest charged by the lender for a specified period. However, in case simple interest has been charged that would essentially mean that the lender has forgone its interest over the accrued interest. Hence, the same shall not be eligible for benefit under the EGS.

- What will be eligibility of a borrower under EGS in any of two scenarios covered below?

Scenario 1: The borrower has taken moratorium benefit until the first three months under moratorium scheme, i.e. from 01.03.2020 till 31.05.2020.

Scenario 2: The borrower has taken the moratorium benefit for the last three months of the moratorium scheme, i.e. from 01.06.2020 till 31.08.2020.

Yes, the borrower shall be eligible for ex-gratia payment in both of the scenarios mentioned above. The Ex-gratia scheme is applicable on all the specified loan accounts, whether moratorium benefit is completely availed, or partially availed, or not availed at all.

All the payments made by such a borrower towards its eligible loan account between 01.03.2020 and 31.08.2020 will be ignored. For the purpose of uniformity, the difference between compound interest and simple interest is to be reckoned at an outstanding amount as on 29.02.2020 for a period of six months.

- Will it be right to say that all specified accounts of eligible borrowers are entitled for Ex-gratia payment under the scheme, irrespective of whether payment deferment have been availed or not under the moratorium scheme?

Yes, all the specified loan accounts of eligible borrowers are entitled to ex gratia payment under the Ex-gratia Scheme.

- Will the lending institutions continue to charge over dues and other penal interest on borrower’s account even including those to whom the benefit is granted under the scheme?

Yes. The ex-gratia scheme’s objective is to pass the differential benefit of compound interest and simple interest in specified loan accounts by crediting such loan accounts of eligible borrowers.

All the over dues charges and other penal interest shall continue to apply on all borrowers as may be applicable.

- What are the rates of interest on which the difference between compound interest and simple interest on the amount outstanding as on 29.02.2020 will be calculated?

The rate of interest would be prevailing as on 29.02.2020, any change thereafter shall not be reckoned for purpose of computation. Additionally penal interest rate or late payment penalty not to be included as contracted rate or WALR.

A ready reference on manner of determining the rate of interest on eligible loans has been provided in image below:

Time Periods under the Ex-gratia Scheme

- What is the time period for credit/payment of an ex-gratia amount by the lender?

The scheme provides that the exercise of crediting the amount under the scheme shall be completed by respective lending institutions on or before 05.11. 2020.

Therefore, the amount under this Ex-gratia scheme has to be credited to the borrower’s account by the lending institutions within the stipulated time.

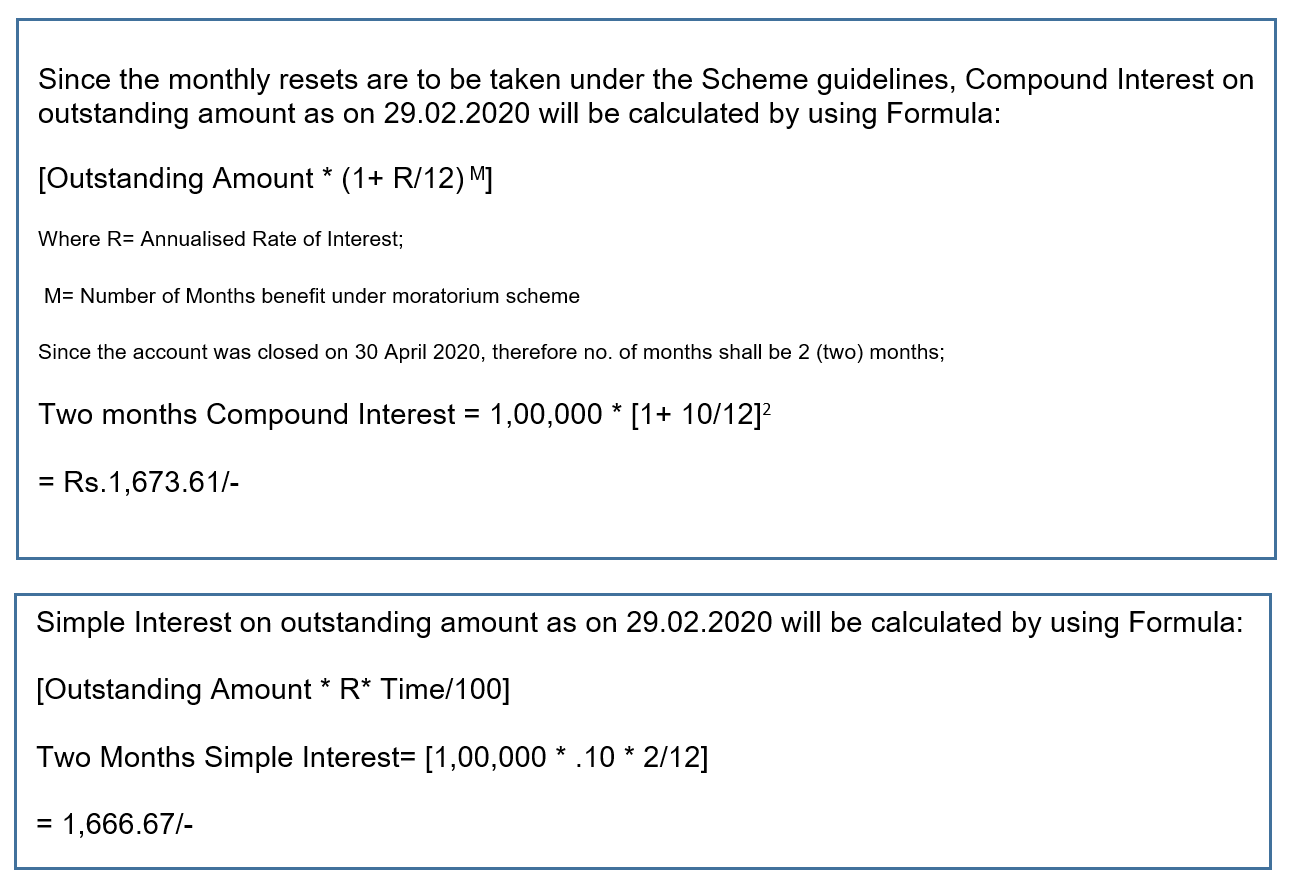

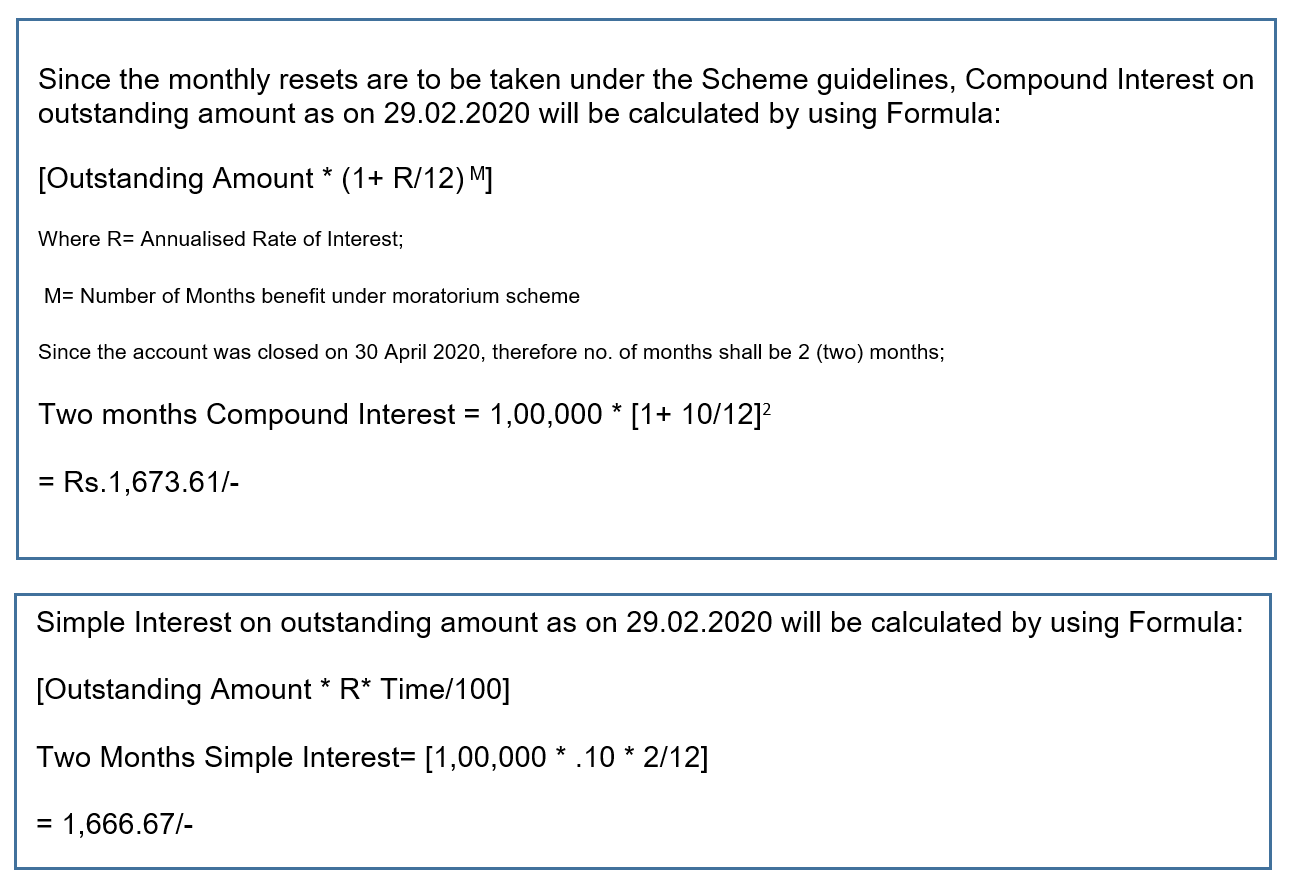

- What shall be the compounding frequency if the loan agreement/document provides that interest shall be compounded semi-annually or quarterly?

The operational guidelines of the scheme in para 7 provides the manner of claiming reimbursement. As under the scheme compound interest shall be reckoned on a monthly basis, except where the contrary is provided. Therefore, where a contractual term specifically provides that the annualised rate should have quarterly or semi annually resets then in all such cases the adjustment shall be given to the same. If the contract or document is silent on the same the compound interest shall be calculated based on monthly resets.

- What would be the change in ex-gratia payout if loan installments are payable quarterly or semi-annually?

The payment of loan installment interval i.e. either monthly / semi-annually or quarterly will have no effect on ex-gratia payment computation if the interest rate is compounded with monthly resets.

Modus operandi for passing on the benefit to the Borrowers

- Does this Ex-gratia Scheme mean that no interest will be charged by the lending institutions for the period of 01.03.2020 till 31.08.2020 on specified loan accounts?

No, this Ex-gratia scheme is in the form of waiver of interest on interest in the specified loan account category, irrespective of whether moratorium benefit was extended/availed completely, partially or not availed at all on such loan accounts.

Therefore, all the eligible borrowers in specified loan accounts will receive payment under the Scheme from their respective lending institution. The credit amount would be such part of interest which would have been chargeable by the lending institutions on the accrued interest component during the six months deferment period from 29.02.2020 till 31.08.2020. That is the difference between the Compound interest and Simple Interest on the outstanding amount will be payable by the lending institution which shall be reimbursed to them by the Government.

Illustration:

Outstanding loan amount in the specified loan account as on 29.02.2020 was Rs. 1,00,000 (Rupees One Lakh).

Interest Rate as applicable on such a loan account as on 29.02.2020 is taken @ 10% annualised rate, compounded monthly.

Therefore, the balance 105.33/- shall be credited to the specified account of the borrower by the lending institution.

- What is the exact manner of passing on the benefit to the borrower? Is it merely a credit to the account of the borrower, or does it lead to any cash benefit being transferred to the borrower?

In our view, the Scheme is simply a limited relief on compound interest. The interest differential as computed under the Scheme is simply credited to the account of the borrower by the 05.11.2020 as specified. Crediting the amount does not mean any actual cash transfer. The interest differential is treated as an amount paid by the borrower. The question of any refund will arise only if the outstanding amount by the borrower is less than the amount of the differential, or the account is fully squared off.

- The borrower’s account has a principal outstanding, but no EMIs or other sums are currently due. In that case, what is the treatment of the interest differential?

If there are no currently dues by the borrower, the interest differential may be treated as a payment of principal by the borrower. Of course, it will be counter-intuitive to apply the clauses pertaining to prepayment, for instance, a prepayment penalty..

- A borrower loan account has been closed in the books of the lending institution as on 30.04.2020. However, the borrower was eligible under the scheme as on 29.02.2020. Will the borrower receive any benefit under the Scheme?

Since the eligibility is to be determined as on 29.02.2020, the fact that the loan account has been closed should not deprive the borrower of the benefit under the Scheme.

Such borrowers are eligible for refund of differential interest from 01.03.2020 upto the date of closure of account.

Illustration

The outstanding amount in a specified loan account as on 29.02.2020 is Rs. 1,00,000 (Rs. One Lakhs Only). The borrower paid all the dues towards the loan amount by 30.04. 2020. The contracted annualised rate compounded monthly as on 29.02.2020 is at 10%.

The ex-gratia payment as under the scheme guidelines should be as follows:

Therefore, the borrower shall be entitled to Rs. 6.94 under the ex-gratia scheme.

It will be credited to the borrower’s savings/ current account. If no such account is maintained by the borrower with the lending institution, the borrower can advise the lending institution the details of the account in other banks where the amount can be credited /remitted to.

63A. Will the treatment of loans that have matured during 01.03.20 to 31.08.20 but are still active in system due to some pending charges, be same as closed loans?

If the loan has been closed during the reference period, and there are pending charges, the treatment shall be the same as a foreclosed account. Accordingly, the credit for differential interest amount can be adjusted with the overdues.

63B. What if the loan is closed in between the month (say 20th of April) how to compute compound interest in such a situation?

The interest shall be computed for the broken period by converting the number of days into a fraction of the month. The same can be done by dividing the number of days by 30 (considering a month has 30 days on average).

63C. A specified loan account is transferred to another lending institution during the period between 01.03.2020 to 31.08.2020. Which lending institution will provide ex-gratia benefit to the customer?

The transferor lending institution shall provide the benefit to the customer. The reference period for calculating compound interest and simple interest differential amount will be from 01.03. 2020 till the date such loan account is tranferred.

- In case the borrower account has been closed, can the difference amount be retained by the Lending Institution as repayment by Borrower?

Yes, if there is an amount pending to be paid by the borrower.

64A. In case the account is foreclosed during the Reference Period, will the benefit of this scheme be applicable?

On October 29, 2020, the Department of Financial Services issued a set of FAQs, which state that for the accounts foreclosed during the Reference Period, the benefit of the scheme shall be available.

- Does the outstanding amount as on 29.02.2020 include overdue instalments or any other overdue charges such as overdue interest, penalty, etc?

The amount outstanding as on 29th Feb would include all amounts showing as outstanding from the borrower. If the overdue interest or any other charges have been debited to the loan account, and are shown as a part of the outstanding, in the loan account of the borrower, in our view, the same should form part of the reference amount, both for reckoning the limit of Rs 2 crores, as also for computing the interest differential. [Revised answer on 29th October 2020]

- Will it be possible for the lenders to ensure the credit of the differential amount to all the borrowers before 05.11.2020?

The determination of the eligible borrowers, the computation of the differential amount and the process of crediting the same to their respective accounts will be a cumbersome and lengthy process. It will be a burden for the lending institutions and seemingly the Government may have to extend the timelines.

Modus operandi for claiming the payment from the CG

- Where shall the lending institutions file their reimbursement claims after crediting the ex-gratia amounts in specified accounts of eligible borrowers?

The claims shall be submitted to the designated officer (s) /cell at State Bank of India (SBI). The SBI shall act as a nodal agency of the Central Government for settlement of all the claims of lending institutions.

- What are the procedures to be followed by lending institutions for reimbursement of claims processing?

The following timelines and procedures need to be complied by all the lending institutions falling under the scheme.

- The last date for filing claims of reimbursement of amounts credited to specified loan accounts of eligible borrowers is by 15.12.2020.

- The reimbursement claim amount should be pre-audited by a statutory auditor of the lending institution.

- A certificate by an auditor shall be attached with the claim.

68A. In co-lending transactions, can one entity pass on the benefit to borrower and get the credit from CG?, or same shall be availed from CG in the ratio of disbursement?

In co-lending transaction, the primary co-lender may pass on the benefit to the borrower on behalf of both the lenders and reclaim the same from the CG at the blended rate of interest. The claim amounts once received from CG shall be shared subsequently in the ratio agreed under the terms of co-lending.

Grievance Redressal Mechanism

- What is the timeline for lending institutions to address grievances of borrowers?

As under the operational guidelines of the EGS, each lending institution is required to put in place a grievance redressal mechanism for eligible borrowers within one week from date of issuance of ex-gratia guidelines i.e. latest by 30.10.2020.

- Lending institutions usually have a grievance redressal mechanism in place. Is there a need to establish a separate mechanism for the purpose of this scheme?

The scheme does not require the lenders to develop a separate mechanism for redressal of grievances arising due to the scheme. The same may be a part of the existing grievance redressal mechanism of the lender. However, the scheme states that the lenders can consider communication dated 1.10.2020 from the Indian Banks’ Association (IBA) in respect of the resolution framework for COVID-19 related stress.

For the purpose of incorporating the aforesaid in the existing grievance redressal mechanism, necessary communication in this regard may be circulated internally by the Nodal Officer or such other personnel authorised under the Grievance Redressal Policy of the lending institution.

- What are the requirements under the abovementioned communication from IBA?

The said communication form the IBA lays down the following:

- A web-based platform shall be developed for automatic lodgement and handling of grievances. The grievances may be received on the said portal/branch office of the lender. Grievances received at the branch should also be fed into the portal and the system shall generate a digital receipt for the customer.

- The grievances should be directly handled at zonal/circle level based on the hierarchical structure of the lender. Preliminary remarks should be provided to the customer within a maximum of 72 hours by the Nodal Officer and final response should be provided within 7 working days.

- Escalation matrix may be provided separately for different kinds of loans such as for retail and commercial banking customers. The grievance related to commercial loans may be handled at a higher level.

- The framework should provide for re-opening of the grievance if the customer is not satisfied by the response.

- A dashboard on the status of grievances viz. no. of grievances received, pending status etc. should also be made available to controllers/regulators for close monitoring.

- Is it mandatory to abide by the above guidelines provided by the IBA?

The scheme does not mandate compliance of the guidelines from the IBA. However, the same may be mandatory for the banks who are members of the IBA (owing to their membership) and recommendatory for other lending institutions.

- What are the remedies for a lending institution having grievances concerning the Scheme?

Grievances of lending institutions shall be resolved through designated cell at State Bank of India (SBI) in consultation with the Ministry of Finance, GoI. However in respect to the issues/queries related to interpretation of the scheme, the decision of GoI shall be final.

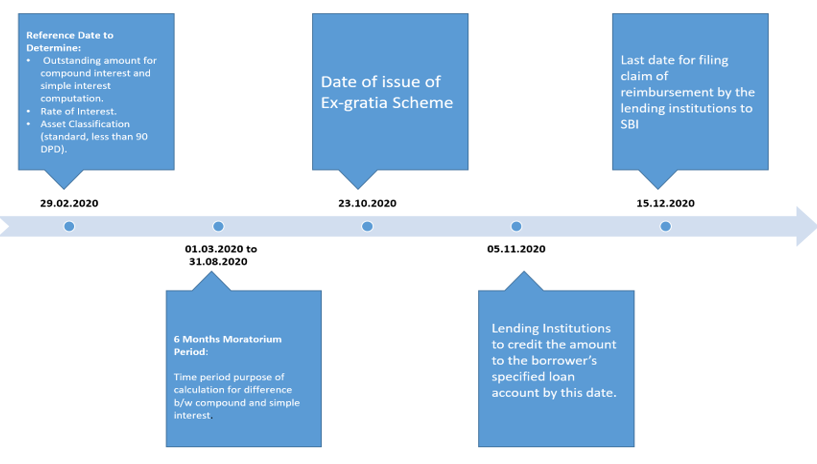

The timeline below summarises the important dates to be abided by Lending Institutions under the ex-gratia scheme.

Calculation Table-

[1] Our write up ‘Moratorium Scheme: Conundrum of Interest on Interest’ dated 16-09-2020, <http://vinodkothari.com/2020/09/moratorium-scheme-conundrum-of-interest-on-interest/>

[2] Operational guidelines on ex-gratia payment scheme dated 23-10-2020, <https://financialservices.gov.in/sites/default/files/Scheme%20Letter.pdf>

[3] Department of Financial Services GOI notification dated 26.10.2020 < https://financialservices.gov.in/sites/default/files/FAQs%20on%20Ex%20gratia%20Package_26.10.2020_v1.pdf>; Department of Financial Services GOI notification dated 29.10.2020 <https://financialservices.gov.in/sites/default/files/FAQs.pdf>;

Department of Financial Services GOI notification dated 03.11.2020

<https://financialservices.gov.in/sites/default/files/FAQs%20dated%203.11.2020.pdf>; Department of Financial Services GOI notification dated 04.11.2020 <https://financialservices.gov.in/sites/default/files/FAQ_4.11.2020-converted.pdf>

[4] Writ Petition(s)(Civil) No(s). 825/2020; Supreme Court of India

[5] FAQs on moratorium- http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

[6] FAQs on moratorium 2.0- http://vinodkothari.com/2020/05/moratorium-2-0-on-term-loans-and-working-capital/

Other Related Write-ups: