Archive for month: February, 2020

Recent Developments in Corporate Laws

/0 Comments/in Companies Act 2013, Insolvency and Bankruptcy, SEBI /by Vinod Kothari ConsultantsIn its stride to achieve transparency, good governance, and ease of doing business, the Government has time and again introduced amendments, proposed new ideas in the corporate laws. The very recent example of such changes are (a) Changes in RPTs proposed in LODR; (b) Minority Squeeze outs under Companies Act; and (c) introduction of Winding-up Rules, 2020.

In light of the these amendments/ proposed amendments, it becomes important to understand its impact on the already existing set-up. A brief analysis of the aforementioned topics has been discussed here

SEBI revises the format of No Due Statement

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsComparative Analysis of provisions enabling majority shareholders to squeeze out minorities

/1 Comment/in Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsHarshil Matalia, Executive, Vinod Kothari & Company

Introduction

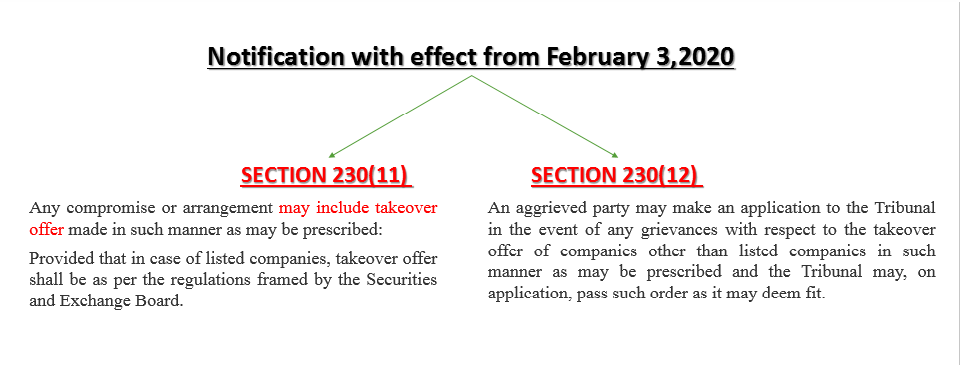

Squeezing out minority shareholders has gradually become an area of intense interest and scrutiny. With the recent set of notifications, Ministry of Corporate Affairs (MCA) has opened yet another way of squeezing out minority shareholders. The MCA has recently notified[1] sub section (11) and (12) of section 230 of the Companies Act, 2013 (‘Act’) on 3rd February, 2020 (effective from the date of notification itself), whereby power has been given to the majority shareholders holding atleast 3/4th of the share capital of the target company to enter into arrangement for acquisition of any part of the remaining shares of the target company.

While section 236 of the Act specifically provides for squeezing out of minority shareholders, the prerequisite of holding atleast 90% of the share capital is a challenge to implement. Whereas, with the notification, those holding atleast 75% can move ahead with the proposal before the NCLT via Scheme and can acquire the balance by offering a fair price determined by the Registered valuer.

The term ‘squeeze out’ reflects a situation whereby controller shareholders undertakes a transaction to forcibly acquire remaining shares of a company. There are number of methods provided in the Act through which minorities can be squeeze out by majorities, viz. reduction of share capital, consolidation of shares etc.

This write up is an attempt to analyse the implementation of the recently notified provisions and a brief comparison of the same with the existing options of squeezing out minority shareholders.

An Overview of Section 230

Section 230 of the Act provides for any compromise and arrangement between shareholders or creditors of a company with the company pursuant to a scheme. The company or any shareholder or creditor or liquidator (in case the company is under liquidation) can file application before the National Company Law Tribunal (NCLT) for the approval of the scheme of compromise or arrangement along with the documents as provided under rule 3 of the Companies (Compromises, Arrangements and Amalgamations ) Rule, 2016.

Approval from at least 90% of shareholder and creditors of applicant companies will enable the companies to get dispensation from the NCLT convened meeting, otherwise, dual approval as per section 230 (6) of the Act will be required, which is ‘majority of persons representing 3/4th in value.

Further, the Act also provides for sending of a copy of application to all the regulatory authorities, such as Registrar of Companies, Central Government (power delegated to Regional Director), Official Liquidator, Income Tax Authorities, Securities and exchange board of India (in case of listed companies), CCI and Reserve bank of India (in case of NBFC, for inviting their objection, if any on the proposed scheme. In consideration of all the respective Tribunal can allow the scheme. The scheme, once approved by the Tribunal, shall be binding on the company, all the shareholders, creditors, and in case of company being wound up, on the liquidator and the contributories of the company.

Proviso to section 230 (4) provides for right to object to the shareholder holding 10% of the share capital of company either individually or together with other shareholders; and the creditors holding 5% of the outstanding debt either individually or together with other creditors.

The enabling notifications[2] provides for ‘takeover offer’ by the shareholders holding at least 3/4th of the shares of a company to the remaining shareholders, which means shareholders holding 75% or more of the issued share capital of the a company can now enter into an arrangement with the target company to acquire remaining shares by offering them the price determined by the registered valuers. While the other compliance as set out in section 230 of the Act will remain same for the scheme involving takeover offer, the applicant shall additionally be required to deposit 50% of the offer price in a separate bank account after getting requisite approval from the shareholders and creditors but before getting approval from the Tribunal.

In addition to the right to object u/s 230 (4), further liberty has been given to the aggrieved party, other than listed companies, to make application before the NCLT in case of any grievances with the said takeover.

Analysis of acquisition of minority shareholding in terms of section 236

Section 236 empowers the registered holders holding at least 90% of the issued share capital of a company, either individually or along with person acting in concert, by virtue of:

- an amalgamation,

- share exchange,

- conversion of securities or

- for any other reason

to first intimate the company regarding their intention to buy the remaining shares or part thereof, then to make offer to the minority shareholders at a price determined by the registered valuer and finally getting the possession of the shares by depositing the amount equal to the value of shares to be acquired in a separate bank account. Alternatively, the minority shareholders may also offer the shares to the acquirer at a price determined on the basis of valuation by a registered valuer in accordance with prescribed rules.

However, in the practical scenario, the section fails to achieve its objective of releasing the minority shareholders as the section does not clarify whether upon receiving such an offer the minority shareholders or the Acquirer is obligated to sell or buy the shares, and no specific timelines have been prescribed for acceptance of such an offer or for the tender of shares. Further, the instance where the shares are held in demat form, has also not been considered.

The process under section 236 can be seen below:

Other methods of acquiring minority shares under the Act

Apart from the transactions mentioned above, there are several other methods available to implement squeeze out minority shareholders within the Act, such as consolidation of shares, reductions of share capital etc. out of which, most commonly used method is reduction of share capital. However, all the provisions have their own benefits and lacuna’s. The brief overview of the said transactions are as follows:

Consolidation of shares:

Consolidation of shares means consolidating nominal value of shares that results into decrease in the number of shares with increase in nominal value of each share. For example 100 shares of face value of Rs. 10 each may be consolidated into 1 share of face value of Rs 1000 each. Consolidation is also known as reverse stock split, which is the effective tool by which a company can restructure its capital and can eliminate minority holding with the approval of Tribunal in terms of section 61 (1) (b) of the Act and Rule 71 of the NCLT Rules, 2016.

Reduction of share capital:

A company limited by shares can reduce its share capital through: (a) reducing/extinguishing its liabilities on unpaid share capital; (b) with or without extinguishing or reducing its liabilities on any shares which is lost or is unrepresented by its existing assets; or (c) with or without extinguishing or reducing its liabilities on any shares which is in excess of its requirement. Section 66 of the Act provides for the reduction of capital by a company with the approval of Tribunal, only if it is not defaulted in repayment of any deposit accepted by it or interest thereon.

Acquiring Minority shareholding in terms of section 235:

An Acquirer/Transferee Company can acquire the shares of Transferor Company under a scheme or contract subject to the approval of holders of minimum 90% of value of shares other than shares already held by Transferee Company or its nominee or its subsidiary companies. Such approval is required to be obtained by Transferee Company within 4 months after making such offer. Upon receipt of the said approval, within 2 months from the expiry of the offer period, the Transferee Company shall give notice to dissenting shareholders by conveying its intention to acquire their shares and the dissenting shareholders may then approach NCLT for seeking remedy within one month from the date of such notice.

The entire process of acquiring the shares from the dissenting shareholders is extensive and time consuming for the acquirer. This makes the process of squeezing out dissenting shareholders unreasonably lengthy.

Conclusion

In conclusion, the notified section has added a way for unlisted companies to eliminate minorities smoothly vide scheme of arrangement which will further boost the dominance of majority over minority. On prima-facie view, one can say that the section seems to have covered the lacuna’s of other squeezing out provisions of the Act, however, the supervisory role of the respective regulatory authorities and the views to be taken by respective Tribunals will decide the materialisation of the notification.

Links to related write ups –

Takeover under Companies Act, 2013- http://vinodkothari.com/2020/02/takeover-under-ca-2013/

[1] http://www.mca.gov.in/Ministry/pdf/Notification_04022020.pdf

An all-embracing guide to identity verification through CKYCR

/0 Comments/in Financial Services, Fintechs and Payment and Settlement Systems, KYC/PMLA, NBFCs, RBI /by Vinod Kothari Consultants-Kanakprabha Jethani | Executive

Updated as on January 19, 2022

Introduction

Central KYC Registry (CKYCR) is the central repository of KYC information of customers. This registry is a one stop collection of the information of customers whose KYC verification is done once. The Master Direction – Know Your Customer (KYC) Direction, 2016 (KYC Directions)[1] defines CKYCR as “an entity defined under Rule 2(1) of the Rules, to receive, store, safeguard and retrieve the KYC records in digital form of a customer.”

The KYC information of customers obtained by Reporting Entities (REs) (including banks) is uploaded on the registry. The information uploaded by an RE is used by another RE to verify the identity of such customer. Uncertainty as to validity of such verification prevails in the market. The following write-up intends to provide a basic understanding of CKYCR and gathers bits and pieces around identity verification through CKYCR.

Identity verification through CKYCR is done using the KYC identifier of the customer. To carry out such verification, an entity first needs to be registered with the CKYCR. Let us first understand the process of registration with the CKYCR.

Registration on CKYCR

The application for registration shall be made on CKYCR portal. Presently, Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) has been authorized by the Government of India to carry out the functions of CKYCR. Following are the steps to register on CERSAI:

- A board resolution should be passed for appointment of the authorised representative. The registering entity shall be required to identify nodal officer, admin and user.

- Thereafter, under the new entity registration tab in the live environment of CKYCR, details of the entity, nodal officers, admin and users shall be entered.

- Upon submission of the details, the system will generate a temporary reference number and mail will be sent to nodal officer informing the same along with test-bed registration link.

- Once registered on the live environment, the entity will have to register itself on the testbed and test the application. It shall have to test all the functionalities as per the checklist provided at https://www.ckycindia.in/ckyc/downloads.html. On completion of the testing, the duly signed checklist at helpdesk@ckycindia.in shall be e-mailed to the CERSAI.

- The duly signed registration form along with the supporting documents shall be sent to CERSAI at – 2nd Floor, Rear Block, Jeevan Vihar Building, 3, Parliament Street, New Delhi -110001.

- CERSAI will verify the entered details with physical form received. Correct details would mean the CERSAI will authorize and approve the registration application. In case of discrepancies, CERSAI will put the request on hold and the system will send email to the institution nodal officer (email ID provided in Fl registration form). To update the case hyperlink would be provided in the email.

- After completion of the testing and verification of documents by CERSAI, the admin and co-admin/user login and password details would be communicated by it.

Obligations in relation to CKYCR

The establishment of CKYCR came with added obligations on banks and REs. The KYC Directions require banks and REs to upload KYC information of their customers on the CKYCR portal. As per the KYC Directions – “REs shall capture the KYC information for sharing with the CKYCR in the manner mentioned in the Rules, as required by the revised KYC templates prepared for ‘individuals’ and ‘Legal Entities’ as the case may be. Government of India has authorised the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI), to act as, and to perform the functions of the CKYCR vide Gazette Notification No. S.O. 3183(E) dated November 26, 2015.

…Accordingly, REs shall take the following steps:

- Scheduled Commercial Banks (SCBs) shall invariably upload the KYC data pertaining to all new individual accounts opened on or after January 1, 2017 with CERSAI in terms of the provisions of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005.

- REs other than SCBs shall upload the KYC data pertaining to all new individual accounts opened on or after from April 1, 2017 with CERSAI in terms of the provisions of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005.”

Further, para III and IV of the Operating Guidelines of CKYCR require reporting entities (including banks) to fulfill certain obligations. Accordingly, the reporting entities shall:

- Register themselves with CKYCR

- Carry out due diligence and verification KYC information of customer submitting the same.

- Upload KYC information of customers, in the KYC template provided on CKYCR portal along with scanned copy of Proof of Address (PoA) and Proof of Identity (PoI) after successful verification.

- Communicate KYC identifier obtained from CKYCR portal to respective customer.

- Download KYC information of customers from CKYCR, in case KYC identifier is submitted by the customer.

- Refrain from using information downloaded from CKYCR for purposes other than identity verification.

- In case of any change in the information, update the same on the CKYCR portal.

In and around verification

Registered entities may download the information from CKYCR portal and use the same for verification. Information can be retrieved using the KYC identifier of the customer. Before we delve into the process of verification and its validity, let us first understand what a KYC identifier is and how would a customer obtain it.

KYC identifier

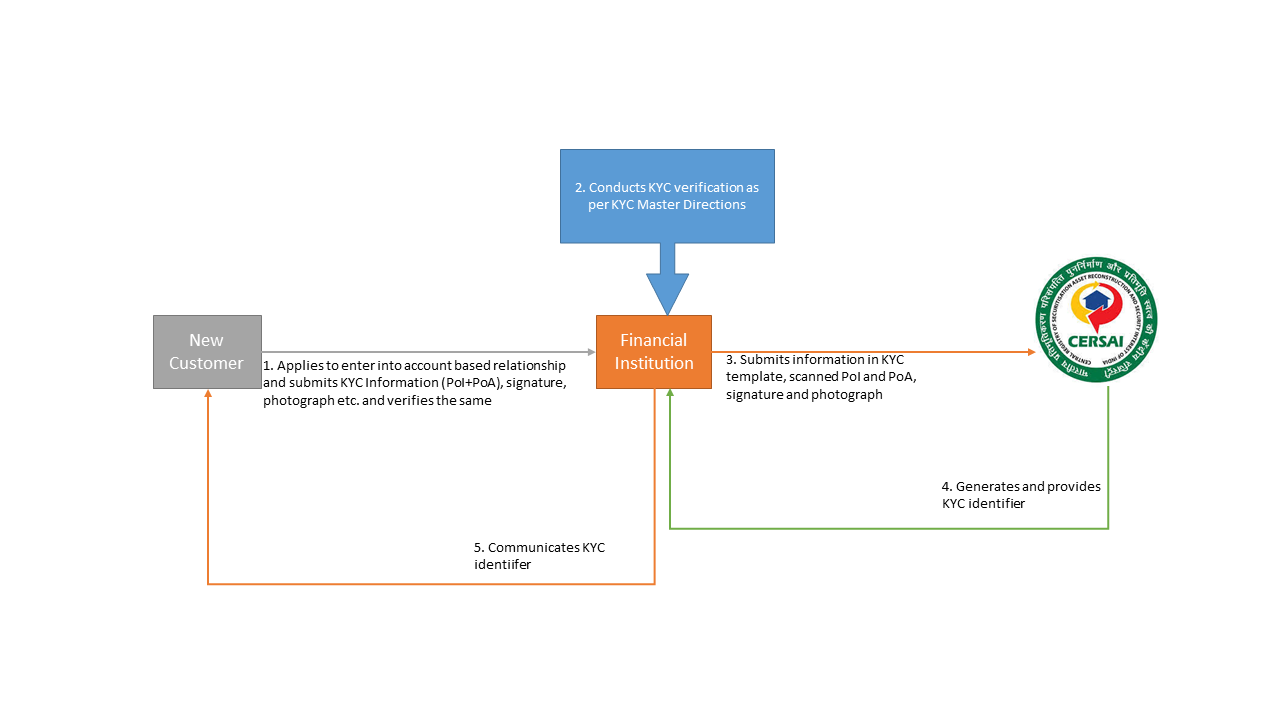

A KYC Identifier is a 14 digit unique number generated when KYC verification of a customer is done for the first time and the information is uploaded on CKYCR portal. The RE uploading such KYC information on the CKYCR portal shall communicate such KYC Identifier to the customer after uploading his/her KYC information.

Obtaining KYC identifier

When a customer intends to enter into an account-based relationship with a financial institution for the very first time, such financial institution shall obtain KYC information including the Proof of Identity (PoI) and Proof of Address (PoA) of such customer and carry out verification process as provided in the KYC Master Directions. Upon completion of verification process, the financial institution will upload the KYC information required as per the common KYC template provided on the CKYCR portal, along with scanned PoI and PoA, signature and photograph of such customer within 3 days of completing the verification. Different templates are to be made available for individuals, and on the CKYCR portal. Presently, only template for individuals[2] has been made available.

Upon successful uploading of KYC information of the customer on the CKYCR portal, a unique 14 digit number, which is the KYC identifier of the customer, is generated by the portal and communicated to the financial institution uploading the customer information. The financial institution is required to communicate the KYC identifier to respective customer so that the same maybe used by the customer for KYC verification with some other financial institution.

Verification through CKYCR

When a customer submits KYC identifier, the RE, registered with CKYCR portal, enters the same on the CKYCR portal. The KYC documents and other information of the customer available on the CKYCR portal are downloaded. The RE matches the photograph and other details of customer as mentioned in the application form by the customer with that of the CKYCR portal. If both sets of information match, the verification is said to be successful.

Identity Verification through CKYCR- is it valid?

The process of CKYCR is not a complete process in itself and is merely a means to obtain documents from the central registry. In the very essence, the registry acts as a storehouse of the documents to facilitate the verification process without having the customer to produce the KYC documents every time he interacts with a regulated entity. Para 56(j) provides that Regulated entities are not required to ask the customer to submit KYC documents, if he/she has submitted KYC Identifier, unless:

(i) there is a change in the information of the customer as existing in the records of CKYCR;

(ii) the current address of the customer is required to be verified;

(iii) the RE considers it necessary in order to verify the identity or address of the customer, or to perform enhanced due diligence or to build an appropriate risk profile of the client.

The above specification is for obtaining the documents from the customer and not for verification of the same. Verification can be done only through physical, digital or V-CIP modes of CDD.

Furthermore, V-CIP as a manner of CDD was introduced through an amendment to KYC Directions introduced on 9th January, 2019[5]. Para 18(b) of the KYC Directions prescribes that documents for V-CIP procedure may be obtained from the CKYCR portal. Logically, if the CKYCR procedure was to be complete in itself, the same would not have been indicated in conjunction with the V-CIP mode of due diligence.

Benefits from CKYCR

While imposing various obligations on REs, the CKYCR portal also benefits REs by providing them with an easy way out for KYC verification of their customers. By carrying out verification through KYC Identifier, the requirement of physical interface with the borrower (as required under KYC Master Directions)[4] may be done away with. This might serve as a measure of huge cost savings for lenders, especially in the digital lending era.

Further, CKYCR portals also have de-duplication facility under which KYC information uploaded will go through de-duplication process on the basis of the demographics (i.e. customer name, maiden name, gender, date of birth, mother’s name, father/spouse name, addresses, mobile number, email id etc.) and identity details submitted. The de-dupe process uses normaliser algorithm and custom Indian language phonetics.

- Where an exact match exists for the KYC data uploaded, the RE will be provided with the KYC identifier for downloading the KYC record.

- Where a probable match exists for the KYC data uploaded, the record will be flagged for reconciliation by the RE.

Conclusion

Identity verification using the KYC identifier is a cost-effective way of verification and also results into huge cost saving. This method does away with the requirement of physical interface with the customer. Logic being- when the customer would have made the application for entering into account-based relationship, the entity would have obtained the KYC documents and carried out a valid verification process as per the provisions of KYC Master Directions. So, the information based on valid verification is bound to be reliable.

However, despite these benefits, only a handful of entities are principally using this method of verification presently. Lenders, especially FinTech based, should use this method to achieve pace in their flow of transactions.

[1] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11566

[2] https://rbidocs.rbi.org.in/rdocs/content/pdfs/KYCIND261115_A1.pdf

[3] https://testbed.ckycindia.in/ckyc/assets/doc/Operating-Guidelines-version-1.1.pdf

[4] Our detailed write-up on the same can also be referred- http://vinodkothari.com/wp-content/uploads/2020/01/KYC-goes-live-1.pdf

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11783&Mode=0

Our FAQs on CKYCR may also be referred here- http://vinodkothari.com/2016/09/ckyc-registry-uploading-of-kyc-data/

Our other write-ups on KYC:

NBFC Account Aggregator – Consent Gateways

/2 Comments/in Fintechs and Payment and Settlement Systems, NBFCs, RBI /by Vinod Kothari ConsultantsTimothy Lopes, Executive, Vinod Kothari Consultants Pvt. Ltd.

The NBFC Account Aggregator (NBFC-AA) Framework was introduced back in 2016 by RBI[1]. However the concept of Account Aggregators did exist prior to 2016 as well. Prior to NBFC-AA framework several Account Aggregators (such as Perfios and Yodlee) undertook similar business of consolidating financial data and providing analysis on the same for the customer or a financial institution.

To give a basic understanding, an Account Aggregator is an entity that can pull and consolidate all of an individual’s financial data and present the same in a manner that allows the reader to easily understand and analyse the different financial holdings of a person. At present our financial holdings are scattered across various financial instruments, with various financial intermediaries, which come under the purview of various financial regulators.

For example, an individual may have investments in fixed deposits with ABC Bank which comes under the purview of RBI, mutual fund investments with XYZ AMC which comes under the purview of SEBI and life insurance cover with DEF Insurance Corporation (which comes under the purview of IRDAI.

Gathering all the scattered data from each of these investments and consolidating the same for submission to a financial institution while applying for a loan, may prove to be a time-consuming and rather confusing job for an individual.

The NBFC-AA framework was introduced with the intent to help individuals get a consolidated view of their financial holdings spread across the purview of different financial sector regulators.

Recently we have seen a sharp increase in the interest of obtaining an NBFC-AA license. Ever since the Framework was introduced in 2016, around 8 entities have applied for the Account Aggregator License out of which one has been granted the Certificate of Registration while the others have been granted in-principle[2].

Apart from the above, we have seen interest from the new age digital lending/ app based NBFCs.

In this article we wish to discuss the concerns revolving around data sharing, the reason behind going after an Account Aggregator (AA) license and the envisaged business models.

Going after AA License – The reason

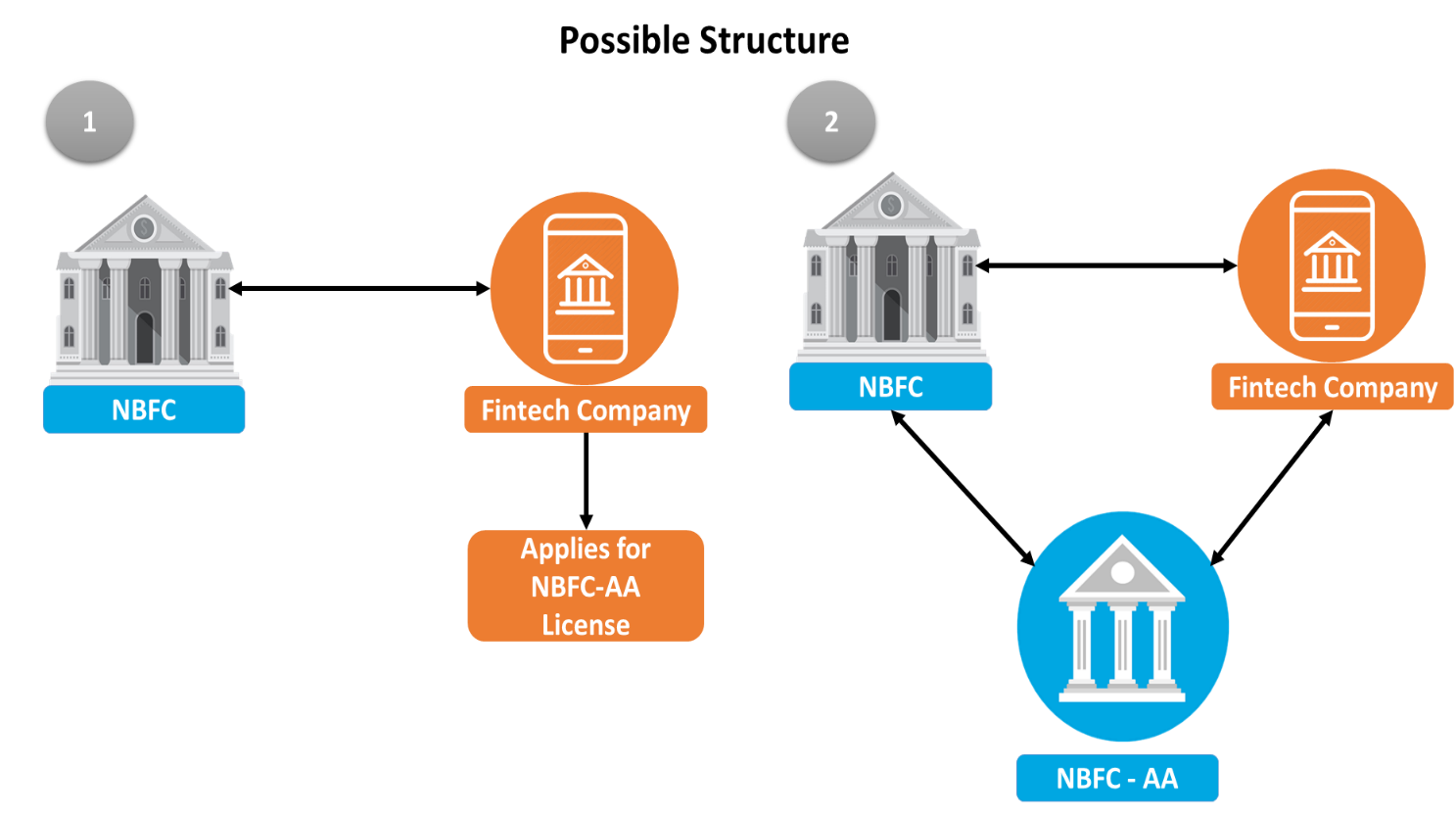

New age lending mainly consists of a partnership model between an NBFC which acts as a funding partner and a fintech company that acts as a sourcing partner. Most of the fintech entities want to obtain the credit scores of the borrower when he/she applies for a loan. However, the credit scores are only accessible by the NBFC partner, since they are mandatorily required to be registered as members with all four Credit Information Companies (CICs).

This is where most NBFCs are facing an issue since the restriction on sharing of credit scores acts as a hurdle to smooth flow of operations in the credit approval process. We have elaborately covered this issue in a separate write up on our website[3].

What makes it different in the Account Aggregator route?

Companies registered as an NBFC-AA with RBI, can pull all the financial data of a single customer from any financial regulator and organise the data to show a consolidated view of all the financial asset holdings of the customer at one place. This data can also be shared with a Financial Information User (FIU) who must be an entity registered with and regulated by any financial sector regulator such as RBI, SEBI, IRDAI, etc. The AA could also perform certain data analytics and present meaningful information to the customer or the FIU.

All of the above is possible only and only with the consent of the customer, for which the NBFC-AA must put in place a well-defined ‘Consent Architecture’.

This data would be a gold mine for NBFCs, who would act as FIUs and obtain the customer’s financial data from the NBFC-AA.

Say a customer applies for a loan through a digital lending app. The NBFC would then require the customer’s financial data in order to do a credit evaluation of the potential borrower and make a decision on whether to sanction the loan or not. Instead of going through the process of requesting the customer to submit all his financial asset holdings data, the customer could provide his consent to the NBFC-AA (which could be set up by the NBFC itself), which would then pull all the financial data of the customer in a matter of seconds. This would not only speed up the credit approval and sanction process but also take care of the information sharing hurdle, as sharing of information is clearly possible through the NBFC-AA route if customer consent is obtained.

The above model can be explained with the following illustration –

What about the Fintech Entity?

Currently the partnership is between the fintech company (sourcing partner) and the NBFC (funding partner). With the introduction of an Account Aggregator as a new company in the group, what would be the role of the fintech entity? Can the information be shared with the fintech company as well as the NBFC?

The answer to the former would be that firstly the fintech company could itself apply for the NBFC-AA license, considering that the business of an NBFC-AA is required to be completely IT driven. However, the fintech company would require to maintain a Net Owned Fund (NOF) of Rs. 2 crores as one of the pre-requisites of registration.

Alternatively the digital lending group could incorporate a new company in the group, who would apply for the NBFC-AA license to solely carry out the business of an NBFC-AA. This would leave the fintech entity with the role of maintaining the app through which digital lending takes place.

The above structures could be better understood with the illustrations below –

To answer the latter question as to whether the information can be shared by the NBFC-AA with the fintech entity as well? The answer is quite clearly spelt out in the Master Directions.

As per the Master Directions, the NBFC-AA can share the customers’ information with a FIU, of course, with the consent of the customer. A FIU means an entity registered with and regulated by any financial sector regulator. Regulated entities are other banks, NBFCs, etc. However, fintech companies are not FIUs as they are not registered with and regulated by any financial sector regulator. An NBFC-AA cannot therefore, share the information with the fintech company.

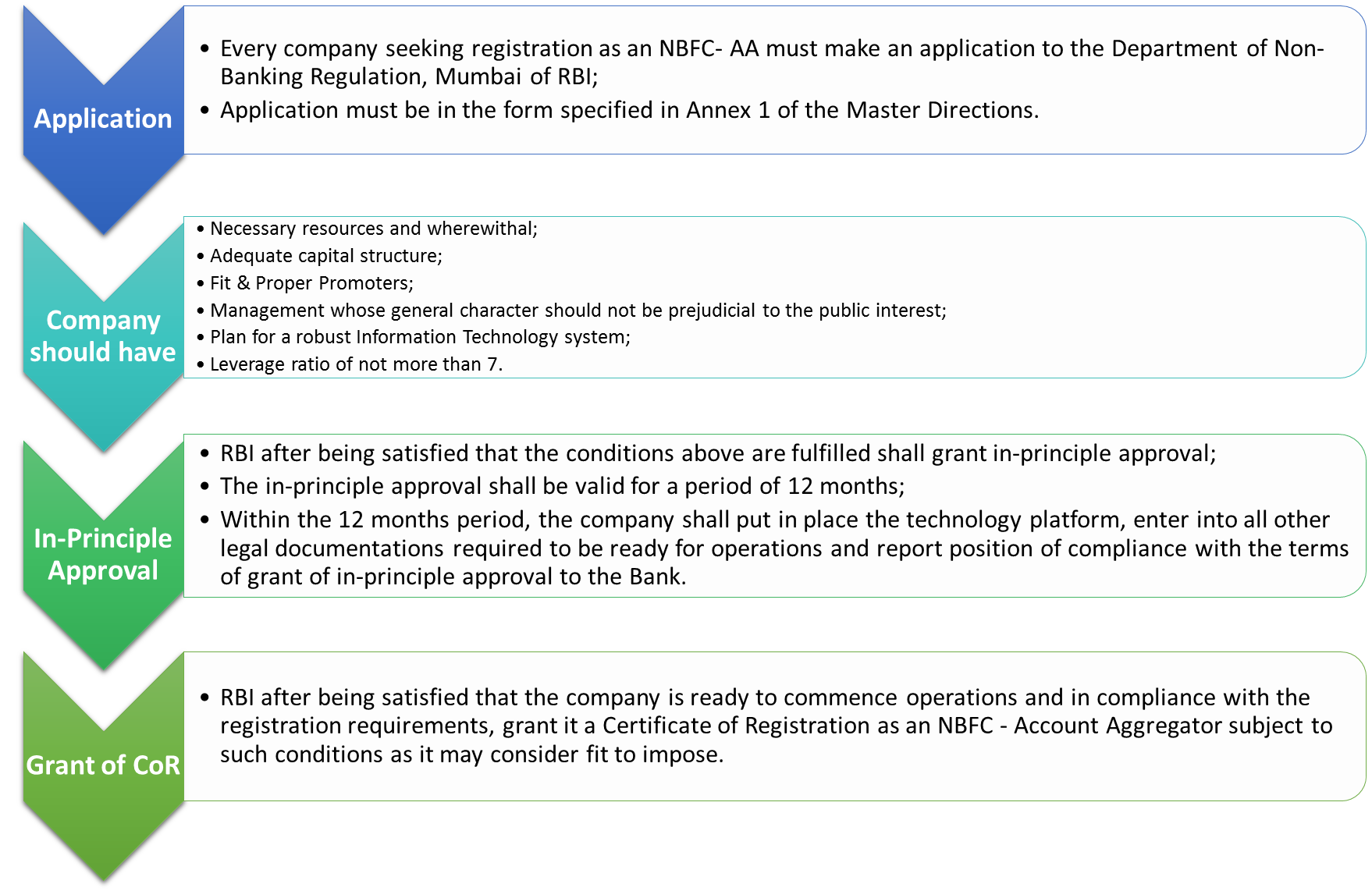

How to register as an NBFC-AA?

Only a company having NOF of Rs. 2 crores can apply to the RBI for an AA license. However there is an exemption to AAs regulated by other financial sector regulators from obtaining this license from RBI, if they are aggregating only those accounts relating to the financial information pertaining to customers of that particular sector.

Further the following procedure is required to be followed for obtaining the NBFC-AA license –

Consent Architecture

Consent is the most important factor in the business of an NBFC-AA. Without the explicit consent of the customer, the NBFC-AA cannot retrieve, share or transfer any financial data of the customer.

The function of obtaining, submitting and managing the customer’s consent by the NBFC-AA should be in accordance with the Master Directions. As per the Master Directions, the consent of the customer obtained by the NBFC-AA should be a standardized consent artefact containing the following details, namely:-

- Identity of the customer and optional contact information;

- The nature of the financial information requested;

- Purpose of collecting such information;

- The identity of the recipients of the information, if any;

- URL or other address to which notification needs to be sent every time the consent artefact is used to access information

- Consent creation date, expiry date, identity and signature/ digital signature of the Account Aggregator; and

- Any other attribute as may be prescribed by the RBI.

This consent artefact can also be obtained in electronic form which should be capable of being logged, audited and verified.

Further, the customer also has every right to revoke the consent given to obtain information that is rendered accessible by a consent artefact, including the ability to revoke consent to obtain parts of such information. Upon revocation a fresh consent artefact shall be shared with the FIP.

The requirement of consent is essential to the business of the NBFC-AA and the manner of obtaining consent is also carefully required to be structured. Account Aggregators can be said to be consent gateways for FIPs and FIUs, since they ultimately benefit from the information provided.

Conclusion

There are several reasons for the new age digital lending NBFCs to go for the NBFC-AA license, as this would amount to a ‘value added’ to their services since every step in the loan process could be done without the customer ever having to leave the app.

However the question as to whether this model fits into the current digital lending model of the NBFC and Fintech Platform should be given due consideration. The revenue model should be structured in a way that the NBFC-AA reaps benefits out of its services provided to the NBFC.

The ultimate benefit would be a speedy and easier credit approval and sanction process for the digital lending business. Data coupled with consent of the customer would prove more efficient for the new age digital lending model if all the necessary checks and systems are in place.

Links to related write ups –

Account Aggregator: A class of NBFCs without any financial assets – http://vinodkothari.com/2016/09/account-aggregator-a-class-of-nbfc-without-any-financial-assets/

Financial Asset Aggregators: RBI issues draft regulatory directions – http://vinodkothari.com/wp-content/uploads/2017/03/Financial_asset_aggregators_RBI-1.pdf

[1] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10598

[2] Source: Sahamati FAQs (Sahamati is a collective of the Account Aggregator System)

[3] http://vinodkothari.com/2019/09/sharing-of-credit-information-to-fintech-companies-implications-of-rbi-bar/

Limits of the Limitation Law and IBC

/8 Comments/in Case laws, Insolvency and Bankruptcy /by Vinod Kothari Consultants-Megha Mittal

The law of limitation revolves around the basic concept of fixing or prescribing the time period for barring legal actions beyond that period. A concept widely acknowledged, in India, the law of limitation is governed by the Limitation Act, 1963[1]. As stated in its preamble, the Limitation Act, 1963 (“Act”) is an act to consolidate the laws for the limitation of suits and other proceedings and for purposes connected therewith.

As observed in the 89th Report of the Law Commission of India[2], the laws of limitation are ultimately based on justice and convenience. An individual should not live under the threat of possible action for an indefinite period, and at the same time, should be saved from the task of defending a stale cause of action, as it would be unjust. The Report states, “all that has been said on the subject can be summarised by stating that the laws of limitation rest upon three main foundations – justice, convenience and the need to encourage diligence.”

The very crux of having a limitation law in force is that a person cannot sleep over his rights[3] for an indefinite period and seek such remedy at a later stage. That being the tenet on which the law is based, there are several basic principles which the law states. These principles substantively affect the rights of parties. Recently, there has been a lot of commotion around the manner and the circumstances, in which the limitation law can be invoked in the context of the Insolvency and Bankruptcy Code, 2016 (‘Code’), though it is established now that the limitation law is applicable to the proceedings under the Code by virtue of section 238A.

In this article, we have made a humble attempt to analyse the various principles of the Limitation Act and its impact on the Code.