UNDERSTANDING THE CONCEPT OF OUTSOURCING- ENVISAGING A TOUGH ROAD AHEAD FOR THE SERVICE PROVIDERS

By Saloni Mathur (finserv@vinodkothari.com)

INTRODUCTION

Mr. Le Kuan Yu, Singapore’s founding father once said, “If you are depriving yourself of the outsourcing business and your competitors do not, you are putting yourself out of the business.” These words reflect upon the importance of outsourcing as a function that has become a necessity for the business organizations in the current scenario, to manage their core as well as ancillary functions through the specialized services of the third parties. This business process re-engineering can reap bundle of benefits to the organizations and its inevitability can be based on the fact that these activities can help organizations to access skilled expertise, reduce overhead, offer flexible staffing, increase efficiency, enhance technological know-how, reduce turnaround time, and eventually generate more profits for the business houses.

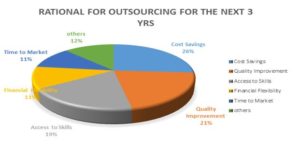

SOURCE– KPMG INSTITUTES.COM, “THE RADICAL NEW

WAY OF OUTSOURCING FOR TECHNOLOGY RELATED SERVICES

According to a report of the Boston consulting group ‘21st annual analysis of the outsourcing industry’, the average number of functions outsourced by the organizations across the world has risen by 225% over the past 5 years and are expected to keep on growing. Outsourcing has been moving from the peripheral activities to the core ones. The recent survey report of the ‘Statistita on Global market size of the Outsourced services from 2000-2016, March 2017’ says that the use of outsourcing in the Indian financial services sector is projected to increase by 36% in the next 3 years, with a CAGR of 7.6%.[1]

Suffice it to say, that the competition between banks, financial institutions in India have increased significantly in the last decade and the consumers now have even higher expectations than in the past when it comes to customer experience and service for which they are using the services of specialised entities. However, such rampant outsourcing of key functions are coming at the cost of loss of managerial control, threat to security and confidentiality and the quality problems, owing to the fact that these institutions are responsible for the funds of the general public. Therefore, it is the need of the hour to have a robust regulatory mechanism which shall ensure appropriate norms for the outsourcing, in order to safeguard the interest of both the customers and the organization.

WHAT IS OUTSOURCING OF FINANCIAL SERVICES?

The transferring of financial services to the third parties for using their specialised services, which otherwise could be performed by them itself, would amount to outsourcing. However, using the services of the third parties for actions that could not be taken in-house would not be considered as outsourcing. For example, statutory audits of the companies cannot be conducted in house itself, thereby keeping them out of the purview of the concept, outsourcing. Similarly, the payment gateway services and agreements would not constitute to outsourcing because these cannot be taken by the companies itself and require the services of the third parties for a speedy and an efficient process.

Thus, the agreements in the nature of debt recovery and repossession agreements, the agreements with the direct selling agents, the agreements related to cash management with the third party would constitute to outsourcing.

Hence organizations have to clearly demarcate between what is outsourcing and what is not, thereby applying this code of conduct only to the key areas of outsourcing.

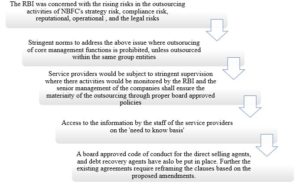

AN OVERVIEW OF THE RBI’S MASTER DIRECTIONS ON OUTSOURCING BY NBFC’S

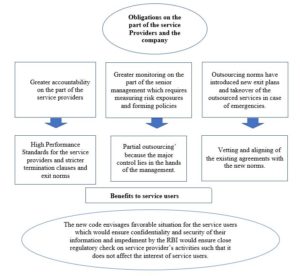

The RBI’s master directions [2]on the outsourcing norms have put stringent compliances on the service providers while discharging their functions, and increased responsibility and monitoring on the part of the non-banking financial companies. The RBI has come up with more tougher norms, where the new directions prohibits the NBFC’s to outsource the core management functions to the third parties including the internal audit, the strategic and compliance functions, and the decision-making functions. However, they can be outsourced within the same group/conglomerate subject to the compliance and instructions in para 6 of the master directions, which states that the NBFC’s shall have a board approved policy and service level arrangements with the group entities prior to entering into such transactions with them.

Further the scope of these directions and new code of conduct applies only to the ‘outsourcing of the financial services’ keeping, general IT related services, and management services like janitorial services, housekeeping, catering of staff out of the purview of this code. Further the code requires NBFC’s strict compliance and monitoring of the activities of the service providers, where the service providers shall not impede or interfere with the RBI during the monitoring of its functions.

RATIONALE BEHIND THE NEW NORMS

The RBI is of the view that over the years, increased outsourcing in the financial sector have posed major risks to the organizations in terms of strategy, reputation, compliance operational, legal, concentration and the country risk. As we could see the rapid outsourcing in different sectors of the services, the underlying principles behind these directions emphasise that the regulated entity shall ensure that outsourcing arrangements neither diminish its ability to fulfil its obligations to customers and RBI nor impede effective supervision by RBI. NBFCs, therefore, have to take steps to ensure that the service provider employs the same high standard of care in performing the services as is expected to be employed by the NBFCs, if the activities were conducted within the NBFCs and not outsourced.

REGULATORY IMPACT ANALYSIS OF THE NEW MASTER DIRECTIONS

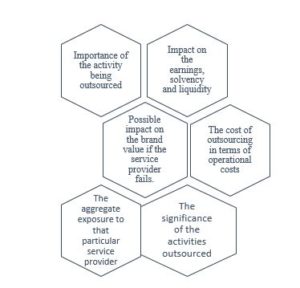

ANALYSING MATERIAL OUTSOURCING

The board of directors and the senior management shall have to observe the materiality while outsourcing the key functions in terms of the business operations, reputability, profitability and customer service. The materiality would be based and assessed on the following parameters.

Thus, companies board first need to determine the materiality of the activities being outsourced. For example, an agreement with the direct selling agents, direct marketing agents, debt recovery agents, to market the company’s products would be material outsourcing, because here the brand value of or the reputation would be at stake if the service provider fails. Further such kind of outsourcing would be material in nature because of the huge operational costs in direct marketing and high DSA’s pay-outs.

CONCLUDING REMARKS

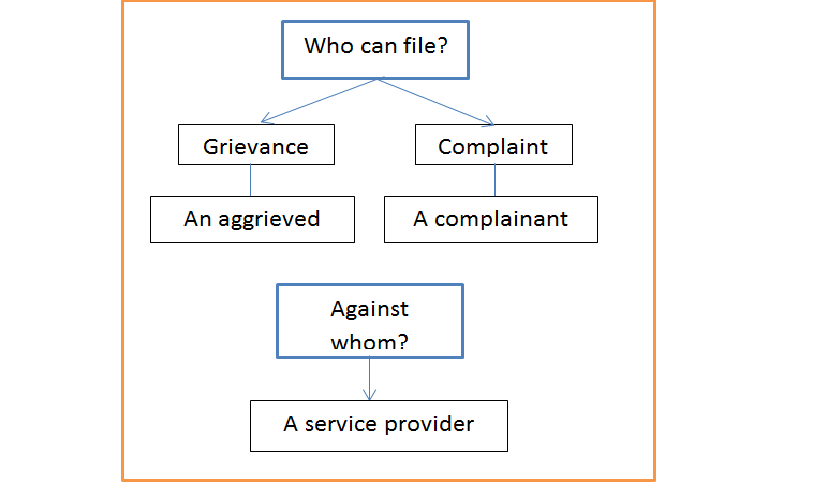

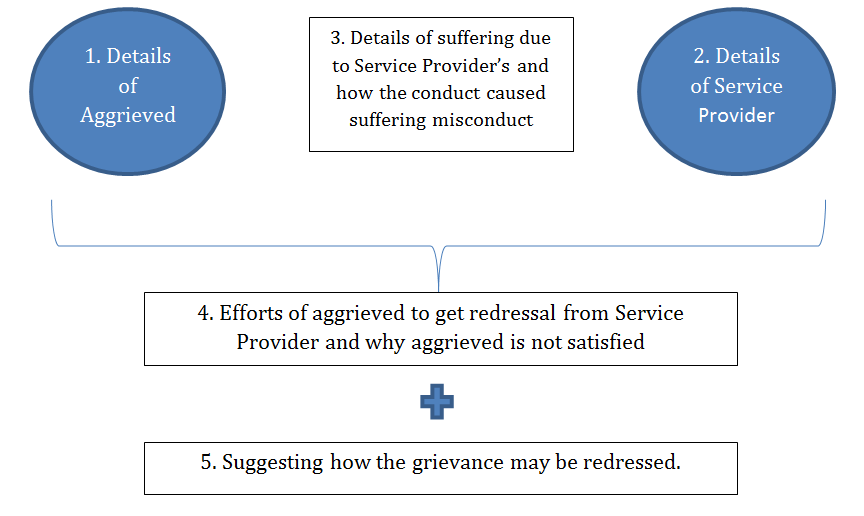

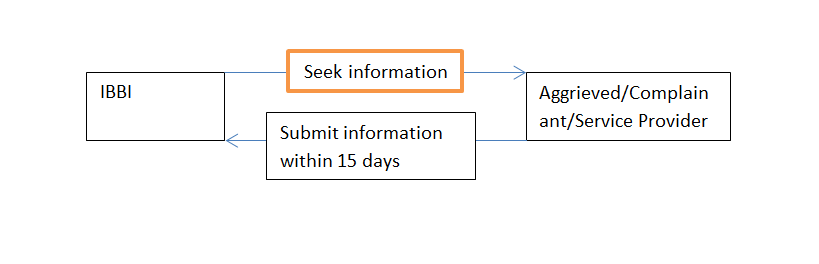

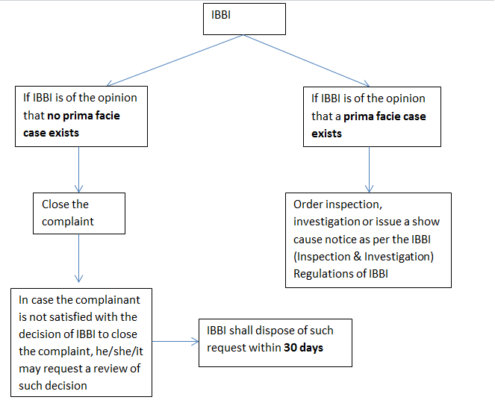

The new directions on outsourcing can be envisaged as careful and robust approach by the RBI in safeguarding the NBFC’S from certain risk exposures with the service providers. Initiatives like a holistic code of conduct for the direct selling agents, the setting up of the internal and the external audit committees to monitor the outsourcing activities, the increased role of RBI to have a close eye on the operations, substantially drafted service agreements that deal with all the risks that could arise and the subsequent clauses to address them, set up of a grievance redressal mechanism, could pave a way for a better regulatory environment and protection of the interests of the public, the NBFC’S and the service providers.

- http://www.kpmg.institutes.com/content/dam/kpmg/sharedservicesoutsourcinginstitute/pdf/2015/spps-it-outsourcing-infographic-2014-15.pdf

- ttps://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT87_091117658624E4F2D041A699F73068D55BF6C5.PDF