NHB introduces Aadhaar based OTP for HFCs

By Mayank Agarwal (finserv@vinodkothari.com)

Introduction

The National Housing Bank (NHB) has introduced various reforms to the existing Aadhaar based e-KYC procedure vide Circular No.85[1] issued on 8th December, 2017. Bringing certain modifications to Circular No. 72[2] issued on 23rd April, 2015 which recognizes E-Aadhaar as an Officially Valid Document (OVD) under the PML Rules, NHB has further introduced an option of Aadhaar based One Time Pin (OTP) for carrying out e-KYC of the prospective customer.

The mandate for acceptance of e-KYC as a valid process of KYC verification comes from Para 2 of the Circular No. 72, which states-

“In order to reduce the risk of identity fraud, document forgery and have paperless KYC verification, UIDAI has launched its e-KYC service. Accordingly, it has been decided to accept e-KYC service as a valid process for KYC verification under Prevention of Money Laundering (Maintenance of Records) Rules, 2005. Further, the information containing demographic details and photographs made available from VIDAL as a result of e-KYC process (“which is in an electronic form and accessible so as to be usable for a subsequent reference”) may be treated as an officially valid document under PML Rules.”

Existing guidelines relating to e-KYC verification

Earlier, HFCs used to carry out e-KYC of the customer by either obtaining information from biometric verification or by verifying the e-Aadhaar print downloaded from the UIDAI website.

In order to carry out such verification, the customer is required to provide explicit consent to UIDAI to release his/her information to the branch offices of the concerned HFC. Additionally, the HFC itself must sign a KYC User Agreement with the UIDAI to permit access to e-KYC service and must ensure that it has proper infrastructure in place, which has been elaborated upon in the Annex I of Circular No. 72, to facilitate such verification.

Aadhaar based OTP authentication

By way of the latest circular, HFCs now have the option to send Aadhaar based OTP to the customer in order to carry out their e-KYC verification. The process involves verification by input of OTP that has been sent at the time of registration to the mobile number of the customer which is linked with his/her Aadhaar.

However, the circular has introduced certain conditions that must be followed to carry out e-KYC by way of OTP. These conditions are as follows:

- Explicit consent from the customer for authentication through OTP;

- The aggregate amount of all the deposit accounts taken together for a customer shall not exceed rupees one lakh;

- The customer can only make term loan borrowings.

- The aggregate amount of term loans sanctioned shall not exceed rupees fifty thousand in a year;

- For accounts which have been opened through this process, payment of deposit shall be accepted only through internet banking/ECS from a designated bank account of the customer;

- All payments in respect of such deposits should be made only to the designated bank account through which funds are deposited;

- The HFC shall procure a declaration from the customer stating that no other account has been opened nor will be opened using OTP based KYC either with the same entity or with any other HFC.

- While uploading the KYC information of the customer to the CKYCR, HFCs shall clearly indicate that such accounts are opened using OTP based e-KYC pending ‘Customer Due Diligence’ (CDD) and other HFCs shall not open accounts based on the KYC information of accounts opened with OTP based e-KYC procedure until the CDD have been completed.

- HFCs would be required to update the status of completion of CDD to the CKYCR portal once the same has been done.

- The CDD of the deposit account opened through the aforesaid process must be done within three months, failure of which shall lead to immediate closure of account by refunding the deposit amount without interest into depositor’s designated bank account.

- Failure to complete CDD within three months in respect of borrower’s account will allow the HFC to grant no further loans to the concerned customer.

- The HFC must ensure that it has in place strict monitoring procedures, including systems, to generate alerts in case of any non-compliance or violation, to ensure compliance with the above mentioned conditions.

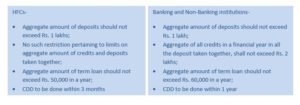

These guidelines are already in place for various banking and non-banking entities in the country, however there are certain key differences that are worth mentioning, which have been described below:

Reforms introduced in Biometric authentication process

The recent circular has also introduced certain reforms to the existing guidelines pertaining to biometric authentication for e-KYC verification. One of the most substantial changes is the fact that while previously the customer had to visit the branch/ office of the HFC to provide biometric authentication, he/she can now provide the same to an authorized person of the HFC.

For any HFC that opens accounts through the above-mentioned process, it needs to comply with certain criteria, which are as follows:

- Payment shall be accepted only through Account Payee cheque drawn in favour of the HFC;

- The cheque shall be drawn only from a designated bank account of the customer; and

- All payments in respect of such deposits should be made only to the designated bank account through which funds are deposited.

These conditions should be publicly disclosed by the HFC in order to promote transparency and fair treatment.

Conclusion

The conditions imposed by NHB relating to opening of accounts through Aadhaar based OTP makes it clear that only accounts with small ticket size can opt for such method. The requirement to carry out the Client Due Diligence within 3 months as compared with 1 year in case of Banks and Non-Bank institution seems to be stringent in nature.

The latest procedure for e-KYC is a welcome addition and is favourable for both the HFC and the customer, reducing the stress and time devotion on the part of both. Not only will the latest reform make the process of e-KYC much smoother and faster, it will also substantially reduce the infrastructural burden that the HFCs had to maintain so far.

[1] http://nhb.org.in/wp-content/uploads/2017/12/NHB(ND)-DRS-Policy-Circular-No.85-2017-18.pdf

[2] https://test.nhb.org.in/Regulation/NHB(ND)-DRS-Policy-Circular-No-72-2014-15.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!