Moving towards sustainable finance through sustainable bonds

SLBs awe-inspiring issuers and investors ! Payal Agarwal, Executive (payal@vinodkothari.com) ESG or Environmental, Social and Governance concerns are been on a high focus in recent times. The issues are not only been addressed by the environmentalists, but the corporate world is also becoming more and more attentive towards the ESG concerns and devising various ways and means to collate them with their operational activities. One of the various such treads in this regard is the issuance of ESG focussed bonds, which is gradually becoming a popular trend in the global economy, India being no exception. These bonds give a boost to sustainable finance, helping issuers raise finance and investors ensuring their investments fulfil their sustainability goals.

Legal framework in India

In India, the green bonds[1] are one of the most popular and legally recognised means of raising sustainable finance. SEBI, vide its circular dated May 30, 2017 has issued “Disclosure Requirements for Issuance and Listing of Green Debt Securities” which are in addition to the general requirements under the SEBI (Issue and Listing of Debt Securities) Regulations, 2008. Amidst the constant push towards business sustainability and responsibility conduct through reporting for listed entities[2], India also recognised the need for such ESG debt securities in the Consultation Paper released on draft International Financial Service Centres Authority (Issuance and Listing of Securities) Regulations. The said consultation paper provides for a framework for issuance and listing of securities, including ESG debt securities in the stock exchanges under the IFSC region in India. Now, the International Financial Service Centres Authority (Issuance and Listing of Securities) Regulations, 2021 (“IFSC Regulations”) provide a framework for listing of “ESG debt securities”. In this article, we will discuss the internationally recognised means of raising sustainable finance and the present and potential capacities of India in raising such sustainable finance by means of ESG debt securities.

Meaning and types

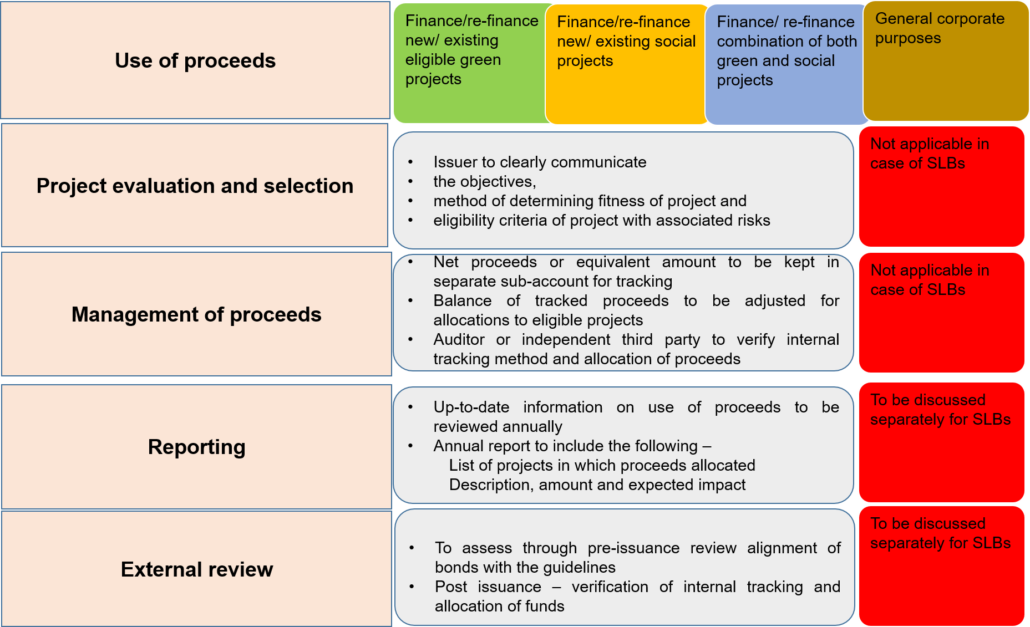

As the name suggests, ESG bonds or debt securities are debt instruments that are linked to or contribute to the development of ESG concepts in some way or the other. The International Capital Market Association (ICMA) recognises 4 types of bonds that are interested in sustainable financing –  Further separate guidelines[3] have been issued by ICMA in respect of each of these bonds. A snapshot showing comparative between these 4 types of bonds is as follows –

Further separate guidelines[3] have been issued by ICMA in respect of each of these bonds. A snapshot showing comparative between these 4 types of bonds is as follows –  A study of these guidelines show that the SLBs are quite different from other sources of sustainable finance, being “general corporate funds” instead of “use of proceeds” funds. Therefore, the same has been discussed separately in later parts of this article. Further, the categories of projects in which proceeds of green bonds, social bonds, and sustainable bonds can be used have been listed below (the list is illustrative) –

A study of these guidelines show that the SLBs are quite different from other sources of sustainable finance, being “general corporate funds” instead of “use of proceeds” funds. Therefore, the same has been discussed separately in later parts of this article. Further, the categories of projects in which proceeds of green bonds, social bonds, and sustainable bonds can be used have been listed below (the list is illustrative) –

Similar standards have been issued by the Climate Bonds Standard Board that recognises only green bonds, Association of South East Asian Nations (ASEAN) having set different standards for green bonds, social bonds and sustainable bonds. Similar standards have also been issued by the European Union for green bonds and social bonds. It is noteworthy that all these standards are voluntary in nature and aligned with the ICMA Guidelines with some modifications of their own. The IFSC Regulations also recognise all the 4 types of bonds as ESG debt securities, issued as under any of the aforesaid guidelines.

Similar standards have been issued by the Climate Bonds Standard Board that recognises only green bonds, Association of South East Asian Nations (ASEAN) having set different standards for green bonds, social bonds and sustainable bonds. Similar standards have also been issued by the European Union for green bonds and social bonds. It is noteworthy that all these standards are voluntary in nature and aligned with the ICMA Guidelines with some modifications of their own. The IFSC Regulations also recognise all the 4 types of bonds as ESG debt securities, issued as under any of the aforesaid guidelines.

Sustainability-linked bonds (SLBs) – where lies the uniqueness?

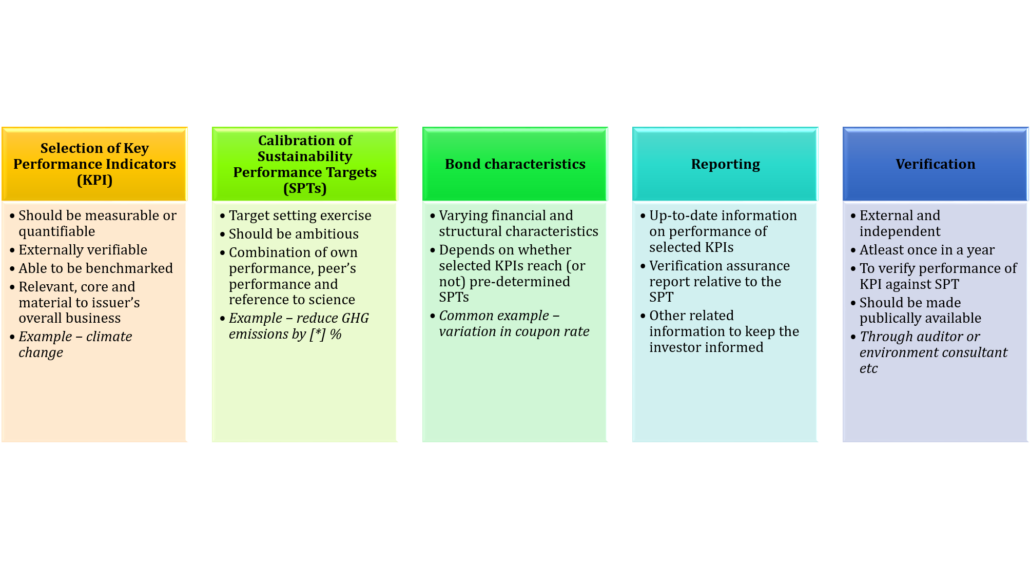

As discussed above, internationally there are four types of recognised ESG bonds, which are also proposed to be imbibed in the legal framework in India. While the first three being in the nature of “use-of-proceeds” bonds, the Sustainability-linked bonds or SLBs have distinguishing features. The SLBs rests on five key pillars, as follows –  The SLBs require companies to frame key performance indicators and Sustainability Performance Targets. To give an example, a company may frame its sustainability performance target to reduce its greenhouse gas (GHG) emissions by 20% compared to that of the year 2018 as baseline. In this case, the key performance indicators can be reduction of CO2 emissions, reduction of carbon footprint etc.

The SLBs require companies to frame key performance indicators and Sustainability Performance Targets. To give an example, a company may frame its sustainability performance target to reduce its greenhouse gas (GHG) emissions by 20% compared to that of the year 2018 as baseline. In this case, the key performance indicators can be reduction of CO2 emissions, reduction of carbon footprint etc.

Growth of ESG bonds

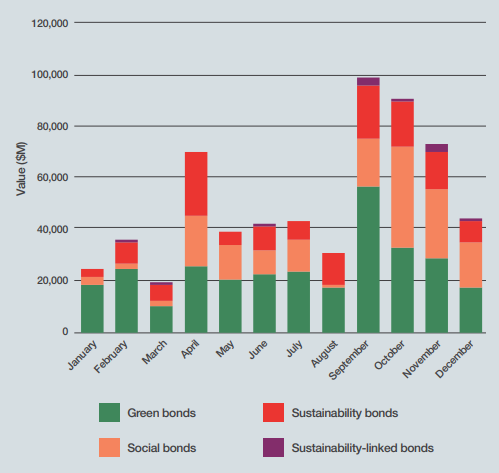

The Environmental Finance – Sustainable Bonds Insight, 2021 provides  data analytics in respect of the various types of sustainable bonds issued during the year 2020. The data shows high volume of green and social bonds issued during the year as compared to sustainable bonds and SLBs, which are relatively new and evolving concept. While the figures show a comparative between different types of ESG bonds issuance, it also provides an insight on the increasing volume of the ESG bonds being issued in the Covid era (an increase in the bonds issuance in the months of September, October and November).

data analytics in respect of the various types of sustainable bonds issued during the year 2020. The data shows high volume of green and social bonds issued during the year as compared to sustainable bonds and SLBs, which are relatively new and evolving concept. While the figures show a comparative between different types of ESG bonds issuance, it also provides an insight on the increasing volume of the ESG bonds being issued in the Covid era (an increase in the bonds issuance in the months of September, October and November).

Present position v/s potential growth

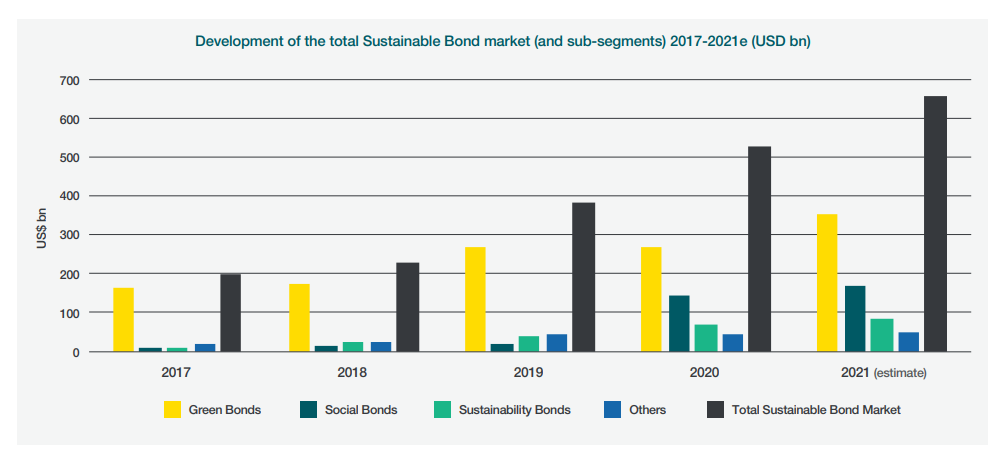

The Report shows a comparison of the development of sustainable bond market in the recent years and an estimate of what is expected in the current year 2021. It demonstrates clearly that the sustainable bond market is expected to rise further in the upcoming areas.

Growth of ESG bond market in India in recent times

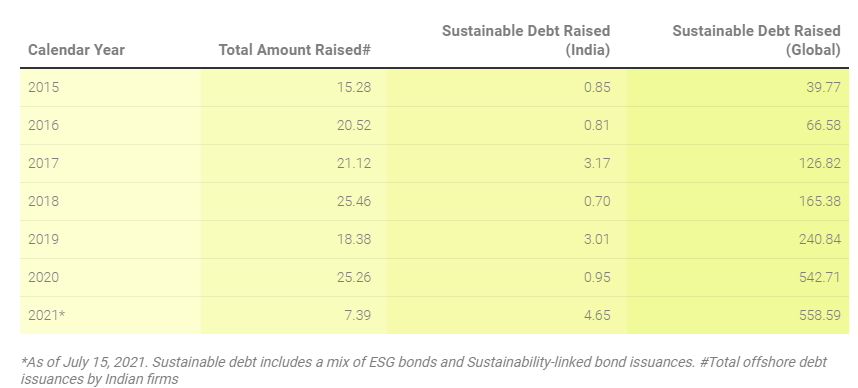

In India, the ESG bonds issuance is witnessing an evident upshot. However, the same has not found much investors’ interest in the country. Nevertheless, the Indian issuer companies have still been able to raise much funds from the issuance of ESG bonds from global investors. The below chart clearly demonstrates the increase in funds raised by way of issue of ESG bonds[4]. Some of the big Indian issuers of ESG focussed bonds include GreenCo, JSW Hydro Energy, Shriram Transport Finance Company, India Green Power Holdings, ReNew Power, Ultratech Cement Ltd etc. Sustainability linked bonds or SLBs, as discussed, is relatively new and innovative concept in the podium of ESG bonds in the world. India has made a remarkable entry in this field with Ultratech Cement Limited[5], issuing SLBs, thereby, being the first company in India and second in Asia to issue SLBs. The company has raised a total of 400 million USD equivalent to Rs. 2900 crores by way of issuance of such SLBs. The same has been listed in the Singapore Exchange Securities Trading Limited[6].

Some of the big Indian issuers of ESG focussed bonds include GreenCo, JSW Hydro Energy, Shriram Transport Finance Company, India Green Power Holdings, ReNew Power, Ultratech Cement Ltd etc. Sustainability linked bonds or SLBs, as discussed, is relatively new and innovative concept in the podium of ESG bonds in the world. India has made a remarkable entry in this field with Ultratech Cement Limited[5], issuing SLBs, thereby, being the first company in India and second in Asia to issue SLBs. The company has raised a total of 400 million USD equivalent to Rs. 2900 crores by way of issuance of such SLBs. The same has been listed in the Singapore Exchange Securities Trading Limited[6].

ESG Bonds – Motivations for the Issuer and Investor

Issuer’s perspective

- Cost advantage due to yield reduction – The yield payment in respect of ESG bonds are relatively lower than that of other conventional bonds[7]. A reason for such lower yields is increase in demand with limited supply of such bonds. An example may be the issuance of green bonds by Italian Government[8], which was oversubscribed by 10 times.

- Role as corporate citizens – The ESG bonds contribute to demonstrating the role of issuers as responsible corporate citizens, spending the proceeds generally on sourcing of renewable energy, pollution reduction, climate change initiatives.

- Attracts responsible investors – The ESG bonds align with social development goals (SDGs) and principles of responsible investing (PRI) thereby attracting socially responsible investors whose investment decisions are more of impact-oriented than yield-based.

- Seen as ethical companies – The companies issuing ESG bonds are looked upon as ethical companies by the stakeholders thereby helping in demonstrating a good corporate image.

Some additional advantages motivation lies for issuance of SLBs –

- Flexibility of designing structure – The main feature of SLB is that it gives a flexibility to the issuers to design their issued bonds in their own way.

- Flexibility with regard to use of proceeds – Another flexibility is with regard to the use of issue proceeds which need not necessarily be towards promoting green projects, social projects or the like. Therefore, the companies are free to use the proceeds for their operational activities without giving a second thought on whether the same qualifies as a green project or social project.

- Motivation for fulfilment of ESG targets – The SLBs put a “step-up” on the coupon rate of the bonds in case the issuer misses its ESG target. Therefore, it gives an additional economic interest for the issuers to fulfil their ESG targets.

Investor’s perspective

It is said that behind the investors’ growing interest in ESG bonds lies two reasons – (i) values-driven and (ii) value-driven. While the investors, as part of their responsibility towards the society and environment, consider ESG in their investment analysis, that is not the only reason investors are investing in ESG bonds. Another reason that drives the investors in supporting ESG concerns and investing in ESG bonds is the long term perspective and the expectation of deriving great value from their investment portfolio. The investors believe that a company that invests in the ESG concerns and addresses the ESG issues properly, are more likely to earn profits in the long term. Therefore, while the investors are demonstrating their values and responsible behaviour by choosing ESG focussed bonds, they are also booking adequate profits for themselves in the long run. Now, with the new SLBs coming into picture, the investors are likely to get more benefits out of their investment in the ESG bonds in the form of SLBs. The terms of SLBs are designed as such that the investors get a “step-up” or hike in the coupon rates as and when the issuer misses a pre-defined target (identified as SPTs).

Sustainability-linked bonds (SLBs) – investors always at the winning end

The concept of SLBs comes with a very interesting feature – where investor benefits on the issuer missing its ESG target. Since the investor is making profits on the cost of compromise in ESG responsibilities by issuer, therefore it is controversial that how can an investor show his ESG responsibility at a time when it is making profits on failure to reach ESG targets? However, that is not the case. Another viewpoint towards the case maybe that the investors are motivating their issuers in reaching their ESG targets, and where they fail to do, the investors cast a penalty on the issuer. Whatever the case may be, in both the scenarios, investors are the one who are at the winning side. A recent interesting case of issue of ESG bonds in the form of SLBs may be discussed here. A Japanese firm, Nomura Research Institute Ltd, has issued ESG bonds with the “variable bond characteristics” as below –

- Where the issuer reaches target – early redemption of debts

- Where the issuer misses target – extra yield to investors

In both the cases, the investors will be benefitted. In the first case, the investor will earn return on their investments early, so they will be in possession of their funds again at a shorter span of time. On the contrary, in the second case, though the funds of the investors will be locked for a longer time, the same will bring them higher yield. So, the investors, are very well in a win-win position in all probable cases.

Requirements for listing of ESG debt securities in India

The Ministry of Finance has notified the IFSCA (Issuance and Listing of Securities) Regulations, 2021 or the IFSC Regulations. It is a unified framework for various kinds of securities and is framed with the main intent of consolidating the regulatory requirements in order to access the global capital with more ease and less complexity. The concept of ESG bonds have been specifically recognized and captured under Chapter X of the said Regulations. However, it has to be noted that these IFSC regulations are applicable only for the IFSC-listed companies. No specific framework is provided for ESG bonds for other domestic companies in India outside the scope of IFSC Regulations. The same can still be taken as a guidance for other domestic issuances. While the requirements for issuance and listing of ESG bonds are given in Chapter X, the same is in addition to those under Chapter IX of the Regulations. Please note that, Chapter IX lays down the requirements for issuance and listing of debt securities. By “debt securities” is meant the non-convertible debt securities, as is clear from the definition of “debt securities” under Regulation 2(e) of the Regulations. The additional requirements for the ESG bonds are as follows –

- An independent external review is required to be obtained in order to satisfy that the issue of ESG bonds are in line with internationally recognised standards set for ESG bonds, the principles of ICMA being one of them.

- Review may be in the form of verification, certification, second party opinion, or scoring/rating.

- The most important requirement under ESG investing is disclosure and reporting The same is being discussed here under a separate head.

- Impact report is important in order to measure the actual impact of the projects in which the ESG funds have been spent.

Disclosure and reporting

As also envisaged by the Sustainability-linked bond principles of ICMA, disclosure is a main pillar of ESG investing. The IFSCA Regulations also focusses on the disclosure requirements. Under the IFSCA Regulations, the following disclosures are required to be made –

- The objectives of the issue of debt securities

- The process followed for selection and evaluation of projects

- The system employed for tracking deployment of issue proceeds

- Intended vs actual utilisation of issue proceeds

- Specific projects to which the issue proceeds have been disbursed/ allocated.

Further, in case of SLBs, the reporting guidance as under the ICMA Guidelines shall apply.

Applicability to other listed entities not covered under IFSC Regulations

The IFSC Regulations are not applicable to companies other than those listed under the jurisdiction of IFSC Authority. However, the IFSC Regulations are in alignment with other internationally-recognised principles in this regard. We have taken examples of some Indian companies like JSW Steel, Ultratech Cement, Adani Energy, Shriram Transport Finance Co. Ltd, Ultratech Cement etc which provides disclosures and follow the requirements of external review in line with the ICMA Guidelines and IFSC Regulations, which re-iterate requirements of ICMA and other internationally recognised guidelines.

Conclusion

As the world has approached the twentieth century, a shift has become apparent towards more grounded aspects of life – rather than just profit earning. Earlier, it was believed that the corporate world has only one motive – the profit earning motive. However, the focus has now been modified to include various other aspects as well. With instruments like ESG bonds, the efforts are being made to include sustainability in the economy, so that both can progress side-by-side. As the statistics above suggest, India is nowhere lagging behind in the ESG investing. This may be seen as one of the probable cause that IFSCA has included ESG bonds as a specified security in its Listing Regulations. The IFSCA Regulations do not introduce the ESG bonds in India for the first time, rather it just seeks to regulate issuance of the same by means of express regulations in this regard.

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

[1] Our article on the same can be read here [2] Read our articles on the same here [3] Green Bond Principles Social Bond Principles Sustainability Bond Guidelines Sustainability-linked Bond Principles [4] https://www.refinitiv.com/ [5] See Page 4 of the Annual Report here [6] Listing confirmation can be accessed here [7] Asian Development Outlook – 2021 [8] Read this here Our other related resources –

- https://vinodkothari.com/2014/03/prospects-green-bonds-rise/

- https://vinodkothari.com/2017/05/guidelines-for-issuance-of-green-bonds/

- https://vinodkothari.com/wp-content/uploads/2017/03/India_plans_to_tap_Green_Bonds-1.pdf

- http://vinodkothari.com/2020/08/cartload-of-details-in-brsr-a-challenge-ahead-for-elaborate-reporting/

- http://vinodkothari.com/2020/08/brr-in-process-to-become-a-fully-loaded-electronic-form/

- http://vinodkothari.com/2021/03/esg-concerns-on-corporate-governance-in-india/

- https://vinodkothari.com/2021/07/corporate-responsibility-towards-climate-change-uk-leads-regulatory-measures/