SEBI’s move to strengthen transparency

Pammy Jaiswal| Partner| Vinod Kothari and Company

corplaw@vinodkothari.com

Background

It has always been interesting to see how SEBI takes various steps to increase the level of transparency for augmenting the level of corporate governance in a listed company. Recently, SEBI notified the changes under the SEBI Listing Regulations on 6th May, 2021, which contained several significant changes to enhance corporate governance (hereinafter referred to as CG), like specifying the scope of the risk management committee or intimation of recordings and transcripts for analyst meetings[1]. Following the said notification, SEBI, on 31st May, 2021, came up with a circular[2] dealing with enhanced disclosures under CG report to be submitted to the stock exchange under Regulation 27 (2) of the SEBI Listing Regulations by adding Annexure IV to the existing formats.

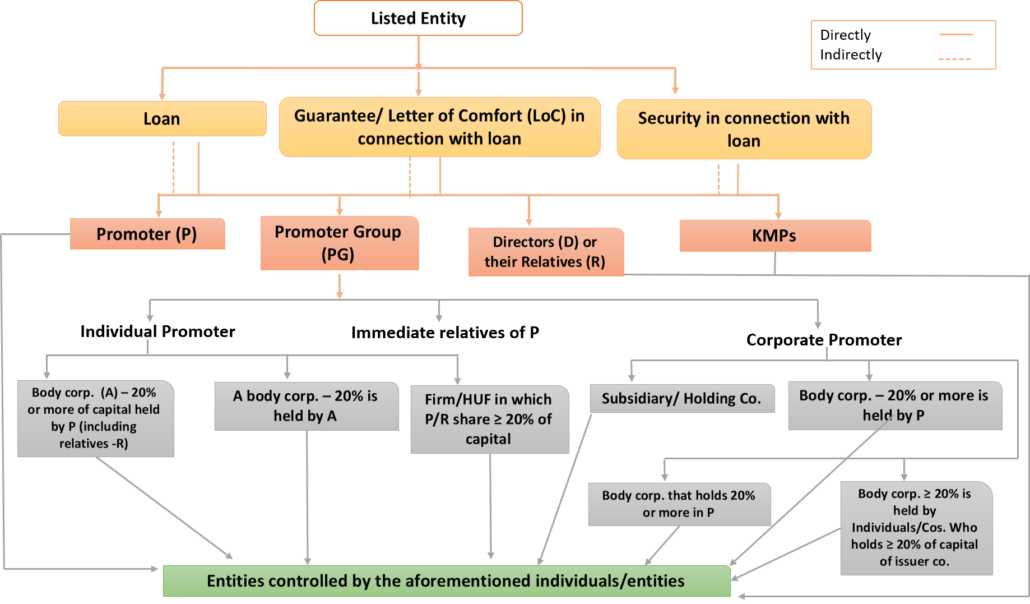

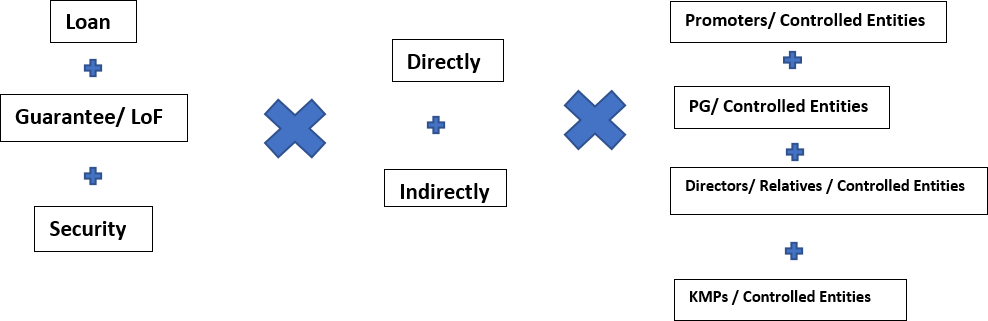

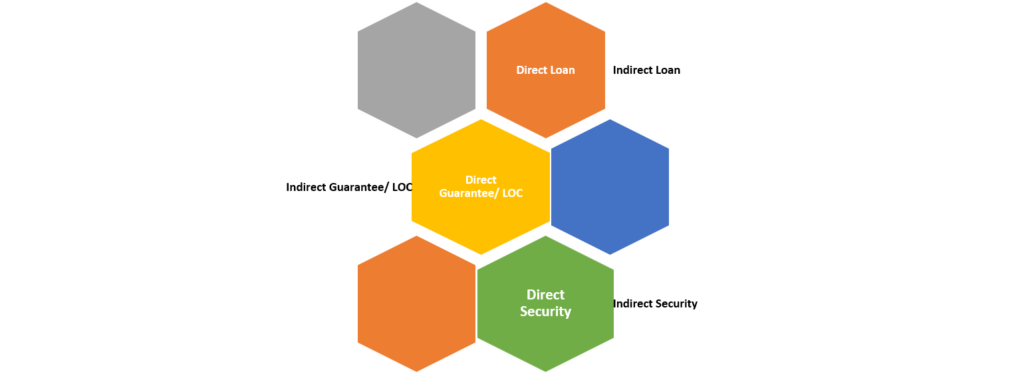

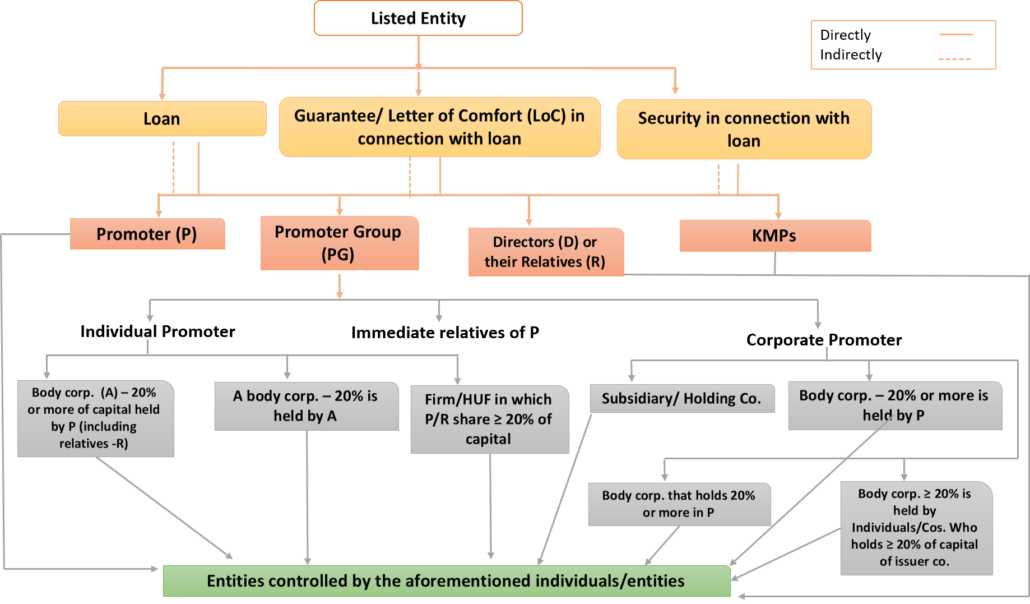

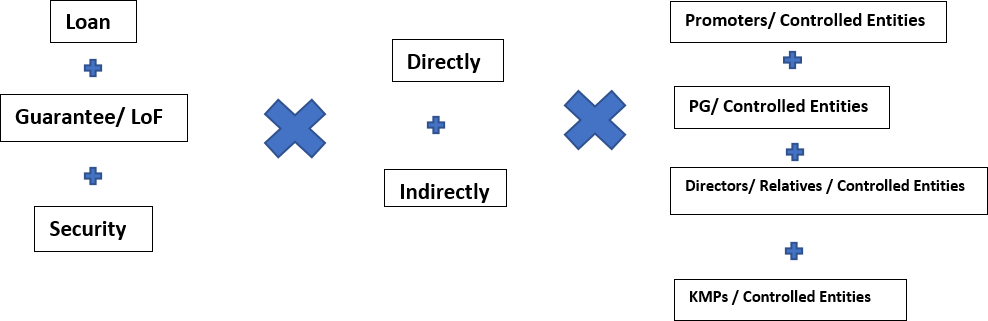

The new requirement coming out from this circular is extremely significant since it aims at revealing almost all types of financial transactions (to say almost 24 types of permutations) which the company has entered into with its close connections and which may have the highest chances of involving any conflict of interest.

In this write up we have tried to critically discuss and examine the requirements emanating from the said circular.

Scope and time of applicability

- Annexure IV which contains the new disclosures will have to be filed by the listed entities which have listed their specified securities.

- The same is to be filed on a half yearly basis starting from the first half year 2021-2022, i.e., for the half year ended 30th September, 2021.

- While Regulation 27 (2) only talks about quarterly filings within 21 days from the end of the quarter, therefore, there is no explicit time period within which this new annexure will have to be filed with the exchange from the end of the half year.

- The disclosure will not only cover the financial transactions undertaken during the half year ended 30th September, 2021, but also cover all outstanding financial contracts which the entity has entered any time in the past.

Financial Permutations covered

Critical Aspects

While the format under the new annexure may seem to be simple in terms of presentation, however, it has various aspects related to it which needs to be discussed. Owing to the extent of disclosure required, listed companies will have to consider and understand every part under the format before feeding the details. Some points which need to be discussed include the actionable, the meaning of the entities controlled by the promoters, the meaning of direct and indirect accommodation, distinction between a LoC and a co-borrowing arrangement, and last but not the least the ‘affirmation’ on the economic interest of the company.

Actionable on the part of the listed entity

- Identify the entities

- This identification process may reveal that companies have a large number of interested entities falling under these 4 types of entities.

- Identify transactions

- After having prepared the list of entities that are included under the 4 categories, the next step will be to identify the financial transactions which include loan, guarantee or security in connection with the loan to the entities under the list.

- Identify outstanding balances

- Once the entities and the transactions entered into with them have been identified, listed companies will have to identify the outstanding balance as on the date of the report.

- Since the transactions involve providing guarantee or security as well, there can be a situation that companies will have to look for both on and off-balance sheet items to come to the actual outstanding balance for the purpose of reporting.

Entities controlled by Promoters/ PG

While the meaning of the term promoter and PG is well defined under SEBI ICDR Regulations, the question that may arise is which entities will be considered to be controlled by the promoters or the PG. The meaning of control here has to be taken form SEBI Takeover Regulations, which defines it as a right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or PAC, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

As per the definition of PG, entities which have a substantial stake (20%) held by the promoters or by common group pf shareholders are covered under the said definition of PG. However, if one has to identify the entities which are controlled by PG, it may cover even larger number of companies.

Ambit for covering directors and controlled entities for the purpose of disclosure

The ambit for making disclosures is very wide under Annexure IV. Therefore, it becomes imperative to pinpoint the entities related to the directors of the listed entity that are covered for the purpose of disclosure under the said Annexure. The same is represented below:

SEBI Listing Regulations refer to the definition of ‘relatives’ provided under Section 2(77) of the Companies Act, 2013.

In a situation where the directors do not have any direct control over the entity to whom the listed entity has extended the financial accommodation, but the control is with the relatives of such directors alone, the same should be enough to make the financial transaction be covered for the purpose of the disclosure under Annexure IV.

Leaving such transactions outside the disclosure will frustrate the whole intent of the said requirement since, it is very unlikely that a financial accommodation will be offered to an entity controlled by the director’s relative without any nexus or benefit to the directors altogether. There exists a possibility of the directors or their relatives indirectly gaining benefit or influencing transactions undertaken. Therefore, such transactions will also be required to be disclosed, given the intent of the disclosures.

Nature of book debt covered

As per the format of annexure IV, any other form of debt advanced is also required to be included for the purpose of the said disclosure. Looking at the intent of the disclosure, any book debt that is present in the books like merely selling of goods on credit should not be made part of this disclosure. In our view, only the book debt which has the color of an advance and which is in the nature to serve as a financial accommodation (for example selling of goods on credit for an unreasonable period of time or under unreasonable terms of understanding) is required to be disclosed.

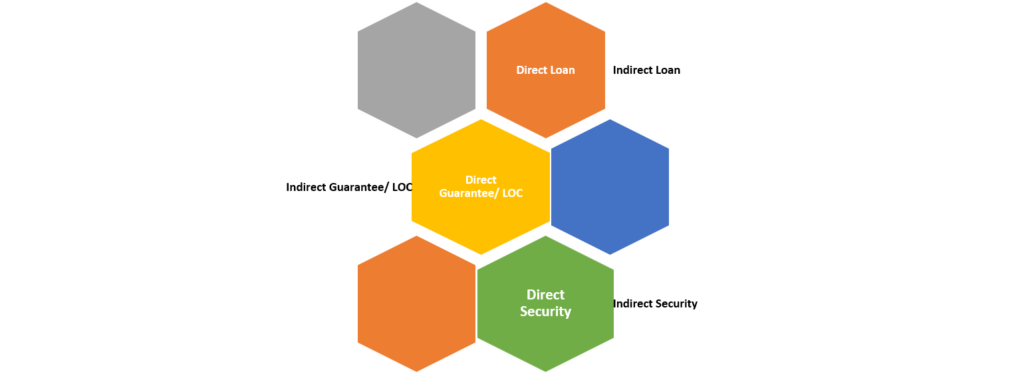

Meaning of direct and indirect financial accommodation

As per the requirement, one of the biggest challenges for the listed entities will be to identify the connecting links or conduits through which these interested entities have been benefitted. Such transactions are generally camouflaged and put through layers to create smokescreen. These entities which are used to route the benefits to the interested parties are merely acting as a stopover. Therefore, it is extremely important to identify such transactions where there is a clear and direct nexus between flow of money from the listed entity to the intermediary and ultimately to the interested party. For instance, if a company raises preference share capital with the reason that it needs it for its own business operations, however, uses the funds so raised to on lend to another entity.

Difference between LoC and co-borrowing arrangement

The new requirement includes an LoC to be disclosed in the half yearly report. One needs to understand that providing a guarantee or giving an LoC by the listed company is nothing but to agree and provide financial accommodation to the borrower. It is significant to note that companies cannot disguise the LoC into a co-borrowing arrangement and therefore, avoid the disclosures to be made under Annexure IV.

Under a co-borrowing arrangement, if the listed entity is the co-borrower, then it should be getting the benefit or be a beneficiary of the loan being taken together with the interested party. Acting merely as a signatory to the co-borrowing agreement will make it no different from being considered as a guarantee or providing an LoC.

Affirmation for being in economic interest of listed company

One of most crucial and difficult part of the disclosure is the part requiring affirmation that loan (or other form of debt), guarantee / comfort letter (by whatever name called) or security provided in connection with any loan or any other form of debt is in the economic interest of the Company.

Some pointed issues under this are:

- Who will give this affirmation?

The report on CG as per the SEBI circular (annex I, annex II and annex III) are required to be signed either by the compliance officer or the company secretary or the MD or CEO or CFO. However, Annex IV (which is the new requirement) requires the affirmation to be signed either by the CEO or CFO.

Further, the practicing professionals who provide their report on compliance with CG requirements and which has to be annexed with the CG report cannot be expected to dive into this question and scrutinize the reasoning provided by the company.

- What will be the basis of this affirmation?

Further, it is imperative to note that the entities covered under this disclosure are mainly upstream entities which are either promoters or PG or controlled entities by them. Therefore, it becomes all the more difficult to justify the act of financial accommodation to be in the economic interest of the company. If it were a case of downstream accommodation (like subsidiaries, associates, joint ventures, etc.), it would have been much easier to form a basis to affirm that the same is serving the economic interest of the company since any profits in them will reflect in the consolidated financial results of the listed entity, however, the same reason cannot be for an upstream entity.

Also, merely earning an interest on loan granted or a commission on a guarantee or security or even on lending cannot act as a justification here since the earning interest or commission cannot be said to serve the economic interest of a company which is not even in the business of lending. Having said that listed NBFCs may have an upper hand in terms of providing justifications in this case.

• Whether the same needs to be reviewed by the Audit Committee as well?

Regulation 18 of the Listing Regulations read with Part C of Schedule II as well as section 177 of the Companies Act requires that the audit committee needs to scrutinize the inter-corporate loans and investments. While the same is required and covers loans, there does not seem to be any reason to exclude provision of security or extending guarantee since it is given in connection with loan.

The management needs to show the audit committee how does the transactions covered for the purpose of the said disclosure are in the economic interest of the Company.

Comparison between section 185 of the Companies Act, 2013 and Annexure IV

Section 185 of the Companies Act, 2013 (Act, 2013) deals with the provisions to provide loan and related services to directors or the interested entities. While section 185 is more from an angle of regulated provisions, the extent of casting restrictions on providing loan to directors or its connected parties is divided into two parts. One is completely prohibited (to directors and to firms where the director or his relative is partner) and the other one is restrictive, which means, financial accommodation can be given subject to prior approval of the shareholders.

The new disclosure requirement has several similarities with section 185 which are given below:

| Basis of comparison |

Section 185 |

Annex IV of SEBI Circular dated 31st May, 2021 |

| Services covered |

Provision of loan, provision of guarantee or Letter of Comfort and providing security in connection with the loan |

Similar |

| Mode |

Direct as well as indirect |

Similar |

| Entities covered |

· director of company, or its holding company or any partner or relative of any such director;

· any firm in which any such director or relative is a partner;

o The aforesaid two bullets are completely prohibited

· any private company of which any such director is a director or member;

· any body corporate at a general meeting of which not less than twenty-five per cent. of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together;

· any body corporate, the Board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the Board, or of any director or directors, of the lending company |

Refer to figure 1 above. |

While the format requires the financial accommodation made, if any, to the directors or their relatives or entities controlled by them, it will surely not include or have any disclosure relating to financing of directors since it is completely prohibited under section 185 of the Act, 2013.

Exclusions

The aforementioned disclosure shall exclude the reporting of any loan (or other form of debt), guarantee / comfort letter (by whatever name called) or security provided in connection with any loan or any other form of debt:

- by a government company to/for the Government or government company

- by the listed entity to/for its subsidiary [and joint-venture company whose accounts are consolidated with the listed entity.

- by a banking company or an insurance company; and

- by the listed entity to its employees or directors as a part of the service conditions.

While one of the exclusions is for a banking company, it is imperative note the following:

SEBI (LODR) Regulation does not define the term “banking company” but the term “banks”.

Section 5(c) of the Banking Regulation Act, 1949 (‘BR Act’) defines banking company as: “banking company” means any company which transacts the business of banking in India;”

Further, section 5(d) of the BR Act defines company as: “company” means any company as defined in section 3 of the Companies Act, 1956 (1 of 1956) and includes a foreign company within the meaning of section 591 of that Act;”

Public sector banks like State Bank of India, being a body corporate, do not fall under the aforesaid definition of banking company. However, it is engaged in the business of banking and should therefore, be excluded.

Accordingly, clarity on the same is still awaited from SEBI.

Concluding remarks

As stated in the beginning, SEBI’s move to increase the standards for CG has been extremely interesting. Further, considering the fact that listed companies have a limited amount of time to arrange for huge amount of information, this circular needs the immediate attention of the listed entities.

[1] Our write up on the same can be viewed here

[2] To view the circular, click here

Our other articles on relevant topic can be read here – http://vinodkothari.com/2019/07/sebi-amends-format-of-compliance-report-on-corporate-governance/