Exploring Core Financial Services Solution for NBFCs

Applicability, Features, Modules & Challenges

– Subhojit Shome, Executive and Parth Ved, Executive | finserv@vinodkothari.com

Background

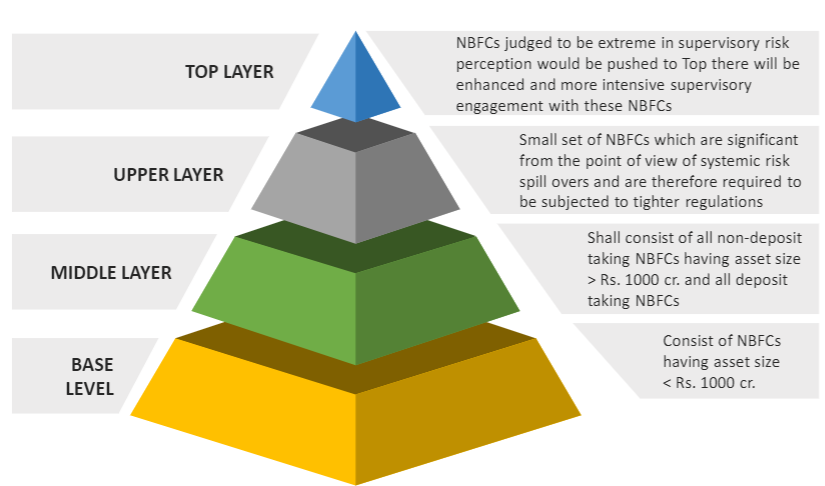

As a part of the overhaul for the NBFC Sector, the Reserve Bank of India (‘RBI’) had, on October 22, 2021, introduced the Scale Based Regulations (SBR): ‘A Revised Regulatory Framework for NBFCs’. Upon application of SBR, NBFCs will now be divided into four major categories starting from base layer, followed by middle and upper layers and a top layer. The categories can be briefly summarised through the below chart (visit https://vinodkothari.com/sbr/ to read our write-ups on SBR and related topics).

Through SBR, various governance guidelines have been newly introduced while the existing guidelines have been modified to keep up with the current market practices. One of the requirements is the introduction of Core Financial Services Solution (CFSS) for NBFCs vide RBI circular dated February 23, 2022 (‘CFSS Circular’).

In this article, we discuss the applicability of CFSS on NBFCs, explore the current core banking systems of banks, highlight the necessary modules which can be adopted by NBFCs along with the issues that may arise during implementation.

Read more →