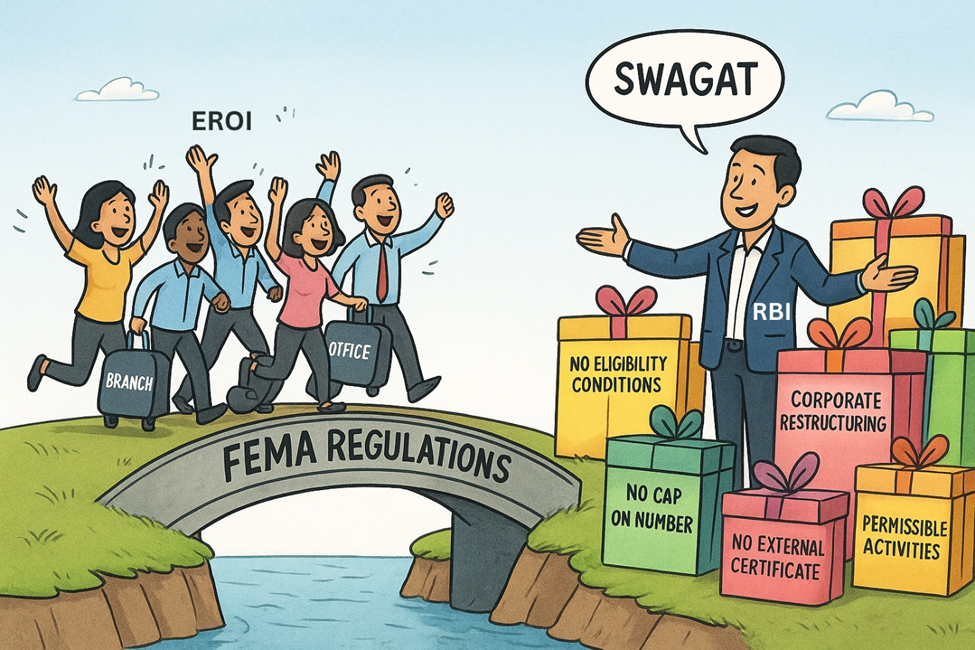

SWAGAT to foreign branches or offices in India: RBI proposes draft regulations on such establishments

– Team Corplaw | Corplaw@vinodkothari.com

As a part of its efforts to rationalise the regulations for establishment of a place of business in India by overseas entities[1], RBI has issued Draft Foreign Exchange Management (Establishment in India of a branch or office) Regulations, 2025. The proposals primarily aim to enable delegation of more powers to AD banks and reduction of compliance burden, thereby further enhancing the ease of doing business in India.

As against the extant Foreign Exchange Management (Establishment in India of a branch office or a liaison office or a project office or any other place of business) Regulations, 2016, as updated in Master Direction – Establishment of Branch Office (BO)/ Liaison Office (LO)/ Project Office (PO) or any other place of business in India by foreign entities, the classification of foreign establishments have been limited to (a) branch and (b) office.

Highlights

- No eligibility conditions based on financial parameters: Conditions related to profit making track record and net worth for a foreign entity to set up establishments in India proposed to be done away with.

- Permissible activities: List of permissible activities have been omitted under the draft Regulations, although explicit restriction retained on:

- Activities prohibited or under approval route as per FDI policy (except with prior approval of the Government)

- Activities related to legal consultancy[2]

- Any commercial activity by an “office” other than Project Office

- No cap on number of establishments: Establishing more than a branch in a zone (i.e., north, west, east, south) does not require additional justification and prior approval of RBI.

- Existing Regulations require the applicant to justify the need for additional office/s and obtain prior approval of RBI, if the number of offices exceeds 4 (i.e. one BO / LO in each zone viz; East, West, North and South).

- No limit on tenure: No ceiling on the tenure of the establishments.

- Currently, 3 years for Liaison office + 2 years extension

- Closure at the end of tenure or conversion into JV/ WOS [Reg 4(d)(III) of extant regulations]

- Prior permission of sectoral regulator: Prior permission of the concerned financial sector regulator for establishing / closing a branch/ office in India by all financial sector regulated entities

- Existing Regulations specify only banking and insurance companies.

- Special conditions for establishments in Special Economic Zones and NPOs omitted: obtain permission under respective Acts

- Relaxation for corporate restructuring: If acquisition/merger/corporate restructuring of the EROI causes change in its ownership and/or control leading the EROI to fall within the list of restrictive items, it needs to make an application to the designated bank.

- The existing regulations required fresh application by closing the existing entity for all cases of restructuring.

- Consequences of not submitting AAC:

- within 6 months of the end of the financial year – no transactions will be allowed in its bank accounts after expiry of thirty calendar days from the completion of such period.

- for a consecutive period of 3 years – the designated AD Bank is empowered to send a closure notice to these establishments. In case no reply is received from these establishments, the Bank is empowered to close them by reporting the information on closure to RBI for cancellation of UINs.

- RBI empowered to order closure: in consultation with the Central Government, wherever considered necessary.

[1] See Para 15 of Part II of Statement on Developmental and Regulatory Policies dated 1st October, 2025

[2] Hon’ble Supreme Court vide its interim orders dated July 4, 2012 and September 14, 2015, passed in the case of the Bar Council of India vs A.K. Balaji & Ors., has directed RBI not to grant any permission to any foreign law firm, on or after the date of the said interim order, for opening of LO in India.

Read more

Leave a Reply

Want to join the discussion?Feel free to contribute!