Investment valuation norms for banks: RBI aligns rules with global accounting standards

– Vinod Kothari | vinod@vinodkothari.com

Vide a 12th Sept notification, the RBI has brought in Master Directions for Classification, Valuation and Operation of Investment Portfolio of Commercial Banks. The new norms bring the accounting and valuation of investments by banks closer to global accounting standards.

While the apparent focus of these Directions would have been valuation of investment portfolios, however, the Directions may also impact investment policies and investment operations of banks as well.

Investments in corporate bonds

- Like all investments, the investment will be policy-driven, that is, based on the internal board-approved policy of the bank. The policy is supposed to put an internal sub-limit for investment in corporate bonds [5(d)]. Additionally, there shall be proper risk management systems for making investment in corporate bonds which shall include entry-level minimum credit ratings/ quality standards and industry-wise, maturity-wise, duration-wise, issuer-wise, etc., limits to mitigate the adverse impact of concentration and liquidity risk. [5(e)]

- An investment in corporate bonds should undergo the same credit risk assessment as in case of loans [5(h)], reliance on credit ratings should not be at the cost of internal credit assessment, and if the issuer is not an existing borrower, the analysis should be more rigorous. [5(j)]

- Investments in corporate bonds will most likely fall under the AFS category. Therefore, they will have to be fair valued, at least on a quarterly basis.

- There will, clearly, be an impetus for listed corporate bonds. Para 30 (a) provides that banks shall invest in listed non-SLR securities, except where there is a specific carve out for investment in unlisted non-SLR securities. Para 30 (b) puts a limit of 10% of total value of non-SLR securities for unlisted investments. Further, investments in units of mutual funds or AIFs will follow a see-through approach: that is, if the investment portfolio of these funds consists of more than 10% investment in unlisted securities, the investment in the fund will also be taken as unlisted investment.

- Notably, investment in security receipts and securitisation notes is not treated as “investment in unlisted non-SLR securities” – see notes below.

- Further, para 30 (e) prohibits investment in unrated bonds, except in case of the infrastructure sector.

Investments in securitised notes

- For the purpose of definition, securitisation notes are not included in the definition of “corporate bonds and debentures”, as the definition given in para 4(a)(v) excludes (a) debt securities issued by Central or State governments, (b) security receipts, and (c) securitisation notes.

- The term “securitisation notes” has been defined to include (a) securitisation notes issued by an SPV under a securitisation transaction in terms of RBI Securitisation Directions, (b) securitised debt instruments issued in terms of SEBI (Issue and Listing of Securitised Debt Instruments) Regulations.

- Banks may invest in asset-backed securities and mortgage backed securities which have ratings of at least investment grade. [30(b)(j)]. However, the RBI says there will be “close monitoring of exposures to ABS on a bank specific basis based on monthly reports submitted to the DoS, RBI under the Supervisory Reporting System”. Is this a matter of concern – the question does not have a clear answer.

FVTPL classification

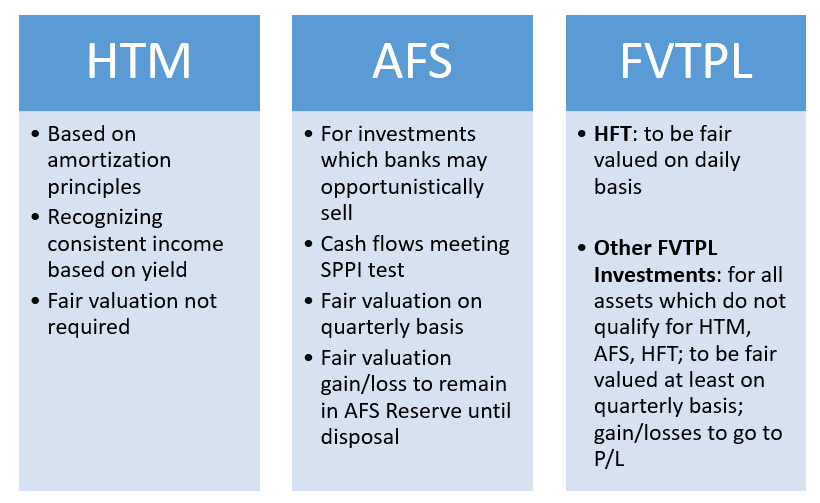

The new feature added by the Directions is the FVTPL category for valuation, which entities adopting IndAS have already been familiar with, but banks have so far followed only what is known as “held for trade”. The classification norms introduced by the Directions are still at some variance from those under IndAS, but terminology apart, we are moving quite close to fair value accounting. Banks will, for the first time, create an “AFS Reserve” which is aligned with the “other comprehensive income” under IndAS.

There will be following classes of investments:

Unrealised gains on AFS assets may form part of CET

As an important difference from the current approach for NBFCs which have majorly moved to IndAS, the RBI permits unrealised gains on AFS investments to be captured as a part of Common equity tier (CET). The only exception for this is those investments which do not have transparent valuations, called Level 3 investments.

This is a major departure from the current rules applicable to NBFCs. In case of NBFCs, the Circular of March 13 2020 clearly states that any gains in OCI will be excluded for the purpose of capital adequacy, and simultaneously, even for the purpose of risk-weighting the assets, the value of assets will exclude the valuation gains.

Further, upon disposition of an investment which is valued under OCI, the accumulated value of the oCI gains are taken (a) in case of equity shares, directly to shareholders’ equity without routing the same through Profit and Loss a/c; and (b) in case of other assets, released into Profit and loss a/c. In the Master Directions, para 13 (e) provides a similar treatment: that the valuation gains sitting the AFS Reserve shall be transferred to Profit and Loss a/c upon disposal of the investment, except in case of equity shares.

Valuation in case of unlisted Corporate bonds

Para 26 lays elaborate rules of valuation for unlisted corporate bonds. Following are the major requirements:

- Minimum mark up over yield curve of Govt securities will be 50 bps

- The markup will be based on ratings of rating agencies, and will not be less than the yield as reflected in the market values of listed bonds of similar maturities, subject, of course, to the inherent credit risk.

- Where the debentures/ bonds are quoted and there have been transactions within 15 days prior to the valuation date, the value adopted shall not be higher than the rate at which the transaction has been recorded on the Exchanges/trading platforms/reporting platforms authorized by RBI/ SEBI.

- For zero coupon bonds, in the absence of market value, the ZCBs shall be marked to market with reference to the present value of the ZCB.

Level 1, 2 and 3 valuation hierarchy

The notification lays down a valuation hierarchy, which is quite similar to that mentioned in the Ind AS 113. The hierarchy identifies three levels – 1, 2 and 3, and the classification depends on the quality of inputs available for valuation.

- “Level 1” in the context of inputs used for valuation of a financial instrument are those inputs which are quoted prices (unadjusted) in active markets for identical instruments that the bank can access at the measurement date. In reference to the valuation of an instrument, it refers to a valuation that is substantively based on Level 1 inputs and does not have any significant Level 2 or Level 3 inputs.

- “Level 2” in the context of inputs used for valuation of a financial instrument are those inputs, other than quoted prices included within Level 1, that are observable for the asset or liability, either directly or indirectly. In reference to the valuation of an instrument, it refers to a valuation that is based on Level 1 and Level 2 inputs and does not have any significant Level 3 inputs.

- “Level 3” in the context of inputs used for valuation of a financial instrument are unobservable inputs. In reference to the valuation of an instrument, it refers to a valuation in which there is a significant Level 3 input.

Therefore, the hierarchy indicates the reliability of the inputs used in the valuation. While level 1 is treated as the most reliable of the three, since, it uses only quoted prices in active markets for identical instruments, level 3 is the least reliable, as it uses unobservable inputs.

The banks are required to classify their investments based on the different levels on their balance sheet.

Leave a Reply

Want to join the discussion?Feel free to contribute!