GoAir Insolvency: Lessors’ rights gone in thin air?

– Financial Services Division, finserv@vinodkothari.com

A Special Bench of NCLT, New Delhi admitted the insolvency of Go Airlines (India) Ltd, popularly known as GoAir, on the 10th May 2023. The insolvency was admitted on an application of the company itself, on the ground of a self-admitted default of Rs. 11.03 crores towards interest to financial creditors, out of a pile of debt, that is, Rs. 2660 cr towards aircraft lessors and Rs. 1202 cr towards its vendors. The application was admitted in the face of strong opposition by the financial creditors and the lessors of aircrafts taken on lease by the company.

Subsequently, on an appeal before the NCLAT, the appellate forum affirmed the order of the NCLT, rejecting the contention that the filing of the insolvency application was malicious. The matter may still be taken up to higher or other forums, but in the meantime, there are question marks on India as a favoured jurisdiction for aircraft leasing. Aircraft lessors need certainty as to the exercise of their rights over the leased aircraft in the event of a lessee default, and the Cape Town Convention (CTC), signed under the auspices of UNIDROIT way back in 2021, is a set of minimum assurances that the countries signing that convention have provided to aircraft lessors. The question is, India having actually been a signatory to the Convention, is it okay to have stayed the rights of the lessors by way of a moratorium during the entire period of insolvency resolution?

The nuances of the insolvency law contained in the GoAir matter have been discussed in another article.

The relevance of aircraft leasing to India’s aviation industry

India is a large aviation market in the world, and is growing faster than several other jurisdictions. In fact, India has become the third largest domestic aviation market in the world and is expected to overtake the UK to become the third largest air passenger market by 2024.

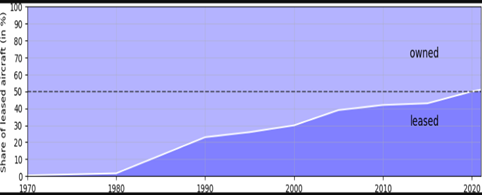

Globally, leasing-in of aircrafts by aviation companies is quite common, and as per estimates, nearly half of the commercial aircrafts that fly the world’ skies are leased. This proportion has continued to grow over time.

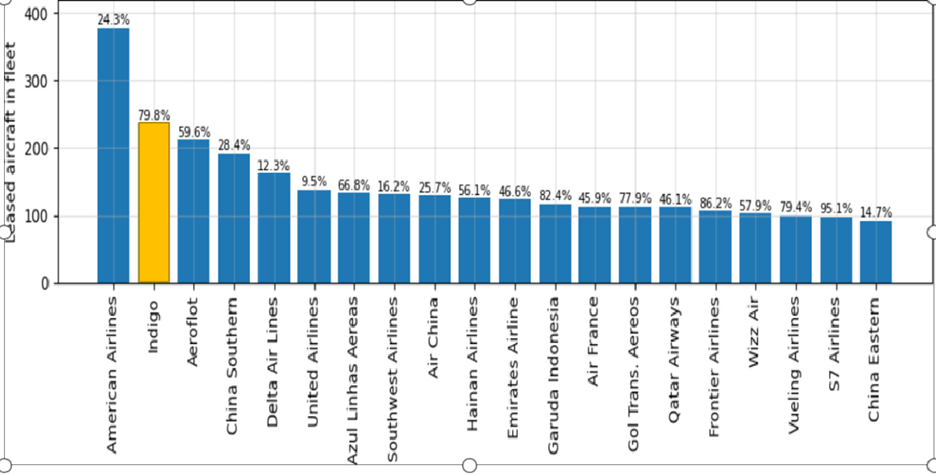

The proportion of leased aircraft is even higher in case of some of the aviation companies in India. For example, a study shows that about 80% of the aircrafts used by Indigo are taken on lease:

This underscores the significance of leasing to India’s aviation industry. It is a strong vindication of this that India has been trying to bring the domicile of registration of aircrafts from popular international places such as Ireland, over to Gift City in Gujarat, and a complete project of the Ministry of Civil Aviation, called Project Raftaar[1], was intended towards that.

In view of the clear policy objective to promote international leasing from the IFSCA, several enabling tax changes have been made over time, including the recent ones in the Budget 2023.[2]

The Cape Town Convention:

Since cross-border leasing involves an interplay of various jurisdictions, entities such as UNIDROIT promote the setting of basic standards to protect the interests of lessors in case of cross border leasing transactions. The UNIDROIT convention on cross-border leasing is one such convention.

Specific to aircraft leasing, the Cape Town Convention (CTC) was signed by the requisite number of confirming parties in 2001.

The CTC, along with its Aircraft Equipment Protocol, contains provisions related to insolvency. These provisions aim to provide clarity and protection to creditors in the event of a debtor’s insolvency. Here are some key aspects:

- Recognition of insolvency proceedings: The Convention recognizes the rights of insolvency administrators to take control of aircraft objects and handle them in accordance with the applicable insolvency law.

- Waiting period and remedies: The Convention establishes a waiting period of 60 calendar days during which creditors cannot exercise their rights to deregister or repossess an aircraft. This period allows the debtor or the insolvency administrator to decide on the future of the aircraft.

- “Alternative A” and “Alternative B”: The Convention offers two alternatives regarding the rights of creditors in insolvency proceedings.

- Alternative A: This option provides a default remedy for creditors, allowing them to take possession of the aircraft object upon the expiration of the waiting period, provided they meet certain conditions. Creditors can also seek speedy relief from courts if the debtor fails to cure defaults or agree on alternative arrangements.

- Alternative B: This option allows the insolvency administrator to decide whether to give up the aircraft or continue using it and making payments in accordance with the lease or security agreement. Creditors’ rights are protected, and they can seek relief if the obligations are not fulfilled.

- Priority of rights: The Convention establishes a priority system for claims in the event of insolvency. Creditors with registered international interests have a higher priority than unregistered or subsequently registered interests. This helps protect the interests of creditors who have registered their security or lease interests.

The CTC’s insolvency provisions provide a framework to address the complex issues that may arise when a debtor becomes insolvent. By establishing clear rules and procedures, it aims to enhance legal certainty and promote the availability of financing for the acquisition and use of aircraft equipment in international transactions.

How GoAir matter dented India’s position in aircraft leasing market

Go Airlines, operating under the brand name Go First, is an airline with a fleet of 54 aircraft, most of which were obtained through leasing arrangements with various aircraft lessor companies. The imposition of insolvency moratorium would mean the lessors would not be able to repossess the aircrafts for the 6 months of insolvency, which may stretch to 9 months.

The implications of this ruling extend beyond Go First and the lessors involved. It is likely to have far-reaching consequences for the entire aircraft industry, especially considering the Indian government’s efforts to promote aircraft leasing in the country. The decision could potentially undermine the progress made in this sector. Consequently, there have been reports of several aircraft lessors associated with another struggling carrier, SpiceJet, seeking to deregister their aircraft. This indicates a growing lack of confidence among international lessors in the Indian market.

In fact this is not the first time, international lessors had to bite the dust in India with respect to repossession of leased aircrafts. Even in the case of Jet Airways, and Kingfisher Airlines the lessors had to struggle.

There have also been reports that Aviation Working Group, a UK-based entity which monitors aircraft leasing and financing related laws for the manufacturers, has issued a negative outlook for India, which is likely to dampen the confidence of the lessors.

The loss of confidence from international lessors could have a significant impact on lease pricing in the future. With lessors becoming wary of the risks associated with leasing aircraft in India, they may demand higher lease rates or impose stricter terms and conditions. This could make it more challenging for Indian airlines to secure affordable leasing options, hampering their growth and potentially increasing costs for passengers.

Is this case unique to India? What is the position elsewhere in the world?

The situation is not unique to India; there have been several cases of airline defaults in other parts of the world before. Some countries have adopted specific laws relating to aircraft leasing, some countries go with the general bankruptcy law.

For instance, in the US, Chapter 11 of the US Bankruptcy Code has provisions relating to aircrafts and vessels. In Chapter 11, an automatic stay prevents creditors from terminating leases or repossessing aircraft or vessels. Violations of the stay are legally void, with sanctions and damages available to debtors. The debtor-in-possession continues to manage the company with some judicial oversight. However, section 1110 allows creditors to exercise remedies if defaults are not cured within 60 days. The section provides that in case of a lease or conditional sale of aircrafts or vessels, the right of the lessor or conditional vendor to seek repossession or enforce other rights of remedies will not be impacted by the insolvency moratorium. However, the protection under sec. 1110 of the US Code is limited to insolvency proceedings under the US law, that is, not applicable to non-US companies.

However, the US did not adopt “Alternative A” as outlined in Article XI of the Aircraft Protocol when it ratified Cape Town, though, the provisions of the US code are a bit stronger than expected under CTC.

The UK ratified the CTC and its Aircraft Equipment Protocol in 2015. As a result, certain provisions of the Convention are integrated into UK law[3]. The CTC’s insolvency provisions apply alongside the UK’s domestic insolvency laws. They provide specific rules and protections related to aircraft in insolvency proceedings.

However, one of the notable case that highlights the conflict between the CTC and local bankruptcy laws is the bankruptcy of Avianca Brazil, formerly known as OceanAir Linhas Aéreas. Avianca Brazil filed for bankruptcy protection in December 2018, and it involved a complex legal battle concerning the repossession of aircraft.

Under the CTC, creditors who hold a registered security interest in an aircraft have the right to repossess it in the event of a default by the debtor. However, the Brazilian bankruptcy law provides for a moratorium period during which the debtor is protected from repossession and can reorganize its affairs.

In the Avianca Brazil case, several aircraft lessors, including GECAS and Avolon, sought to repossess their aircraft. They argued that the CTC granted them the right to do so, bypassing the local bankruptcy proceedings. On the other hand, the bankruptcy court in Brazil held that the lessors could not take possession of the aircraft during the moratorium period, as provided by Brazilian law.

This conflict led to a legal battle between the lessors and the bankruptcy court, with both sides presenting their arguments based on their respective legal frameworks. The lessors claimed that the CTC should prevail as an international treaty, while the bankruptcy court emphasized the primacy of local laws.

Ultimately, the bankruptcy court in Brazil ruled in favor of the moratorium, preventing the lessors from repossessing the aircraft. The court’s decision highlighted the limitations of the CTC in cases where conflicts with local bankruptcy laws arise.

Could there have been a different approach to this?

The current Insolvency and Bankruptcy Code (IBC) in India contradicts the provisions of the CTC, despite India being a signatory to the CTC. It is high time for India to adopt the CTC as a legal statute, which was attempted in 2018 when the Ministry of Civil Aviation invited comments for the Cape Town Convention Bill but did not go through. This adoption is now crucial to restore the trust of the international aviation community in the Indian market.

Until the CTC Bill is enacted, it is vital for the judiciary to approach such cases more reasonably. Taking the present case as an example, one can argue that the National Company Law Tribunal (NCLT) followed a standard approach by ordering a moratorium. While this aligns with the principles and objectives of insolvency proceedings, it’s important to understand the implications.

Under the NCLT’s decision, the assets will remain with the lessee, who may, if feasible, utilize them to recover and stabilize their operations. As a result, the lessors not only have to relinquish possession of the aircraft, allowing them to be used and depreciated, but they also hold a significantly lower position as operational creditors in terms of realizing cash flows. We are assuming the leases are not “financial leases”.

Alternatively, if the NCLT had ordered the retention of assets by the lessee while allowing the lease rentals to be serviced from the surplus cash flows once operations resume, the damage would have been mitigated.

By adopting a more pragmatic approach, the NCLT could have safeguarded the interests of both the lessors and the lessees. This would have allowed the lessee to continue using the assets to generate revenue, while the lessors would have maintained a more secure financial position and improved chances of recovering their investment.

In conclusion, it is imperative for India to incorporate the CTC into its legal framework to restore confidence in the international aviation community. Until then, it is crucial for the judiciary, like the NCLT, to consider the specific circumstances of each case and adopt a more balanced approach that protects the interests of all parties involved. It is important to realise that insolvency law sets insolvency principles, but equity and fairness are more important in insolvency matters than anywhere else, as the insolvent entity sits on a pile of debt and paucity of resources. Thus, there should be no hesitation in the adjudicating bodies writing codes of fairness while passing insolvency orders. That is to say, the manner of utlisation of the cashflows of the insolvent entity may easily form part of the insolvency order itself.

[1] The report of Project Raftaar is here: https://vinodkothari.com/wp-content/uploads/2019/06/Project-Rupee-Raftaar.pdf. Vinod Kothari was a part of the Project Raftaar group.

[2] By the Budget, 2023, non-resident shareholders and other IFSC units have been exempted from capital gains on transfer of equity shares of an IFSC unit primarily engaged in aircraft leasing. This exemption is however available for a specified period and is subject to conditions. Gains arising from aircraft leasing are not taxable in the hands of the IFSC unit subject to the conditions stipulated. Before the amendments, the dividend earned by non-resident shareholders from an IFSC unit was taxable at the rate of 20 percent (plus applicable surcharge and cess), which has now been reduced to 10 per cent.

[3] Part 26, 26A of the Companies Act 2006 and the Corporate Insolvency and Governance Act 2020

My understanding of the matter is that under the Moratorium declared

the lessors of the aircraft should be paid their premiums on the

agreed basis by the RP as long as the leased assets are not returned

to them. They should be handled as ‘prejudicially affected’ stake

holders and the provisions of Sec 14 (2A) takes care of such payments

and what the lessors can do if the corporate debtor (RP) has not paid

dues arising from such supply during the moratorium period.

The article ” GoAir Insolvency: Lessors’ rights gone in thin air?” is

concluding that NCLT in its order should have clarified how the

lessors are protected. Are they not already?

Would be happy to receive a clarification, if possible.