Recent changes in the regulatory framework for the long-term bond market

– Team Finserv | finserv@vinodkothari.com

Table of contents

1. Issuer-related

1.1. Amendments to the mechanism and limits for issuance of debt securities on the Electronic Book Platform (‘EBP’)

The HR Khan Committee recommended the Electronic Book Mechanism (‘EBM’) for private placement of debt securities, which was at the time, mandatory for issuances over Rs. 500 crore, to be extended to all primary market issuances.

Revised framework for EBM rolled out in January, 2018 had reduced the limit to Rs. 200 crore and subsequently to Rs. 100 crore or more via the Operational Circular dated August 10, 2021.

SEBI has now, vide its circular dated October 10, 2022[1], introduced various changes to the EBP Framework, including further reduction of the limit. Some of the major amendments are as below –

- Reduction in limit: Threshold for issuances of debt securities to mandatorily be carried out through the EBP platform has been reduced from INR 100 crore in a financial year to INR 50 crore.

- Concern with respect to ‘fastest finger first’ bidding: The Circular has attempted to address the concern of ‘fastest finger first’ by modifying the book-building process in order to ensure allocations are based on the ‘best bid’ rather than the bidder with the best technology for placing the fastest bid. Further, each eligible participant shall provide confirmation to the EBP that it is not using any software, algorithm, Bots or other automation tools, which would give unfair access for placing bids on the EBP platform.

- Introduction of anchor investor: The concept of ‘anchor investor’ has also been introduced as an option to enable them to assess the demand and receive assurance from certain prospective investors towards subscription.

- Limit on green shoe option: Green-shoe option for oversubscription shall not exceed five times the base issue size. There was no limit specified earlier.

- Increase in arranger bid portion: An arranger can now bid up to Rs. 100 crore, or 5% of the base issue size (whichever is lower), from the earlier limit of Rs. 15 crore.

Our snippet may be viewed here[2].

How is this going to impact long term bond issuances?

The private placement market in India is completely bespoke in nature, and issuances are almost completely OTC negotiations. During several discussions with issuers and investors during the course of our practice and interactions, we have been informed that irrespective of the EBP, the practice of the market being bespoke in nature, continues. The issuers still negotiate the private placement on OTC basis, and then place the offer on the EBP. Where the manner of issuance should be voluntary, further reducing the limit of mandatory issuance through EBP would capture more issuances and additional issuers will have to adhere to compliance of the EBP framework.

The book-building process has been modified to ensure that the allocations are based on the ‘best bid’ rather than the bidder with the best technology for placing the fastest bid. Having an anchor investor will enable the issuer to be assured from certain prospective investors towards subscription.

While the Circular has been introduced to address difficulties with EBP issuance, the approach of the issuers, in our view, would still remain the same.

1.2. Capping of ISINs

The HR Khan Committee had recommended that issuers coming out with frequent debt issues with the same tenor during a quarter may club them under the same umbrella ISIN which in turn would increase the float in the market, thus enhancing its liquidity. These issuers may come out with a feasible maturity structure wherein they can stagger the redemption amount across the year by amortizing the repayments. Necessary changes may be made in the issuance process of ISINs by depositories, viz., NSDL and CDSL to facilitate the same.

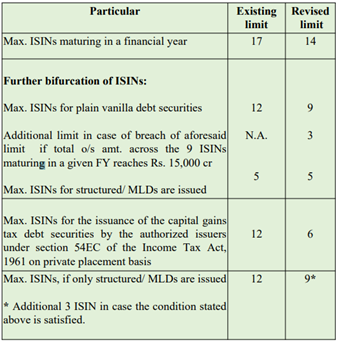

SEBI, vide its circular dated June 30, 2017[3], had implemented the above by imposing ISIN restrictions of 17 ISIN in a FY with bifurcation as 12 for plain vanilla debt securities, 5 for structured debt securities.

Now, SEBI, vide its circular dated October 31, 2022[4], has put a further cap on the number of ISINs maturing in a financial year for debt securities issued on private placement basis.

Applicable from – Issuances of debt securities from April 01, 2023.

How is this going to help long term issuances?

Overall number of active ISINs will reduce thereby increasing the liquidity in the secondary market.

The capping of ISINs reduces fragmentation in the primary market as well as improves liquidity in the secondary market. A trader would normally want to trade in corporate bonds of a particular issuer, which have been freshly issued, thereby rendering the outstanding issues of that same issuer illiquid. This in turn affects the secondary market liquidity in corporate bonds. While the number of ISINs has been reduced, the limits have been kept the same for issuers having outstanding listed debt securities of Rs. 15,000 crores in value. Accordingly, large issuers remain unaffected.

Our snippet on the same may be viewed here[5].

1.3. Reduction in the denomination for debt securities

Vide SEBI Circular dated October 28, 2022[6], minimum face value of an NCD issued as well as the trading lot of such NCDs (either on stock exchange or OTC basis) has been reduced to Rs. One lakh per debenture from Rs. 10 Lakhs per debenture.

Impact –

Non-institutional investors consider the high-ticket size as a deterrent which restricts their ability to access the market for corporate bonds. If the face value and trading lot is reduced, more investors would be able to participate, which in turn will enhance the liquidity in the corporate bond market.

1.4. Enhanced guidelines for debenture trustees and listed issuer companies on creation of security and initial due diligence

SEBI has issued enhanced guidelines for Debenture Trustees (‘DT’) and listed issuer companies on security creation and initial due diligence w.r.t to issuance of NCS, vide its circular dated August 04, 2022[7], providing the following:

- Manner of change in security/ creation of additional security/ change from unsecured to secured in case of listed NCDs – DTs are required to undertake DD for change in security, creation of security/ additional security as per the manner specified, and issue an NOC to the issuer for going ahead with the proposed change in the structure or creation of security. Thereafter, the specified procedure for security creation is to be followed by the issuer.

- Encumbrance on securities for issue of listed NCDs – Creation of encumbrance on the securities for securing the NCDs shall be through the depository system. Meaning of encumbrance has been provided.

- Due diligence certificate– In case security details have not been finalized at the time of the filing of the draft shelf prospectus/ placement memorandum, the DT shall undertake due diligence as specified in the circular.

- Manner of empanelment of External Agencies by DTs for carrying out due diligence has been specified.

- Operations of Distributed Ledger Technology– Issuers, Depositories, DTs and CRAs shall ensure that they are in compliance of SEBI circulars August 13, 2021, March 29, 2022 and other circulars on DLT system for complying with Security and Covenant Monitoring System.

Impact – Increased transparency and disclosure for debenture holders.

1.5. Monitoring of covenants, security creation and continuous due diligence

1.5.1. Security and Covenant Monitoring using Distributed Ledger Technology (DLT)[8]

SEBI had introduced the concept of DLT, a system for recording and monitoring of the security created and monitoring of covenants of non-convertible securities. The system has come into effect from April 01, 2022. Operational guidelines have been issued in this aspect.

Our article may be viewed here.

1.5.2. Revised format of security cover certificate and revision in timeline for submission thereof (effective w.e.f. October 1, 2022)

Regulation 54 read with regulation 56(1)(d) of SEBI LODR Regulations require listed entities to disclose security cover to the stock exchanges and Debenture Trustees, in the format as prescribed as per Annexure A of SEBI Circular dated November 12, 2020. SEBI, vide its circular dated May 19, 2022[9] has revised the format to provide a holistic picture of all the borrowings and the status of encumbrance on the assets of the listed entity.

Formulae for Security Cover Ratios have also been prescribed to ensure uniformity.

Further, listed entities will be required to prepare the security cover certificate and the statutory auditor of the listed entity shall certify the book values of the assets provided in such certificate on a quarterly basis.The requirement seems to be in addition to the corresponding required under Reg. 15 (1) (t) (ii) of Debenture Trustee Regulations, where statutory auditors of the listed entity are required to furnish a certificate on a half yearly basis regarding security cover including compliance with the covenants of the Offer Document/ Information memorandum in the manner as may be specified by SEBI from time to time.

Our article on the above may be referred to here[10].

1.5.3. Monitoring of covenants

SEBI, vide its circular dated May 19, 2022[11], has provided the following requirements-

- Issuers are required to quarterly submit the compliance status of covenants of listed debt securities certified by statutory auditor to the DT.

- Covenants are required to be formulated and categorised as financial covenants, affirmative covenants, negative covenants etc., as per the guidance note provided.

- The DTs are required to monitor breach of covenants in terms of Reg 15 (f) of DT Regulations. The present circular specifies various actionables for the DTs, right from framing internal policies for monitoring with clearly defined roles and responsibilities for its employees, to preparing category wise list of covenants applicable viz. financial, affirmative, negative covenants etc. and furnish status report to the stock exchange and upload on its website on quarterly basis.

Our article on the above may be referred to here[12].

1.5.4. Monitoring of Recovery Expense Fund (REF) by Debenture Trustee(s):

SEBI vide circular dated October 22, 2020 had issued guidelines in respect of the contribution by issuers towards creation of REF in order to enable the DTs to take prompt action for enforcement of security in case of ‘default’ in respect of listed debt securities.

Clarification has been issued with respect to usage of the recovery expense fund for enforcement of security interest as well as any other legal proceedings.

1.6. Regulation of online bond platform

Online bond platforms are a secondary marketplace that allow investors, particularly retail investors, an opportunity to invest in listed and/or unlisted debt securities without routing through brokers. Some of these platforms seemingly operate in a manner similar to organized avenues for trading like market infrastructure institutions, especially stock exchanges, bringing together buyers and sellers for executing trades in debt securities. While these bond platforms contribute to enhance the much-needed liquidity in the bond market, SEBI raised concerns that they do not come under any regulatory purview and remain unregistered. SEBI, vide its consultation paper dated July 21, 2022[13], introduced various recommendations, including registration as a stock broker with SEBI.

Now, SEBI, vide the SEBI (Issue and Listing of Non-Convertible Securities) (Second Amendment) Regulations, 2022 dated November 09, 2022[14] read with SEBI Circular on Registration and regulatory framework for Online Bond Platform Providers[15] has notified the regulatory framework for online bond trading platforms.

Major requirements –

- Allowing only listed/ proposed to be listed debt securities to be traded;

- Registration as a stock broker;

- Lock-in period of 6 months from date of allotment of securities.

Impact: this increases the exit opportunities for investments in listed debt securities, also likely to improve price discovery in the secondary market.

1.7. Additional participation on the ‘Request for Quote’ Platform

RFQ[16] is an electronic platform to enable sophisticated, multilateral negotiations to take place on a centralized online trading platform with straight-through-processing of clearing and settlement to complete a trade. It is a platform that allows participants to invite as well as give quotes which are then placed to an identified counterparty-participant or to all the participants.

Eligible participants on the platform currently were regulated entities, listed bodies corporate, institutional investors and all India financial institutions. In 2021, SEBI mandated registered mutual funds[17] and portfolio managers[18] to undertake at least 10% of their total secondary market trades (in value) per month, in corporate bonds through the RFQ platform. Further, stock brokers were already allowed to bid in their proprietary capacity.

SEBI, vide its circular dated October 19, 2022[19], has permitted stockbrokers registered under the debt segment of the stock exchanges to place and seek bids on behalf of their clients through the RFQ Platform to enable wider participation.

1.8. Operational Circular for Listing Regulations

For effective regulation of the corporate bond market and to enable the issuers and other market stakeholders to get access to all the applicable circulars at one place, this Operational Circular dated July 29, 2022[20], has been prepared. Further, formats for reporting of the following have been provided:

- Format (Chapter IV, Annex-IV-A of the Operational Circular) for indicating the utilisation of issue proceeds of listed NCD to the SEs [regulation 52(7) of the SEBI LODR Regulations]

- Format (Chapter IV of the Operational Circular) for review of rating obtained by the listed entity from CRA w.r.t NCS (Regulation 55 of the SEBI LODR Regulations)

- Formats (Chapter XI) for submitting details with respect to payment of interest/dividend/principal obligations on the NCD to the SEs [regulation 57 of the SEBI LODR Regulations]

- Inclusion (Chapter VI) of additional points of disclosure to be provided in the draft scheme of arrangement where an entity with listed specified securities has issued NCS in lieu of specified securities, vide a scheme of arrangement.

2. Investor related

2.1. Insurance companies as investors

2.1.1. Permitting investment in Additional Tier-1 (AT-1) bonds of bank[21]

IRDAI has relaxed rules for insurance companies to invest in AT-1 perpetual bonds of banks, to enable insurance companies to invest in banks despite non-declaration of dividend.

2.1.2. Increasing investments in infrastructure sector through banks[22]

Investments in long-term bonds for ‘Infrastructure and Affordable Housing’ has been removed from the overall limit of investment in banking, financial services and insurance (BFSI) as investments in infrastructure have no industry limit under the prudential exposure norms.

2.1.3. Exposure draft – investment in other forms of capital – IRDAI (Other Forms of Capital) Regulations, 2022.

IRDAI has issued an exposure draft on August 02, 2022[23], with respect to investment by insurance companies in other forms of capital, which includes subordinated debt.

Some of the key changes being proposed in the regulations are: –

- Discontinuation of the prior approval of IRDAI for raising resources through issue of OFC;

- Discontinuation of the prior approval for exercising call option on existing OFC, subject to conditions;

- Revision of the limits up to which OFC resources can be raised by insurers;

- Boards of insurers to be responsible for ensuring compliance with the Regulations; and

- Rationalization of the other compliance requirements.

2.1.4. Investment in debt securities of InvITs and REITs [24](22nd April, 2021)

Consequent to Finance Act, 2021 permitting Trusts to issue Debt Securities, the following conditions have been provided for insurance companies intending to invest in debt securities issued by InvITs / REITs:

- The Debt Instruments of InvIT / REIT shall be rated and not less than “AA” as a part of Approved Investments.

- Debt Instruments of InvITs / REITs rated and or downgraded below “AA” shall form part of Other Investments.

- No insurer shall invest more than 10% of the Outstanding Debt instruments (including the current issue) in a single InvIT/REITs issue.

- The cumulative Investments in Units and Debt Instruments of InvITs and REITs shall not exceed 3% of total fund size of the Insurer at any point of time.

- No investment shall be made in Debt instruments of an InvIT/REIT where the Sponsor is under the Promoter Group of the Insurer.

- Group shall have the meaning as defined under Regulation 2(g) of IRDAI (Investment) Regulations, 2016

- Investment in Debt Instruments of InvIT will form part “Infrastructure Investments”.

- Investment in Debt Instruments of REIT will form part of industry group “Real Estate Activities” under NIC Industry Classification.

- The Investment in Debt Securities of InvITs/REITs shall be valued either as per FIMMDA or at applicable market yield rates published by any Rating Agency registered with SEBI.

2.2. Provident funds as investors

2.2.1. Exit from investments

The Central Board of Trustee (EPF), in its meeting dated 20th November, 2021[25], discussed the following –

Para 6 of notified Pattern of investment clearly provides the legal framework for any exit from the Investments in EPFOs portfolio. It was informed that EPFO traditionally holds all its investments till maturity. However, in certain cases if the credit ratings and minimum requirements fall below the investable grade as per the prescribed pattern of investment and CBT approved guidelines, to protect the interests of the PF members it is desirable that EPFO exit from such investments and recover the amounts invested before the issuer defaults and thereby endanger the whole investment. The committee was briefed about the draft Exit policy which specifically laid out the monitoring mechanism, the events which trigger the process for considering exit, the standard operating procedure and timelines for the exit process and the roles and responsibilities of the various agencies like the consultant, Portfolio managers, ECA and IMC division of EPFO in the process.

It was explained to the committee the exit policy is clearly contained in para 6 of the pattern of investment notified by the Government and that there is no change in exit policy, rather, a clear cut trigger events, Standard Operating Procedure with clear timelines, roles and responsibilities etc has been proposed to be put in place.

However, the notification in this regard could not be found.

2.2.2. Private sector bonds as investment options

As per news reports[26], the Employees’ Provident Fund Organisation (EPFO) is likely to start investing again in corporate bonds issued by private sector companies, after a gap of over two years. Options like when to invest in private-sector bonds and when and how to exit from such investments were discussed at the retirement fund body’s Finance Investment and Audit Committee (FIAC). The same has been discussed in the meeting dated November 20, 2021[27] by the CBT.

2.3. Supreme Court Ruling – Enforcement actions for debenture holders

Even though not a regulatory development, but a recent Supreme Court ruling, Securities and Exchange Board of India v. Rajkumar Nagpal and Others dealt with the interplay between the RBI’s ‘Prudential Framework for Resolution of Stressed Assets’ issued in June, 2019 (‘RBI Resolution Framework’) and SEBI’s Circular on ‘Standardisation of procedure to be followed by Debenture Trustees in case of ‘Default’ by Issuers of listed debt securities’ (‘SEBI Circular’) dated October 13, 2020. and consequent impact of the same on the rights of the debentureholders. The ruling brings out two highlights:

(a) Joining the ICA: an additionality not a mandate

The ruling highlighted that joining the ICA for recovery in case of default by issuers of listed debt securities, as per SEBI Circular., should not be seen as a mandate upon the debenture holders to join the ICA. Neither it is the only route to entering into a compromise with the issuer entity. SEBI Circular goes a step ahead to provide an option to debenture holders to be a part of ICA, by way of collective decision, and such collective decision has to be arrived at by following the modalities as prescribed in the said Circular. If debenture holders do not wish to be a part of ICA, they may consciously decide, as SEBI Circular requires positive consent by requisite majority to enter into an ICA. If such majority consent is not received, the trustee cannot sign ICA. Therefore, SEBI Circular will apply only if the debenture holders want to become part of the ICA. Hence, the decision has to be taken by the debenture holders whether or not they want to be a part of ICA. The modality of how such a decision should be taken, comes from the SEBI Circular.

(b) Dissenting investors can be bound by statute only; contracts cannot bind dissenters

The SC discussed broadly three possible routes for the investors of arriving at a decision –

- section 230 of the Companies Act, 2013 dealing with compromise and arrangements basis requisite extraordinary majority and sanction of the NCLT,

- Section 62 of the Contract Act, 1872, wherein parties to a contract may agree to substitute, rescind or alter the original contract, and then such original contract need not be performed.

While in the first two options above, the collective decision of the majority would bind the dissenting debenture holders by way of statutory force; the third option is completely contractual. Intending debenture holders can voluntarily enter into a contract in terms of section 62 of the Contract Act, however such provision would only bind the consenting party/ies. Hence, the SC ruling makes it clear that contractual compromises, which do not fall either under section 230 of the Companies Act or under the SEBI Circular, cannot bind dissenting debenture holders.

Our article may be referred to here.

[1] https://www.sebi.gov.in/legal/circulars/oct-2022/review-of-provisions-pertaining-to-electronic-book-provider-platform-replacement-of-chapter-vi-to-operational-circular-dated-august-10-2021_63807.html

[2] https://vinodkothari.com/2022/10/sebi-rationalizes-issuances-on-electronic-book-platform/

[3] https://www.sebi.gov.in/legal/circulars/jun-2017/specifications-related-to-international-securities-identification-number-isins-for-debt-securities-issued-under-the-sebi-issue-and-listing-of-debt-securities-regulations-2008_35215.html

[4] https://www.sebi.gov.in/legal/circulars/oct-2022/review-of-provisions-pertaining-to-specifications-related-to-international-securities-identification-number-isin-for-debt-securities-issued-on-private-placement-basis-modification-to-chapter-viii-_64522.html

[5] https://vinodkothari.com/wp-content/uploads/2022/11/Final-ISIN-snippet.pdf

[6] https://www.sebi.gov.in/legal/circulars/oct-2022/reduction-in-denomination-for-debt-securities-and-non-convertible-redeemable-preference-shares_64429.html

[7] https://www.sebi.gov.in/legal/circulars/may-2022/revised-format-of-security-cover-certificate-monitoring-and-revision-in-timelines_59051.html

[8] https://www.sebi.gov.in/legal/circulars/mar-2022/operational-guidelines-for-security-and-covenant-monitoring-using-distributed-ledger-technology-dlt-_57331.html

[9] https://www.sebi.gov.in/legal/circulars/may-2022/revised-format-of-security-cover-certificate-monitoring-and-revision-in-timelines_59051.html

[10] https://vinodkothari.com/2022/09/security-cover-certificate-format-notified-by-sebi-for-listed-secured-debt/

[11] https://www.sebi.gov.in/legal/circulars/may-2022/revised-format-of-security-cover-certificate-monitoring-and-revision-in-timelines_59051.html

[12] https://vinodkothari.com/2022/09/security-cover-certificate-format-notified-by-sebi-for-listed-secured-debt/

[13]https://www.sebi.gov.in/reports-and-statistics/reports/jul-2022/consultation-paper-on-online-bond-trading-platforms-proposed-regulatory-framework_61087.html

[14] https://egazette.nic.in/WriteReadData/2022/240162.pdf

[15] https://www.sebi.gov.in/legal/circulars/nov-2022/registration-and-regulatory-framework-for-online-bond-platform-providers_65014.html

[16] https://www.nseindia.com/products-services/about-request-for-quote

[17] https://www.sebi.gov.in/legal/circulars/oct-2021/circular-on-minimum-percentage-of-trades-carried-out-by-mutual-funds-through-rfq-platform_53145.html

[18] https://www.sebi.gov.in/legal/circulars/dec-2021/transaction-in-corporate-bonds-through-request-for-quote-platform-by-portfolio-management-services-pms-_54523.html

[19] https://www.sebi.gov.in/legal/circulars/oct-2022/request-for-quote-rfq-platform-for-trade-execution-and-settlement-of-trades-in-listed-non-convertible-securities-securitised-debt-instruments-municipal-debt-securities-and-commercial-paper_64215.html

[20] https://www.sebi.gov.in/legal/circulars/jul-2022/lodr-single-operational-circular-for-listing-obligations-and-disclosure-requirements-for-non-convertible-securities-securitized-debt-instruments-and-or-commercial-paper_61345.html

[21] https://www.lifeinscouncil.org/component/03%20Aug%202022%20F%20and%20I-CIR-165%20Amendments%20to%20Investments-Master%20Circular.pdf

[22] https://www.lifeinscouncil.org/component/03%20Aug%202022%20F%20and%20I-CIR-165%20Amendments%20to%20Investments-Master%20Circular.pdf

[23] https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo4775

[24] https://www.irdai.gov.in/admincms/cms/whatsNew_Layout.aspx?page=PageNo4454&flag=1

[25] https://www.epfindia.gov.in/site_docs/PDFs/CBT_Files/Cbt_meeting_Agenda_230th.pdf

[26] https://www.financialexpress.com/money/epfo-considering-investing-pf-monies-in-private-corporate-bonds/2429845/

[27] https://www.epfindia.gov.in/site_docs/PDFs/CBT_Files/Cbt_meeting_Agenda_230th.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!