RBI Guidelines at odds with the Companies Act on appointment of Auditor

A comparative analysis between the Companies Act, SEBI Guidelines and SEBI Circular dated 18th Oct. 2019

– Ajay Kumar K V | Manager (corplaw@vinodkothari.com)

Introduction

The Reserve Bank of India has issued Guidelines[1] for Appointment of Statutory Central Auditors (SCAs)/Statutory Auditors (SAs) of Commercial Banks (excluding RRBs), UCBs and NBFCs (including HFCs) under Section 30(1A) of the Banking Regulation Act, 1949, Section 10(1) of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980 and Section 41(1) of SBI Act, 1955; and under provisions of Chapter IIIB of RBI Act, 1934 for NBFCs, on 27th April 2021.

The Guidelines provide for appointment of SCAs/SAs, the number of auditors, their eligibility criteria, tenure and rotation as well as norms for ensuring the independence of auditors.

However certain provisions of these Guidelines are either completely different or stringent as compared to the provisions of the Companies Act, 2013 (Act). Further, in case of listed entities the question would arise whether the SEBI circular CIR/CFD/CMD1/114/2019[2] dated 18th October 2019 shall be applicable, where the existing auditor is ineligible to continue as the auditor of the company and a new auditor is to be appointed.

In this write up, we have discussed the requirements under both RBI Guidelines as well as the Act.

Comparison of Critical aspects w.r.t to SA appointment

| Basis of difference | RBI Guidelines | Companies Act 2013 | Remarks |

|

Applicability

|

● Commercial Banks (excluding RRBs), ● UCBs and ● NBFCs including HFCs having asset size of 1000 crores or more |

Every company registered under this Act or under any previous company law;

Such other companies as provided in Sec. 1 of the Act. |

The Guidelines shall be exclusively applicable to banking & non-banking entities while the Act has a wider applicability. |

|

Eligibility |

The auditor shall meet the criteria as specified in Annex I to the Guidelines. |

The auditor shall meet the eligibility requirements specified in Sec. 141 of the Act read with Rule 10 of the Companies (Audit and Auditors) Rules, 2014. |

In case of an entity to which the RBI Guidelines are applicable shall fulfil the eligibility norms under both the Guidelines and the Act.

However, in cases where the eligibility norms differ under the RBI Guidelines and the Act, one may take a view that being the sectoral regulator, the criteria set forth by the RBI should be complied.

For example: The time gap between any non-audit works by the SCAs/SAs for the entity or for its group entities should be at least 1 year;

The full-time partners shall have at least 1-year continuous association with the firm.

|

|

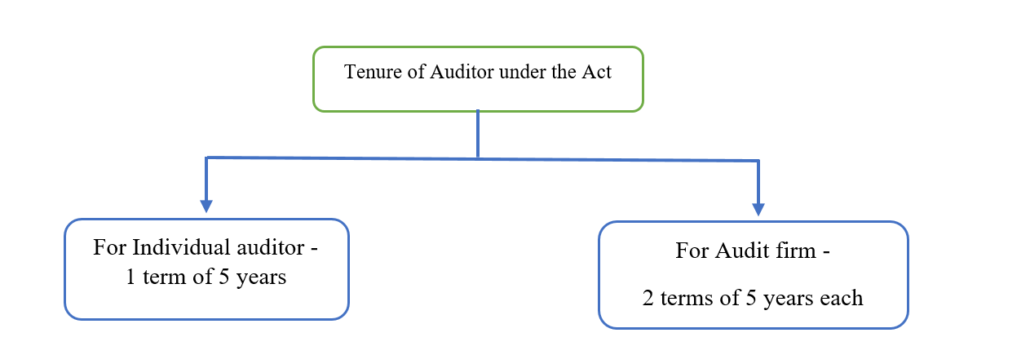

Tenure |

A continuous period of 3 years. |

For Individual auditor- 1 term of 5 years

For Audit firm – 2 terms of 5 years each

|

The provision of RBI Guidelines is stricter when compared with the provisions of the Act. |

|

Cooling-off period

|

6 years (two tenures) after completion of full or part of one term of the audit tenure.

|

5 years from the completion of 1/2 term(s) of 5 years as applicable |

The provision of the Guidelines is stricter as it adds an additional 1 year to the period of 5 years prescribed under the Act.

|

|

Individual Auditor Vs Audit firm |

As per the Guidelines, only a firm of auditors can be appointed as the SAs. |

The Sec. 141 of the Act allows an individual as well as a firm of auditors to be appointed as SAs. |

Again, the Guidelines are stringent w.r.t to the eligibility norms which inter alia prescribes qualification of partners, experience, etc. |

| Yearly ratification of appointment

|

The Guidelines casts the responsibility on the Board/Audit committee to assess the eligibility of the SA on a yearly basis and to submit a certificate to this effect with the RBI.

|

The requirement of yearly ratification was omitted by the Companies Amendment Act, 2017. | This is a new requirement which needs to be complied by the entities covered by these Guidelines.

|

|

Formulating a policy |

The Guidelines also require that the entities covered by the same are required to formulate a board approved policy which should contain various factors like size and spread of assets, accounting and administrative units, complexity of transactions, level of computerization, availability of other independent audit inputs, identified risks in financial reporting, etc. for determining the number of auditors required.

|

The Act does not cast any such obligation on the companies. |

This is an additional requirement which needs to be complied by the entities covered by these Guidelines. |

|

Maximum number of auditors

|

Based on the asset size of the applicable entity, the Guidelines have fixed the maximum number of auditors.

|

The Act does not provide any such restriction. |

This is an additional requirement which needs to be complied by the entities covered by these Guidelines. |

|

Branch Audit

|

The SCAs/SAs shall visit and audit at least the Top 20 branches/Top 20% of the branches of the Entities (in case of entities having less than 100 branches), to be selected in order of the level of outstanding advances, in such a manner as to cover a minimum of 15% of total gross advances of the entities.

|

As per Section 143 (8), the audit of branch office shall be conducted by the SAs or any other person qualified for appointment as an auditor of the company under the Act.

|

The Guidelines provide an additional requirement along with the compliance of Section 143(8) of the Act. |

Critical analysis on the conflicts

Having observed the various differences between the RBI Guidelines and the Act, we have critically analysed the same below

1. Eligibility

The eligibility norms under the Guidelines have specifically provided various requirements including the qualification of partners, continuous engagement with the firm, CISA qualification, number of professional staff, etc. In case of an entity in which the existing auditor is ineligible as per the eligibility norms, such an auditor has to vacate the position.

The appointment of auditors can be made only at the general meeting of the members and the role of Board/Audit Committee (‘AC’) is simply to check whether the SAs meet the eligibility criteria. The Board/AC is required to file the certificate specified in Form A, where the affirmation on eligibility is given for each term.

However, the Board/AC does not have the power to ratify an appointment made by members at their meeting. Hence, the logical interpretation here would be that, the appointment has to be done once for a period of 3 years in the AGM and thereafter every year the role of Board/AC would be to confirm the eligibility to continue such appointment of the SA.

The question that arises here is, whether it will be a resignation within the meaning of the SEBI circular on the resignation of statutory auditors from listed entities and their material subsidiaries, and the related compliances will be attracted due to such vacation?

An analysis of the critical questions w.r.t to the SEBI circular is discussed in the later part of this write up.

2. Tenure of Auditor

The Guideline 8 provides for the tenure & rotation of SCAs/SAs where an applicable entity will have to appoint the SCAs/SAs for a continuous period of 3 years, subject to the firms satisfying the eligibility norms each year.

Whereas, as per Sec. 139 (2) of the Act, the term of auditor shall be as follows;

The question that arises here is that in the case of an NBFC, while appointing an auditor what will be the term of the auditor? Whether it will be 3 years as per the Guidelines or a term of 5 years as per the Companies Act, 2013?

Impact

The Guidelines regarding appointment of SCAs/SAs shall be implemented from second-half of the FY 2021-22 in order to ensure smooth transition. In case the existing auditors (including joint auditors) have already completed their tenure or are ineligible to continue, they shall vacate the office upon the determination of eligibility by the AC/Board of the Entity.

Since NBFCs and UCBs have the relaxation up to second half of FY 2021-22, the determination may happen in the third quarter. In such a case, the auditors (including joint auditors) of FY 2020-21 shall have the flexibility to continue for the Limited Review for Q1, Q2, etc. This has also been clarified by the RBI vide its FAQs dated June 11, 2021.

The NBFCs and UCBs shall appoint such auditor for a period of 3 years only as per the Guidelines, since the RBI is the sectoral regulator for Banks & NBFCs including HFCs, and has the exclusive regulatory authority over the banking & non-banking sector.

Actionable for the entities to which the Guidelines shall apply:

- To identify whether the existing auditor is meeting the eligibility norms of the Guidelines.

- If yes, to check whether the existing auditor has completed a term of 3 years already. If the answer is affirmative, then such an auditor can not be re-appointed for a block of 6 years. If such auditor has conducted the audit of any Entity for part-tenure (1 year or 2 years), the remaining part of such period shall be allowed to be continued subject to the maximum period of 3 years.

- Where the existing auditor does not meet the eligibility norms, a new auditor shall be appointed in the ensuing AGM of 2021.

- The applicable entity shall, for the purpose of appointment of auditor, shall shortlist a minimum of 2 audit firms for every vacancy of SCAs/SAs.

- The auditor shall provide a certificate of eligibility as provided in the Form B to the Guidelines.

- The entity shall submit a certificate to the RBI within 1 month of such appointment in Form C to the Guidelines based on the certificate received from the auditor in Form B.

3. Cooling-off period

As per the Guidelines, while calculating the cooling off period between any non-audit works (services mentioned at Section 144 of Companies Act, 2013, internal assignments, special assignments, etc.) by the SCAs/SAs for the applicable entities or any audit/non-audit works for its group entities should be at least one year, before or after its appointment as SCAs/SAs.

However, the RBI has in its FAQs clarified that the requirement aforesaid cooling-off period shall be applicable prospectively- “…Therefore, if an audit firm is involved in some non-audit work with the Entity and/or any audit/non-audit work in other RBI Regulated Entities in the Group and completes or relinquishes the said assignment prior to the date of appointment as SCA/SA of the Entity for FY 2021-22, the said audit firm would be eligible for appointment as SCA/SA of the Entity for FY 2021-22.”

It should be noted that, an audit firm engaged with audit/non-audit works for the Group Entities (which are not regulated by RBI) may be considered for appointment as SCAs/SAs. However, the Board/ACB/LMC of the Entity must review that there is no conflict of interest and the independence of auditors is ensured. The minutes of the meetings of Board/AC shall also make note to this effect.

Further, it should be noted that the audit firm whose partner is a director of an RBI regulated entity in the group shall not be eligible to be appointed as the SCAs/SAs under these Guidelines. However, if such directorship is in an entity that is not regulated by RBI, the said audit firm shall make appropriate disclosures to the AC as well as Board while being considered for the appointment.

Thus, unlike the provisions of the Act, where only the term as auditor is considered for determining the eligibility after one term, the Guidelines casts an additional requirement where any kind of non-audit service rendered to the applicable entity including the group entities would have to be factored in the cooling-off period time of 6 years.

The entities and the suit firms have to be careful in identifying such services provided since it includes a wide range of services including those provided to the group entities of the applicable entity.

Note that the term ‘Group Entities’ shall refer to the RBI Regulated Entities in the Group only, which fulfill the definition of Group Entity, as provided in the Guidelines.

4. Individual Auditor Vs Audit firm

The Guideline provides additional eligibility criteria over and above the conditions specified in Sec. 141 of the Act. As per the eligibility norms, only a firm of auditors can be appointed as the SA of an applicable entity.

The Section 139 of the Act provides that a company may have either an individual auditor or a firm of auditor who fulfills the eligibility criteria as provided in Sec. 141.

Impact

The applicable entities shall ensure that only a firm of auditors that fulfills the eligibility norms and provides a certificate to this effect shall be appointed as the SAs. It can be seen that the direction 74 in Chapter XI of the RBI Master Direction on NBFC-SI- D & ND, also mandated the rotation of partners of the Statutory Audit firm after a period of 3 years, which implied that an individual auditor can not be appointed in an applicable NBFC.

The Guidelines have now expressly made it clear that only an audit firm can be appointed as the SAs of applicable entities with an asset size of 1000 crore and above, by providing eligibility norms which inter alia includes, minimum number of full-time partners, partner’s qualifications, minimum number of professional staff, etc.

The rationale behind such a bar on individuals being appointed as the SAs could be that, considering the asset size and the huge scale of operation with complex transaction structures, the audit efficiency and coverage should not be compromised with limited resources. Hence the eligibility criteria have specific provisions w.r.t qualification of partners & number of professional staff, etc.

5. Yearly ratification of Auditor appointment

As per the RBI guidelines, the Board/Audit committee shall assess the eligibility of the appointed statutory auditor on a yearly basis and shall submit a certificate to this effect with the RBI.

Meanwhile, the Companies Amendment Act, 2017 read with Notification S.O. 1833(E) dated 7th May 2018 deleted the provision of annual ratification of the appointment of auditor.

Prior to such deletion the proviso to Section 139(1) read as under;

‘Provided that the company shall place the matter relating to such appointment for ratification by members at every annual general meeting’

Impact

Though there is no requirement of ratification of appointment by members on a yearly basis, the Board/Audit Committee needs to make a yearly assessment which could be considered as an erstwhile yearly ratification under the Act.

Thus, the appointment will be done once for a period of 3 years in the AGM and thereafter every year the role of Board would be to confirm the eligibility to continue such appointment of the SA (para 3.3 read along with para 7.2 and 8.1).

6. Board approved Policy

The applicable entities shall formulate a board approved policy which will form the basis of appointment of SCAs/SAs which will cover the process of appointment, audit assessment, independence, branch audit, audit fees and removal of auditor.

The policy shall be framed after considering various factors including but not limited to, size and spread of assets, accounting and administrative units, complexity of transactions, level of computerization, etc.

The applicable entities shall also host such policy on the website of such entities to ensure public access.

7. Maximum Number of Auditors

As per the Guidelines, the applicable entities which satisfy the specified asset size have to limit the number of auditors it can appoint as provided in the guideline. Meanwhile the Act does not provide any ceiling limit on the number of auditors that can be appointed in an entity.

The Guidelines have fixed the minimum and maximum number of auditors that can be appointed based on the asset size of the applicable entity. Hence the intention here is to ensure efficiency of audit that commensurate with the scale of operation of the applicable entities.

Cap on Audit assignments

The Guidelines have also fixed the cap on the audit assignments that can be taken up by an individual audit firm during a year, which is as follows;

- 4 Commercial Banks (includes one PSB or AIFI);

- 8 UCBs (excluding co-operative societies) and;

- 8 NBFCs.

The cap will also be subject to the overall ceiling prescribed by any other statutes or rules applicable to such entities.

Further, the RBI FAQs dated June 11, 2021, has interestingly clarified that the limit on NBFCs will include all NBFCs that are regulated by RBI irrespective of the asset size. Thus, NBFCs with an asset size of less than 1000 crores to which the Guidelines are not applicable are included for the count of ‘total 8 NBFCs’ in the case of an audit firm to which these Guidelines are applicable.

The outcome of the above clarification would be that a number of audit firms may become ineligible due to the breach of the aforesaid limits.

8. Branch Audit

The Guidelines provides that the SCAs/SAs appointed shall visit and audit at least the Top 20 branches/Top 20% of the branches of the applicable entities (in case of entities having less than 100 branches), to be selected in order of the level of outstanding advances, in such a manner as to cover a minimum of 15% of total gross advances of the entities.

Meanwhile, the Sec. 143 (8) of the Act requires either the appointed SAs or any other person qualified to be appointed as the auditor to conduct the audit of the branch offices.

It is to be noted that, the Guidelines requires SCAs/SAs to physically visit and audit the accounts of the Top 20 branch offices selected on the basis of the criteria mentioned above. Meanwhile there is no such requirement under the Act.

Thus, the Guidelines has put an additional requirement of physical verification for top branches which may put logistic challenges as well to the SCAs/SAs during the course of audit.

Compliance requirement in case of vacation of SAs

In case the SA vacates the position of auditor due to the ineligibility under the Guidelines, the applicable entity shall undertake the following compliance requirement under the Act;

- Auditor shall send a letter to the Board citing reason as ineligibility under the RBI Guidelines;

- Board to accept the letter & initiate the process for appointing a new auditor under the Guidelines;

- File ADT-3 for the casual vacancy of the auditor;

- Audit Committee/Board to identity new auditor and check the eligibility;

- Considering it to be a case of casual vacancy not due to resignation but ineligibility due to introduction of new laws, the board is to appoint the new auditor within a period of 30 days of such vacation;

- The said auditor should be able to hold office till the next AGM where the appointment can be regularised;

- File ADT-1 for the appointment of the new auditor both after the board has appointed as in case of a casual vacancy and then at the time of regularisation at the AGM;

The compliance requirements under the SEBI circular on ‘resignation of statutory auditors from listed entities and their material subsidiaries’ is discussed below.

Whether the vacation of auditor will be construed as removal/resignation?

The vacation of auditor due to ineligibility under the Guidelines is neither a ‘resignation’ under the provisions of the Act and rules made thereunder nor is a ‘removal’ under the Act, since the same require the prior approval of the Central Government.

But as a matter of protocol, the intimation will be given to the stock exchange up on the vacation of the position of auditor.

Further, the Board of Directors shall also make the necessary noting in the minutes that the auditor has vacated the position due to ineligibility under the RBI Guidelines applicable to the entity.

Will the timeline be extended for adoption of the Guidelines?

The recent news reports[3] says that the RBI may grant extension of time for adoption of the new Guidelines for appointment of auditors. The various regulated entities and their stakeholders were making representation before the regulator due to the fact that many entities to which the Guidelines are applicable have either already re-appointed auditors for the year 2020-21 or were in the process of such appointment.

The applicable entities were of the view that the Guidelines should have been applicable from 1st April 2022, to avoid practical difficulties in identifying & short-listing eligible audit firms for appointment.

Hence the stakeholders may expect a relaxation on the applicability of the Guidelines by a year to give room for the transition to the new norms.

SEBI Circular- CIR/CFD/CMD1/114/2019 dated 18th October 2019: “Resignation of statutory auditors from listed entities and their material subsidiaries”

The capital market watchdog, Securities and Exchange Board of India issued from time-to-time issues circulars & directions to ensure timely disclosures to the investors for enabling them to take informed investment decisions.

Applicability of the Circular

Listed companies which have listed their specified securities and their material subsidiaries.

What is a material subsidiary?

As per the Regulation 16(1) (c) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, a material subsidiary shall mean a subsidiary, whose income or net worth exceeds 10% of the consolidated income or net worth respectively, of the listed entity and its subsidiaries in the immediately preceding accounting year.

Requirements of the Circular

As per the circular, the statutory auditor of a listed entity/material subsidiary up on resignation shall comply with certain conditions w.r.t limited review / audit report as per SEBI LODR Regulations, areas under:

| Basis | Condition

|

|

If the auditor resigns within 45 days from the end of a quarter of a financial year |

The auditor shall, before such resignation, issue the limited review/ audit report for such quarter.

|

|

If the auditor resigns after 45 days from the end of a quarter of a financial year

|

The auditor shall, before such resignation, issue the limited review/ audit report for such quarter as well as the next quarter

|

|

If the auditor has signed the limited review/ audit report for the first three quarters of a financial year

|

The auditor shall, before such resignation, issue the limited review/ audit report for the last quarter of such financial year as well as the audit report for such financial year.

|

Further the Chairman of the Audit Committee of the listed entity plays a vital role in dealing with the concerns of the auditor in case of non-availability of information / non-cooperation by the management which may hamper the audit process.

The circular also mandates to include the aforementioned conditions in the terms of appointment of the statutory auditor at the time of appointing/re-appointing the auditor.

Obligations of the listed entity and its material subsidiary

Upon resignation, the listed entity / its material subsidiary shall obtain information from the Auditor in the format as specified in Annexure A to the Circular.

The listed entity shall also make disclosure of the same under the Sub-clause (7A) of Clause A in Part A of the Schedule III under Regulation 30(2) of SEBI LODR Regulations.

Further, the listed entity shall continue to provide all such documents/information as may be necessary for the audit / limited review from the period of communication of resignation and till such report is received by the entity.

Disclosure of Audit Committee’s views to the Stock Exchanges

The Audit Committee has to deliberate upon the concerns raised by the auditor in relation to the resignation not later than the next meeting of the committee and shall communicate its views to the management.

The listed entity shall ensure the disclosure of the Audit Committee’s views to the stock exchanges as soon as possible but not later than twenty-four hours after the date of such Audit Committee meeting.

Applicability of SEBI Circular where an existing auditor is ineligible under the Guidelines

SEBI, in the circular had provided the rationale that the resignation of a SAs from the listed entity/its material subsidiary before completion of the audit of the financial results for the year due to reasons such as pre-occupation may seriously hamper investor confidence and deny them access to reliable information for taking timely investment decisions.

The question arises here is that whether such vacation of due to ineligibility under the RBI Guidelines in a listed applicable entity can be considered as a resignation and thereby the provisions of the circular would apply on such auditor & the entity?

It is to be noted that the existing auditor has to vacate the position of the auditor due to a dis-qualification caused by a Statutory Guideline and not a voluntary act of its own. Hence, such a vacation of the position of SA before the completion of earlier appointed term can not be called a ‘resignation’ within the meaning of the aforesaid circular.

Having said that, looking at the very intention of the circular which is to protect the larger interests of the capital market and the investors in it, any instances that would hamper the investor confidence and the availability of reliable information should be avoided.

Hence, if the existing auditor of the listed entity is ineligible to continue as the auditor of the entity as per the Guidelines, though the same shall not be regarded as a resignation by the auditor, such auditor shall comply with the provision of the Circular.

Our FAQs on the RBI Guidelines can be read here

Conclusion

The RBI Guidelines on the appointment of SCAs/SAs have brought stricter norms for commercial banks, UCBs and applicable NBFCs in terms of identifying and appointing a SCA/SA in the entity. It can be viewed that the underlying intent behind the Guidelines is to improve the audit efficiency and to ensure that auditor independence is not compromised by having a long-term association with companies.

Being the sectoral regulator for Banks & NBFCs including HFCs, RBI has the exclusive regulatory authority over the banking & non-banking sector. Accordingly, even though these Guidelines contain requirements which are stringent in nature as compared to the Act, it is clear that it shall have an overriding effect on other laws for banking & non-banking entities in this regard.

Our other related articles:

[1]https://www.google.com/url?q=https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NOTI258A67AD30976F44929FA2AB2B41DC805D.PDF&sa=D&source=hangouts&ust=1623235495598000&usg=AFQjCNGlg6SeSaaNBW1Jpx3iubF50SpXjw

[2]https://www.sebi.gov.in/legal/circulars/oct-2019/resignation-of-statutory-auditors-from-listed-entities-and-theirmaterial-subsidiaries_44703.html

[3]https://www.thehindubusinessline.com/money-and-banking/rbi-may-give-banksnbfcs-more-time-to-appoint-auditors/article34782339.ece

Leave a Reply

Want to join the discussion?Feel free to contribute!