Creating regulatory eco-system for SPACs in India

– Ajay Kumar KV, Manager & Himanshu Dubey, Executive

From a little-known word and a preserve of a select few finance professionals, the term Special Purpose Acquisition Companies (SPACs) is today a buzzword. The regulators across the globe are taking necessary actions to enable SPACs to raise money from investors – jurisdictions like the US, UK and Malaysia lead from the front. Having a sound regulatory framework is important because if investors are keen towards SPACs, and the regulators do not enable it, it is quite likely that the country will not be a friendly destination for SPACs. Hence, India’s securities regulator SEBI has recently constituted an Expert Group for examining the feasibility of SPACs in India, and the International Financial Services Center Authority (IFSCA) has issued IFSCA (Issuance and Listing of Securities) Regulations, 2021[1] which provides a regulatory framework for listing of SPACs within its jurisdiction.

In this write up, the authors take a look at the global legislative measures, and also outline the various changes in the regulations that may be needed in India to enable to make India a SPAC-friendly jurisdiction.

Contents

Important regulatory concerns. 3

- Sponsor’s contribution. 4

- Safekeeping of IPO proceeds. 4

- Acquisition Process. 4

- Managing conflict of interest 5

- Exit mechanism… 5

- Speculation on shares. 5

- Celebrity endorsements. 6

Regulatory framework in India. 6

Exploring some scenarios and the concomitant regulatory ramifications. 13

Regulatory framework on SPACs abroad. 16

Introduction

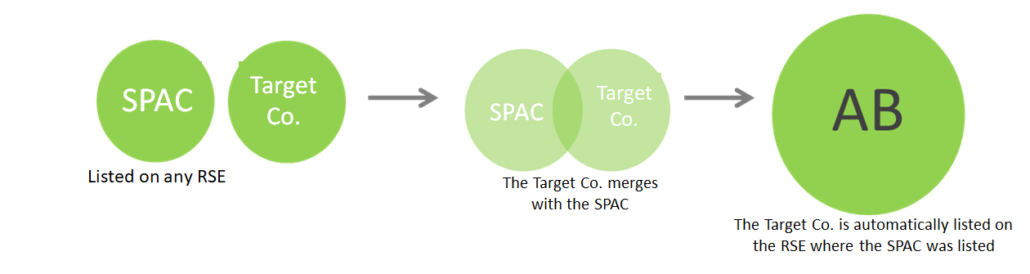

For the uninitiated, a SPAC is a non-operating company with the admitted intent of doing an acquisition of a potential target. Importantly, at the time of its public offering, a SPAC has no business. It is only formed with the intent of acquiring another company, viz., the target. The sponsors of SPACs are typically fund managers or private equity investors. The sponsors put some of their money; but the larger part of the money is garnered through a public offering. The SPAC needs to complete the acquisition of a target within a stipulated time, or return the money raised from the investors.

Offering, and public offerings in any jurisdiction are always subject to substantial regulation and oversight – SPACs are no exception. Infact, the need for a proper regulation becomes all the more pressing because of the inherent opacity – a special purpose entity raising funds for a target which is not even identified at the time of the offering. It thus becomes imperative for the concerned regulatory authorities to ensure that the economic value inherent in SPACs is fully exploited and it doesn’t become a tool for raising investors’ money without any sense of answerability or accountability.

The extent and complexity of the regulatory provisions differ from jurisdiction to jurisdiction. Before diving deep into the regulatory environment of SPACs, let us first understand the process starting from the formation of SPACs to the final acquisition of the target.

Once the SPAC is formed, the sponsors then quickly move towards its IPO. The first thing that comes up in this process is to appoint necessary intermediaries and issue the prospectus. The disclosure requirements of prospectus vary from jurisdiction to jurisdiction.

Important regulatory concerns

A SPAC is essentially a shell company formed with the ‘special purpose’ of acquiring a target company and with a proposal of future economic benefits. As is known to all, shell companies have been a matter of concern to regulators across the globe, importantly because shell companies have been infamously known to vanish into the thin air after taking public money on false promises. But a SPAC is not your regular shell company that most regulators have already blacklisted in their records – these are companies that come with a strict regulatory framework with lesser supervisory control as compared to traditional listed companies.

While the regulatory framework across different jurisdictions continues to evolve based on experience and on field challenges, USA has been leading the race in terms of the highest number of IPOs gathering billions of dollars since the inception of SPACs.

Some of the major regulatory concerns have been ensuring that the sponsor’s have their skin in the game right from the start till the successful acquisition of a target, safe keeping of IPO proceeds, ensuring an acquisition within a reasonable timeline, managing of conflict of interest and appropriate disclosures to shareholders while obtaining shareholders’ consent for potential acquisition and measures of return of money back to shareholders in case the SPAC fails to meet its objective within the allowed timeline.

1. Sponsor’s contribution

The whole amount cannot be raised through IPO only. Sponsors are also obliged to contribute funds which generally fall around 20% of the total issue[2]. However, the shares issued to sponsors pursuant to their contribution (‘founder shares’) is different from the units issued to the public via IPO as they receive it for a nominal price which would dilute the relative value of other shareholders. Further, even though both of them carry the same voting rights, it is only the founder shares that carries the right to appoint directors on the Board of SPAC.

2. Safekeeping of IPO proceeds

The money raised through IPO is kept in an escrow account till the time a target company is identified for acquisition. Only the expenses incurred on running the SPAC and necessary fees & charges required to be paid can be appropriated against the money held in the escrow account.

3. Acquisition Process

Various regulatory authorities across jurisdictions have even prescribed the timeline by which the SPAC shall identify a target and complete the acquisition. Once a target is finalised, the approval of the shareholders is sought. Upon approval, the SPAC heads towards the acquisition of the target. However there may be instances where the amount required for acquiring the target may be higher than the amount raised through IPO together with the contribution of the sponsors. In such a scenario, additional funds are brought in exchange of equity, called Private Investment in Public Equity (PIPE).

After the acquisition is complete, the target becomes a listed company without actually going through the meticulous and perplexing compliance requirements of a traditional IPO. The investors holding units in SPACs become the shareholders of the target company.

4. Managing conflict of interest

One of the challenges that regulators face is to ensure that there is no conflict of interest of the sponsors vis-a-vis investors, in a potential acquisition transaction. It is possible that the sponsor may use the SPAC to acquire an entity in which the sponsor has a direct or indirect interest and in such cases, the sponsor shall have to disclose the complete details while approaching the shareholders for approval. USA has made strict provisions for disclosure of interest by sponsor(s) and even allows shareholders to exit the SPAC if the proposal of potential acquisition is not in their interest.

5. Exit mechanism

A question that ponders in the minds of every prospective investor is whether he/she may be able to sell the units allotted to them after investing and what amount they will receive at such an exit. USA has made clear provisions for exit under which a unit holder can exit when the proposal of an acquisition is placed before the shareholders or the SPAC is unable to meet its objective within the allowed timeline. Similar provisions, as discussed below, have also been embibed by IFSCA (Issuance and Listing of Securities) Regulations, 2021, thereby protecting the investors’ principal sum.

6. Speculation on shares

Once the SPAC shares are admitted for trading on the exchange, there could be chances of speculation on the shares based on the possible targets being considered by the SPACs for acquisition. This may lead to price changes and volatility for public investors. However, investors may be assured of the fact that the price at which the target company is listed is a negotiated price and as such is free from market sentiments, rumours and influences – thus, giving an optimal price.

7. Celebrity endorsements

While investment on the sponsors’ confidence and experience is free from the market speculations, the USA market has seen some celebrity endorsements and co-investment in SPACs with substantial advertisement through social media. In such cases, even if such endearment may come as a legitimate interest, however, they provide no guarantee of returns and may lead to share price volatility. It shall, at no instance, be a substitute for proper due diligence

Regulatory framework in India

Recently, IFSCA (Issuance and Listing of Securities) Regulations, 2021 (‘IFSCA Listing Regulations’) have been issued. It is a first of its kind regulations in terms of providing regulatory recognition to SPACs in India.

Similarly, Securities and Exchange Board of India (SEBI) in March, 2021 formed an expert group to study the feasibility of SPACs in India[3]. However, there has been no further development regarding the same.

In India, the regulatory arena on SPACs revolves primarily around the followings:

- The Companies Act, 2013 (Act)

- SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (ICDR)

- Foreign Exchange Management (Cross Border Mergers) Regulations, 2018 (CBMR)

- Income Tax Act, 1961

Issues under the Act

- Incorporation stage

At the time of incorporation, the ‘object clause’ of the Memorandum of Association (MoA) of the SPAC will have to state that the entity has been formed for the purpose of acquiring another entity, which until its listing remains unidentified. This poses a preliminary question as to whether a mere statement that the company has been formed for the purpose of acquisition will suffice or atleast the industry in which the company intends to make the acquisition shall also be mentioned.

Further, the Section 10A read with Rule 23A of the Companies (Incorporation) Rules, 2014 requires that a declaration is to be filed by a director within 180 days of incorporation that the company has commenced its business. If the aforesaid requirement is not fulfilled then the Registrar may initiate a strike-off process.

In the case of SPACs, what will actually tantamount to commencement of business is an open question. Since, they do not have any other business except the acquisition of another potential entity, how then, can a director of a SPAC give such a declaration is to be debated.

Given the very nature of SPACs, and that they are allowed a period of 36 months for identifying and acquiring the target company, it is understood that certain amendments/ exceptions would be required in the extant provisions.

- Approval for Scheme of Arrangement

The Sections 230 to 232 of the Companies Act, 2013 governs compromise or arrangement between the company and its creditors or between the company and its members. It can take place in the form of reorganisation of capital, corporate restructuring including sale of assets or the whole business of the company or amalgamation with another company.

The scheme of arrangement shall have to be approved by the Hon’ble National Company Law Tribunal and is a lengthy process, involving several rounds of approval from different stakeholders like the shareholders; regulatory authorities. The parties to such arrangement have to go through a number of procedural matters including calling of meetings of members, creditors or any classes thereof, newspaper advertisements, accounting treatments, obtaining any other sectoral regulatory approvals,if applicable. These activities are expensive as well as time consuming.

While a typical acquisition time period of a SPAC acquisition ranges from 18-24 months, it would be doubtful if SPAC can be accommodated under the existing regime.

- Cross border merger- RBI approval

The Section 234 of the Companies Act, 2013 deals with merger or amalgamation of an Indian company with a Foreign company. The provision requires every foregin company to obtain prior approval from the Reserve Bank of India to merge into an Indian company and vice versa.

This is another hurdle for SPAC acquisitions as every such acquisition would require the regulator’s approval and from the past experiences, obtaining such approvals is not a cake walk. Once again a short time window puts concern for SPAC as the basic idea is to avoid procedural roadblocks and to achieve a faster acquisition process.

- FEMA compliances

A cross border merger is also governed by the Foreign Exchange Management (Cross Border Mergers) Regulations, 2018 and Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2014. Where the SPAC is listed outside India or if an Indian SPAC receives investment from foreign investors, the provisions of the aforesaid regulations would apply.

The regulations provide that the Indian office of the target company shall be deemed to be the branch office of the combined entity upon the approval of the scheme of merger by the NCLT.

The regulations further states that, a resident individual may acquire securities outside India, provided that the fair market value of such securities is within the limits prescribed under the Liberalized Remittance Scheme (presently USD 250,000/financial year) and the Foreign Exchange Management (Transfer or issue of any Foreign Security) Regulations, 2004 are complied with.

Issues under the SEBI ICDR

For coming up with IPO, the SPACs will have to face following hurdles pursuant to the ICDR:

1. The eligibility requirement pursuant to Regulation 6:

- Net tangible asset of at least INR 3 crore in each of the preceding three years (earlier requirement of maximum of 50% to be held in monetary assets has been done away with in case the entire public offer is through sale).

- Minimum average consolidated pre-tax operating profit of INR 15 crore during any three of the last five years.

- Net worth of at least INR 1 crore in each of the last three years.

Since SPACs don’t have any business and are formed for the sole purpose of acquiring another company, they cannot meet this requirement. However, they may still be eligible to make an initial public offer only if the issue is made through the book-building process and at least seventy five per cent of the net offer is allotted to qualified institutional buyers (QIBs).

2. Though Special Rights (SR) equity shares are allowed, how the same may be applicable to SPACs is a matter of interpretation. In case of SPACs, as already discussed above, there are two types of shares- the founder shares and the units issued to investors. Both have same rights except for appointment of directors since this right is reserved and voting rights on this particular matter is exercisable only pursuant to holding of founder shares.

3. If the above mentioned falls under the SR shares category, ICDR provides for certain other requirements to be complied in case of SR shares as mentioned under Regulation 6(3). At the very perusal of the requirements, the following hurdles can be recognised for SPACs:

- The issuer shall be intensive in the use of technology, information technology, intellectual property, data analytics, bio-technology or nano-technology to provide products, services or business platforms with substantial value addition. It doesn’t seem that SPACs fall under any of these or if the said requirement will be deemed to be fulfilled if the acquisition target of the SPAC falls under any of these criteria. Nevertheless, an amendment to pave way for SPAC will be necessary;

- The SR shares were issued only to the promoters/ founders who hold an executive position in the issuer company. It might be a hurdle to issue SR shares to sponsors who are body corporate;

- The SR equity shares have been held for a period of at least 6 months prior to the filing of the red herring prospectus. There might be cases where SPACs proceed for IPO as quickly as possible and therefore may fall short of meeting this requirement.

In case either of the SPACs or the target is a foreign company, the CBMR will come into picture. The compliances will differ depending upon whether it’s an inbound merger i.e. where the resulting company will be an Indian company or outbound merger i.e. where the resulting company will be a foreign company. We already have such examples in India like Yatra, Videocon DTH etc. which were merged with a SPAC and subsequently became listed on a foreign stock exchange.

Regulatory framework for SPACs as per the IFSCA (Issuance and Listing of Securities) Regulations, 2021

The Chapter VI of the IFSCA (Issuance and Listing of Securities) Regulations, 2021 (Regulations) provides the framework for IPO and listing of SPACs within its jurisdiction

1. Conditions to be satisfied for raising funds through IPO:

- the target business combination has not been identified prior to the IPO; and

- the SPAC has the provisions for redemption and liquidation in line with the Regulations

2. Salient features of the Regulations w.r.t. SPACs:

- Offer size: Not less than USD 50 million or any other amount as may be specified by the Authority from time to time;

- The sponsors shall hold at least 15% and not more than 20% of the post issue paid up capital:

Provided that the sponsors shall also have aggregate subscription (all securities) in terms of amount in the SPAC company prior to, or simultaneous to the IPO, amounting to:

(a) at least 2.5% of the issue size or

(b) USD 10 million, whichever is lower, or

(c) any other amount as may be specified by the Authority;

- Pricing: The issue shall be made through a fixed price mechanism and in consultation with the Lead Managers. However, the price of the equity shares in the initial public offer shall not be less than USD 5 per share;

- Minimum application: the minimum application size in an initial public offer of SPAC shall be USD 100,000;

- Minimum subscription: the minimum subscription received in the issue shall be at least 75% of the issue size;

- Minimum subscribers: the minimum number of subscribers shall be 50 or as may be specified by the Authority. Also, no single application shall be allotted more than 10% of the post issue capital and the allotment to investors shall be on proportionate basis or discretionary basis, as disclosed in the offer document;

- SPAC specific obligations: requirements have also been prescribed with respect to maintenance of escrow account, eligible investments pending utilisation, acquisition timeline of 3 years extendable upto 1 year, right of dissenting shareholders, liquidation provisions, etc.

3. Opening of Escrow account and compliances thereon

The entire proceeds of the IPO, together with 50% of the underwriting commission, shall be kept in an interest-bearing escrow account controlled by an independent custodian until the execution of the SPAC‘s business combination. The escrow funds shall be invested only in instruments disclosed in the offer document and shall include only short-term investment grade liquid instruments.

The income derived from the amount placed in the escrow account may be withdrawn by the issuer for the following purposes:

- Payment of taxes; and

- General working capital expenses, subject to prior approval by way of special resolution of the shareholders other than sponsors

4. Disclosure of acquisition target

While seeking the approval of shareholders, the SPAC is obliged to file a detailed prospectus with the recognised stock exchange(s) setting out the relevant disclosures regarding the proposed business combination which inter alia includes the following disclosures:

- Overview of industry and business, organisational structure, board of directors, management and key managerial personnel (KMPs), major shareholders, material shareholders‘ agreements, audited financial statements for at least previous 3 financial years, outstanding material litigations against the company and its directors and KMPs, potential conflicts of interest and other material information;

- Information about the business combination transaction including valuation of the entities and the methodologies used for valuation;

- Information about the process involved in the business combination and the various regulatory and statutory approvals required for completion of the transaction;

- Information about the resulting issuer company that would be formed after completion of the business combination; and

- Any other information as may be specified by the recognised stock exchange(s) or IFSCA from time to time.

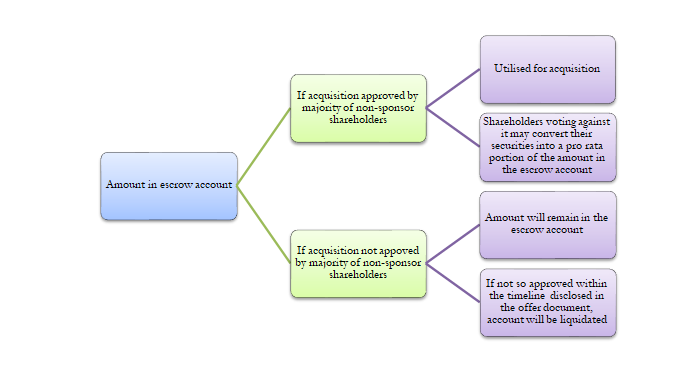

5. Prior approval by Shareholders

The acquisition shall obtain prior approval from the shareholders by majority of the votes cast by shareholders other than sponsors(s) and if a shareholder votes against it, he may convert his securities into a pro rata portion of the aggregate amount deposited in the escrow account (net of taxes payable) and exit from the investment.

6. Change in control of the SPAC

In the event of change in control of the SPAC, the SPAC issuer shall provide the redemption option to the shareholders (other than sponsors) for converting their securities into a pro rata portion of the aggregate amount held in the escrow account (net of taxes payable).

7. Liquidation of Escrow

The SPAC issuer shall complete the business acquisition within the timeline disclosed in the offer document not exceeding 36 months of the date of listing and if an acquisition is not completed within the aforesaid time period, the escrow account shall be liquidated in terms of the Regulations and disclosures in the offer document and the sponsors shall not participate in the liquidation distribution in the event of liquidation and delisting.

8. Restriction on transfer of shares

A sponsor shall not transfer or sell any of his specified securities prior to the completion of a business combination. The SPAC issuer shall ensure that the businesses acquisition shall have an aggregate fair market value equal to at least 80% of the aggregate amount deposited in the escrow account, excluding deferred underwriting commissions held in escrow and any taxes payable on the income earned on the escrowed funds. The SPAC and the sponsors shall ensure that there is no related party transaction or connection of sponsor or any of their associates with the business combination.

9. Post combination requirements

The resulting issuer shall immediately disclose details regarding the completed transaction to the recognised stock exchange(s) and shall be required to meet the listing eligibility criteria set out in the Regulations within 180 days, in order to continue listing on the recognised stock exchange(s). It shall also comply with the listing obligations and continuous disclosure requirements as specified in the Regulations

10. Lock-in of Shares

The shareholding of the sponsors of the SPAC in the resulting issuer shall be locked up for a period of one year from the date of closing of the business combination and the shareholding of the promoters, promoter groups, controlling shareholders, directors and key managerial personnel of the resulting issuer shall be locked up for a period of one year from the date of closing of the business combination.

Exploring some scenarios and the concomitant regulatory ramifications

Merger of a SPAC incorporated in IFSC with a company incorporated in India (other than in IFSC): whether a cross border merger or a domestic merger?

The concept of IFSC traces its regulatory inception in India from Section 2 (q) of the Special Economic Zones (SEZ) Act, 2005[4] which says that an IFSC means an IFSC which has been approved by the Central Government under sub-section (1) of section 18. Section 18(1) of the aforesaid Act says that the Central Government may approve the setting up of an IFSC in a SEZ and may prescribe the requirements for setting up and operation of such IFSC.

The concept of SEZ was introduced to create such jurisdictions within the country which provides ease to businesses for setting up units by providing various relaxations and benefits. IFSC is also a kind of SEZ, meant especially for financial services. Both SEZs and IFSC are considered to be foreign jurisdictions for certain purposes but can not be construed that they will be considered as such for all purposes. SEZs are provided with certain benefits and relaxation wrt direct and indirect tax as well as import-export among other things. However, they are still governed by the Indian laws and considered as Indian companies for all other purposes unless specifically exempted.

Similarly, the units in IFSC will be governed by the normal laws applicable to companies in any other part of the country except for those provisions in respect of which IFSCA has issued specific regulations. Therefore it cannot be said that the IFSC units shall be considered as foreign companies for all purposes. The FAQs[5] released by the IFSCA also indicate the same on the question of key difference between a IFSC unit and a domestic unit by saying that a unit set up in IFSC is treated as a “person resident outside India” (i.e. non-resident) for exchange control purposes whereas a domestic unit is treated as a “person resident in India”. Hence, an IFSC unit enjoys the privileges of a non-resident under exchange control provisions.

This clearly indicates that for certain purposes the IFSC units will be considered as a foreign/non-resident entity like in the instant case the AIF units registered in IFSC will be exempted from exchange control provisions as applicable to AIFs in the rest of the country. But as previously mentioned, the provisions applicable to units incorporated in the rest of the country will be applicable to units registered in IFSC as well, until they are specifically exempted.

On mere perusal of the Companies Act, 2013, we see a bunch of exemptions and relaxations to IFSC units however the same manifests this too that for all those provisions where no exemption or relaxation is provided to IFSC units, the provisions as applicable to all other companies applies to them as well. Thus, a merger between a SPAC registered in IFSC and a company incorporated in India (other than in IFSC) will be considered as a domestic merger under the provisions of Section 230-232 of the Companies Act, 2013.

Acquisition without merger

The possibility of instances where SPACs acquire companies but do not actually merge with them cannot be ruled out. Though the aforesaid possibility is minimal since one of the main objectives for SPACs acquisition is that the company being acquired becomes a listed company post the acquisition. However, assuming the possibility that a SPAC is formed with the intent to bring increased participation of retail investors in private equity investments, let’s explore the scenario where a SPAC merely acquires a target but does not undergo a merger.

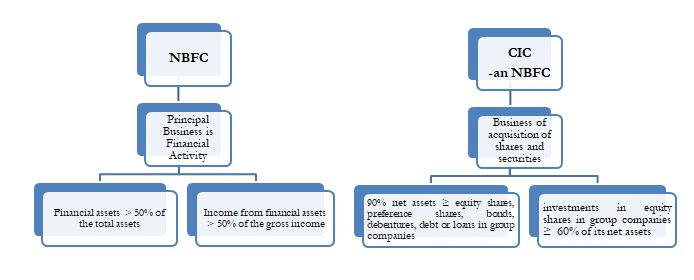

To explore the above mentioned scenario, it is imperative to understand the meaning of Non-banking Financial Companies (NBFCs) and Core Investment Companies (CICs) in India.

Reserve Bank of India (RBI) Act, 1934 defines NBFC[6] as a company the principal business of which is financial activity i.e. the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business with certain exceptions.

Further, financial activity is considered as a principal business when a company’s financial assets constitute more than 50 per cent of the total assets and income from financial assets constitute more than 50 per cent of the gross income. A company which fulfils both these criteria will be registered as NBFC by RBI. The term ‘principal business’ is not defined by the Reserve Bank of India Act. The Reserve Bank has defined it so as to ensure that only companies predominantly engaged in financial activity get registered with it and are regulated and supervised by it. Hence, if there are companies engaged in agricultural operations, industrial activity, purchase and sale of goods, providing services or purchase, sale or construction of immovable property as their principal business and are doing some financial business in a small way, they will not be regulated by the Reserve Bank. Interestingly, this test is popularly known as 50-50 test and is applied to determine whether or not a company is into financial business.

The SPAC in the above mentioned scenario may also fall within the purview of CIC. CIC is a NBFC which carries on the business of acquisition of shares and securities and holds not less than 90% of its net assets in the form of investment in equity shares, preference shares, bonds, debentures, debt or loans in group companies. Further investments in equity shares in group companies constitutes not less than 60% of its net assets[7].

One more dimension that must be considered in the given scenario is when the SPAC holds multiple acquisitions. In such a case, there is a possibility that it might be categorised as an Alternative Investment Fund (AIF). AIF means any fund established or incorporated in India which is a privately pooled investment vehicle that collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors[8].

The crux of exploring possibilities of a SPAC acquisition without merger is to illustrate how that scenario may lead to a SPAC being categorised as an NBFC, CIC or an AIF. Falling under the purview of any of the aforesaid set-up will also attract compliance burden of various regulations, guidelines, circulars, etc. issued by the RBI or the SEBI as the case may be.

Regulatory framework on SPACs abroad

1. Malaysia

Malaysia was one of the early runners when it came to give SPACs regulatory recognition. The Malaysian Securities Commission issued Equity Guidelines in 2009[9] which provides for a regulatory framework for listing of SPACs in Malaysia. The first SPAC to be listed in Malaysia was Hibiscus Petroleum Berhad which was listed on the Main Market of Bursa Malaysia on 25 July 2011. It was anticipated that Malaysia will become the center for SPACs especially with regard to acquisitions in the oil and gas sector. Though the aforesaid didn’t go as expected still we shall look at the provisions that the Malaysian regulator prescribed for SPACs.

In order to list SPACs on Bursa Securities in Malaysia, the same must be incorporated in Malaysia. This unequivocally manifests that there is no space for a SPAC incorporated outside Malaysia to seek listing there. Let’s understand the other requirements to be complied by SPACs:

Issue size and pricing

- SPACs must issue new securities to the investors since an offer for sale is restricted in their case

- The minimum amount that a SPAC shall raise through the IPO shall be RM 150 million, which in terms of US dollars comes around 35-36 million

- Pricing of the securities has to be determined in relation to the price of securities offered to the management team and pre-IPO investors. The minimum effective price (MEP) of securities issued to the management team must be at least 10% of the price at which the securities are offered under the IPO and the same shall be at least 60% of the price at which securities offered to pre-IPO investors i.e. investors other than the management team who invested in the SPAC before the IPO

Sponsors’ contribution and restriction on diluting stakes

- Members of the management team must, in aggregate, own at least 10% equity interest in the SPAC on the date of its listing

- Members of the management team are not allowed to sell, transfer or assign their entire holdings in the securities of the SPAC as at the date of listing of the SPAC, from the date of listing until the completion of qualifying acquisition. Upon completion of the qualifying acquisition, members of the management team are allowed to sell, transfer or assign up to a maximum of 50% per annum, on a straight-line basis, of their respective holdings in the securities under moratorium

- Similarly pre-IPO investors are also not allowed to sell, transfer or assign their entire holdings in the securities held in the SPAC as at the date of listing of the SPAC, which were acquired at a price lower than the price offered under the initial public offering, from the date of listing until the completion of the qualifying acquisition

IPO proceeds and escrow account

- A minimum of 90% of the IPO proceeds shall be deposited into a seperate account. The guidelines use the term ‘trust account’ instead of ‘escrow account’

- The reason for the amount not so deposited shall be disclosed and shall also be mentioned in the prospectus

- Such proceeds from the IPO that are not placed in the trust account must not be utilised for the payment of remuneration, including any remuneration-in-kind, directly or indirectly, to the members of the management team or their related parties. The ambit of the clause is wide enough which specifically includes consulting fees, bonus, loans etc.

- The amount not deposited in trust account may be used for defray expenses related to IPO and operating costs or searching and acquiring the target

Acquisition

- The resolution for approving the acquisition must be approved by a majority in number of the holders of voting securities representing at least 75% of the total value of securities held by all holders of voting securities present and voting either in person or by proxy at a general meeting duly called for that purpose. In case of more than one acquisition, each acquisition must be approved by the holders of voting securities in the same manner. Members of the management team and persons connected to them must not vote on such resolution

- If the SPACs fails to make an acquisition, it shall be liquidated and all the amount shall be distributed to investors other than the members of the management team and pre-IPO investors. A pre-IPO investor will be eligible for the amount distributed pursuant to liquidation only for those securities bought by them during and after the listing. Similarly members of the management team will be entitled to the distribution proceeds only for those shares bought by them after the listing.

2. Canada

The Toronto Stock Exchange (TSX) prescribes the TSX Company Manual[10] which provides for the requirements of SPACs listing in the TSX. TSX recommends that SPACs seeking listing on the Exchange be incorporated under Canadian federal or provincial corporate laws. Where a SPAC is incorporated under laws outside of Canada and wishes to list on the Exchange, the Exchange recommends that it obtain a preliminary opinion as to whether the jurisdiction of incorporation is acceptable to the Exchange. Other requirements of the TSX Company Manual are as follows:

Issue size and pricing

- A minimum of 30 million Canadian Dollars shall be raised via IPO

- The prospectus shall contain a statement that the issuer as of the date of filing, has not entered into a written or oral binding acquisition agreement with respect to a potential qualifying acquisition

- The minimum price of shares/units shall be $2.00 per share or unit

- Public holders shall hold not lease than 1,000,000 freely tradable securities

- Minimum number of public holders shall be 150, holding at least one board lot each

Escrow account

- Atleast 90% of the IPO proceeds shall be deposited in the escrow account

- The said amount may be invested in certain permitted investments but SPACs need to disclose the proposed nature of such investments in the prospectus

- The underwriters shall also deposit 50% of their commission from IPO in the escrow account till the time of completion of acquisition

Acquisition

- A SPAC must complete a qualifying acquisition within 36 months of the date of closing of the distribution under its IPO prospectus and if there are more than one acquisitions, the same shall be completed within 36 months

- The acquisition must be approved by majority of directors unrelated to the qualifying acquisition and majority of shareholders casting votes

- There are certain conditions under which shareholders approval will not be required for the acquisition but the same shall be disclosed in the prospectus

- If a SPAC fails to make the acquisition within the permitted time frame of 36 months, it must complete liquidation distribution within 30 calendar days after the end of such permitted time, pursuant to which the escrowed funds must be distributed to the holders of shares (other than founding securityholders in respect of their founding securities) on a pro rata basis

- The 50% of the underwriting commission deposited in the escrow account shall also be distributed

3. United Kingdom (UK)

The Lord Jonathan Hill Review[11] had recommended changes in the UK’s listing regime to ease out the current regulatory regime of SPACs in the UK. As per the existing regulations, SPACs are listed in the standard listing segment as they are unable to meet the conditions for premium listing including independence of business and track record requirements, etc.

The IPO process

- Capital raised via offering of share and/or warrant.

- The proceeds of the offer are normally held in US Treasuries and other money market instruments till acquisition.

- In order to have their ‘skin in the game’, the sponsor can purchase warrants/ordinary shares in addition to their founder shares’.

Post-IPO

The industry knowledge & experience of the sponsor is the key factor behind the identification of the target for acquisition.

- The average period to complete an acquisition is 24 months.

- The acquisition will take place in the form of a Reverse Takeover (RTO).

- Once the initial business combination is announced, the trading on the shares of SPAC is suspended due to the presumption that there will be insufficient publicly available information in the market.

- A RTO requires a re-listing of the new entity, cancellation of the existing listing and the need to go through the usual eligibility process to achieve re-listing.

- SPACs will require shareholder approval if they list on AIM (London Stock Exchange’s market for small and medium size growth companies), however shareholder approval is not required on the Standard Segment.

- The business operates under a public listing to create value for investors, alongside sponsors.

- The proceeds after deducting expenses are returned to the investors.

The Lord Jonathan Hill Review has made recommendations for revision in listing rules for removing the existing provisions including the requirements of RTO, suspension of trading upon announcement of an acquisition, etc.

FCA Consultation on Investor Protection measures for SPACs[12]

The Financial Conduct Authority of the UK released a consultation on 30th April 2021, for the proposed changes to Listing Rules in order to bring flexibility in the UK market for SPAC listings.

In order to avoid suspension of trading upon announcement of an acquisition, the SPAC shall satisfy the following conditions;

- Minimum size of IPO- £200m to be raised in the initial IPO

- Ring-fencing of IPO proceeds- to ensure IPO proceeds are used either to fund an acquisition, or is returned to shareholders after deducting any expenses incurred on the SPAC;

- Shareholder approval- To obtain shareholder approval for any proposed acquisition (to make sufficient disclosure in case of conflict of interests)

- Exit opportunity- The investors shall be provided with an opportunity to exit a SPAC, prior to any acquisition being completed and/or after a time limit on a SPAC’s operating period if no acquisition is completed;

- Public disclosure – adequate disclosure shall be made to investors on key terms and risks from the SPAC IPO, including at time of any reverse takeover deal.

- Time limit for acquisition – A period of 2 years which can be further extended by 12 months subject to the approval of public shareholders.

4. United States of America (USA)

USA has the highest number of SPACs worldwide and has one of the most structured regulatory frameworks.

- At the IPO stage, the investor relies on the management team that formed the SPAC, i.e., the sponsor(s), as the SPACs look to acquire or combine with an operating company. This is known as the initial business combination.

- The potential target may be an operating company or a specific industry but it is not obligated to pursue a target in the identified industry.

- Once the SPAC has identified an initial business combination opportunity, the business combination is executed, if approved by SPAC shareholders. This transaction happens in the form of a reverse merger in which the target company merges with and into the SPAC or a subsidiary of the SPAC.

- The typical period of executing a business combination ranges from 18-24 months. An extension of this time period may require shareholders’ approval.

- SPAC may give its investors an opportunity to redeem their shares rather than become a shareholder of the combined company after acquisition.

- If the SPAC is unsuccessful in a business combination within the stipulated time, shareholders are beneficiaries of the trust money and are entitled to their pro rata share of the aggregate amount held in the trust account.

SPAC IPO

- SPAC units are usually priced a nominal $10 per unit. The identifiable difference compared to a traditional IPO is that a SPAC IPO unit price is not based on a valuation of an existing business.

- A SPAC IPO can be structured to offer investors a unit of securities consisting of (1) shares of common stock and (2) warrants.

Note: A warrant gives the holder the right to purchase from the company a certain number of additional shares in the future at a certain price, often at a premium to the current stock price at the time of issue of the warrant.

IPO Proceeds

- The IPO proceeds, after basic charges and related expenses are held in a trust account (as per SEA Rule 419). Alike an escrow account the money is kept till the acquisition or the SPAC is liquidated for not having completed an acquisition within a certain period of time.

- SPACs generally invest the proceeds in relatively safe, interest-bearing instruments and use this interest to pay taxes.

NASDAQ Listing Rules

- Within 36 months or such a shorter time period as specified by the SPAC, the SPAC must complete one or more business combinations having an aggregate fair market value of at least 80% of the value of the trust account.

- Minimum number of 300 shareholders post-listing.

- A proposal has been placed before the Securities Exchange Commission for excluding SPAC from the requirement that 50% of a company’s required minimum number of round lot holders need to hold $2,500 worth of securities at the time of initial listing.

Form filing obligations;

- Form S-1- a registration statement with the SEC at the time of the IPO.

- Form B423- final prospectus.

- Form 10-Q- statement to disclose the amount of the fund raised immediately after the IPO.

- Form S-4- filed, after entering into an agreement with the target company but before shareholders’ approval, with the SEC for approval.

- Form 8-K- it must contain all the information that would be required in a Form 10 registration statement (the registration statement for companies that become public reporting companies other than through a registered IPO).

A comparison of regulatory framework across geographies

| Particulars | India | USA | UK | Malaysia | Canada |

| Issue size | USD 50 million | not specified | £200 million$ | RM 150 million | CAD 30 million |

| Pricing | Not less than USD 5 per share | $10 per unit | not specified | at least 10% of the price at which the securities are offered under the IPO and the same shall at least 60% of the price at which securities offered to pre-IPO investors | $2 per share |

| Time limit for acquisition | 36 months | 18-24 months | 24 months | within permitted time frame | 36 months |

| Approval from shareholders | majority of non-founder shareholders | at least 60% of the shareholders and in some cases up to 80% | majority of shareholders | approval by majority in no. representing 75% of shareholding | approval by majority of directors unrelated to the qualifying acquisition and majority of shareholders casting votes |

| Minimum Sponsor’s contribution | not less than 15% and not more than 20% | 20% | not specified | 10% | not less than 10% of the SPAC immediately following closing of the IPO and not more than 20% of the SPAC immediately following closing of the IPO |

| Escrow account | all the IPO proceed together with 50% of the underwriting commission | at least 90% | all the IPO proceeds after basic charges and related expenses | 90% | 90% of IPO proceeds plus 50% of underwriter’s commission |

| Regulatory framework | The IFSCA (Issuance and Listing of Securities) Regulations, 2021 | The Securities Exchange Commission governs through The Securities Exchange Act, 1934;

NASDAQ through its Listing rules; NYSE through its Listing rules. |

The Financial Conduct Authority (FCA) via

the LSE Listing rules. Disclosure obligations transparency w.r.t. and market abuse.

|

The Equity Guidelines issued by

Malaysian Securities Commission |

The Toronto Stock Exchange Company Manual |

$ Proposed in FCA consultation

Conclusion

SPACs as a structure is intriguing and caters to the needs of both private equity and retail investors, in the era of tech savvy startups, to get a slice of the cake of rapid wealth creation that a lot of venture capitalists have witnessed. The regulatory framework for SPACs across various parts of the globe are filled with both similarities as well as peculiarities. However, from an Indian perspective, considerable efforts will be required on behalf of the regulators since it necessitates tweaking some important provisions of major regulations that govern the corporate sector in India to showcase India as a favourable destination for SPACs IPO and listing.

[1] https://egazette.nic.in/WriteReadData/2021/228383.pdf

[2] In India, the IFSCA Listing Regulations have provided a window of 15-20%

[3]https://economictimes.indiatimes.com/markets/stocks/news/sebi-forms-expert-group-to-examine-feasibility-of-spacs/articleshow/81449254.cms

[4] http://sezindia.nic.in/upload/uploadfiles/files/SEZAct2005.pdf

[5] http://www.giftgujarat.in/documents/FAQs-for-AIFs-in-GIFT-IFSC.pdf

[6] https://www.rbi.org.in/Scripts/FAQView.aspx?Id=92

[7] https://m.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=945

[8] https://www.sebi.gov.in/sebi_data/attachdocs/1471519155273.pdf

[9] https://www.sc.com.my/api/documentms/download.ashx?id=c81eed76-295b-4027-a89f-ca1feaef0a5b

[10]https://qweri.lexum.com/w/tsx/tsxcme-en#!fragment/zoupio-_Toc56069281/BQCwhgziBcwMYgK4DsDWszIQewE4BUBTADwBdoAvbRABwEtsBaAfX2zgFYA2ABi4E4ATAA4AjAEoANMmylCEAIqJCuAJ7QA5BskRCYXAiUr1WnXoMgAynlIAhdQCUAogBknANQCCAOQDCTyVIwACNoUnZxcSA

[11]https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/966133/UK_Listing_Review_3_March.pdf

[12] https://www.fca.org.uk/publication/consultation/cp21-10.pdf

Other Articles on SPACs –

https://vinodkothari.com/2021/08/spacs-value-proposition-regulatory-framework/

Leave a Reply

Want to join the discussion?Feel free to contribute!