Investment window for FPIs widened

Permitting FPIs to invest in defaulted debt securities

-Aanchal Kaur Nagpal (aanchal@vinodkothari.com)

While the Indian equity market has consistently shown a rigorous growth, the bond market in India has mostly been relatively lagging behind. The size and performance of the Indian bond market has been quite inappreciable as compared to the developed economies in the world. The COVID-19 pandemic further caused a turmoil in the market. Among the investor class, Foreign Portfolio Investors (FPI) are a major participant in the debt market contributing to approximately 10% of the total debt investment.

Source: CRISIL Yearbook on Indian Debt Market, 2018

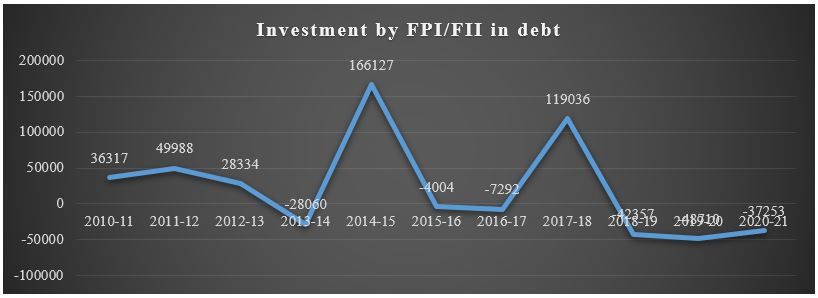

Further, as depicted below, the investments by FPIs in debt market has not been a consistent or a straight line and has seen more downward trend than upward.

Source: NSDL

As on February 5, 2021, foreign investment in corporate bonds has only reached 25% of the total available limit[1]. Further, the proportion of FPI investment as a part of the total foreign investment in India, is constrained by various investment limits and regulatory requirements.

FPIs are allowed to invest in eligible government securities and eligible corporate bonds. In case of corporate bonds, the following restrictions are imposed –

- Restriction on short term investment in corporate bonds

FPIs are not permitted to make short term investments of more than 20% of their total investment in corporate bonds. The above cap was increased from 20% to 30% of the total investment of the FPI providing more flexibility to FPIs in making investment decisions.

- Issue limit

Investment by any FPI, including related FPIs, cannot exceed 50% of any issue of a corporate bond. In case an FPI, including related FPIs breaches the same and invests in more than 50% of any single issue, it cannot make further investments in that issue until the condition is met.

- Minimum residual maturity

FPIs can only invest in corporate bonds with a minimum residual maturity of 1 years, subject to the condition that short-term investments limit in corporate bonds.

Exempted Securities –

However, there are certain securities that are exempt from the above restrictions –

- Debt instruments issued by ARCs; and

- Debt instruments issued by an entity under the CIRP as per the resolution plan approved by the NCLT under the Insolvency and Bankruptcy Code, 2016.

The aforesaid exemption was introduced with the intent to further widen the scope of investment by FPIs. It not only allowed FPIs to make short term investments in the above debt instruments without any limit but also bring in more options for FPIs to invest without having to consider the single/group investor-wise limits

FPIs are allowed to invest in security receipts issued by ARCs to address the NPA issue of financial institutions. Further, debt instruments issued by a corporate debtor under CIRP have also been made eligible for FPI investment. This was done with the intent to revive corporate debtors under a resolution plan. Thus, RBI has allowed FPIs to invest in such securities that are in dire need of investment, while granting various exemptions to make them more attractive.

Power of RBI to permit debt instruments or securities for FPI investment

As per SEBI (Foreign Portfolio Investors) Regulations, 2019, amongst other eligible debt instruments, FPIs are allowed to invest in any debt securities or other instruments as permitted by RBI [Regulation 20(1) (g)].

Thus, RBI has the power to prescribe eligible debt securities for FPI investment.

Foreign Portfolio Investors (FPIs) Investment in Defaulted Bonds

As discussed, investment by FPIs in debt instruments issued by ARCs or an entity under the CIRP, are exempted from the short-term limit and minimum residual maturity requirement. In order to further promote investment by FPIs in corporate bonds, RBI, in its Statement on Developmental and Regulatory Policies dated 5th February, 2021[2], has proposed to extend similar exemptions to defaulted corporate bonds. Accordingly, FPI investment in defaulted corporate bonds are proposed to be exempted from the short-term limit and the minimum residual maturity requirement. For this purpose, detailed guidelines will be issued separately by RBI.

Defaulted debt securities refer to ‘non-payment of interest or principal amount in full on the pre-agreed date and shall be recognized at the first instance of delay in servicing of any interest or principal on such debt.

At present, FPIs are permitted to invest in defaulted debt securities only against repayment of amortising bonds. Now, RBI is intending to permit FPIs to invest in defaulted corporate bonds as fresh issues as well and in all other cases as well.

Existing provision on FPI investment in corporate bonds under default –

Investments by FPIs in corporate bonds under default [Para 15 of Operating Guidelines for FPIs[3]]

- FPIs are permitted to acquire NCDs/bonds, which are under default, either fully or partly, in the repayment of principal on maturity or principal instalment in the case of an amortising bond.

- FPIs will be guided by RBI’s definition of an amortising bond in this regard.

- The revised maturity period for such NCDs/bonds restructured based on negotiations with the issuing Indian company, should be as per the norms prescribed by RBI from time to time, for FPI investments in Corporate Debt.

- The FPIs shall disclose to the Debenture Trustees, the terms of their offer to the existing debenture holders/beneficial owners of such NCDs/bonds under default, from whom they propose to acquire.

- All investments by FPIs in such bonds shall be reckoned against the prevalent corporate debt limit. All other terms and conditions pertaining to FPI investments in corporate debt securities shall continue to apply.

SEBI also issued an operational framework[4] for transactions in defaulted debt securities post redemption date along with obligations of Issuers, Debenture Trustees, Depositories and Stock Exchanges while permitting such transaction

However, the motive for FPIs for investing in such defaulted corporate bonds is still to be understood. Since defaulted debt securities refer to securities even with one-time defaults, corporate bonds with favourable future prospects or where the security against such bonds is sufficient and promising, may attract FPI investments. RBI’s intent behind this move is to deepen the financial market, bring better liquidity in defaulted debt securities and also provide an additional investment opportunity to FPIs. The detailed guidelines are awaited to be issued by RBI.

[1] Source: NSDL- https://www.fpi.nsdl.co.in/web/Reports/ReportDetail.aspx?RepID=1

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51078

[3]https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Operational%20Guidelines%20for%20FPIs,%20DDPs%20and%20EFIs%20revised_p.pdf

[4]https://www.sebi.gov.in/legal/circulars/jun-2020/operational-framework-for-transactions-in-defaulted-debt-securities-post-maturity-date-redemption-date-under-provisions-of-sebi-issue-and-listing-of-debt-securities-regulations-2008_46912.html

Our articles on related topics-

Leave a Reply

Want to join the discussion?Feel free to contribute!