Melt-down of Market-linked debentures, Debt mutual funds get fatal blow

No grandfathering for MLDs, prospectively, tax benefit for debt mutual funds goes away

-Vinod Kothari and Aanchal Kaur Nagpal

As expected, the Finance Bill, 2023 was passed on March 24, 2023 by Lok Sabha within minutes. With a huge amount of changes including several newly inserted provisions, the so-called amendments were actually a Bill in itself, minus any “notes on clauses” or “memorandum of delegated legislation”, and given the amending document that refers to page numbers and line numbers of the Bill, it is a hard to read document, more so to realise the long term impact it has for the capital markets.

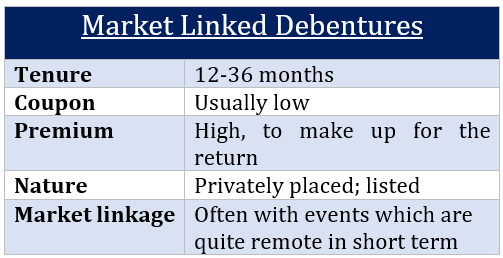

For capital markets, the amended Bill confirms that there will be no grandfathering for market-linked debentures (MLDs), as it specifically provides for a grandfathering only for debt mutual funds. Thus, the future of an approximately Rs. 20 lakh crore non-equity-oriented mutual funds in the country[1], going forward, will be questionable.

Read more →