Market-linked debentures: Is it the end of the market for them?

– Aanchal Kaur Nagpal, Manager | finserv@vinodkothari.com

Tax proposal to tax gains on MLDs as short-term capital gains

The Budget proposes that the capital gains on market linked debentures (MLDs) will be taxed as short term capital gain.

Presently, MLDs are mostly listed, and as listed securities they have 2 advantages:

- First , there are exempt from withholding tax. This is one of the carve-outs in sec. 193

- Secondly, the holding period for capital gain purposes is 12 months, as opposed to 36 months in case of normal capital assets. This comes from sec. 2 (42A) of the Act. Therefore, if a listed security is held for at least 12 months, and transferred or redeemed thereafter, the gain will be taxed as long term capital gain, with a rate as low as 10%.

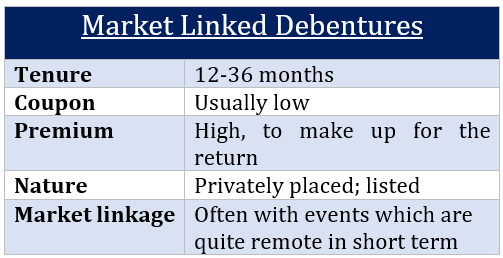

Market linked debentures is a concept that prevails world-over, with different names such as equity-linked bonds, index-linked bonds, etc. However, in India, the issuance of MLDs was being exploited as a regulatory and tax arbitrage device.

Regulatory arbitrage:

Apart from not requiring periodic interest payouts as in case of plain-vanilla NCDs, MLDs also enjoy certain exemptions from the regulatory front as well. This includes exemption from issuance of MLDs through electronic book mechanism and exemption from the limit of ISINs which applies in other cases.The exemption from the electronic bidding process itself is a major advantage, permitting the bond issuer to structure the bond on a bespoke basis and issue the same so as to suit the investor in front. Also, MLD issuances can garner additional 5 ISINs for issuing entities.

On analysing various issuances in the market, we have observed that downside conditions to which MLDs are usually linked to are highly unlikely to occur, resulting in the returns to be actually definitive and fixed and not truly linked to the market. For instance, Nifty falling below 2,850 points. This, in fact, makes the MLDs akin to plain vanilla NCDs, and draws a conclusion that issuers take heed of MLDs to obtain the benefit of such regulatory arbitrages. A detailed study on the same may be referred to in our earlier articles[1] on the subject.

Tax arbitrage:

In case of plain-vanilla NCDs, an investor is taxed on the regular interest payouts as per his/ her slab rates. While in case of listed MLDs, the investor is able to reduce his holding period to merely 12 months to claim the benefit of a long term capital asset.

Is there a market risk that the investor is exposed to?

On the fact of it, one might understand that the investor is taking risk in some market indices such as NIFTY returns, bond spreads, etc.

However, in reality, the issuers intend to pass a contractually fixed rate of returns. Hence, there is a threshold return, and then there is a market-linked return which is often linked with eventualities which are unlikely to happen, particularly given the short span of the term. Notably, MLDs are mostly issued for 15-18 months’ maturity, and sometimes longer, just to satisfy the definition of being a long-term capital asset. Typically, there may not be a coupon on MLDs – they may only have a premium on redemption, which may easily qualify as a capital gain.

A popular instrument with NBFCs:

MLDs were quite a popular instrument with NBFCs. A report by Careratings is commonly cited to say that the volume of MLDs in the current financial year may top up Rs 14000 crores.

Tax arbitrage goes away:

With the Finance Minister’s Budget proposals, the tax arbitrage goes away. If teh tax arbitrage goes away, will the regulatory benefits be strong enough to hold the market for MLDs – the answer does not seem positive.

The Budget proposes a double whammy for MLDs: first, irrespective of the holding period, the tax will be a short term capital gain, thereby hiking the rate of tax to the slab rate as may be applicable.

Secondly, the withholding tax exemption also goes away, which is proposed in case of all listed bonds, and without a grandfathering exemption (see discussion elsewhere).

For capital gain treatment for MLDs, a new section 50AA is proposed to be inserted, to provide that irrespective of the holding period, capital gains on MLDs will be taken as “short term capital assets”. Interestingly, even if the tenure of the MLDs is 36 months or longer (which is the usual holding period for qualifying as a long term capital asset), the MLDs will still be treated as short-term capital assets.

The scope of the expression “market linked debentures” includes:

- Where the returns are linked to market returns on other underlying securities or indices,

- Any other security treated as a market linked debenture in terms of SEBI Regulations.

Therefore, if the issuer/investor is desirous of achieving the classification as an MLD, and get the various benefits under SEBI Regulations (see Regulatory Arbitrage), then the issuer/ investor will have to reconcile with the entire income, other than regular coupons, being taxed as short term capital gain.

This is, however, not to result in the coupons on the MLDs being taken as capital gains, as the capital gain treatment is applicable only to the consideration received on (a) transfer, (b) redemption or (c) maturity of the instrument. However, ironically, many of the MLDs do not have significant coupons – they typically have a redemption premium which makes up for the return.

Effective date, no grandfathering:

The section 50AA is sought to be inserted with effect from 1st April, 2024, and therefore, will apply for the income year 2023-24.

Unfortunately, there is no grandfathering for the provision. This means that even where the MLDs were issued before the Budget announcement, and the investor had factored as 10% tax rate for computing his overall post-tax yield, the yield will drop down significantly, maybe almost 25-30% of the agreed yield.

The provision will be agitated for its retroactive effect: because it attacks investors’ decision to invest in a capital market security with presumption as to a particular tax effect. A retroactive tax nabs investors, leaving them without any choice of readjust their investment decisions. Quite likely, the FM may be inclined to provide for a grandfathering provision, as was done in case of LTCG on listed shares.

Since the Budget announcement is likely to create quite a flurry in the market, there might be several issuers who may for for early redemption, before the 31st March, 2023. This will be particularly possible where the bonds have already had a vintage of at least 12 months, to qualify as long term asset as per extant provisions. Further, exercise of a call option under the ILNCS Regulations [Reg 15 (5)] can be done after 12 months from issuance.

Of course, this will create liquidity pressure on the issuers, particularly as we are edging towards the end of the fiscal year.

[1] Market-Linked Debentures – Real or Illusory?: https://vinodkothari.com/2021/01/market-linked-debentures-real-or-illusory/

Market Linked Debentures – Adding Flavour to Plain Vanilla Bonds: https://vinodkothari.com/2020/11/market-linked-debentures-adding-flavour-to-plain-vanilla-bonds/

Our article has also been published in Mint: https://www.livemint.com/money/personal-finance/marketlinked-debentures-are-they-real-or-illusory-11666200073594.html

Marked Linked Debentures have been a popular investment option among retail investors since its inception but recently there has been some speculation that these instruments might soon become obsolete due to changes in regulations VinodKothari does an excellent job elucidating why this may be true thus helping potential investors make informed decisions when considering this type of investment opportunity

MLDs will be deemed as short-term capital assets. The applicable rate of tax would be 15% plus SC as is applicable to STCG on equity investments or at the regular slab rates?

Dear Sir,

The newly inserted section 50AA of the Finance Bill, 2023 states income received on an MLD (i.e. full value of the

consideration received/ accruing to be received minus cost of acquisition/ issuing),

shall be considered as capital gains arising from the transfer of a short-term

capital asset.

As per section 111A of the Income

Tax Act, the 15% rate of tax is only applicable to STCG on equity shares or specified

units of business trusts. Since MLDs do not get covered under either of these

instruments, they shall be taxed at the regular slab rates.

Is the tax change applicable for investments made earlier and maturing in the next few months or is it applicable only on fresh MLDs issued from 01st April 2023 ?