SEBI amends framework for Large Value Funds

CS Prapti Kanakia, Manager and Samarth Batta, Executive | corplaw@vinodkothari.com

Background

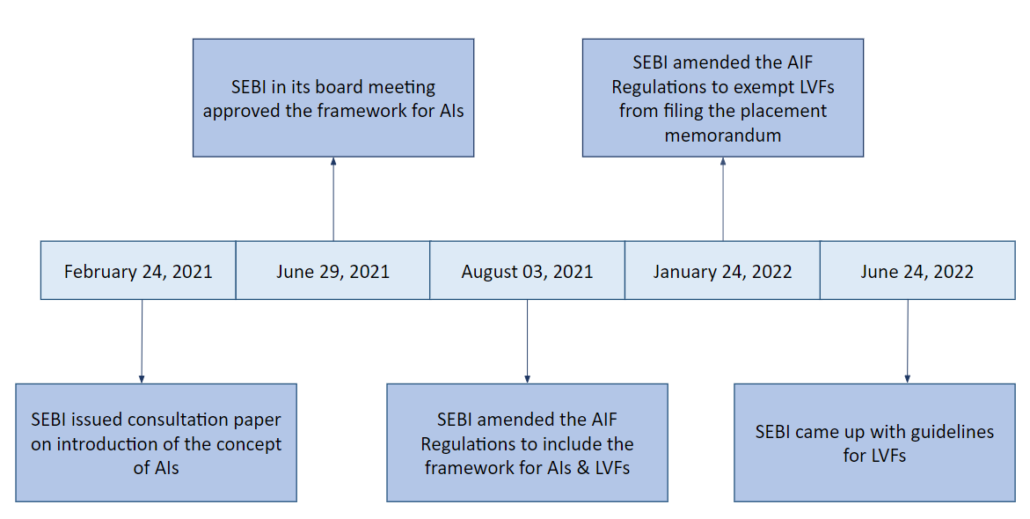

In a recent Circular[1], SEBI has come up with the Guidelines for Large Value Funds for Accredited Investors (LVFs) and requirement for appointment of compliance officer for managers to Alternative Investment Funds[2] (AIFs). SEBI had introduced the concept of LVFs alongwith the concept of Accredited Investors (AIs) in August, 2021. A brief timeline showing the evolution of the framework of AIs in India is as follows:

AI also known as qualified investor/professional investor/ experienced investor are a class of investors who have in-depth market knowledge and high risk bearing capacity to take an informed investment decision. Since, these AIs are well informed investors, therefore, the intermediaries providing services to these investors are given regulation-light regime i.e. less regulatory oversight & relaxed compliance requirement by SEBI.

Read more →