SEBI amends framework for Large Value Funds

CS Prapti Kanakia, Manager and Samarth Batta, Executive | corplaw@vinodkothari.com

Background

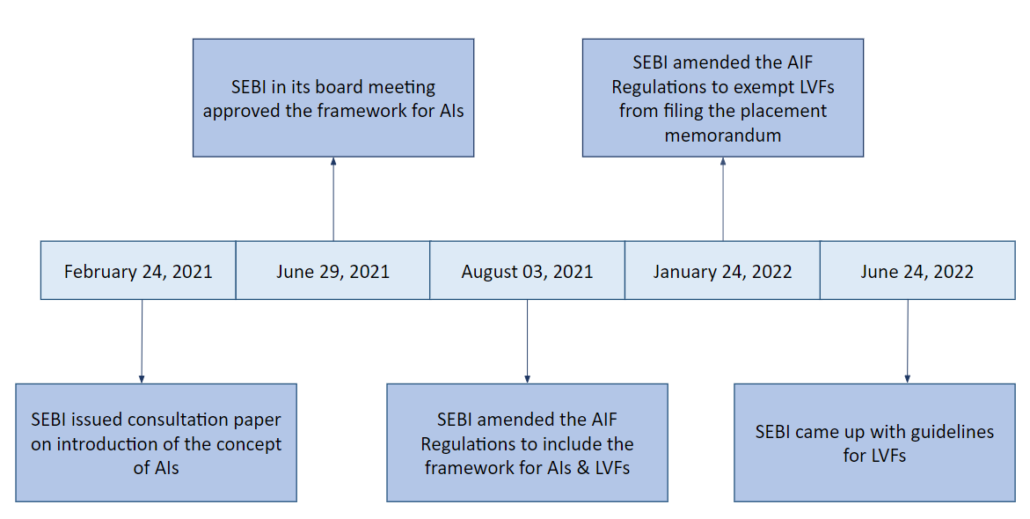

In a recent Circular[1], SEBI has come up with the Guidelines for Large Value Funds for Accredited Investors (LVFs) and requirement for appointment of compliance officer for managers to Alternative Investment Funds[2] (AIFs). SEBI had introduced the concept of LVFs alongwith the concept of Accredited Investors (AIs) in August, 2021. A brief timeline showing the evolution of the framework of AIs in India is as follows:

AI also known as qualified investor/professional investor/ experienced investor are a class of investors who have in-depth market knowledge and high risk bearing capacity to take an informed investment decision. Since, these AIs are well informed investors, therefore, the intermediaries providing services to these investors are given regulation-light regime i.e. less regulatory oversight & relaxed compliance requirement by SEBI.

Many countries have identified AIs on the basis of knowledge and investment experience along with the financial capacity. In United States[3], AIs are defined on the basis of their net worth and income criteria, as well as other professional criteria like Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82), or Directors, executive officers, or general partners of the company selling the securities, etc. In Australia[4], AIs are defined on the basis of net worth and income criteria.

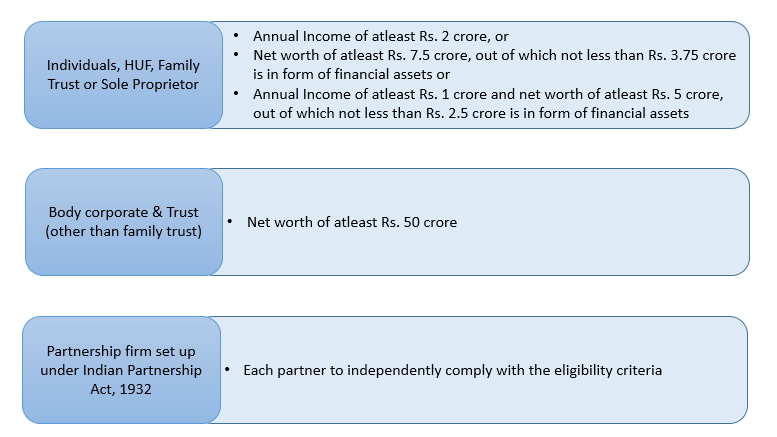

In India, AIs are identified based on their financial capacity only. SEBI defines[5] AIs as any person who is granted a certificate of accreditation by an accreditation agency and who fulfills the annual income and net worth criteria mentioned below:

SEBI has granted the status of deemed AIs to certain entities like Central and State Governments, developmental agencies set up under the aegis of the Central Government or the State Governments, sovereign wealth funds and multilateral agencies, funds set up by the Government, Category I foreign portfolio investors, qualified institutional buyers, etc.

SEBI has defined[6] LVFs as an AIF or scheme of AIF in which each investor (other than the manager, sponsor, employees or directors of the AIF or employees or directors of the Manager) is an AI and invests a minimum of Rs. 70 crore. Along with the introduction of the concept of LVFs in the regulation, SEBI has granted certain relaxations to LVFs, such as

- LVFs are exempted from filing placement memorandum with SEBI. LVFs have to only intimate SEBI the placement memorandum[7].

- Close ended schemes of LVFs are allowed to extend their tenure beyond two years subject to terms of the contribution agreement, other fund documents and such conditions as may be specified by SEBI.

- LVFs of category I and II AIFs are allowed to invest up to 50% of the investable funds in an investee company, directly or through investment in the units of other AIF whereas other AIFs of category I and II are allowed to invest only up to 25%.

- LVFs of Category III AIFs may invest up to 20% of the investable funds in an Investee Company, directly or through investment in units of other AIFs whereas other AIFs of category III are allowed only to invest only up to 10%.

Through the Circular, SEBI provides a framework for implementing the relaxations. This article takes you through the changes brought in through the SEBI Circular dated June 24, 2022.

Undertaking to be filed along with placement memorandum

SEBI has already granted relaxations to LVFs from filing the placement memorandum by requiring them to only intimate the placement memorandum to SEBI as per proviso to Regulation 12 of SEBI (Alternative Investment Funds) Regulations, 2012[8] (“AIF Regulations”). Vide the Circular, SEBI has mandated to submit an undertaking in the format prescribed therein from the CEO & compliance officer of the manager to AIF along with the placement memorandum. The format of the undertaking is provided by SEBI as Annexure-A to the circular.

The undertaking to be given by the CEO & compliance officer states that

- they have independently exercised due-diligence regarding the information given;

- all the disclosures are based on the latest information;

- the AIF, its sponsor & manager are fit & proper person;

- proposed activities of the scheme are bonafide and fall within the objectives of the fund;

- the disclosure in the placement memorandum is true, fair and as per AIF regulations and other applicable requirements.

Also, pursuant to the undertaking, CEO & compliance officer have to obtain accreditation certificate from the AIs and an undertaking from AIs that they are aware about the terms & conditions of the schemes and wish to avail benefits under AI framework. Undertaking shall also state that AIs are aware that the investment product would not be subject to the same regulatory oversight as those investment products meant for investors other than AI.

The aforementioned undertaking by the CEO & compliance officer has to be submitted by July 31, 2022 with SEBI for the existing LVF schemes where the placement memorandum has already been filed with SEBI.

Extension of tenure for close-ended schemes

SEBI has granted relaxation to LVFs for extension of tenure for close ended schemes beyond two years as per proviso to Regulation 13(4) of the AIF Regulations. Close ended schemes are those schemes in which tenure of investment is specific and any redemption takes place only at the end of the tenure of the scheme. Through the Circular, SEBI has provided the following conditions for extension of the tenure beyond two years for close ended schemes.

- The terms and conditions for extension of tenure beyond two years must be mentioned in the placement memorandum, contribution agreement & other fund documents;

- LVF has to obtain approval from its governing body (i.e. trustees/Board/ Designated Partner) atleast one month before the completion of the term.

In case the conditions mentioned in placement memorandum/contribution agreement/fund document are not fulfilled, the LVF shall liquidate as per the AIF Regulations.

Appointment of Compliance Officer for Manager of AIFs

SEBI has mandated the Manager of all AIFs to designate an employee/director as Compliance Officer who shall be responsible for compliances applicable to AIF. Further, the criteria mentioned is that the CEO of the manager of the AIFs cannot be appointed as the compliance officer. There is no clear mention of the timeline for appointment of compliance officer, however, a compliance officer should ideally be appointed forthwith to ensure compliance with the Circular. Further, in case of LVF schemes already filed with SEBI, the undertaking is required to be signed and stamped by the CEO & compliance officer of the Manager to AIF before July 31, 2022. Accordingly, such AIFs which are required to file the aforementioned undertaking should ideally appoint a compliance officer before July 31, 2022 to ensure compliance with the Circular.

Conclusion

In India, presently 969 AIFs are registered with SEBI as on July 13, 2022[9]. With the growing number of AIFs in India, SEBI is continuously bringing regulatory changes for the growth of the AIF industry and protection of investors. The requirement for appointment of compliance officer may be a step towards the protection of investors.

AIFs as a model of investment in the Indian securities market was not so popular among the retail investors in the past. However, with the passage of time, AIFs and the investors in AIFs have significantly grown in number. High net worth investors who have risk taking capabilities often enter into AIFs to create huge returns on their investments. These new concepts of AIs and LVFs will further boost the participation of investors in the AIF industry. Providing a regulatory light regime will help SEBI in better channelizing its resources for the protection of the investors. The intermediaries like AIF, PMS, etc will be able to offer more customized products to AIs. The compliance burden on intermediaries will be reduced which will in turn reduce their cost. AIs will also be benefitted as they can diversify their portfolio into more risky products. AIs will have wider options available. By providing these relaxations, SEBI is putting in place the required framework for the development of these specialized products for AIs and in turn developing the Indian securities market.

[2] Our PPT explaining the concept of AIF and its regulations can be read here

[4] Definition of AI in Australia

[5] Regulation 2(ab) of SEBI (AIF) Regulations, 2012

[6] Regulation 2(pa) of SEBI (AIF) Regulations, 2012

[7] Our article describing the content of placement memorandum can be read here

[8] SEBI (AIF) Regulations, 2012

[9] https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=16

Our write-ups on the topics can be read here:

- RBI bars lenders’ investments in AIFs investing in their borrowers

- AIF Second Amendment Regulations, 2021 – Regulated Steps towards Liberalised Investment,

- 2020 – Year of changes for AIFs,

- SEBI issues further guidelines addressing various aspects to ensure greater compliance by AIFs,

- AIF Regulations: Meaning of ownership interests and investor interests in a company.

Leave a Reply

Want to join the discussion?Feel free to contribute!