Cautious Approach to be taken by NBFCs while outsourcing activities ancillary to financial services

By Mayank Agarwal & Anita Baid, ( finserv@vinodkothari.com)

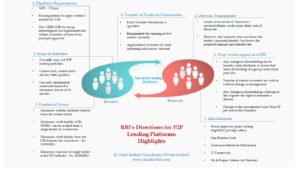

The Reserve Bank of India (RBI), on the 9th of November, 2017 released a notification bringing out the Directions on Managing Risks and Code of Conduct in Outsourcing of Financial Services by Non-Banking Financial Companies (NBFCs).[1] (“Directions”) These Directions are a much awaited outcome of the draft guidelines[2] which had been issued long back, in the year 2015. The Directions come in the wake of ever-increasing need to outsource ancillary activities such as applications processing (loan origination, credit card), document processing, marketing and research, supervision of loans, data processing and back office related activities in order to provide the customers best possible services associated with the core business of the company. The Directions have been issued to ensure that there exists no possibility of discrepancy or fallibility that could affect the customer as well as the NBFC in an adverse manner.