RPT provisions in India and other countries

Other ‘I am the best’ presentations can be viewed here

Our other resources on related topics –

Other ‘I am the best’ presentations can be viewed here

Our other resources on related topics –

Other ‘I am the best’ presentations can be viewed here

Our other resources on related topics –

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

Other ‘I am the best’ presentations can be viewed here

Our other relevant resources –

Other ‘I am the best’ presentations can be viewed here

Our other resources on related topics –

By Harsh Juneja | Executive ( corplaw@vinodkothari.com)

After facing economic crisis owing to the Covid-19 pandemic in March, 2020, a thunderstorm of IPOs strikes India’s Primary Markets. Since July 2020, a total of 48 Initial Public Offers (IPOs) have been issued which includes companies like Burger King, Zomato and Indigo Paints. Draft Red Herring Prospectus (DHRP) has also been filed by various unicorns like One 97 Communication (Paytm), Policy Bazaar Insurance and Nykaa for stepping their toes in the Indian Primary Market.

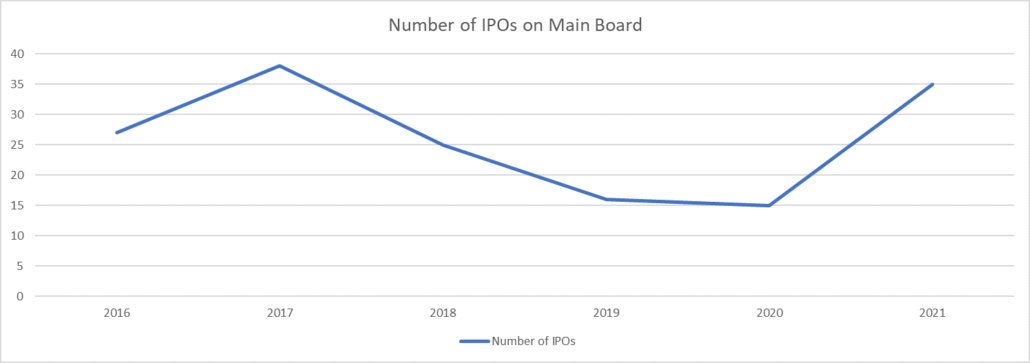

The above table indicates that even though the economy was not at its best pace in 2020, but still the number of IPOs had increased. Moreover, for 2021, even though the year has not completed yet, but the number of IPOs goes on increasing.

At the time of complete nationwide lockdown, stock market had hit rock bottom. But every cloud has a silver lining. Foreign Direct Investments (FDI) into country rose 15% on year-to-year to $39.9 billion (₹29,400 crore), according to a [1]report by CARE Ratings. Due to surge in foreign investments in the Indian market, it started healing itself. During these hard times, ‘Route Mobile Limited’ came up with an IPO which was a blockbuster in the capital market, as it was listed with a premium of 102.28%. Since then, capital market has been very receptive towards investments. This reception has made people more optimistic towards investment in primary markets.

As we have discussed above, the people feel optimistic towards the Market, many companies which want to raise funds want to just swim along this wave. Companies feel that this is the best time to raise funds through stock market since they will be able to draw maximum premium for their shares. Potential companies need to ensure that mere compliance of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘SEBI (ICDR) Regulations’), is not sufficient as pursuant to listing, a plethora of compliances fall on the back of a company. Schedule VI of the SEBI (ICDR) Regulations, which deals with disclosures to be given in the Abridged Prospectus also requires a company to disclose that it has complied with the Corporate Governance provisions as specified under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘the Listing Regulations’). Prospective issuers are also required to disclose the details of its committees along with a list of their members and detailed ‘Terms of References’ of such committees. These companies need to be prepared with compliances of the aforesaid provisions, along with some other compliances, beforehand to ensure that transitioning from an unlisted to listed company goes smoothly.

A snap shot of compliances one is required to be adhere to as a part of prepping up for an IPO can be seen below:

Starting from the composition of the Board to the remuneration of the managerial personnel and requirement of Whole-time Key Managerial Person to review of all existing and probable related party transactions, all of these needs a reconsideration from the transition from a closely held company to a listed company.

The Board shall comprise of at least one woman director. At least 50% of total directors shall be non-executive directors (NEDs). The requirement of appointment of independent directors (IDs) shall also be adhered to as per the Listing Regulations.

Audit Committee shall have at least 3 members out of which at least 2/3rd members shall be IDs. The Chairperson of this Committee shall also be an ID and CS of the Company shall be the Secretary of the Committee.

NRC shall have at least 3 directors. Only NEDs can become members of NRC. At least 2/3rd members of NRC shall be IDs. The Chairperson of NRC shall be an ID only and chairperson of the Company, whether ED or NED, may become a member of NRC but shall not chair such committee.

SRC shall constitute of at least 3 directors, with at least one being an ID. The Chairperson of SRC shall be a NED.

As of now, requirement of constitution of RMC is applicable only on top 1000 listed companies. RMC shall consist of at least 3 members, majority of which shall member of the Board, with at least one being an ID.

The ambit of related party shall be widened as it is not limited only to section 2(76) of the Companies Act, 2013 (‘the Act’), but also includes related parties as per Ind AS-24. All related party transactions shall be approved by only those members of the Audit Committee, who are IDs. All ‘material related party transactions’, as defined under Regulation 23 of the Listing Regulations, shall require approval of the shareholders and no related party shall vote to approve such resolution.

Pursuant to section 203 of the Act, read with Rule 8 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, every listed company shall ensure it shall have the following Whole-time KMP:

Pursuant to listing, section 197 of the Act shall become applicable on a company. Therefore, it must ensure that the remuneration to managerial personnel is as per the limits prescribed under this section, before coming with an IPO. The Company is also required to pass a special resolution in case-

A company which is closely held is entitled to certain exemptions under the Act. However, pursuant to listing, the veil of all these exemptions gets lifted in the following manner:

The PIT Regulations, 2015 defines ‘proposed to be listed’ company as an unlisted company, whose securities are getting listed pursuant to filing of offer documents or other documents or pursuant to any merger or amalgamation. Prevention of Insider Trading in a company becomes inevitable in case its securities get listed. Therefore, the PIT Regulations also requires a company, even if it is proposed to be listed, to comply with its provisions. There are also few compliances which a company should be prepared with before coming up with an IPO:

Companies Act, 2013 does not mandate a company to create a website. However, pursuant to listing, Regulation 46 of the Listing Regulations gets triggered which mandates it to maintain a functional website and upload various information on it as mentioned under Regulation 46(2). We discussed above about the Code of Fair Disclosure which companies are required to make under the PIT Regulations. This Code is also required to be disseminated on the website of the Company. Companies Act, 2013, requires following information to be disclosed on the website of a company, in case it maintains, –

The Listing Regulations and PIT Regulations require a listed company to prepare various policies. As launching an IPO is itself a cumbersome process and requires a lot of other compliances to be fulfilled a prospective issuer should prepare these policies beforehand. The following policies required to be made are: –

As we have discussed, there are many companies which have been raising funds through IPOs this year and mere compliance of checklist of ICDR Regulations is not sufficient for a company from transition from an unlisted to a listed company. Potential issuers must bear in mind that pursuant to listing, the money of retail individual investors also vests with a company and thus requires good corporate governance practices.

[1] https://www.careratings.com/upload/NewsFiles/SplAnalysis/FDI%20Update%20-%20H1%20FY21.pdf

[2] https://www.mca.gov.in/Ministry/pdf/Exemptions_to_private_companies_05062015.pdf

You may also refer to our video on Appraising post-IPO governance requirements – https://www.youtube.com/watch?v=CXh3tiISxxY

Anushka Vohra, Deputy Manager corplaw@vinodkothari.com

In common jargon, promoters are the persons who conceive the idea of incorporating a company and are associated with the company since its inception. In legal parlance, the concept of promoter has been kept open-ended. The definition has been captured under various legislations and has been made inclusive.

The status of a promoter might seem to be dignified and magnificent when looked from a wild blue yonder. However, as the saying, ‘uneasy lies the head, that wears the crown.’; likewise the status of being a promoter brings with itself shedload of liabilities and obligations. It is pertinent to note that once a promoter, always a promoter unless reclassified. Considering the several disclosures that an entity falling under the ambit of promoter / promoter group is required to provide, it is likely for a dormant promoter / promoter group to want to re-classify themselves.

Regulation 31A of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 provides the modus operandi with respect to re-classification of promoter / promoter group shareholding to public category.

There are several aspects to this re-classification. For example, what if the entity intending to re-classify intends to continue to be a shareholder, what if it’s a Trust, is there any exception for married daughters, estranged relations etc.

In this write-up, we have tried capturing the stance of stock exchange / SEBI for matters which have already been preferred for re-classification.

Message for Readers:We have endeavoured to cover all cases of re-classification occurred between the advent of Regulation 31 A in 2015 till August 05, 2021 but the same cannot be verified. We shall be further updating our list, based on applications made to the stock exchange(s). We shall also be coming with a consolidated write-up covering the intricacies of Regulation 31A and a detailed analysis on what motivates Promoter’s to reclassify them as public. |

| Sr.No | Date of approval | Name of the listed entity | Outgoing promoter/ promoter group [name] | Whether promoter / promoter group (PG) | Promoter type (whether director or otherwise) | Shareholding at the time of re-classification (%) | Rationale given in the application for re-classification |

| 1. | June 24, 2021 | Fortis Malar Hospitals Limited[1] | Malvinder Mohan Singh | Promoter | Individual | NIL | Pursuant to SEBI order[2] |

| Shivi Holdings (P) Limited | |||||||

| RHC Finance Private Limited | |||||||

| Todays Holdings Private Limited | |||||||

| Oscar Investments Limited | |||||||

| Malav Holdings Private Limited | |||||||

| RHC Holdings Private Limited | |||||||

| Fortis Healthcare Holdings Private Limited | |||||||

| 2. | May 27, 2021 | Arvind Limited | AML Employee’s Welfare Trust[3] | Trust | 2.44 | No control | |

| 3. | April 06, 2021 | ISMT Limited[4] | Tara Jain[5]

|

Promoter | Individual | 0.97 | The members belong to Ashok Kumar Jain group, the later Promoter Director. After the demise of Mr. Ashok Kumar Jain, none of the family members have been appointed on the Board and do not exercise any control. |

| Ashok Kumar Jain (HUF) | PG

|

HUF | 1.73 | ||||

| Aayushi Jain | Individual | 0.03 | |||||

| Akshay Jain | Individual | 0.01 | |||||

| Tulika Estate & Holdings Limited | Company | 0.37 | |||||

| 4. | April 05, 2021 | Healthcare Global Enterprises[6] | Ramesh S Bilimagga | Promoter | Individual

|

0.21 | No control

|

| Ganesh Nayak

|

Promoter | 0.22 | |||||

| Venkatesh Sudha | PG | 0.02 | |||||

| Pradeep Nayak

|

PG | 0.02 | |||||

| Adarsh Ramesh

|

PG | NIL | |||||

| Gopi Chand Mammillapalli

|

Promoter | 1.44 | |||||

| Gopinath K S

|

Promoter

|

0.32 | |||||

| Prakash Nayak

|

PG | 0.05 | |||||

| Srinivas K Gopinath | PG | NIL | |||||

| 5. | April 01, 2021 | VXL Instruments Limited[7] | M V Nagaraj | Promoter | Individual | 2.39 | 1. Leading life and occupation independently;

2. Not connected with any activity of the Company. |

| 6. | March 31, 2021 | Aarti Industries Limited[8] | Dilip Dedhai and Nimesh Dedhai | None specified | Individuals | 0.04 | No control |

| Bhavesh Mehta

|

Individual | 0.04 | |||||

| Bhavesh Mehta and Alka Mehta | Individuals | 0.10 | |||||

| 7. | January 28, 2021 | Nippon Life India Asset Management Limited[9] | Reliance Capital Limited | Promoter | Company | 0.93 | Pursuant to Share Purchase Agreement (‘SPA’) |

| 8. | January 08, 2021 | Mafatlal Industries Limited[10] | Vishad Padmanabh Mafatlal Public Charitable Trust | Promoter | Shareholder- Trust | 0.17 | No control. |

| 9. | December 24, 2020 | Jyoti Limited[11] | Chirayu Ramanbhai Amin | PG | Individual | NIL | Not engaged in day to day affairs |

| Mayank Nitubhai Amin | |||||||

| 10. | December 24, 2020 | Teamlease Services Limited[12] | Dhana Management Consultancy LLP | PG | LLP | 4.99 | Not engaged in day to day affairs |

| Anupama Gupta | Promoter | Individual | 0.02 | ||||

| 11. | December 15, 2020 | Mindtree Limited[13] | Krishnakumar Natarajan & family | Promoter & PG | Individuals

|

5.00 | This re-classification was sought pursuant to takeover of Mindtree by L&T. L&T acquired 60 %

|

| Rostow Ravanan & family | 0.67 | ||||||

| N S Parthasarathy & family | 1.43 | ||||||

| Subroto Bagchi & family | 4.77 | ||||||

| LSO Investment Private Limited[14] | Promoter

|

Foreign Company | 1.16 | ||||

| Kamran Ozair

|

Individual

|

NIL | |||||

| Scott Staples

|

NIL | ||||||

| 12. | December 09, 2020 | Birlasoft Limited[15] | Shashishekhar Pandit | None specified

|

Individual

|

NIL

|

No control. |

| Nirmala Pandit

|

|||||||

| Chinmay Pandit

|

|||||||

| Kishor Patil

|

|||||||

| Shrikrishna Patwardhan | |||||||

| Ajay Bhagwat | |||||||

| Ashwini Bhagwat jointly held with Mr. Ajay Bhagwat | |||||||

| Sachin Tikekar | |||||||

| Anupama Patil | |||||||

| Proficient Finstock LLP | LLP | ||||||

| K and P Management Services Pvt. Ltd. | Company | ||||||

| Hemlata Shende | Individual | ||||||

| 13. | November 26, 2020 | Ruchi Soya Industries Limited[16] | The entire PG was replaced by new set of Promoters | – | – | 0.14 | This was pursuant to approval of Resolution Plan under Corporate Insolvency Resolution Process of Ruchi Soya Industries Limited (“the Corporate Debtor”). |

| 14.

|

November 23, 2020 | DFM Foods Limited[17] | Mohit Jain | None specified. | Individual | NIL

|

Entire stake was sold to AI Global Investments (Cyprus) PCC Limited. |

| Surekha Jain | |||||||

| Rohan Jain | |||||||

| Rashad Jain | |||||||

| The Delhi Flour Mills Company Limited | Company | ||||||

| 15. | November 19, 2020 | Aplab Limited[18] | Zee Entertainment Enterprises Limited | Promoter | Company | 9.50 | Pursuant to termination of shareholder’s agreement |

| 16. | October 07, 2020 | Igarashi Motors India Limited[19] | Mukund P | Promoter | Individual | NIL | 1. Divested his stake on August 28, 2019 in favor of Igarashi Electric Works Ltd, Japan and Agile Electric Sub Assembly Private Limited;

2. Ceased to be MD from October 01, 2019. |

| MAPE Securities Private Limited | Company | No control. | |||||

| 17. | July 29, 2020 | Tourism Finance Corporation of India Limited[20] (TFCIL) | Red Kite Capital Private Limited (RCPL) | None specified | Company | 0.17 | Sale of entire stake[21] |

| 18. | July 13, 2020 | Andhra Paper Limited[22] | International Paper Investments Luxembourg s.a.r.l. | None specified | Foreign Company | NIL

|

1. NIL shareholding;

2. No special rights. |

| IP International Holdings Inc | |||||||

| 19. | June 25, 2020 | Welspun Group[23] | Intech Metals S.A. | PG | Body Corporte | 1.54 | 1. Not connected with any activity of the Company;

2. No control over the affairs of the Company. |

| 20. | June 24, 2020 | XT Global Infotech Limited[24] | Velchala Premchand Krishna Rao | PG

|

Individual | 0.80 | Leading life and occupation independently |

| V. Radhabai | 0.00 | Expired on December 25, 2015

|

|||||

| 21. | June 12, 2020 | Yes Bank[25] | Madhu Kapur

|

Promoter

|

Individual | 1.12 | Pursuant to RBI direction. |

| Rana Kapur

|

NIL | ||||||

| Yes Capital (India) Private Limited | Company

|

NIL | |||||

| Mags Finvest Private Limited | 0.30 | ||||||

| Morgan Credits Private Limited | NIL | ||||||

| 22. | February 26, 2020 | Ajmera Realty and Infra India Limited[26] | Fahrenheit fun and games Private Limited | None specified. | Company | 7.05 | 1. Not involved in the management;

2. No control over the affairs of the Company. |

| 23. | February 20, 2020 | Essel Propack Limited[27] | Ashok Kumar Goel, Trustee of Ashok Goel Trust | None specified | Trustee | 7.67 | Pursuant to Share Purchase Agreement (“SPA”) |

| Goel Ashok Kumar | Individual | 0.27 | |||||

| Kavita Goel | 0.01 | ||||||

| Vyoman Tradelink India Private Limited | Company | 0.06 | |||||

| Pan India Paryatan Private Limited | 0.02 | ||||||

| Nandkishore | Individual | NIL | |||||

| 24. | January 31, 2020 | Innovassynth Investments Limited[28] | Futura Polyesters Limited | None specified | Company | NIL | Do not want to be associated with the Company. |

| 25. | January 29, 2020 | Sudarshan Chemical Industries Limited[29] | Rohit Kishor Rathi | None specified | Individual | 6.72 | No control over the affairs of the Company. |

| Kishor Laxminarayan Rathi | 1.10 | ||||||

| Aruna Kishor Rathi | 1.10 | ||||||

| Laxminarayan Finance Private Limited | Company | 1.01 | |||||

| 26. | October 14, 2019 | Astra Microwave Products Limited[30] | K Murali Mohan | None specified. | Individual | 0.95 | No control. |

| ASSR Reddy | 0.34 | ||||||

| Lakshmi Reddy Chittepu | 0.23 | ||||||

| Padmavathi Chfttepu | 0.19 | ||||||

| Shumlreddy Lakshmi | 0.13 | ||||||

| Chandrasekara Reddy G | 0.06 | ||||||

| Subrarnanyam J | 0.03 | ||||||

| Venkatamma Chittepu | 0.00 | ||||||

| G Thulasi Devi | 0.00 | ||||||

| Narapu Reddy CV | 0.00 | ||||||

| T.Sitarama Reddy | 1.00 | ||||||

| 27. | March 25, 2019 | Refex Industries Limited[31] | T. Jagdish | None specified | Individual | 0.0478 | No control. |

| Seema Jain | 0.5436 | ||||||

| 28.

. |

September 19, 2019 | Redington (India) Limited[32] | Harrow Investment Holding Limited | Promoter | Company | NIL | Disinvested entire stake in the Company in 2017 |

| 29. | November 21, 2018 | India Gelatine & Chemicals Limited[33] | Manorama N. Mirani | None specified | Individual | 0.17 | No substantial shareholding |

| Sunil P. Mirani | 1.11 | ||||||

| Arjun S. Mirani | 0.01 | ||||||

| Aditi P. Mirani | 0.05 | ||||||

| Madhav N. Mirani | 0.97 | ||||||

| Kishorsinh R. Mirani | NIL | ||||||

| Manish K. Mirani | NIL | ||||||

| Nayankumar C. Mirani | NIL | ||||||

| Rahul C. Mirani | NIL | ||||||

| Jash N. Mirani | NIL | ||||||

| Nimisha M. Mirani | NIL | ||||||

| Hina N. Mirani | NIL | ||||||

| Tanmay N. Mirani | NIL | ||||||

| Purnima K. Mirani | NIL | ||||||

| 30. | October 19, 2018 | Sonata Software Limited[34] | Bela M Dalal

|

None specified | Individual | 0.21 | The aforesaid members have gradually reduced their shareholding over the past few years and current shareholding along with PACs is not more than 5% |

| Mukund Dharamdas Dalal | 0.99 | ||||||

| Daltreya Investment & Finance Private Ltd | 0.10 | ||||||

| Bhupati Investments and Finance Pvt Ltd | 1.49 | ||||||

| Shyam Bhupatirai Ghia | 0.00 | ||||||

| 31. | September 28, 2018 | Eicher Motors Limited[35] | Arjun Joshi | None specified | Individual | 0.37 | 1. Shares were acquired pursuant to transmission during 2017-18;

2. Prior to inheritance they did not fall into Promoter & Promoter Group category;

3. None of them is an immediate relative of any other Promoter. |

| Nihar Joshi | 0.37 | ||||||

| Shonar Joshi | 0.37 | ||||||

| 32. | September 21, 2018 | Electrosteel Steels Limited[36] | Electrosteel Castings Limited | Promoter | Company | 45.23 | Pursuant to approval of Resolution Plan under IBC, Electrosteel Steels Limited was acquired by Vedanta Star Limited. |

| 33. | October 09, 2017 | Century Textiles and Industries Limited[37] | Ravi Makharia | None specified | Individual | 0.001 | Ramavatar Makhari was an Executive Director (ED) of Pilani Investment and Industries Corporation Limited, which is the Promoter of Century Textiles and Industries Limited. Therefore, he had also shown the shareholding of his immediate relatives under Promoter Group category.

Further, Ramavatar Makharia ceased to be the ED w.e.f. September 23, 2016. And hence re-classification was sought. |

| Lakshmi Devi Makharia | 0.0032 | ||||||

| Ramavatar Makharia | 0.0031 | ||||||

| 34. | October 05, 2018 | Kalpataru Power Transmission Limited[38] | Mohammed Kanga | PG | Individual | NIL | No control over the affairs of the Company. |

| Ishrat Imtiaz Kanga | |||||||

| Imran Imtiaz Kanga | |||||||

| Ismat Imtiaz Kanga | |||||||

| 35. | March 20, 2017 | Adani Ports and Special Economic Zone Limited[39] | Rakesh Namanlal Shah | Not specified | Individual | 0.06 | No control. |

| Pritiben Rakeshlal Shah | 0.02 | ||||||

| Bhavik Bharatbhai Shah | 0.00 | ||||||

| Surekha Bhavikbhai Shah | 0.00 | ||||||

| Vinod Sanghavi | 0.00 |

| Sr.No | Date of approval | Name of the listed entity | Proposed outgoing promoter/ promoter group [name] | Whether promoter / promoter group (PG) | Promoter type (whether director or otherwise) (eg say if trust) | Shareholding at the time of re-classification (%) | Reason cited by the stock exchange, if any |

| 1. | March 18, 2020 | ABM Knowledgeware Limited[40] | Baburao Bhikunaik Rane | Promoter Group

|

Individual- immediate relative of Promoter KMP

|

0.02 | The Promoter seeking re-classification are holding more than 10% of the voting rights in ABM Knowledgeware Limited.

|

| Sunita Baburao Rane | 0.01 | ||||||

| Sharada Bhushan Rane | 0.01 |

| Sr.No | Date of making application | Name of the listed entity | Proposed outgoing promoter/ promoter group [name] | Whether promoter / promoter group (PG) | Promoter type (whether director or otherwise) (eg say if trust) | Shareholding at the time of re-classification (%) | Rationale given in the application for re-classification

|

| 1. | August 05, 2021 | Axis Bank Limited[41] | United India Insurance Company Limited | Promoter | Company | 0.03 | 1. Insignificant shareholding;

2. No representative on the board;

3. Have no control over the affairs of the Bank. |

| National Insurance Company Limited | 0.02 | ||||||

| New India Assurance Company Limited | 0.67 | ||||||

| General Insurance Corporation of India | 1.01 | ||||||

| 2. | July 12, 2021 | Lux Industries Limited[42] | Neha Poddar | PG | Individual- Immediate relative of Promoter | 0.17 | 1. Their name is included in PG by virtue of they being immediate relative of the Promoter.

2. They are financially independent and in no way are related to the business carried out by the Company. |

| Shilpa Agarwal Samriya | 0.17 | ||||||

| 3. | July 09, 2021 | JK Cement Limited[43] | Kavita Y Singhania | Promoter | Individual | 5.01 | On demise of her husband |

| 4. | June 29, 2021 | The Sandur Maganese & Iron Ores Limited[44] | Nazim Sheikh | PG

|

Managing Director | 0.10 | Resignation |

| U R Acharya | Director(Commercial) | 0.02 | |||||

| K Raman | CFO | 0.01 | |||||

| 5. | June 18, 2021 | Arvind Limited[45] | Samvegbhai Arvindbhai Lalbhai | None specified | Individual | NIL | No control |

| Anamikaben Samvegbhai Lalbhai | |||||||

| Saumya Samvegbhai Lalbhai | |||||||

| Snehalben Samvegbhai Lalbhai | |||||||

| Badlani Manini Rajiv | 0.00 | ||||||

| Arvind Farms Private Limited | Company | NIL | |||||

| Adore Investments Private Limited | |||||||

| Amardeep Holdings Private Limited | |||||||

| Samvegbhai Arvindbhai HUF | HUF | ||||||

| 6. | April 26, 2021 | Jindal Photo Limited[46] | Aakriti Ankit Aggarwal | None specified | Individual | NIL | No control over the affairs of the Company. |

| Aakriti Trust | Trust | ||||||

| 7. | April 12, 2021 | Strides Pharma Science Limited[47] | SeQuent Scientific Limited | PG | Immediate relative of Promoter KMP | NIL | Pursuant to SPA, the shares held by Stride were sold to an LLP. |

| 8. | April 10, 2021 | Sequent Scientific Limited[48] | Agnus Capital LLP | None specified | LLP | NIL | Pursuant to SPA |

| 9. | April 08, 2021 | Solara Active Pharma Sciences Limited[49] | SeQuent Scientific Limited | None specified | Company | 1.54 | Pursuant to SPA |

| 10. | May 25, 2021 | Shree Cement Limited[50] | Padma Devi Maheshwari | PG | Individual | 0.0017 | Neither the individual nor the person related to individual, holds more than 1% of the total voting rights. |

| 11. | March 09, 2021 | Shreyas Shipping and Logistics Limited[51] | Mahesh Sivaswamy | Promoter | Individual | NIL | 1. The Promoters had disposed off their entire stake during the period July 2018 to September 2018 by way of gift to other promoters;

2. No control over the affairs of the Company. |

| Mala Mahesh Iyer | |||||||

| Murli Mahesh | |||||||

| Mithila Mahesh | |||||||

| 12. | January 22, 2021 | Gati Limited[52] | Mahendra Kumar Agarwal | None specified | Individual | 1.29 | Erstwhile founder and MD of the Company, now has no control |

| TCI Finance Limited | Company | 0.82 | No control. | ||||

| Mahendra Investment Advisors Private Limited | 0.12 | ||||||

| Mahendra Kumar Agarwal & Sons HUF | HUF | 0.45 | |||||

| Bunny Investments & Finance Private Limited | Company | 0.22 | |||||

| Jubilee Commercial & Trading Private Limited | 0.12 | ||||||

| 13. | January 06, 2021 | Integrated Capital Services Limited[53] | Ambarish Chatterjee | Promoter | Individual | 0.07 | 1. They were the shareholders of Deora Associates Private Limited which merged with Integrated Capital Services Limited w.e.f. September 26, 2018. Pursuant to the merger, the shareholders of Deora Associates Private Limited became shareholders of Integrated Capital Services Limited.

2. They became Promoters by virtue of the merger and have no control over the affairs. |

| Jai Rani Deora | 1.15 | ||||||

| Arun Deora[54] | 1.12 | ||||||

| Rajeev Kumar Deora[55] | 6.74 | ||||||

| Brijender Bhushan Deora[56] | 0.982 |

Note:

Reference to our other articles on similar topic:

[1] https://www.bseindia.com/xml-data/corpfiling/AttachHis/1224bd10-df95-458f-a82a-a9f7229d36bb.pdf

[2] https://www.sebi.gov.in/sebi_data/attachdocs/mar-2019/1553000134426.pdf

[3] https://www.bseindia.com/xml-data/corpfiling/AttachHis/fdcba980-f25c-4483-a710-d451cfb08a08.pdf

[4] https://www.bseindia.com/xml-data/corpfiling/AttachHis/16958972-8291-4026-a7df-1ef880e5a231.pdf

[5] Wife of Late Mr. Ashok Kumar Jain, former Promoter of the Company.

[6] https://hcgel.com/wp-content/uploads/2021/04/SE-intimation-Promoter-reclassification-06-April-2021.pdf

[7] https://www.bseindia.com/xml-data/corpfiling/AttachHis/0e9eb184-b8e9-4958-b20d-2ef8b216340c.pdf

[8] https://www.aarti-industries.com/Upload/PDF/approval-of-reclassification.pdf

[9] https://www.bseindia.com/xml-data/corpfiling/AttachHis/0e924e6e-2018-40a5-afa2-9882e984ddfb.pdf

[10] https://www.bseindia.com/xml-data/corpfiling/AttachHis/fe5eeda8-626a-49d3-a21e-4923e8a84636.pdf

[11] https://www.bseindia.com/xml-data/corpfiling/AttachHis/02390e16-475f-4941-99f3-d3a922888112.pdf

[12] https://www.bseindia.com/xml-data/corpfiling/AttachHis/491066f3-a579-4ea1-a72d-4e6ce8564643.pdf

[13] https://www.mindtree.com/sites/default/files/2020-12/235IntimationonReclassificationapplicationsapproval.pdf

[15] https://www.birlasoft.com/sites/default/files/resources/downloads/investors/intimation-of-the-approval-of-the-stock-exchanges-for-reclassification-of-promoters.pdf

[16] http://www.ruchisoya.com/stock_exchange/Approvals_form_BSE___NSE_for_Promoters_classification__1_.pdf

[17] http://www.dfmfoods.com/download/investors/Intimation-of-Approval-of-Stock_Exchanges-for-Reclassification-of-Outgoing-Promoters.pdf

[18] https://www.bseindia.com/xml-data/corpfiling/AttachHis/66abdb7d-4257-478f-9dc8-ee38315844b1.pdf

[19] https://www.bseindia.com/xml-data/corpfiling/AttachHis/ff9326d6-c22d-4a06-9dc3-dc2f628dee76.pdf

[20] https://www.tfciltd.com/public/investor/160224589357-TFCIReclassApproval290720.pdf

[22] https://www.andhrapaper.com/uploads/investors/1626162587ApprovalsfromSEforreclassificationofPromoters.pdf

[23] https://www.bseindia.com/xml-data/corpfiling/AttachHis/ece3265f-9040-4b46-b2a2-33afd5890b8f.pdf

[24] https://www.valueresearchonline.com/downloads/stock-announcement/D57DFE0F-AEFD-40AD-89DC-64B185E5F8AD/

[25] https://www.yesbank.in/pdf/promoter_reclassification_stock_exchange_approval_pdf

[26] https://www.bseindia.com/xml-data/corpfiling/AttachHis/56b8219e-d087-4739-bda1-5397a359e058.pdf

[27] https://www.bseindia.com/xml-data/corpfiling/AttachHis/3cfdd742-3061-44cc-a3c6-e332c41bb130.pdf

[28] https://www.bseindia.com/xml-data/corpfiling/AttachHis/7307deb5-0f51-48d0-9b4a-f546c525d863.pdf

[29] https://www.sudarshan.com/perch/resources/sudarshan-approval-to-application-for-promoters-reclassification-klr-group.pdf

[30] https://www.bseindia.com/xml-data/corpfiling/AttachHis/e40baa8a-828d-41fe-b4f3-7af24e64c7b9.pdf

[31] https://www.bseindia.com/xml-data/corpfiling/AttachHis/abac5973-e866-4a5d-8cf8-68f462ded13e.pdf

[32] https://redingtongroup.com/wp-content/uploads/2019/09/HarrowReclassificationapproval.pdf

[33] http://www.indiagelatine.com/financial/Reclassification%20approval%20by%20BSE_21.11.pdf

[34] https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2018/10/d9b5e05c-3085-4155-b315-4edcdc0fd1c1.pdf

[35] https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2018/9/876a9088-9393-4e2e-9b5d-d09ddd3f8ca4.pdf

[36] https://www.eslsteel.com/investor-relations/pdf/lodr-26sep18a.pdf

[37] https://www.centurytextind.com/assets/pdf/news-and-events/reclassification-under-regulation-sebi.pdf

[38] https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2018/10/da115de5-ff37-420f-8975-e3bd10d73753.PDF

[39] https://www.adaniports.com/-/media/Project/Ports/Investor/corporate-governance/Corporate-Announcement/other-intimation/11420032017Update-on-reclassification-for-promoter-group.pdf?la=en

[40] https://www.valueresearchonline.com/downloads/stock-announcement/416C36C1-0DA3-4A5A-BDE8-BB60AEA1FD05/

[41]https://www.axisbank.com/docs/default-source/corporate-announcements/material-events-disclosed-under-sebi-(listing-obligations-and-disclosure-requirements)-regulations-2015/2020-2021/submission-of-application-for-promoter-reclassification-05-08-2021.pdf

[42] https://www.bseindia.com/xml-data/corpfiling/AttachHis/f32e9326-71bb-4bbe-940a-1e2dda2c5ed5.pdf

[43] https://www.bseindia.com/xml-data/corpfiling/AttachLive/43f432f7-a179-4fc3-8c45-fe02834f6e06.pdf

[44] https://www.sandurgroup.com/doc/21-06-29-Ltr2Bse-Intimation-under-Reg-30-and-31A-BM-reclassification-from-Promoter-to-Public.pdf

[45] https://www.moneycontrol.com/livefeed_pdf/Jun2021/ff77f16f-f738-4da1-80ed-8f09b8144312.pdf

[46] https://www.bseindia.com/xml-data/corpfiling/AttachHis/fb767238-c630-4908-bb6a-220c9e8abec8.pdf

[47] https://www.bseindia.com/xml-data/corpfiling/AttachHis/234a75e4-8668-4cc0-be1b-54de843a9447.pdf

[48] https://www.bseindia.com/xml-data/corpfiling/AttachHis/3259619c-6041-4ebf-aa06-eda0173eb68f.pdf

[49] https://www.bseindia.com/xml-data/corpfiling/AttachHis/295e848a-1943-48d5-ba67-3fa699d2e5b6.pdf

[50] https://www.bseindia.com/xml-data/corpfiling/AttachHis/3148e1be-41fe-44ac-971d-e65f36221854.pdf

[51] https://www.bseindia.com/xml-data/corpfiling/AttachHis/ecae4e2e-77cc-4b1b-bb2f-5485af0af388.pdf

[52] https://www.bseindia.com/xml-data/corpfiling/AttachHis/f67f33ba-8c77-4458-b0ae-6160022abdc1.pdf

[53] https://www.bseindia.com/xml-data/corpfiling/AttachHis/bbda8d1c-e076-4fe4-9a3b-b91da3707016.pdf

[54] Held office as a NED from July 25, 2007 and resigned on October 12, 2018.

[55] NRI and permanently settled in Australia, not connected directly / indirectly.

[56] Held office as a NED and Chairman from July 25, 2007 and resigned from office on June 19, 2020.

Loading…

Loading…

Other write-ups on the subject matter:

1.Recent amendments relating to independent directors

2.SEBI notifies substantial amendments in Listing Regulations

3.New year brings stricter norms for appointment of IDs

4. LODR changes on Independent Directors – Things to do before 1st Jan., 2022