Making Corporate Governance IPO-ready

By Harsh Juneja | Executive ( corplaw@vinodkothari.com)

IPO Market Heating up

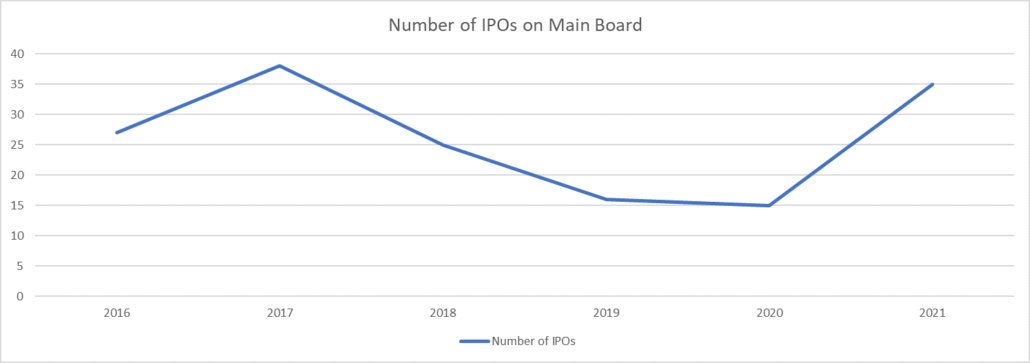

After facing economic crisis owing to the Covid-19 pandemic in March, 2020, a thunderstorm of IPOs strikes India’s Primary Markets. Since July 2020, a total of 48 Initial Public Offers (IPOs) have been issued which includes companies like Burger King, Zomato and Indigo Paints. Draft Red Herring Prospectus (DHRP) has also been filed by various unicorns like One 97 Communication (Paytm), Policy Bazaar Insurance and Nykaa for stepping their toes in the Indian Primary Market.

The above table indicates that even though the economy was not at its best pace in 2020, but still the number of IPOs had increased. Moreover, for 2021, even though the year has not completed yet, but the number of IPOs goes on increasing.

Post Pandemic Recovery

At the time of complete nationwide lockdown, stock market had hit rock bottom. But every cloud has a silver lining. Foreign Direct Investments (FDI) into country rose 15% on year-to-year to $39.9 billion (₹29,400 crore), according to a [1]report by CARE Ratings. Due to surge in foreign investments in the Indian market, it started healing itself. During these hard times, ‘Route Mobile Limited’ came up with an IPO which was a blockbuster in the capital market, as it was listed with a premium of 102.28%. Since then, capital market has been very receptive towards investments. This reception has made people more optimistic towards investment in primary markets.

Preparation in this IPO wave

As we have discussed above, the people feel optimistic towards the Market, many companies which want to raise funds want to just swim along this wave. Companies feel that this is the best time to raise funds through stock market since they will be able to draw maximum premium for their shares. Potential companies need to ensure that mere compliance of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘SEBI (ICDR) Regulations’), is not sufficient as pursuant to listing, a plethora of compliances fall on the back of a company. Schedule VI of the SEBI (ICDR) Regulations, which deals with disclosures to be given in the Abridged Prospectus also requires a company to disclose that it has complied with the Corporate Governance provisions as specified under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘the Listing Regulations’). Prospective issuers are also required to disclose the details of its committees along with a list of their members and detailed ‘Terms of References’ of such committees. These companies need to be prepared with compliances of the aforesaid provisions, along with some other compliances, beforehand to ensure that transitioning from an unlisted to listed company goes smoothly.

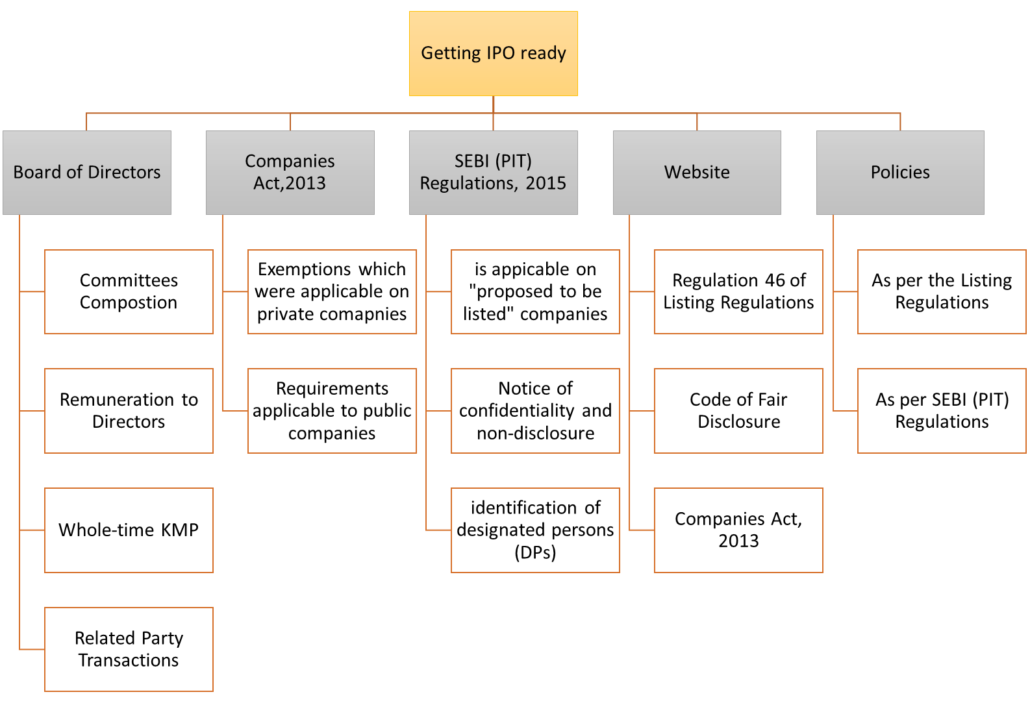

A snap shot of compliances one is required to be adhere to as a part of prepping up for an IPO can be seen below:

Board of Directors

Starting from the composition of the Board to the remuneration of the managerial personnel and requirement of Whole-time Key Managerial Person to review of all existing and probable related party transactions, all of these needs a reconsideration from the transition from a closely held company to a listed company.

Composition

The Board shall comprise of at least one woman director. At least 50% of total directors shall be non-executive directors (NEDs). The requirement of appointment of independent directors (IDs) shall also be adhered to as per the Listing Regulations.

Committees

· Audit Committee

Audit Committee shall have at least 3 members out of which at least 2/3rd members shall be IDs. The Chairperson of this Committee shall also be an ID and CS of the Company shall be the Secretary of the Committee.

· Nomination and Remuneration Committee (NRC)

NRC shall have at least 3 directors. Only NEDs can become members of NRC. At least 2/3rd members of NRC shall be IDs. The Chairperson of NRC shall be an ID only and chairperson of the Company, whether ED or NED, may become a member of NRC but shall not chair such committee.

· Stakeholders Relationship Committee (SRC)

SRC shall constitute of at least 3 directors, with at least one being an ID. The Chairperson of SRC shall be a NED.

-

Risk Management Committee (RMC)

As of now, requirement of constitution of RMC is applicable only on top 1000 listed companies. RMC shall consist of at least 3 members, majority of which shall member of the Board, with at least one being an ID.

Related Party Transactions

The ambit of related party shall be widened as it is not limited only to section 2(76) of the Companies Act, 2013 (‘the Act’), but also includes related parties as per Ind AS-24. All related party transactions shall be approved by only those members of the Audit Committee, who are IDs. All ‘material related party transactions’, as defined under Regulation 23 of the Listing Regulations, shall require approval of the shareholders and no related party shall vote to approve such resolution.

Whole-time Key Managerial Personnel (‘KMP’)

Pursuant to section 203 of the Act, read with Rule 8 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, every listed company shall ensure it shall have the following Whole-time KMP:

- Managing Director, or Chief Executive Officer or Manager and in their absence, a Whole-time Director;

- Company secretary; and

- Chief Financial Officer.

Managerial Remuneration

Pursuant to listing, section 197 of the Act shall become applicable on a company. Therefore, it must ensure that the remuneration to managerial personnel is as per the limits prescribed under this section, before coming with an IPO. The Company is also required to pass a special resolution in case-

- Remuneration payable to a NED exceeds 50% of the total remuneration payable to all NEDs; and

- Remuneration payable to EDs who are promoters or a part of promoter group, which is exceeding the limits prescribed under Regulation 17(6)(e) of the Listing Regulations.

Provisions of Companies Act, 2013 applicable on listed entities

A company which is closely held is entitled to certain exemptions under the Act. However, pursuant to listing, the veil of all these exemptions gets lifted in the following manner:

- Pursuant to [2]MCA Notification dated June 05, 2015, private companies are exempt from compliances with various provisions of the Act like section 160, 162 and 180 etc. But due to listing, all these exempted provisions become applicable; and

- Various provisions like section 152(6) and 196 of the Act, which are only applicable on public companies, shall also become applicable on a private company post-listing. Therefore, the Company should ensure that provisions of these sections are complied with before an IPO.

SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘the PIT Regulations’)

The PIT Regulations, 2015 defines ‘proposed to be listed’ company as an unlisted company, whose securities are getting listed pursuant to filing of offer documents or other documents or pursuant to any merger or amalgamation. Prevention of Insider Trading in a company becomes inevitable in case its securities get listed. Therefore, the PIT Regulations also requires a company, even if it is proposed to be listed, to comply with its provisions. There are also few compliances which a company should be prepared with before coming up with an IPO:

- The Board should formulate and publish on its official website, a code of practices and procedures for fair disclosure of unpublished price sensitive information that it would follow in order to adhere to each of the principles set out in Schedule A to the PIT Regulations. A policy for determination of ‘legitimate purposes’ shall also form a part of this Code;

- Any person in receipt of UPSI pursuant to a “legitimate purpose” shall be considered an “insider” and due notice shall be given to such persons to maintain confidentiality of such unpublished price sensitive information in compliance with these regulations; and

- Before listing, the Company should identify its ‘designated persons’ who shall be governed by the Company’s Code of Conduct on Insider Trading.

Website

Companies Act, 2013 does not mandate a company to create a website. However, pursuant to listing, Regulation 46 of the Listing Regulations gets triggered which mandates it to maintain a functional website and upload various information on it as mentioned under Regulation 46(2). We discussed above about the Code of Fair Disclosure which companies are required to make under the PIT Regulations. This Code is also required to be disseminated on the website of the Company. Companies Act, 2013, requires following information to be disclosed on the website of a company, in case it maintains, –

- Details of business

- Invitation of Deposits

- Closure of books

- Statement for unpaid Dividend Account

- Corporate Social Responsibility

- Consolidated Financial Statements

- Terms and conditions of appointment of IDs

- Notice of candidature for directorship

- Notice of resignation from directorship

- NRC Policy

Policies

The Listing Regulations and PIT Regulations require a listed company to prepare various policies. As launching an IPO is itself a cumbersome process and requires a lot of other compliances to be fulfilled a prospective issuer should prepare these policies beforehand. The following policies required to be made are: –

Conclusion

As we have discussed, there are many companies which have been raising funds through IPOs this year and mere compliance of checklist of ICDR Regulations is not sufficient for a company from transition from an unlisted to a listed company. Potential issuers must bear in mind that pursuant to listing, the money of retail individual investors also vests with a company and thus requires good corporate governance practices.

[1] https://www.careratings.com/upload/NewsFiles/SplAnalysis/FDI%20Update%20-%20H1%20FY21.pdf

[2] https://www.mca.gov.in/Ministry/pdf/Exemptions_to_private_companies_05062015.pdf

You may also refer to our video on Appraising post-IPO governance requirements – https://www.youtube.com/watch?v=CXh3tiISxxY

Leave a Reply

Want to join the discussion?Feel free to contribute!