CSR –“comply or suffer” provisions made effective

CSR Policy Amendment Rules, 2021 brings plethora of other changes

PCS Nitu Poddar, Senior Associate, Vinod Kothari & Company

Introduction

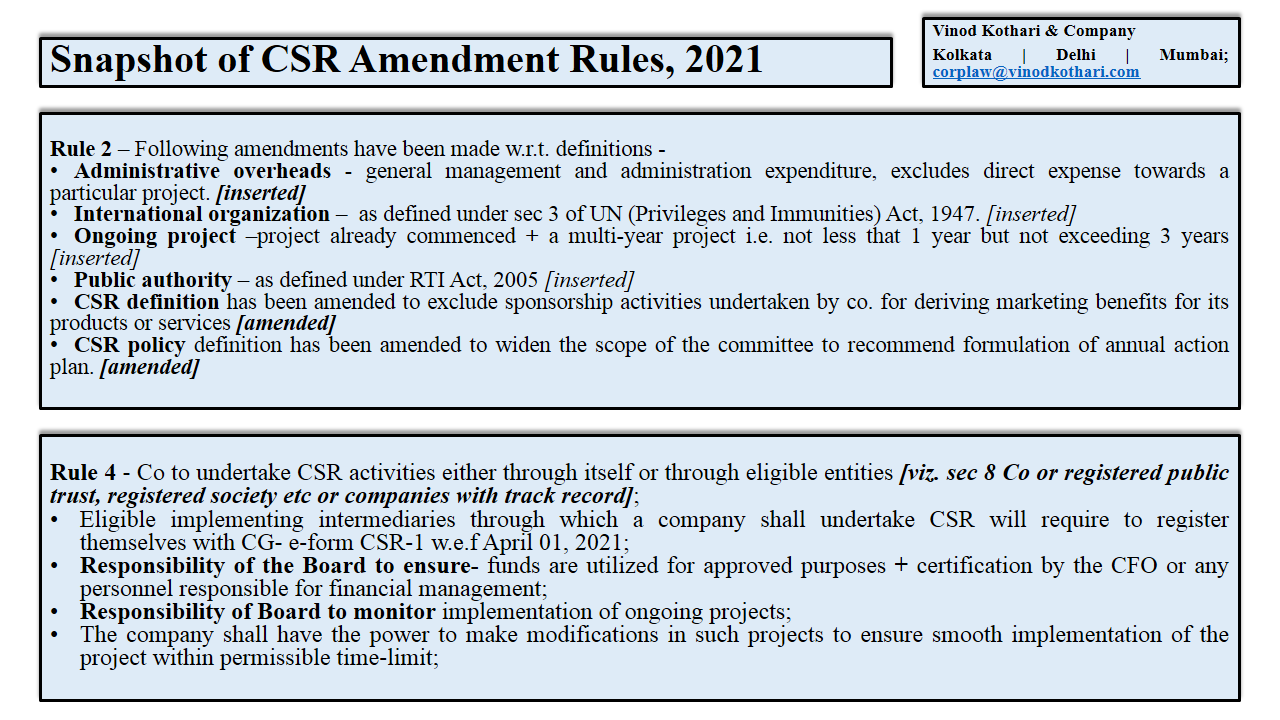

The long pending amendment brought in the provisions of section 135 of Companies Act, 2013 dealing with Corporate Social Responsibility (“CSR”), implementation of which was pending for want of respective amendment in the Rules, has finally been made effective on and from January 22, 2021[1] along with amendment in the CSR Policy Rules, 2021[2].

With the coming into force of this amendment, the penal provisions for non-compliance CSR provisions have also come into force, changing the very nature of the CSR provisions from “comply or explain” to “comply or suffer”. Pursuant to the amendment, the companies are now required to do either of the following: (i) spend the required amount for CSR activities as prescribed under schedule VII or (ii) park the unspent amount of ongoing projects in a separate account within 30 days of the end of financial year or (iii) transfer unspent amount to such funds as mentioned in Schedule VII viz. Clean Ganga Fund or PMNRF or like within 6 months of the end of financial year.

Further, the amendment in the Rules are not just limited to the changes made in the section, rather, it extends to make substantial changes in the implementation of the entire CSR activity. Infact, couple of fresh concepts have also been introduced in the Rules like registering of implementing agencies by filing e-form CSR-1 with the MCA, CFO certificate, mandatory impact assessment.

In this write up, we discuss the impact of the significant changes made in the CSR Rules by the MCA.

Negative attributes of what will not be considered as “CSR”

A list of 6 items have been mentioned in the negative attributes of what would not include to be a CSR expenditure. This includes:

- Activities undertaken in normal course of business;

- [3]Exclusion for three year till FY 2022-23, in case companies do expense for R&D activity of vaccine/ drugs/ medical devices related to covid-19, to such companies which are engaged in R&D activity of new vaccine, drugs and medical devices in their normal course of business. This exclusion will be allowed only in case the companies are doing such R&D in collaboration with organisations as mentioned in item (ix) of schedule VII and disclose the same in their board’s report.

- Activity undertaken outside India;

- Excluded – training of Indian sports personnel representing any State or Union territory at national level or India at international level

- Contribution to political party under section 182;

- Activities benefitting the employees[4] only;

- In case the activity is intended to provide generic benefit to the public and large and the employees also get benefited in the process, the Rule does not intend to discard such activity as a CSR activity. The idea is that the companies should not come out with activities where the employees are the only intended beneficiaries.

- It should also be noted that the definition of employee has been referred from Code on Wages which is quite wide.

- In the draft rules, it was proposed that the activities which have less than 25% employees shall be deemed to be CSR activity. This proposal has been dropped in the final Rules.

- Sponsorship activities which help the company in deriving marketing benefits;

- This was always deemed, however, now have been made absolutely clear that sponsorship / marketing activities cannot be classified as CSR expenditure.

- Activities carried out for fulfiling statutory obligation[5].

This is not a new provision added; this infact was anyway covered under Rule 4 and FAQ of CSR by MCA. from where it has been replaced in the definition clause.

Definition of CSR Policy

The definition of CSR Policy focuses on the role of board towards CSR Policy which has to be prepared taking into account the recommendation of the CSR Committee. It is clear from the amendments that unlike the current prevalent practice where several companies simply picks and choose any activity under schedule VII as a CSR activity, the government intends the Board of companies to have a more thoughtful approach towards undertaking CSR activity. The new definition seems to require the board to do a strategic planning with respect to CSR activity to be undertaken by the company. It requires the Policy to have approach and direction of Board along with guiding principles for selection, implementation and monitoring of the CSR activities undertaken by the companies. This apart, the Policy should also contain annual action plan.

This change may require the companies to revisit their existing CSR Policy soonest so that the same may be placed in the upcoming CSR and Board meeting.

Defining “ongoing projects”

As per the amendment in section 135, unspent amount, if any, for ongoing projects, may be parked in a separate bank account for three years and is not required to be transferred to the Fund. The definition of ongoing projects have been defined in the Rules. As per the definition:

- The ongoing project can be a program of maximum 4 years (including the first year of commencement); – mere one-time spending surely cannot be a “project”. It requires continued expenditure over time.

- “Year” would surely mean financial year. Therefore if say a project has been commenced in the month of February, 2020, the three FY therefrom, will be FY 2022-2023.

- Year wise allocation will have to be made

- Basis reasonable justification, a bullet program can also be converted to an ongoing project by the board of directors

While the timeline of 4 years at one go has been provided, the gaps seems to be two-fold:

- What about the projects which may take longer than 4 years; so as to keep a close check on India Inc., seems like the govt. intends the companies to make budgets for 4 years and either implement it or transfer amount to the National CSR account.

- Can such projects be extended after completion of the 4 years? – to our mind, the answer to this seems to be positive.

Modes of implementing CSR activities

So far, a section 8 company, trust, or a society, having track record of three years in carrying out similar activity were qualified to be an implementing agency. Several amendments have been brought in the provisions relating to implementing agencies:

- On and from April 1, 2021, companies can undertake CSR activity only through implementing agencies which are registered with MCA; – it seems that the MCA is intending to govern the third leg of the economy which consist of not for profit organization by requiring registration of these entities

- Registration has to be done by filing e-form CSR-1 with MCA, post which the implementing agencies will receive a unique CSR Registration Number. This e-form has to be verified by a practicing CA/ CS/ CWA;

- Following entities can only apply for such registration:

- Established by the company either singly or jointly with other company – Section 8 company, registered public trust, registered public society (not private), registered under section 12A and 80G of the Income Tax Act, 1961;

- Established by the Government – Section 8 company, registered trust (here both public and private), registered public society;

- Established under an Act of Parliament or State Legislature – any entity;

- Established by anyone – Section 8 company, registered public trust, registered public society (not private), registered under section 12A and 80G of the Income Tax Act, 1961; having track record of atleast three years in undertaking similar activities.

Mandatory registration of implementing agency with the MCA

As mentioned above, this is a fresh introduction. The template of the e-Form is present in the rules. Also, this would mean that, entities will not be hired as implementing agencies until they register themselves.

Role of International Organisation

The Rules prescribe that companies may engage international organisations for designing, monitoring and evaluation of the CSR projects or programmes as per its CSR policy as well as for capacity building of their own personnel for CSR. The provision, using the word “may”, is directory and not mandatory. Accordingly, companies can take a call to appoint any other entity to undertake the prescribed overhead jobs in respect of CSR. In any case, the threshold allowed as administrative overhead will be applicable,

In the draft rules, it was proposed that the companies may also undertake CSR activities through International Organisations, making them one of the implementing agencies, with the prior permission of the central government, however, this proposal has been dropped in the final rules.

Board responsibility and CFO certification

This is an extremely important amendment. In addition to the monitoring by the board, it requires the CFO or alike to give utilisation certificate of the disbursements made. This makes the role of monitoring all the more crucial. This apart the, CFO will also be required to sign the annual CSR report.

This clause makes the CFO apparently responsible for the entire CSR provision without him being part of the CSR committee or the board of directors. Probably, such certificate shall have to be placed before the CSR committee and / or the board – the draft rules are silent on this.

CSR Committee – responsibility to recommend annual action plan

This seems to be another immediate actionable on part of the Committee. While annual budget and areas of activities was being recommended by the CSR Committee, however, the manner of execution was something that was currently being decided by the board. Also, practically speaking, there used to be one of meeting of CSR in several cases in which the allocating of budget for next FY and approving and signing of the report of last FY used to be done.

However, as per the amendment, the committee is required to draw a detailed annual action plan to undertake CSR program. The amendment rules are clear to indicate the intension of the government which is in full mood to get the management on their heels for effective implementation of the CSR provisions along with ensuring that such spent is making impact in the society.

Mandatory CSR impact assessment

The High Level Committee on CSR[6] highlighted importance of the need and impact assessment for projects with higher outlays. This will help in bringing forth the areas requiring more attention, for there development.

Companies having minimum 10 cr of average CSR obligation in last 3 years shall have to undertake mandatory impact assessment. Interestingly, the report of such assessment is required to be formed a part of the annual report.

There are several question around this:

- who does this assessment ? surely, the govt acknowledges that an outside entity can also be engaged for such assessment and therefore there is increased limits of allowed overhead expenditure for such companies who are mandatorily required to undertake such assessment

- also, it is to be noted that the CSR report as mentioned in the annexure, includes surplus from CSR in the total CSR obligation; – will this mean that where there is extraordinary surplus, compliance of this provision becomes applicable because of surplus ? it may in such cases prove to be waste of resources

Surplus out of CSR program

Though it may seem to be amendment in this provision, however, there is no effective change. The surplus out of CSR activity was anyway prohibited to form part of business profits of the Company. This is just an explicit clarification to say that it has to be used back for CSR purpose only – either the same program from which such surplus has been generated or any other project as per CSR policy of the company.

Such surplus is required to be transferred to the unspent account within 6 months from the end of financial year.

Title holder of CSR assets

This is another important proposal which says that any capital asset acquired / created for the purpose of CSR has to be in the name of only a section 8 company or a registered public trust or registered society having CSR registration Number and cannot be held in the name of the company itself. Considering the quantum of CSR spent being carried through in-house foundations, this is a very substantial change and will lead to revisit the plan of CSR activity.

180+90 days (extension with reasonable justification) time has been proposed for the compliance of this provision.

Unspent amount of ongoing projects to be transferred to Unspent CSR Account

Since the provisions are applicable from January 22, 2021, any amount that remains unspent on ongoing project in FY 2020-21 will have to be transferred to separate account within 30th April, 2020.

Additional disclosures on the website of the company

This is again an important proposal for the companies which have / are required to have a functional website. This requires the companies to inter alia mandatorily disclose the CSR projects approved by the board. So far, this was only known from the annual report much after the end of the FY. This proposal indicates that the board will have to make a thought-through plan on the recommendation of the CSR Committee as the same will be displayed on its website and therefore cannot be changed as per the whims and fancies of the board.

This will also put check on the random on-off / philanthropic acts of the promoters which currently is, in many cases, being converted to CSR spent.

Annual CSR Report

There are several additional details required in the report which is by and large in line with the additional requirement.

It may be noted that requirement of CIN of implementing agencies will be applicable for section 8 companies only.

Conclusion

While the amended rules are quite technical, considering the intent of CSR, it should be broadly principle based then laden with heavy rules and the CSR committee could be laden with the onus of compliance of the provisions in such case.

In any case, the mind of the government seems to be loud and clear that gone are those days when the companies used to take the CSR provisions lightly by putting cliché explanations in the annual report for all the gaps for unspent amount. One cannot ignore that, as per CARO-2020, the auditor is also required to comment on the CSR provisions specifically with respect to the amount unspent and whether transferred to the unspent account.

Read our other article on subject:

- Proposed changes in CSR Rules, click here

- Draft CSR Rules Make CSR More Prescriptive, click here

- CAB, 2020: Bunch of Proposals for revamping CSR Framework, click here

Our presentation on Unspent CSR & role of implementing agencies can be viewed here – https://vinodkothari.com/2021/09/35882/

To access various web-lectures, webinars and other useful resources useful for the Corporate and Financial sector, visit our Youtube channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

[1] https://www.mca.gov.in/Ministry/pdf/CSRHLC_13092019.pdf

[1] Companies CSR Policy Amendment Rules, 2020. W.e.f 24.08.2020 – http://egazette.nic.in/WriteReadData/2020/221325.pdf

[2] “employee” means, any person (other than an apprentice engaged under the Apprentices Act, 1961), employed on wages by an establishment to do any skilled, semi-skilled or unskilled, manual, operational, supervisory, managerial, administrative, technical or clerical work for hire or reward, whether the terms of employment be express or implied, and also includes a person declared to be an employee by the appropriate Government, but does not include any member of the Armed Forces of the Union;

[3] MCA FAQ- Q3: http://www.mca.gov.in/Ministry/pdf/General_Circular_21_2014.pdf

[1] MCA Notification for effecting amendment brought vide Companies (Amendment) Act, 2019: http://egazette.nic.in/WriteReadData/2021/224636.pdf

MCA Notification for effecting amendment brought vide Companies (Amendment) Act, 2020: http://egazette.nic.in/WriteReadData/2021/224637.pdf

[2] CSR Policy Amendment Rules, 2021: http://mca.gov.in/Ministry/pdf/CSRAmendmentRules_22012021.pdf

Draft CSR Policy Amendment Rules, 2020 dated March 13, 2020: http://feedapp.mca.gov.in/csr/pdf/draftrules.pdf