MCA issues rules to squeeze out minority shareholding held in dematerialized form

Shaifali Sharma | Vinod Kothari and Company

Understanding minority squeeze out

‘Minority squeeze out’ demonstrates the power of majority shareholders to forcibly acquire shares from minority shareholders and drive them out to gain absolute control over the company.

Section 236 of the Companies Act, 2013 (‘Act, 2013’) sets out a process of squeezing out minority shareholder whereby any shareholder of the company, either alone or along with person acting in concert, holding 90% or more of the total issued equity share capital, may acquire the remaining equity shares of the company by giving an offer to the minority shareholders. This “Rule of Majority” principle was recognized in a landmark case Foss v. Harbottle, where it was held that that the minority shareholders are bound by the decision of the majority shareholders and the Courts do not interfere in the internal matters of the Company. However, the powers of majority should be exercised in reasonable manner which do not result into oppression of minority. Thus, the inherent protection under the law is that the acquisition shall take place at a fair value or higher value as determined by the valuer in accordance with Rule 27 of the (Compromise, Arrangements and Amalgamation) Rules, 2016 (‘CAA Rules, 2016’).

The section 236 was incorporated under the Act, 2013 on the recommendation of the Dr. J.J. Irani Committee Report on Company Law, 2005[1] for the reason reproduced below:

“The law should enable companies to purchase the stake of minority shareholders in order to prevent exploitation of such shareholders where a promoter has bought back more than 90% of the equity. Such purchase should, however, on the basis of a fair offer. Appropriate valuation rules for this purpose should be prescribed, or, the last known price prior to delisting, could be made the benchmark for such acquisitions.”

The purpose is to ensure a seamless takeover of a company, since in view of very smallholding of the minority shareholders; the minority shareholders neither will be able to participate in the management of the company nor will be able to seek redressal of their rights or have a meaningful participation in the company’s working. Therefore, to provide fair exit to the minority shareholders and to allow majority shareholders to exercise full control over the company, section 236 has been inserted under the Act, 2013.

This write-up endeavours to analyse (1) the existing process of acquiring minority shares held in physical form, (2) the practical difficulties for acquiring minority shares held in demat form and (3) the new rules introduced vide MCA notification[2] dated 17.12.2020 setting out the procedure of transferring minority shares held in demat form.

Modus Operandi of purchase of minority shareholding held in physical form

- Intimation to the Company

The acquirer holding 90% of the issued equity share capital of a company to inform the company of its intention to oust the minority shareholders in accordance with provisions of Section 236 of Act, 2013. At the same time, the minority shareholders can also offer their shares to be acquired to the acquirer in compliance prescribed provisions.

- Determining the fair value of shares for acquisition

Fair value of the shares of the Company whose shares are being transferred in accordance with Rule 27 (Compromise, Arrangements and Amalgamation) Rules, 2016.

Fair value of the shares of the company to be offered to the minority shareholders shall be calculated by a registered valuer in accordance with Rule 27 of the CAA Rules, 2016 which provides for evaluation criteria for listed companies as well as unlisted companies.

- Transfer Agent

The company whose shares are being transferred to the acquirer, shall act as a transfer agent for receiving and paying the price to the minority shareholders and for taking delivery of the shares and delivering such shares to the majority.

- Depositing of amount in separate account operated by the Company

The majority shareholders are required to deposit an amount equal to the value of shares to be acquired by them, in a separate bank account to be operated by the company for payment to the minority shareholders, for atleast 1 year for payment to the minority shareholders and such amount shall be disbursed to the entitled shareholders within sixty days and even thereafter by the company.

- Despatch of offer letter and consideration by the company

The offer letter received from the acquirer will be dispatched to the shareholders along with the consideration.

- Physical delivery of shares

Minority shareholders shall on receipt of offer letter, provide for physical delivery of their shares to the company within the offer period.

The point of relevance is that, the word used is “physical delivery of shares” and not physical share certificates. Accordingly, physical delivery would cover delivery of both, shares held in physical form as well as shares held in dematerialized form by minority shareholders.

- In case of shares held in physical form, physical delivery will be evidenced by receipt of share certificates by the Company;

- In case of shares held in dematerialized form, physical delivery will be evidenced by the receipt of Delivery Instruction Slips (DIS) in favor of the acquirer. Upon submission of DIS, the Depository Participant processes the DIS and debits the clients account with the said number of shares. Simultaneously, the target demat account is credited with the same number of shares.

7. Failure to tender physical delivery of shares

In the absence of a physical delivery of shares by the shareholders within the time specified by the company, such shares shall be taken as cancelled and the transferor company shall be authorized to issue shares in lieu of the cancelled shares and complete the transfer by following the applicable transfer provision and dispatching the amount paid by the acquirer in advance.

Impracticability to acquire minority shareholding held in dematerialized form

In order to ensure smooth implementation of acquisition of minority shareholding, the Act, 2013 empowers the company whose shares are being transferred to issue new shares in lieu of the undelivered shares within the time specified.

While in case of shares held in physical form, section 236(6) of the Act, 2013 is clear to state that share certificates shall deemed to be cancelled for non-receipt of physical delivery of shares and the company is authorized to issue new shares in lieu of cancelled share certificates, however, there is a difficulty in implementing the same in case of shares held in dematerialized form.

The law is silent on the procedure to be followed by the company for transferring the shares held by minority shareholders in dematerialized form, in the absence of receipt of DIS from minority shareholders. The Depositories, without any clear instructions from Ministry of Corporate Affairs (‘MCA’) or Securities Exchange Board of India (‘SEBI’), does not permit transfer of shares to the demat account of acquirer by virtue of DIS signed by the company on behalf of the minority shareholder.

Therefore, the intent of the law behind the enforcement of section 236 remains unfulfilled in case of shares held in dematerialized form as the company would not be able to give effect to the transfer in the absence of any definitive procedure laid out to give effect to the same.

MCA new rules on purchase of minority shareholding held in dematerialized form

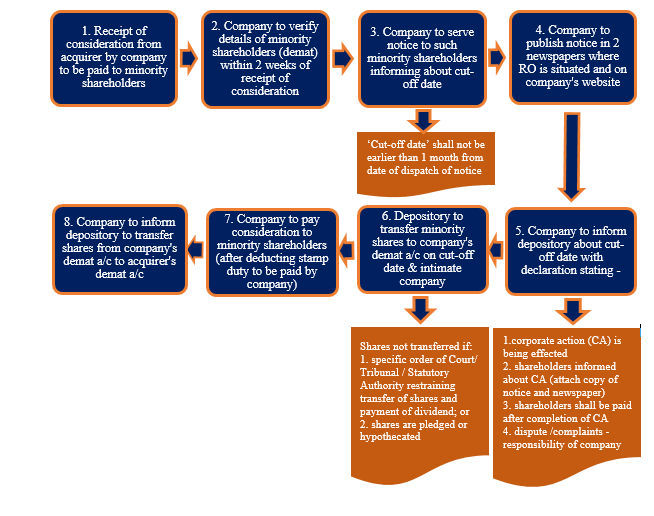

MCA has finally woken up to the need to enable companies to purchase minority shareholding held in demat form. The CAA Rules, 2016 has been amended vide MCA notification dated 17.12.2020 where a new Rule 26A has been introduced to provide process for purchase of minority shareholding held in demat form. The detailed step-by-step process highlighting the actionable for transferor company is explained below:

- Company to verify the details of minority shareholders holding shares in dematerialized form

The company shall within 2 weeks from the date of receipt of the amount equal to the price of shares to be acquired by the acquirer, verify the details of the minority shareholders holding shares in dematerialised form.

- Company to send notice to minority shareholders informing cut-off date

The company shall send notice to minority shareholders by registered post or by speed post or by courier or by email informing about a cut-off date on which the shares of minority shareholders shall be debited from their account and credited to the designated demat account of the company, unless the shares are credited in the account of the acquirer, as specified in such notice, before the cut-off date.

The cut-off date shall not be earlier than 1 month after the date of sending of the said notice. Also, if the cut-off date falls on a holiday, the next working day shall be deemed to be the cut-off date.

- Newspaper publication of notice served to minority shareholders

A copy of the notice served to the minority shareholders shall also be published simultaneously in two widely circulated newspapers (one in English and one in vernacular language) in the district in which the registered office of the company is situated and also be uploaded on the website of the company, if any.

- Company to inform depository about the cut-off date along with a list of declarations

Immediately after newspaper publication of notice, the company shall inform the depository w.r.t cut-off date and submit the following declarations stating that:

- The corporate action is being effected in pursuance of the provisions of section 236 of the Act;

- the minority shareholders whose shares are held in dematerialised form have been informed about the corporate action [a copy of the notice served to such shareholders and published in the newspapers to be attached];

- the minority shareholders shall be paid by the company immediately after completion of corporate action;

- any dispute or complaints arising out of such corporate action shall be the sole responsibility of the company.

For the purposes of effecting transfer of shares through corporate action, the Board of Directors of the company shall authorise the Company Secretary, or in his absence any other person, to inform the depository and to submit the documents as may be required.

- Depository to transfer the minority shares to company on the cut-off date

Except for the shares already credited in the account of the acquirer before the cut-off date by shareholders, the depository shall transfer of shares of the minority shareholders into the designated demat account of the company on the cut-off date and intimate the company.

Note: In case a specific order of Court or Tribunal, or statutory authority restraining any transfer of such shares and payment of dividend, or where such shares are pledged or hypothecated under the provisions of the Depositories Act, 1996, the depository shall not transfer the shares of the minority shareholders to the designated demat account of the company.

- Company to make payment to minority shareholders

The company shall immediately upon transfer of shares by the depository, disburse the price of the shares so transferred, to each of the minority shareholders after deducting the applicable stamp duty, which shall be paid by the company, on behalf of the minority shareholders, in accordance with the provisions of the Indian Stamp Act, 1899.

- Depository to transfer the minority shares from company’s demat account to acquirer’s demat account

One the payment is successfully disbursed to minority shareholders, the company shall inform the depository to transfer the shares of such shareholders, kept in the designated demat account of the company, to the demat account of the acquirer.

Note: The company shall continue to disburse payment to the entitled shareholders, where disbursement could not be made within the specified time, and transfer the shares to the demat account of acquirer after such disbursement.

A pictorial presentation giving step-by-step procedure to the above requirements is summarized below:

Concluding Remarks

The majority shareholders enjoy the right to squeeze out minority shareholders to gain control over the company in toto and attain a greater flexibility in decision making. While the process of acquisition of minority shares held in physical form is clearly established in the Act, 2013, however, companies were facing it practically difficult to implement in case minority shares are held in demat form. In the absence of any clear guidelines, squeezing out minority shareholders turned out as a challenge to implement.

The new rules notified by MCA are certainly a laudable solution facilitating the majority shareholders to smoothly acquire the shares held by minority shareholders in demat form.

Other reading materials on the similar topic:

- ‘Comparative Analysis of provisions enabling majority shareholders to squeeze out minorities’ can be viewed here

- ‘Minority Squeeze Out: A strong new provision under section 236 of the Companies Act, 2013’ can be viewed here

- ‘Takeover under Companies Act, 2013’ can be viewed here

- Presentation on ‘Minority-outs under Companies Act, 2013’ can be viewed here

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

[1] H-ttp://www.nfcg.in/pdf/23-Irani%20committee%20report%20of%20the%20expert%20committee%20on%20Company%20law,2005.pdf

[2] http://egazette.nic.in/WriteReadData/2020/223774.pdf

Whether a holding company can take over the entire share capital of the Subsidiary company, in which Holding Company has 51% equity share?

If yes, then under which provision?

Can a holding company take over the entire turnover of Subsidiary company, in which Holding Company has 51% equity share?

Whether a holding company can take over the entire share capital of the Subsidiary company, in which Holding Company has 51% equity share?

No, under Section 236 of the Companies Act, 2013 a company is required to hold ninety per cent or more of the issued equity share capital of a company in order to be eligible to buy the remaining minority shareholding as per the aforesaid section. Since the holding company has only 51% shares it is not eligible for acquisition of shares under this section.