AIFs ail SEBI: Cannot be used for regulatory breach

Vinod Kothari | corplaw@vinodkothari.com

The alternative investment management industry in India works in the form alternative investment funds (AIFs), a SEBI-regulated vehicle. Most of the PE, VC funds, and hedge funds in India work in this mode.

AIFs have recently been at the receiving end of regulatory flak. RBI had expressed concerns on use of AIFs by regulated lenders for evergreening, and prohibited regulated entities from making any investment in such AIFs as have investments in their borrowers.

Now, SEBI, vide a Consultation Paper dated 19th January heaped a bunch of similar concerns, and required AIFs to affirm that the AIF or investments therein are not being used for regulatory breaches. These concerns, SEBI says, are a result of an ongoing thematic check on the AIF industry, and SEBI says it has already detected at least 40 cases, involving AUM over Rs 30000 crores, where the structure was used to create dents in existing financial regulations.

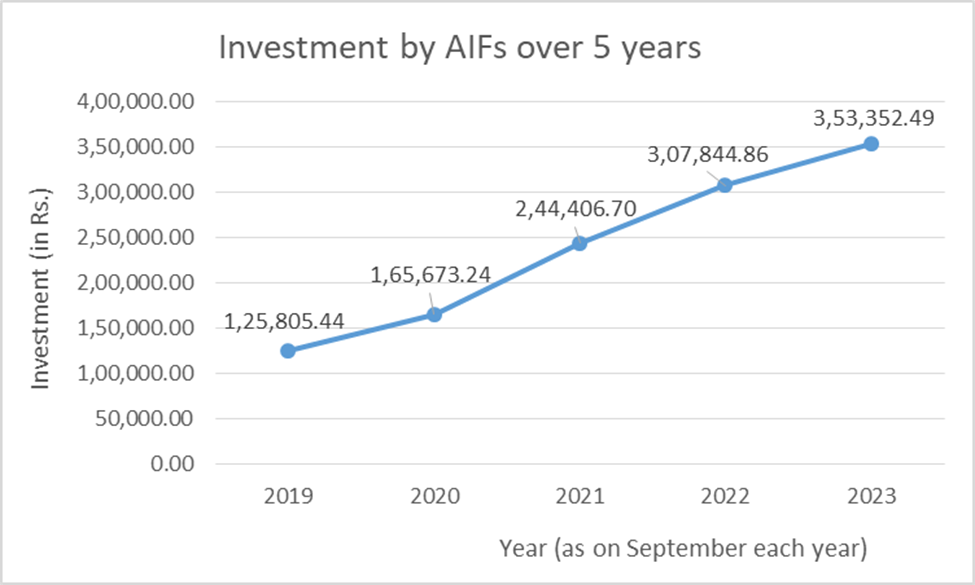

Based on Data relating to activities of Alternative Investment Funds (AIFs)

The AIF industry has demonstrated steady growth in recent years. As of September 2023, the assets under management (AUM) of AIFs have surged to 3.88 lakh crores, a substantial increase from the 13,000 crores recorded in September 2015. [See Graph above].

SEBI-noted Concerns

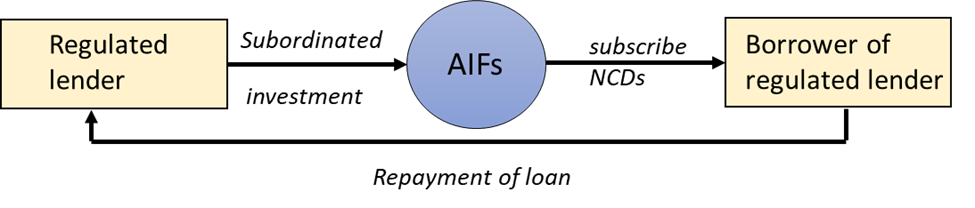

In its CP, SEBI noted that regulated lenders had used AIFs for evergreening loans. Evergreening arises when a loan, on the brink of turning into an NPA, is artificially kept as a performing asset, by circularly lending or investing the money, in this case, by using an AIF.

SEBI’s CP mentions a palpable practice, where a lender makes a subordinated investment in an AIF, and the AIF in turn invests the money into the borrower on the verge of default. With this dud investment, the borrower pays the money to the lender, whereby the loan remains performing. On the other side, since the investment by the lender in the AIF was subordinated, the loss due to the investment into the defaulter will be allocated to the lender entity only, leaving the rest of the investors unaffected. The AIF manager, obviously, makes his management fees on this circuitous flow of money.

The RBI has already acted on this, vide notification dated December 19, 2024, prohibiting all regulated entities (REs), including banks, cooperative banks, NBFCs, and All India Financial Institutions from making investments in AIFs, if the AIF has made any investment into a debtor company. See our write on this issue at RBI bars lenders’ investments in AIFs investing in their borrowers.

2. Circumvention of FEMA norms

SEBI’s Consultation Paper raised two key concerns about FDI norms. First, under FEMA NDI Rules 2019, AIF’s downstream investment depends on the domicile of its manager/sponsor. This has created scope for regulatory arbitrage, as some foreign investors have set up AIFs with domestic managers/sponsors to invest in sectors prohibited for FDI or to invest beyond the allowed FDI sectoral limit.

Secondly, RBI norms restrict foreign investors from directly investing in the debt market, requiring investment through FPI or ECB routes. However, the AIF structure currently provides a loophole for foreign investors to channel funds into debt/debt securities, bypassing the FPI/ECB route.

3. Circumvention of QIB regulations

The qualified institutional buyers (QIBs) are allocated a portion of the offer in case of an initial or further public offer under the SEBI ICDR framework. AIFs also qualify as QIBs.

However, some of the AIFs are so concentrically held that the AIF is nothing but a group entity or a single/limited investors. With the QIB tag, these AIFs get preferential treatment in IPOs.

4. Other concerns:

As SEBI admits, AIFs have been subjected to light-touch regulations, and therefore, there are several other ways AIFs may be exploited for regulatory arbitrage.

Some examples:

- The declaration of a “significant beneficial owner” (SBO) in entities is a global concern. Current SBO rules in terms of sec. 90 of the Companies Act permit the trail of SBI detection to stop at an AIF, and not look at the beneficiaries or unitholders of the AIF. Thus, if an AIF is majorly held by a single investor, and that AIF in turn holds a majority stake in a company, the beneficiary may effectively conceal himself from being shown as an SBO.

- Companies principally engaged in lending activities require RBI registration as an NBFC. However, AIFs may be investing in structured debentures, which are look-alikes of a loan, and yet escape RBI regulations.

- Similarly, group holding companies may come under RBI registration as “core investment companies”. However, AIFs, which may actually be formed with investments from within the group, and may be investing within the group, escape CIC registration.

- There are no “related party transaction” (RPT) regulations currently applicable to AIFs, whereas regulated lenders have to adhere to meticulous controls on RPTs. It may be possible to contend that a fund is not a related party, and therefore, routing of investments through an AIF provides an easy way to escape RPT or connected party lending restrictions.

What has been proposed by SEBI?

- To impose a “general obligation” on AIF, Manager of AIF, and KMP of managers and AIF for carrying out due diligence with respect to their investor and investments, before making any investments.

- Proposed insertion:

“Every Alternative Investment Fund, Manager of the Alternative Investment Fund and Key Management Personnel of the Manager and the Alternative Investment Fund, shall carry out specific due diligence , as may be specified by SEBI from time to time, with respect to their investors and investments, before each investment, to prevent facilitation of circumvention of extant regulations administered by any financial sector regulator.“

And picture abhi baaki hai dost, because SEBI is already piloting a Standards Forum for AIFs, which will do furtehr standard-setting.

How will adherence to this general obligation be ensured?

Mostly, use of AIFs for regulatory arbitrage results in an “in spirit” dent in regulations. It is rarely so that a breach of sectoral regulations is seen on the face of it. When the general obligation is cast on the AIF, its manager and its KMPs, the concerned parties will have to affirm that they are not causing a breach of the regulations by purpose and effect, and not just on the face of the transaction or the structure.

AIFs have been under liquidity strain, as regulated lenders had to disinvest their existing investments within a narrow timeline. SEBI’s CP puts sharp regulatory distrust into the AIF industry. Further developments in this regard will be worth watching.

Also refer to our article on:

RBI bars lenders’ investments in AIFs investing in their borrowers

Leave a Reply

Want to join the discussion?Feel free to contribute!