Need for strategic vision in CSR spending by companies

– Pammy Jaiswal, Partner | corplaw@vinodkothari.com

| The article was also published in the CRA E-Bulletin and can be viewed here |

Background

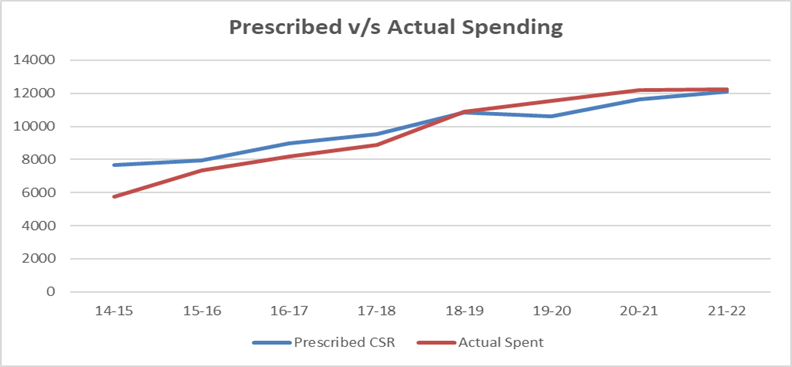

While the sense of ‘Corporate Social Responsibility’ (‘CSR’) might have been the result of the statute, first on a “comply or explain” basis, and later, as a mandate, it is heartening to note that companies are now not looking at CSR as a mere compulsion, but are seeing this as an instrument for social bridge-building. As is well known, the provisions were introduced, arguably as a unique case globally, in 2014 under the Companies Act, 2013 (‘Act’). From that year till FY 2021-2022, companies have spent approximately INR 1,39,202 crores[1] on CSR activities. In fact, it is pleasantly surprising to note that companies have been targeting to spend their minimum obligations; the gap between the prescribed spending and the actual spending has consistently been narrowing as can be seen from the graph given below. With the introduction of the Companies Corporate Social Responsibility Policy (Amendment) Rules, 2021[2], read with the changes under section 135 of the Act pursuant to the Companies (Amendment) Act, 2019[3], an element of penalty for not doing the needful has been added, at the same time permitting companies to overspend their obligation and claim a set off within the next 3 years, there are several companies which are spending more than their targets.

Data Source: India CSR Outlook Reports

Having said that, it will be important to discuss whether spending itself will help attain the motive for which the CSR framework was introduced? CSR is a part of a larger business responsibility and sustainability. If companies confine their CSR ideologies to simply adding up to a requirement of spending amount, will the society get back what it ought to be getting back form a responsible business? Should companies look at CSR beyond mere spending, and construct a CSR vision based on the negative footprints created by their activities, if any, or otherwise, create social impact relevant to their businesses?

Read more →