Financing transition from “brown” to “green”

SEBI prescribes additional requirements for transition bonds

– Mahak Agarwal, Executive | corplaw@vinodkothari.com

Need for transition finance

As climate change and its impacts continue to remain one of the major concerns of any economy, transition finance is a step towards effectively transforming carbon emissions and combating climate change.

‘Transition Bonds’, as the word speaks for itself, are debt instruments that facilitate transition of a carbon-intensive business into decarbonizing business and eventually achieving the Net Zero emissions targets.

While it is true that change is the only constant, it cannot be denied that the same can often be challenging. Similar is the case with enterprises looking to metamorphosize their activities into a sustainable form. A huge amount of finance is required for carbon-intensive sectors to decarbonize and it is here that transition bonds find their application.

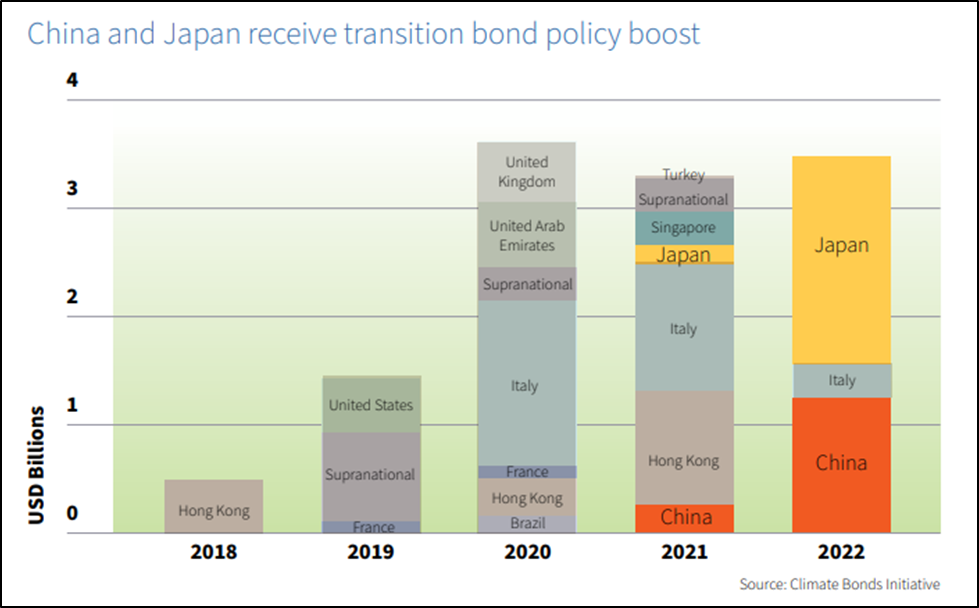

According to a recent report discussing the shape and size of the GSS+ market as of 31st December, 2022, the size of the transition bond market has seen a year on year increase from USD 3.3 billion to USD 3.5 billion.

Furthermore, over the period of 2018 to 2022, the transition bond market has seen a boost, especially with a diverse range of Chinese and Japanese heavy industry issuers coming to the market to raise funds under their respective national transition finance programmes.

Figure 1: Volume of transition bonds issuance over years and by country

Meaning of “transition bonds” and Regulatory Framework in India

In India, regulatory recognition to the concept of transition bonds was given recently, vide an amendment dated 2nd February, 2023. Under this transition bonds were included in to the meaning of Green Debt Securities (“GDS”) under clause (q) of Regulation 2 of SEBI (Issue and Listing of Non Convertible Securities) Regulations, 2021 (“ILNCS Regulations”): :

“transition bonds which comprise of funds raised for transitioning to a more sustainable form of operations, in line with India’s Intended Nationally Determined Contributions,

Explanation: Intended Nationally Determined Contributions (INDCs) refer to the climate targets determined by India under the Paris Agreement at the Conference of Parties 21 in 2015, and at the Conference of Parties 26 in 2021, as revised from time to time.”

The inclusion of transition bonds in the broader GDS framework has been done as a part of the recommendations of CoBoSAC that considers such inclusion “ is in line with India’s vision to move towards a greener economy by achieving the climate targets determined by India in the Paris Climate Deal in COP 21 in 2015 and again revised at the COP 26 at Glasgow in 2021.”

Globally, London Stock Exchange (“LSE”) is the first exchange to launch a dedicated Transition Bond Segment. The LSE defines transition bonds as a “subset of sustainable debt finance instruments whereby the issuer is raising funds in debt markets for climate and/or just transition-related purposes.”

The Ministry of Economy, Trade and Industry of Japan defines transition finance as “a financing means to promote long-term, strategic GHG emissions reduction initiatives that are taken by a company considering to tackle climate change for the achievement of a decarbonized society”

Similar theories have also been adopted by countries like Africa, Korea, China and others. More about transition bonds and other sustainable bonds can be read at Sustainable finance and GSS+ bonds: State of the Market and Developments

Compliances applicable to issuance and listing of transition bonds

Transition bonds are a sub-category of GDS, and therefore, any issuer willing to issue and list transition bonds on the Indian stock exchanges is required to comply with the requirements that are otherwise applicable on any issuance of GDS. The compliance requirements applicable to GDS may be read at SEBI revises framework for green debt securities.

In addition to the same, considering the nature of “transition” bonds, SEBI, vide its Circular dated May 4, 2023 has prescribed certain additional compliances to be followed in case of issuance of transition bonds,in order to facilitate transparency and informed decision making amongst investors and to prevent misallocation funds raised through such bonds. The Circular has been appended as a newly inserted Ch-IXB to the Operational Circular, and is applicable from immediate effect.

These additional compliances include the following –

- Use of a specific denotation ‘GB-T’ for the transition bonds by the issuer to differentiate them from other categories of GDS

- on the cover page of the offer documents as well as in the “type of instrument field”, and

- in the centralized database for corporate bonds maintained with the depositories.

- Disclosure of a transition plan in the offer document containing

- Details of interim targets and milestones to be achieved including timelines for such achievement and indicative figures of emissions expected to be reduced

- Brief of project implementation strategy

- Details regarding the usage of technology for the project implementation

- Mechanism to oversee the utilization of the funds raised through transition bonds and the implementation of the transition plan. Issuers may form a committee to oversee the implementation and ensure timely completion of the defined targets

- Any revision in transition plan during the year along with an explanation of the same to be disclosed to the Stock Exchange

- Disclosure in the Annual Report, the transition plan along with a brief on the progress of the implementation of the transition plan.

The present circular is a step ahead in reducing the prevalence of greenwashing, further to the SEBI circular that aimed at avoiding occurrence of greenwashing as applicable to GDS, which is equally applicable on Transition bonds (being a sub-set of GDS).

Furthermore, India, as a part of its long term climate action strategy submitted to the United Nations Framework Convention on Climate Change (UNFCCC) at UN Climate Conference (COP27) has articulated to achieve its Net Zero target by 2070. This will require at least Rs. 162.5 lac crores of sustainable finance from 2015 to 2030 as per estimates. If successfully implemented, transition bonds are expected to play a significant role in bridging the gap between the ‘brown’ and the ‘green’ towards meeting the targets India has set for itself.

Our resource center on ESG and Sustainability can be accessed here

Leave a Reply

Want to join the discussion?Feel free to contribute!