Measures for promoting MSMEs: credit guarantees and timely payments

The MSME segment represents 30%[1] of the Gross Domestic Product of the country and is a key to India’s vision to become a USD 5 trillion economy. As a result, this has always been a focus area so far as macro-economic policy-making is considered.

During the present year’s budget, the FM highlighted that one of the key areas where the Government has worked on is ease of access to finance.

Access to finance has always been a problem for the MSMEs in the country, and the reasons for this are many, including lack of standardisation of business processes, lack of credit history, lack of formal collateral, etc. To plug the demand and supply gap in MSME financing, the Government of India has over the years launched several schemes to directly or indirectly channelise institutional finance to this segment.

Of the several initiatives taken by the Government, the one which has gained the most popularity is the Credit Guarantee Scheme for Micro & Small Enterprises. To operationalise this, the GOI and SIDBI together formed the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The CGTMSE primarily extends guarantee in case of collateral-free loans and loans with insufficient collateral to micro and small enterprises.

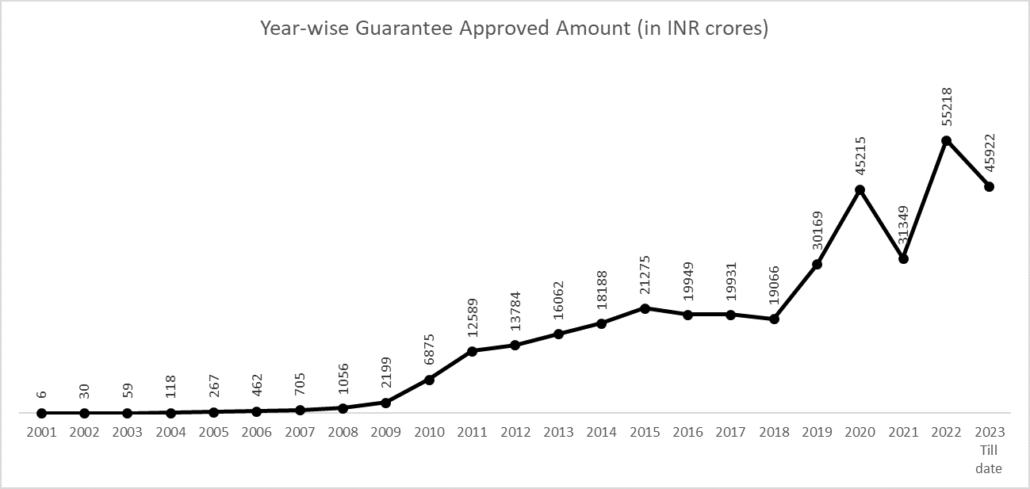

The program was first introduced in 2000. Over the years, the fund has extended guarantees to the extent of Rs. 3.6 lakh crores. The graphic below shows the year-wise guarantee approved since commencement.

In the present budget, the FM has proposed to infuse another INR 9000 crores in the fund, which will enable additional collateral-free guarantee INR 2 lakh crore, and the effective reduction of cost of credit due to this will be by 100 bps.

Types of Credit Guarantee Schemes

The CGTMSE currently runs the following programs:

(a) Credit Guarantee Scheme for the Banks (CGS I)

(b) Credit Guarantee Scheme for the NBFCs (CGS II)

(c) Sub-debt Scheme – for distressed MSMEs

(d) PM Svanidhi for street vendors

(e) Credit Guarantee Scheme for Co-Lending (CGSCL)

While the specifics of the schemes vary, at a macro-level, the key highlights of these schemes are:

Scope:

The schemes mostly target Micro and Small Enterprises, and the guarantee coverage provided is upto INR 2 crores (this amount varies depending on the lending institution, size of the loan etc.)

Coverage:

The guarantee coverage ratios range between 75% – 85% depending on the size of the borrower, and also the member lending institution. For financing retail and wholesale activities, guarantee cover of 50% is applicable.

Eligible activity:

The following end-uses of credit are allowed: Manufacturing, Services, Retail Trade, Wholesale Trade, and Educational / Training Institutions.

Types of MLIs:

The following types of lending institutions can register themselves as member lending institutions:

- Public sector banks

- Private banks

- Regional rural banks

- Financial institutions

- Foreign banks

- Small finance banks

- Non-banking finance companies

- Scheduled urban cooperative banks

- Non-scheduled urban co-operative banks

- District central co-operative banks

For a detailed understanding about various schemes incentivizing MSME financing, read our article, Primer on MSME Financing.

Payment delays to MSMEs will disqualify an expense

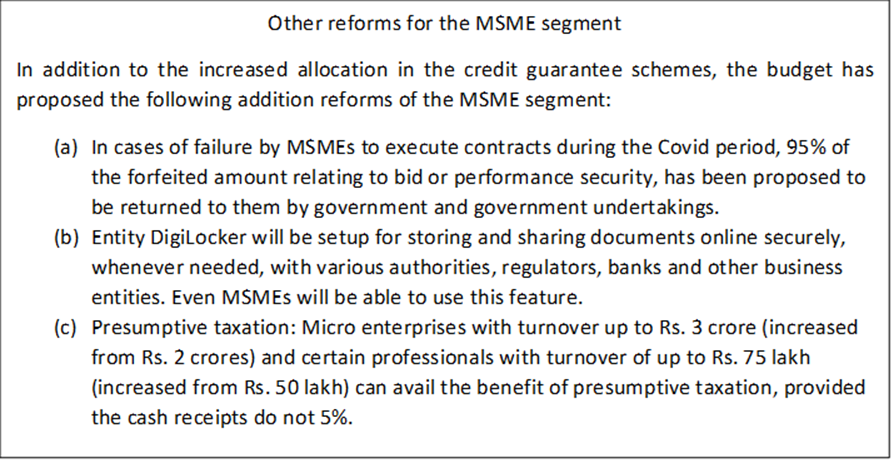

Yet another proposal is an amendment to well-known sec. 43B of the Income-tax Act, whereby, if payments for anything which is claimed as an expense, is not made within the time stipulated under sec. 15 of the MSME Act, the expense will be disallowed in the year of provisioning, only to be allowed in the year of actual payment.

It is important to note that sec. 15 of the MSME Act contains a statutorily binding promise on the part of all buyers of goods or services from MSMEs, to make payment for the same, within a maximum period of 45 days. Pretexts like “invoice was not accepted” or “there was a commercial dispute” also do not work in such invoices, as sec 2(a) provides that an invoice is “deemed accepted” unless a dispute is raised within 15 days.

To add further strength to the timelines for payment to MSMEs, the Budget proposes to insert a new clause (h) in sec. 43B to disallow “any sum payable by the assessee to a micro or

small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium

Enterprises Development Act, 2006”.

It appears that the disallowance will relate to a sum which is claimed as an expense or deduction. Lot of MSME payments relate to capital assets, which are not claimed as such. Hence, the provision may not extend in its sweep to such payments.

[1] For FY 2022

Leave a Reply

Want to join the discussion?Feel free to contribute!