Financial Regulators to have a consultative approach

– Timothy Lopes, Manager | finserv@vinodkothari.com

The need for a consultative approach

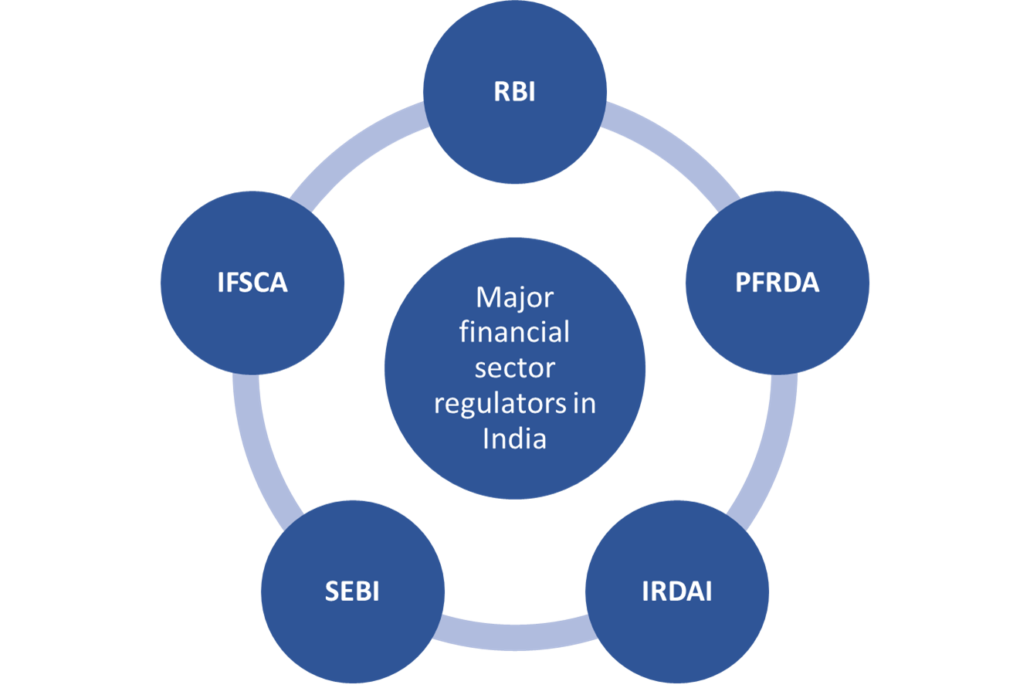

In a post on LinkedIn, Vinod Kothari stated: “Let us face it – the business world is increasingly governed by regulations, and not rule of law. Parliamentary law in most cases is skeletal, laying what may evasively be termed as the essential principles. Most substantive rules that define, delimit or deny business freedom are made by the regulators. In the world of finance and capital markets, the regulators are SEBI, RBI, IRDA, PFRDA, etc.

This note is to make a case that significant regulatory actions, involving change of the rules that govern business, must necessarily be first proposed for public comments. A sudden change in rules can cause great difficulty as the regulated would keep searching for the rationale behind the regulatory action. Quite often, regulators come back and say: we have our own observations. But how does one justify the results of regulatory experience not being shared with the regulated? How does one conclude that the observations of the regulator are unbiased, not myopic, or that the proposed rule-making by the regulator is based on a wrong premise or flawed understanding, or that a proposed rule will not do a damage? There are occasions when a regulatory action may have to be taken without the benefit of prior discussion, but this is exceptional. Perhaps, such an action is justified when the regulator has to act abruptly, or the balance of convenience lies in immediate implementation. But for such exceptional cases, one is not able to make a case for a change in rules that takes people by surprise.

In case of parliamentary law, the parliamentary process by definition involves a bill, which is discussed and debated by the people’s representatives. No regulator can claim to know all that the regulated actually need, or all that the regulator ought to know, without the benefit of consultation.

Therefore, a prior notice of proposed rule-making is a very common practice with many regulators. The practice of advance notice of proposed rule-making is also strictly followed by US Federal regulators.

The benefits of a prior consultation are most intuitive, and generally unarguable. It serves to get perspectives that the regulators may not be aware of. The process becomes inclusive, and therefore, the benefit of better acceptance from the regulated.

On the other hand, the downsides of a non-consultative regulator bringing unannounced rules that seek to regulate business may be drastic. Most importantly, the regulator may be missing on one or more important points. It is notable that recursive change in regulation is never advisable – therefore, regulation is not a fit lab for testing regulations and then tweaking them. It affects business confidence, it affects business. And pretty sure, no government, no regulator would ever wish for the same – as such it is important for the regulators to be deft without being deaf.”

A prior notice of proposed rule-making is a very common practice with many regulators. SEBI, for instance, most commonly comes with discussion papers, and commonly engages working groups with external advisors as well to embark upon major regulatory changes. The practice of advance notice of proposed rule-making is also strictly followed by US Federal regulators[1].

Budget proposes a consultative approach in regulation making

The Hon’ble Finance Minister, in her budget speech 2023-2024 announced that “public consultation” will be brought into the process of regulation making and issuance of subsidiary directions by financial sector regulators.

Further, it is proposed that financial sector regulators will be requested to carry out a “comprehensive review” of existing regulations through a consultative approach in order to “simplify, ease and reduce cost of compliance”.

This would mean that a consultative approach would have to be followed by financial sector regulators in the future when making regulations for regulated entities. This is certainly a welcome approach because of the benefits associated with having in place prior consultation in regulation making.

Benefits of a consultative approach

Reiterating Vinod Kothari’s comments on the benefits of a consultative approach “The benefits of a prior consultation are most intuitive, and generally unarguable. It serves to get perspectives that the regulators may not be aware of. The process becomes inclusive, and therefore, the benefit of better acceptance from the regulated.

On the other hand, the downsides of a non-consultative regulator bringing unannounced rules that seek to regulate business may be drastic. Most importantly, the regulator may be missing on one or more important points. It is notable that recursive change in regulation is never advisable – therefore, regulation is not a fit lab for testing regulations and then tweaking them. It affects business confidence, it affects business. And pretty sure, no government, no regulator would ever wish for the same – as such it is important for the regulators to be deft without being deaf.”

This is indeed a welcome move and will bring more objectivity, reasonability, and therefore, acceptability of the regulations.

[1] https://www.federalregister.gov/uploads/2011/01/the_rulemaking_process.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!