Introduction of the Digital Rupee (e₹)

RBI announces the launch of the first pilot

– Subhojit Shome, Senior Executive | finserv@vinodkothari.com

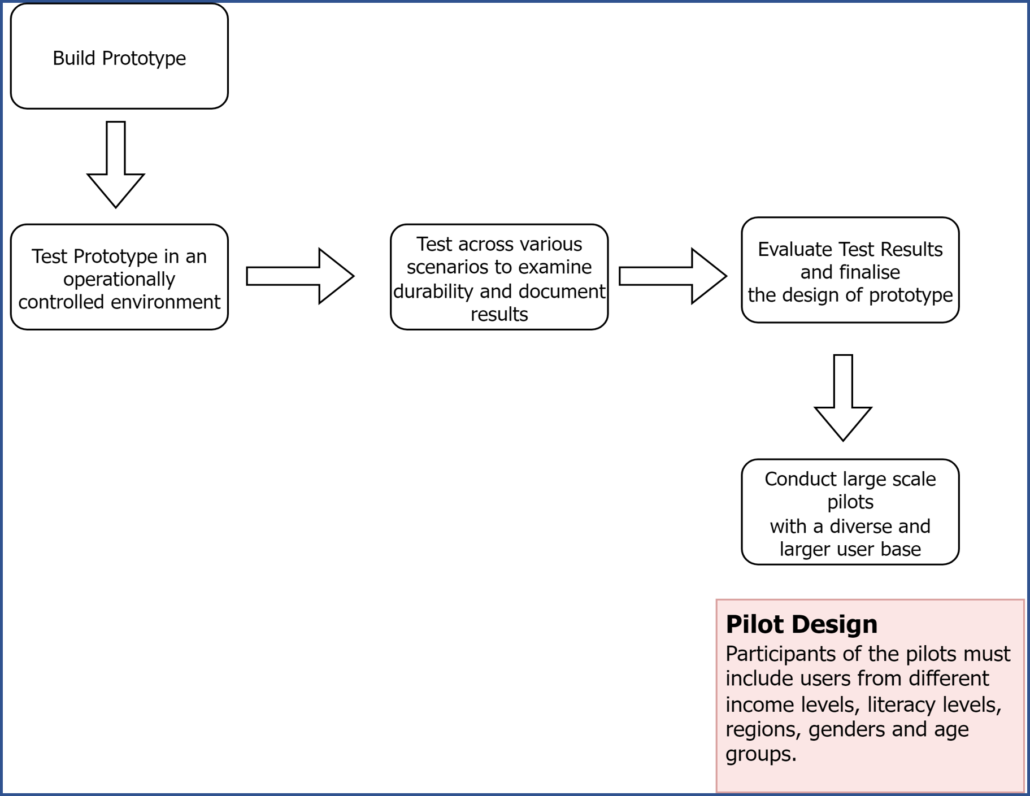

On 7th October, 2022 the RBI published a Concept Note[1] on Central Bank Digital Currency (CBDC) that intended to “create awareness about CBDCs in general and the planned features of the digital Rupee, in particular”. Chapter 8 (“Way Forward”) of the Concept Note provided for a phased approach towards implementation that involved building a prototype and running large scale pilots before actual launch of the ‘Digital Rupee’. The guiding principle being that the introduction of Digital Rupee should cause only a minimal or no disruption to the financial system.

The RBI on 1st November 2022 announced the launch of the first pilot of the digital Rupee (e₹-W).[2] The use case for this pilot is the settlement of secondary market transactions in government securities and entirely focuses on specific financial institutions involved in the interbank market. Nine banks namely, State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC, have been identified to participate in this pilot.

Use of the e₹-W is expected to make the inter-bank market more efficient, reducing transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk.

The Concept Note had described the RBI’s approach towards the design of the Digital Rupee, its considerations for the technology backing it as well as its approach to manage the process of its introduction in the economy in a seamless manner. The Concept Note examined the implications of introduction of CBDC on the banking system, monetary policy, financial stability, and provided an analysis of the privacy issues involved. While the Concept Note acknowledged the need for an open, inclusive, interoperable and innovative currency as an effective alternative to decentralised cryptocurrencies that is currently prevalent in decentralised finance (DeFi) applications, it endeavours to create a Digital Rupee as close to paper currency as possible.

The primary design choices that Note examined were –

- Type of CBDC to be issued – general purpose/ retail (CBDC-R) or wholesale (CBDC-W). CBDC-W being restricted to only specific financial institutions and intended for the settlement of interbank transfers and related wholesale transactions.

- Model of issuance and management – Direct/ Single Tier or Indirect/ Two Tier model. A Direct model would be the one where the central bank is responsible for managing all aspects of the CBDC system viz. issuance, account-keeping and transaction verification. In an Indirect model, the central bank and other intermediaries (banks and any other service providers), each play their respective role.

- Form of CBDC – Token-based or account-based. While an account-based model requires the maintenance of record of balances and transactions of all holders of the CBDC and indicate the ownership of the monetary balances, the token based approach will be more akin to a bearer instrument like banknotes, meaning whosoever holds the tokens at a given point in time would be presumed to own them.

- Instrument design – remunerated or non-remunerated, i.e. whether holding the digital currency will entitle the holder to receive interest against such holding – a ‘deposit like’ CBDC.

- Technology choice – whether the CBDC will be backed by conventional centrally controlled database technology or digital ledger technology (DLT).

- Degree of anonymity – digital currency is expected to leave an electronic trail unlike bearer bank notes. The degree of anonymity is a key design decision for any CBDC, especially, the ability to ensure reasonable anonymity for small value transactions is considered a desirable feature of retail CBDC.

The scope of the current pilot appears to be some distance away from the pilot design envisaged in the Concept Note. The RBI in its press release has announced that other wholesale transactions, and cross-border payments will be the focus of future pilots. The first pilot in the retail segment (e₹-R) is planned for launch within a month in select locations in closed user groups comprising customers and merchants. Decentralised finance (DeFi) has been a substantial contributor towards the adoption and spread of cryptocurrencies[3] that CBDCs attempt to substitute. With the scope of the current pilot being highly limited and catering to a very specific end use, we will need to wait for the future pilots to gauge the design decisions ultimately taken by the Central Bank and the extent to which the e₹ will lend itself towards financial innovation.

[1] https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CONCEPTNOTEACB531172E0B4DFC9A6E506C2C24FFB6.PDF

[2] https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54616

[3] Total value locked (TVL) in DeFi transactions is estimated to be ~$198 billion at the end of FY 2022 as per IOSCO Decentralized Finance Report (IOSCO, March 2022) – https://www.iosco.org/library/pubdocs/pdf/IOSCOPD699.pdf

Our resources on related topic:

Leave a Reply

Want to join the discussion?Feel free to contribute!