Untangling the Mystery of Virtual Digital Assets

– Shreyan Srivastava (finserv@vinodkothari.com)

An Insight into Crypto, Tokens and NFTs

Background

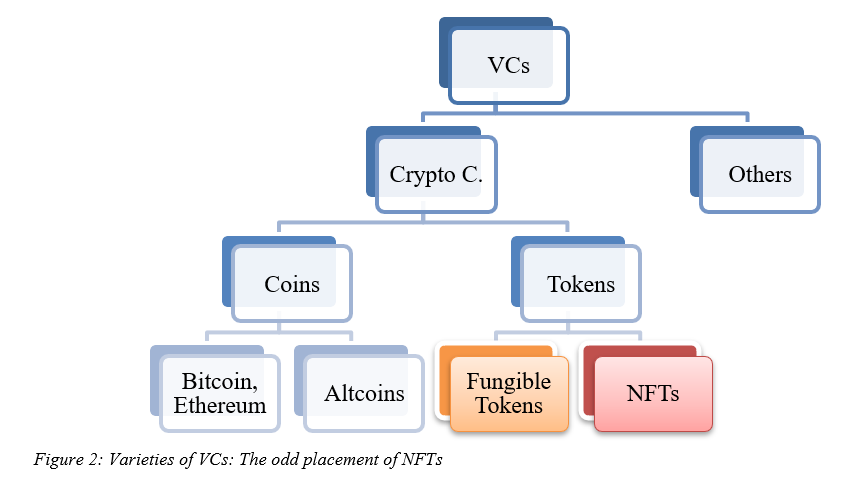

The Union Budget Speech 2022-23 created quite a stir in the cryptocurrency industry once again, as the Hon’ble Finance Minister proposed a 30% blanket taxation on virtual digital assets (“VDAs”). Given the plethora of terms existing such as ‘virtual currencies’, ‘digital currencies’, ‘cryptocurrencies’, ‘NFTs’, ‘altcoins’ and so on, the question arises as to what these individual terms entail and which ones fall under the category of ‘VDAs’ and where does the Central Bank Digital Currency (“CBDC”) fall under the maze of these new terms.

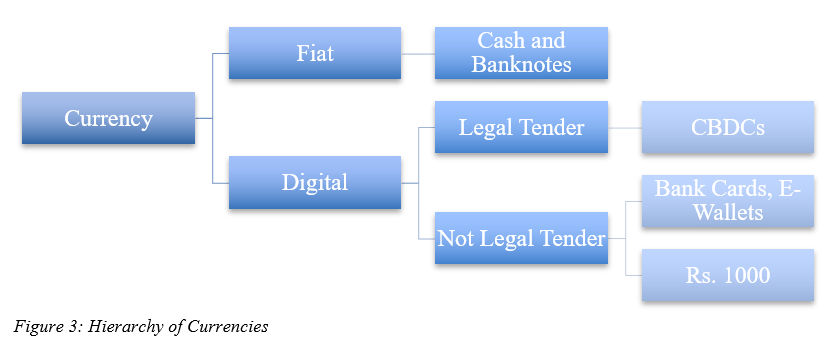

The Finance Bill, 2022 appears to provide some clarity through the proposed clause 2(47A) of the Income Tax Act by defining VDAs. To that effect, the current article is dedicated to clearing the confusion with respect to CBDCs and VDAs, arguing that for anything to qualify as a VDA it needs to progressively fulfil the criteria of asset → digital → virtual.

Assets

An asset comprises any resource, whether tangible or intangible, that can be used to produce a positive economic value. Thus, assets can be subdivided into two categories: –

- Tangible: including a broad variety of physical items that can be converted into cash such as tangible plants and machinery. Cash itself can be considered as an asset.

- Intangible: they include non-physical items that still contribute towards the generation of a positive economic value such as goodwill, patents and trademarks.

Now the question arises: Where do ‘Digital Assets’ stand?

Digital Assets

As far as Digital Assets are concerned, no single internationally accepted definition has been identified. For instance, Deloitte has defined digital assets as “cryptographically secured assets which exist only in a digital form, and typically maintained in a distributed ledger technology (DLT)”.[1] However, this approach appears to constrict the definition of what should be an umbrella term. For instance, Commodity Futures Trading Commission (“CFTC”) gave their approach stating:

“Digital asset is a broader term that encompasses additional applications, including ownership, transaction tracking, identity management, and smart contracts. A digital asset may express characteristics of a commodity or commodity derivative”.[2]

The CFTC further stated that a digital asset can also represent physical or virtual assets, a value, or a use right/service. Such an approach appears to imply that sovereign gold bonds which can be purchased by an individual through a digitised portal on the internet is a digital asset which represents and is backed by something tangible i.e., gold. Similarly, company shares and securities available on the Stock Exchanges are also digital assets that are backed by the respective companies’ physical assets. Digital assets also include animations, photography, spreadsheets and even cryptocurrencies such as Bitcoin, all of which are not backed by any tangible assets.

In essence, it appears that digital assets can be used to describe all transactions or items that occur or are stored in cyberspace such that the said asset is created, traded, and stored in a digital format. Thus, they are a form of intangible assets.

Virtual Digital Assets

The Financial Action Task Force (“FATF”) have defined Virtual Assets as a:

“digital representation of value that can be digitally traded, or transferred, and can be used for payment or investment purposes. Virtual assets do not include digital representations of fiat currencies, securities and other financial assets”.[3]

Thus, what Deloitte had defined as “digital assets” are in reality “virtual assets”. Thus, a VDA is a subset of digital assets that have no tangible existence or any backing by tangible assets and cannot be converted/ materialized into a physical form. They entirely owe their existence to cyberspace i.e., assets in physical form but traded digitally are not virtual. Thus, VDAs are truly intangible.

The Finance Bill 2022[4] introduced the phrase VDAs and proposed the addition of clause 2(47A) to the Income Tax Act. As per the said clause, a VDA will include:-

- any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically;

- a non-fungible token or any other token of similar nature, by whatever name called;

- any other digital asset, as the Central Government may, by notification in the Official

Gazette specify:

Provided that the Central Government may, bynotification in the Official Gazette, exclude any digital asset from the definition of virtual digital asset subject to such conditions as may be specified therein.

Explanation. ––For the purposes of this clause,––

- “non-fungible token” means such digital asset as the Central Government may, by

notification in the Official Gazette, specify; - the expressions “currency”, “foreign currency” and “Indian currency” shall have the same meanings as respectively assigned to them in clauses (h), (m) and (q) of section 2 of the Foreign Exchange Management Act, 1999.’

(Emphasis supplied)

On juxtaposing the FATF’s definition of “virtual assets” and the Finance Bill’s “virtual digital assets” it appears that the latter has elaborated in much greater definition but in essence they cover the same subject.

Now, with the definition of VDAs provided, it becomes necessary to consider which “crypto-item” would fall under its definition. To that effect, we have considered the entire hierarchy starting from VCs as provided below.

Virtual Currency

First, it is important to note that Virtual Currencies (“VCs”) are not currency. As per s.2(h) of the Foreign Exchange Management Act, 1999:

“currency includes all currency notes, postal notes, postal orders, money orders, cheques, drafts, travellers cheques, letters of credit, bills of exchange and promissory notes, credit cards or such other similar instruments, as may be notified by the Reserve Bank”

VCs do not find themselves fitting under this definition and as far as the question of being accepted by the Reserve Bank of India (“RBI”) is concerned, they have repeatedly clarified and warned that Virtual Currencies (“VCs”) are not Currencies and even instituted several bars in its use.[5] Fortunately, the unreasonable ban was subsequently lifted in the landmark judgement in the Internet and Mobile Association of India v. Reserve Bank of India.(“IAMAI”).[6] Pursuant to the judgement the RBI remained sceptical and had asked customers to exercise due diligence when interacting with VCs.[7] Thus, no subsequent notification has been released by the RBI that recognised them as currency.

So, if VCs are not currencies the question arises as to what the acceptable definition is. To that effect, a high-level inter-ministerial committee in its final report in 2019 defined a VC as:

“a digital representation of value that can be digitally traded and functions as

(a) a medium of exchange, and/ or

(b) a unit of account, and/ or

(c) a store of value but does not have legal tender status”.[8]

Taking into consideration that VCs are not currencies in India, the definition of VCs as illustrated above was also adopted by the Supreme Court in the IAMAI case.[9] Thus, on juxtaposing this definition of VCs with that of VDAs it appears that the proposed subclause (a) of the proposed s.2(47) mirrors the language of this definition of VCs, the latter fulfilling the criteria of being “digital representation of value” which can be “exchanged” and has a “store of value”. In essence, VCs are analogous to VDAs to the extent of subclause (a).

Cryptocurrency

The Supreme Court in IAMAI case used the FATF’s definition of cryptocurrency which conceptualises a “math-based, decentralised convertible virtual currency protected by cryptography by relying on public and private keys to transfer value from one person to another and signed cryptographically each time it is transferred”.

Cryptocurrencies are a subset of VCs meant to operate as a medium of exchange without the need of a central administrative authority. Cryptocurrencies usually relying on algorithms and peer-to-peer networks protected by cryptography in a Decentralised or Distributed Ledger Based Technology (“DLT”) with the underlying technology termed as blockchains. Thus, since cryptocurrencies are a store of value generated through cryptographic means they would also fall under the proposed s.2(47).

Tokens[10]

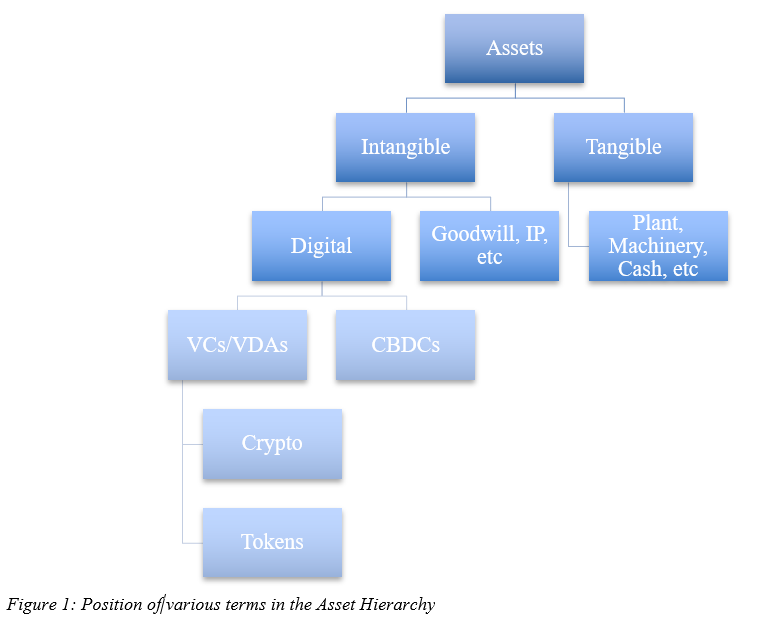

Before understanding Non-Fungible Tokens (“NFTs”), it is important to understand where it finds itself in the VC hierarchy. To this end certain misconceptions allowed the use of the term “cryptocurrency”, “token” and “NFTs” interchangeably. Thus, it is necessary to clear up this confusion.

First, a cryptocurrency is a standard currency which is used for the sole purpose of making or receiving payments on the blockchain. Cryptocurrencies themselves can be subdivided into two categories: –

- Coins: Primarily used as a medium of exchange, similar to actual currencies.

- Tokens: Can also be used to store digital art, smart contracts, programs and such depending on the blockchain network it is built upon.

Blockchain itself is the underlying technology behind cryptocurrencies.[11] Now, each such blockchain possesses a native ‘coin’ and may host multiple tokens. For instance, Ethereum blockchain’s native coin is Ether (ETH). This blockchain can house further ‘tokens’ which in the case of Ethereum includes DAI, LINK, COMP, and Crypto Kitties. The Bitcoin network on the other hand hosts only a native coin with no tokens – Bitcoin (BTC). To better understand the relationship, consider an independent country owned by Ethereum. Now Ethereum releases its own currency i.e., Ether to be used within the nation. It then allots independent plots to other independent entities such as DAI, LINK and so on. Thus, these tokens are wholly dependent on the infrastructure of the blockchain but at the same time each of these assumed entities can engage in a business of their own but to purchase the services of DAI, LINK and such, one must pay in Ether. Moreover, nothing stops Ethereum from starting their own business as well.

Non-Fungible Tokens: Beyond a medium of exchange

Tokens can be either fungible or non-fungible. While being fungible, the object of currency is fulfilled as it can be used as a store of value and as a medium of exchange. However, the issue comes with non-fungible tokens i.e., NFTs.

Though a combination of various definitions and diverse interpretation NFTs can be defined as:

“a cryptographically unique, indivisible, irreplaceable and verifiable token that represents a given asset, be it digital, or physical, on a blockchain”.[12]

Each NFT possesses a unique identification code (say Aadhar Number) and metadata (Name, Age, Address and such associated with the Aadhar Number) that distinguish them from each other.

To better understand NFTs consider the following analogy:

Each 10-rupee banknote has the same value as another 10-rupee banknote. Similarly, every unit of Bitcoin is identical to any other unit of Bitcoin i.e., they are fungible. However, each individual NFT is unique and distinguishable. For instance, consider Crypto Kittes which are hosted on the Ethereum blockchain network as NFTs. Now two individuals: A and B own one Crypto Kitty each. A’s Crypto Kitty would have a unique identifier, say CK-123A (usually a much more complicated ID) which distinguished it from the Crypto Kitty owned by B having the identifier CK-5A53.

In terms of pure nomenclature, NFTs do fall within the hierarchy of VCs. However, its purpose is anything other than operating as a medium of exchange. NFTs are indivisible and as its name suggests are not fungible, the latter of which is a key criterion to be a medium of exchange and thus, as any currency (including VCs). As noted by United States Department of the Treasury, this creates an inconsistency with respect to the definition of VCs “since many ‘tokens’ at issue contain utility beyond that as a medium of exchange”.[13]

Fortunately, the Government of India have dodged this problem by use of the term “asset” instead of “currency”. Given that NFTs have been added as a separate subclause (b) of the proposed s.2(47) under the proposed definition of VDA conceptualises its existence beyond cryptocurrencies. Not to mention that the level of craze it had generated, primarily through the rarity and indivisibility of individual NFTs (since no two NFTs are identical) such that certain NFT was being traded at tens of millions, its apparent craze made the government add it specifically as subclause (b) of the proposed s.2(47) to leave no doubt for its consideration under the proposed section.

CBDCs

With the concept regarding the relevant subsets of VCs clear, the next question is where does the CBDC find itself? In most simple words, CBDC is the digital form of a country’s fiat currency. In one of its publications, RBI defines CBDCs as “the legal tender issued by a central bank in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different.”.[14] CBDCs are actual currencies backed by the Central Bank by virtue of being a legal tender.[15]

As per the definition provided by the FATF, Digital Currencies are excluded from the definition of virtual assets. Moreover, as per the RBI, a legal tender is a “coin or a banknote that is legally tenderable for discharge of debt or obligation”.[16] Thus, it is automatically excluded from the scope of VDAs which in turn are not backed by anything physical.

Concluding Remarks

Concluding Remarks

NFTs, Cryptocurrencies, Tokens, etc all find themselves within the hierarchy of VCs which in turn, as aforementioned, are equivalent to the VDAs defined in the Finance Bill, 2022. To further clarify the position of existing instruments and to summarise the discussion so far, the following table encapsulates which such instruments can be considered as are virtual, digital and as assets:-

| Item | Virtual | Digital | Asset |

| Fiat Currency |

☒ |

☒ |

🗹 |

| CBDCs |

☒ |

🗹 |

🗹[17] |

| Physical Gold |

☒ |

☒ |

🗹 |

| Sovereign Gold Bonds |

☒ |

🗹 |

🗹 |

| Bitcoin, Altcoins, NFTs |

🗹 |

🗹 |

🗹 |

Table: Treatment of various financial instruments in India

[1] Deloitte, “Market Manipulation in Digital Assets” March 2021 <https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Financial-Services/gx-design-market-manipulation-in-digital-assets-whitepaper-v2-1.pdf> accessed 4 February 2022

[2] Commodity Futures Trading Commission, “Digital Asset Primer” December 2020 <https://www.cftc.gov/media/5476/DigitalAssetsPrimer/download> accessed 4 February 2022 (It is to be noted that the views expressed by the CTFC are for informative purposes only and does not indicate that the legislation would follow the indicated approach)

[3] Financial Action Task Force, “The FATF Recommendations” October 2021 <https://www.fatf-gafi.org/media/fatf/documents/recommendations/pdfs/FATF%20Recommendations%202012.pdf> accessed 4 February 2022

[4] Finance Bill 2022 <https://www.indiabudget.gov.in/doc/Finance_Bill.pdf>

[5]Reserve Bank of India “Prohibition of Virtual Currencies”, April 2018 <https://rbi.org.in/scripts/NotificationUser.aspx?Mode=0&Id=11243> accessed 4 February 2022

[6] (2020) 10 SCC 274; For detailed analysis of the order see: Megha Mitta, ‘Crypto-Trading’s Tryst with Destiny’ (IndiaCorpLaw, 17 March 2020) <https://indiacorplaw.in/2020/03/crypto-tradings-tryst-with-destiny.html> accessed 4 February 2022

[7] Reserve Bank of India “Customer Due Diligence for transactions in Virtual Currencies (VC)” <https://rbi.org.in/scripts/NotificationUser.aspx?Mode=0&Id=12103> accessed 4 February 2022

[8] Department of Economic Affairs, ‘Report of the Committee to propose specific actions to be taken in relation to Virtual Currencies’ (2019), Ministry of Finance; See also: Kanakprabha Jethani, ‘Private virtual currencies out: India may soon see regulated virtual currency’ (Vinod Kothari Consultants, 24 July 2019) <https://vinodkothari.com/2019/07/private-virtual-currencies-out-india-may-soon-see-regulated-virtual-currency/> accessed on 4 February 2022;

[9] Internet and Mobile Association of India v. Reserve Bank of India (2020) 10 SCC 274 [2.6]; For detailed analysis of the order see: Megha Mitta, ‘Crypto-Trading’s Tryst with Destiny’ (IndiaCorpLaw, 17 March 2020) <https://indiacorplaw.in/2020/03/crypto-tradings-tryst-with-destiny.html> accessed 4 February 2022

[10] Ojha V, ‘Cryptocurrency on the Path to Legalization?’ (Vinod Kothari Consultants, 13 August 2018) <https://vinodkothari.com/2018/08/cryptocurrency-on-the-path-to-legalisation/> accessed 4 February 2022

[11] Maloo N, ‘BLOCKCHAIN TECHNOLOGY & ITS APPLICATIONS IN FINANCIAL SECTOR’ (Vinod Kothari Consultants, 10 June 2019) <https://vinodkothari.com/wp-content/uploads/2019/06/Blockchain-technology-its-application-in-financial-sector-nikhar-maloo.pdf#pdfjs.action=download> accessed 4 February 2022

[12] Valeonti F and others, ‘Crypto Collectibles, Museum Funding and OpenGLAM: Challenges, Opportunities and the Potential of Non-Fungible Tokens (NFTs)’ (2021) 11 Applied Sciences <https://www.mdpi.com/2076-3417/11/21/9931> accessed 4 February 2022

[13] Department of the Treasury, Federal Register Volume 85, No 122, 24 June 2020 <https://www.cftc.gov/sites/default/files/2020/06/2020-11827a.pdf > accessed 4 February 2022

[14] Reserve Bank of India, ‘Central Bank Digital Currency – Is This the Future of Money – T Rabi Sankar’ (17 August 2021) <https://rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=20438> accessed 4 February 2022

[15] For more information of the CBDCs see: Megha Mitta, ‘CBDCs in India – A Leap of Faith?’ (Vinod Kothari Consultants, 1 February 2022) <https://vinodkothari.com/2022/02/cbdcs-in-india-a-leap-of-faith/> accessed 4 February 2022

[16] Reserve Bank of India, ‘FAQs’ <https://m.rbi.org.in/scripts/FAQView.aspx?Id=136> accessed 4 February 2022.

[17] In traditional accounting, cash is considered as an asset and to that effect, CBDCs being a digital representation of cash must also be considered as assets.

Leave a Reply

Want to join the discussion?Feel free to contribute!