Utilisation of accumulated surplus by section 8 companies

-Can surrogate means be used to relegate funds or benefits to shareholders

Pammy Jaiswal | Partner | Vinod Kothari and Company

Shraddha Shivani | Executive | Vinod Kothari and Company

Background

Section 8 of the Companies Act, 2013 (‘CA’) provides for the formation of companies with specific objects. Since the section revolves around incorporation of companies with charitable or some other specified welfare objectives, it gives an impression that these companies do not work to earn financial gains for their shareholders. This impression becomes evident since Section 8 companies are commonly referred to as ‘not-for-profit’ companies which further substantiates this understanding and adds to the confusion. They may make profits, as indeed, they very often do; however, the profit necessarily gets redeployed to carry the very same objects for which the company was formed, and cannot be relegated to the shareholders.

In fact, earning profits is not just permitted but is also essential for their continued existence and organic growth of its affairs. Most such companies do not borrow; hence, they carry their activities either through corpus contributions or through retained profits. Thus, the restrictions under CA are not on earning profits but on the distribution of the same to its shareholders.

The most common way for a company to distribute profits to its shareholders is by way of payment of dividend. This is explicitly barred in case of a Section 8 company. Having said that, these companies may also come across a situation where they do not foresee any immediate application of their accumulated profits and therefore, may look out for ways to utilise it for some other purpose. The management running these companies, potentially representing shareholders, may not be necessarily driven by avarice when they intend to use the funds other than for the purpose for which the company was formed.

Not only are section 8 companies under the curbs of the Companies Act, they are also under stringent provisions of the Income Tax Act (“IT Act”). Commonly, a section 8 company will also be registered as a charitable institution under sections 12AA or 12AB of the IT Act, and therefore, is covered by the provisions of sec. 11-13, and section 115TD. In fact, the provisions of section 115TD have been considerably tightened in 2021 and 2022. Thus, if a company having registration under section 12A breaches the conditions of registration, it may be called upon to pay tax on its entire accreted income. The 570-page ruling of the Delhi ITAT in the case of Young Indian may have been in the limelight for other reasons, but there are plenty of instances where section 8 companies have had to pay tax because of failure to adhere to the investment limitations given in sec. 11(5) of the IT Act.

(See, for example, the case of Commissioner Of Income-Tax vs Economic And Entrepreneurship; 1991 188 ITR 540 Cal).

Thus, a Section 8 company is under strict limitation of (a) section 8 itself; (b) provisions of MoA of the Company; (c) conditions prescribed in the license granted by the Central Government in terms of section 8; (d) provisions of section 11-13 of the IT Act; (e) conditions laid by the registration granted by the Commissioner under sec. 12A; (f) provisions of the Charities law, if the same is applicable in the State[1].

In essence, there are several restraints to ensure that special status granted by the law to such a company is not misused for personal gain or gain of any of the promoters, shareholders or management of the company.

In this write up, we discuss some of the potential modes utilising the income (including accumulated profits) earned by a Section 8 company and the consequences of violating the conditions laid under CA.

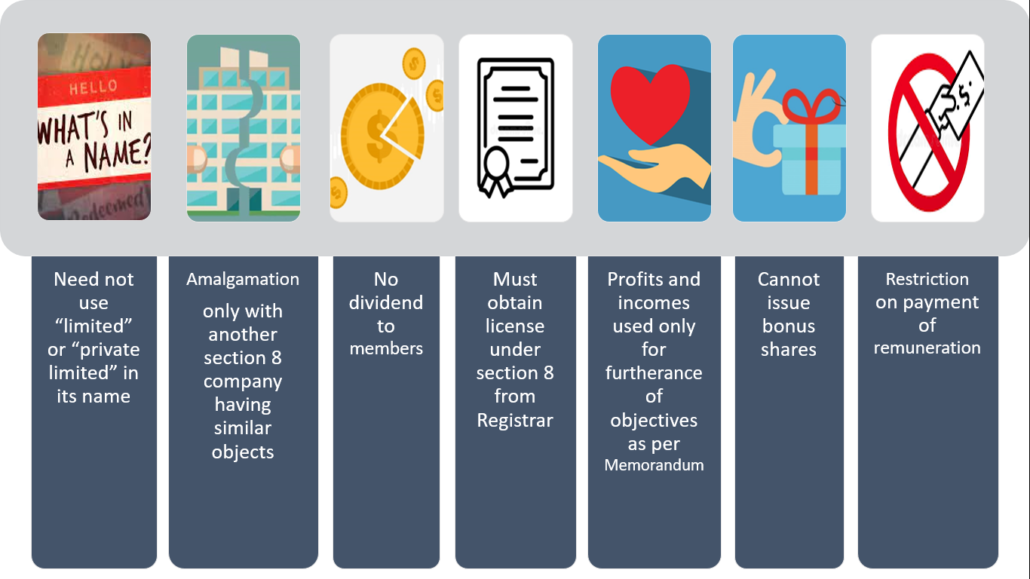

Features of a Section 8 company

CA provides for various conditions as well as relaxations for a Section 8 company considering the fact that it has been formed to attain its foundational purpose for and without enrichment of its settlers. Some of these features are discussed below:

- Relaxation to use the words ‘Limited” or “Private Limited”

A company registered under this section is not required to use the word “limited” or “private limited” in its name. Instead, the name ends with words such as foundation, forum, association, federation, chambers, confederation, council, etc.

- Prohibition to declare dividend

Clause (c) of sub-section (1) of section 8 expressly prohibits a company registered under this section from paying any dividends to its members.

- Profits and other income to be used for the objects for which the company has been formed

A limited company registered under section 8 of CA must have in its objects, the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object. Moreover, it has to apply its profits or any other income solely in promoting its objects.

In B. Ramachandra Adityan vs Educational Trustee Co. (P.) Ltd.; 2003 113 CompCas 334 Mad, the Madras High Court held that where a company formed under section 25 of the Companies Act, 1956 exists solely for getting personal advantage to any party and not in the public interest, the company is liable to be wound up.

- Restriction on payment of managerial remuneration in certain cases

The license issued to a Section 8 company imposes restriction on payment of remuneration or other benefit in money or money’s worth by the company to any of its members except payment of out-of-pocket expenses, reasonable and proper interest on money lent, or reasonable and proper rent on premises let to the company. However, that should not completely restrict the company to pay reasonable remuneration in good faith for any services actually rendered to the company by any person other than its member, unless otherwise stated in the charter documents.

- Restriction on issue of bonus shares

Similar to the prohibition on payment of dividend, the Companies (Incorporation) Rules, 2014 specifically prohibits a Section 8 company to issue bonus shares to its members as the same will tantamount to routing the company’s accumulated earnings back to its shareholders which contradicts the intention with which these companies are set up.

- Amalgamation with another Section 8 company with similar objectives

The profits earned and assets acquired by a Section 8 company throughout its lifetime enjoys various government subsidy and tax exemption benefits. To rule out the possibility of either transferring the said accumulated profits to a non-Section 8 company or passing on the benefit to the shareholders in such company, the Companies (Incorporation) Rules, 2014 provides that a Section 8 company can only amalgamate with another Section 8 company having similar objectives.

- Section 8 Company as a Defunct Company

The term ‘defunct company’ is not defined under the CA, however, to understand its meaning, one needs to take reference from section 248 of the CA which describes the features of a company eligible to be struck off the Register of Companies. It is important to note that there are two ways under section 248 through which the name of such companies can be struck off. The first way is by receiving a notice by the Registrar who has a reason to believe that the company has not commenced its business within one year of its incorporation or has not carried on its business for a period of two preceding financial years. Whereas the other way is when such a company after extinguishing all its liabilities makes an application to the Registrar for removing its name from the Register.

It is important to note that the section explicitly prohibits a section 8 company to make an application for removing its name as mentioned under sub-section (2) of the CA. This restriction on a section 8 company makes it evident that its funds cannot be used for meeting its liabilities per se but can only be used for furtherance of its objects. While meeting liabilities arising in the course of business is no doubt an act done for the furtherance of its objects, however, meeting liabilities so as to exhaust the assets and apply for striking off is definitely not an act for meeting the objects of a section 8 company.

- Section 8 Company as a Dormant Company

While the provisions of section 455 cover application by any company registered under the CA to become a dormant company, however, if we look at the meaning of a Section 8 company, we understand that it is made for pursuing a specific object, therefore it may be a uncommon situation for a Section 8 company to apply for a dormant status. Having said since there is no express bar on a Section 8 company to apply for the dormant status, we find that in reality there are section 8 companies which have applied for dormant status and have been admitted so by the Registrar. The Ministry of Corporate Affairs (MCA) has the list of companies which have applied for becoming a dormant company and if we go through the long list, we find that certain companies are in the nature of Section 8 companies since they have the word ‘Foundation’ etc, in their name without the words ‘Limited’ or ‘Private Limited’

Understanding the fetters on utilization of accumulated profits by a Section 8 company

I. Issue of Redeemable Preference Shares

The Preference Shares of a company are termed so because they have preference over the equity shareholders in regards to payment of dividends, and return of surplus in the event of winding up. As discussed above, section 8 of the CA prohibits a company registered under this section to pay dividend to its members. Moreover, it also prohibits returning the surplus assets of such a company to its members in the event of winding up. Therefore, the entire reasoning behind issue of redeemable preference shares becomes futlie and therefore, section 8 companies cannot issue such securities.

II. Issue of Bonus Shares

Rule 22 (4) of the Companies (Incorporation) Rules, 2014 requires a declaration from the Board of directors that no portion of the income or property of the company has been or shall be paid or transferred directly or indirectly by way of dividend or bonus or otherwise to persons who are or have been members of the company or to any one or more of them or to any person claiming through any one or more of them.

As we discussed earlier, given the objective principles of a Section 8 company, any profit or gain earned by it is to be used for and in furtherance of its objects.

Accordingly, since issuing bonus shares is a means of distributing the profits by capitalizing the same, the issuance of bonus shares to the members of a Section 8 company has been expressly prohibited by the law.

III. Buy-back of shares

Buy-back of shares by a Section 8 company has not been expressly prohibited under CA. However, buyback is only a mode of releasing the value accumulated in the company to its shareholders. If release of profits by a section 8 company is not allowed, it becomes easy to understand that even a buyback will not be allowed

Looking at the intent behind setting up of a section 8 Company on one hand and doing a buy-back of shares on the other, it becomes evident that repayment of capital or its worth to the shareholders of a Section 8 company can never be expected. Where payment of any dividend or bonus itself has been strictly prohibited under CA, buying back of its shares by paying fair consideration out of the specified sources (free reserves, securities premium a/c or proceeds of an issue of any shares or specified securities) cannot be considered at all.

It is also important to note that section 115QA of IT Act treats the consideration amount paid for repurchase of shares as reduced by the consideration received for allotment of such shares as distributed income of the company.

Since, CA prohibits any payment or transfer of income or property ‘by way of dividend or bonus or otherwise’, in our view, it is very clear that the buying back of shares by a Section 8 company will violate the terms on which it was granted the license.

Global Scenario

United Kingdom

The Office of the Regulator of Community Interest Companies in the United Kingdom has clarified that repurchase of shares is in effect a distribution of assets to members particularly where the member receives a premium over the paid up value of the shares. Further Regulation 24 of the Community Interest Company Regulations 2005 (“CIC Regulations”) provides that CIC may not distribute assets to its members by way of the redemption or purchase of the company’s own shares, unless the amount to be paid by the company in respect of any such share does not exceed the paid up value of the share.

Japan

The Japanese laws have similar provisions to that of their Indian counterparts on the regulation of charitable companies. Article 32 of the Japanese Law to Promote Specified Non-profit Activities provides that the remaining assets of a dissolved specified non-profit corporation shall, except in the cases of merger and bankruptcy, be assigned to the entity stipulated by the Articles of incorporation at the time of notifying the government agency with jurisdiction of the completion of liquidation.

If there is no provision in the articles of incorporation regarding assignment of remaining assets, the liquidator may, upon receipt of approval by the government agency with jurisdiction, transfer them to the national government or a local public organization. Any assets that are not disposed of under the provisions of the preceding two paragraphs shall be assigned to the national treasury.

IV. Entering into related party transactions

Just like any other company, a Section 8 company can enter into transactions and agreements/ contracts with other parties during the course for meeting its objectives. Similarly, a Section 8 company may also enter into transactions with its related parties, provided it adheres to the safety standards laid down to regulate such transactions. the same is in the ordinary course of business and on an arm’s length basis.

Having said that, simply stating that an RPT is satisfying both the conditions as aforesaid, will fall short of justifying that same. Accordingly, obtaining external valuations or expert opinion, wherever needed, is always suggested to support or substantiate the stand of the Company for entering into RPTs.

Section 8 companies are however awarded certain exemptions from the provisions regulating related party transactions. For example, the requirement for keeping separate registers for particulars of all contracts or arrangements entered into with related parties as per the provisions of section 189 is not required where the value of such transactions does not exceed ₹1 lakh. Further, Section 184(2) of CA requiring disclosure of interest by a director is also not applicable where the transaction in question does not exceed Rupees 1 lakh in value.

Global scenario

Interestingly, this fact of growing concerns over self-dealing and passing on benefits privately in not-for profit organisations has been discussed in details around the globe.

Australia and United Kingdom

As per the SSRN Paper, ACNC Review has been accepted by the Australian government wherein disclosure of RPTs, reclusion of voting for RPTs by related parties, following certain specific disclosure standards, etc. Similarly, the UK has a specified guidance on managing conflict of interest. Further, as stated by the UK charities regulators, a decision by a charity to enter into any transaction must be made in the charity’s own interests and for the benefit of its beneficiaries. The disclosure of related party transactions is an important element of transparency in financial reporting because: –

- related parties may enter into transactions that unrelated parties would not –

- transactions between related parties may not be made at the same amounts or on the same terms as those between unrelated parties; and

- the existence of the relationship may be sufficient to affect the transactions of the charity with other parties.

V. Loans from Members and Issue of Debentures

There is no restriction on a section 8 company from borrowing funds for its business. However, due to their restrictive nature owing to which they can invest funds only towards the furtherance of their foundational objectives, such companies are often kept out of the lending portfolios of commercial financial institutions. As a result, these companies look for other methods of raising funds.

Section 8 companies may look to its own members for the purpose of borrowing funds and pay interest thereupon and such a transaction is not prohibited by law. Such companies may even issue debentures to the public, including its own members. However, any interest or redemption of such debentures must be purely compensatory in nature and done on an arms’ length basis. Redemption of debentures on a premium to its members might be seen as being in contravention to Rule 22 (4) of the Companies (Incorporation) Rules, 2014.

VI. Sale of Property

A Section 8 company being a separate legal entity can acquire, own, and dispose of its property in its own name in the ordinary course of its business (where the sale of property becomes the only option available or the disposal is the only way to drive value out of such assets or otherwise). The question arises then, can the sale of its property below fair market value be used as a loophole to distribute its accumulated wealth hidden in the intrinsic value of the property to its shareholders?

Given the special status and the various exemptions, privileges and exemptions a Section 8 company enjoys, any transactions taken by such companies that aren’t completely above board on paper may invite investigation from the regulatory authorities.

Having said that, there may be cases where holding of any asset or property of the company may no longer be feasible and it may have to sell off its property below the fair market value. While we agree that a company should not be penalized for what every business experiences during its lifetime, but since a Section 8 company often acquires its property at a subsidized value, it may either be required to pay back the amount of subsidy it received on such acquisition or to sell such property only to another Section 8 company having similar objectives.

VII. Entering into a scheme of arrangement

The license issued to a Section 8 company as per the provisions of Rule 20 of the Companies (Incorporation) Rules, 2014 restrict such companies to amalgamate with another company unless such other company is also a Section 8 company having similar objects.

There is no restriction on the demerger of a Section 8 company, however, keeping in mind the prohibition regarding amalgamation, it can be inferred that the resulting entity out of the demerger or an existing resulting company must also be an entity registered under section 8 of CA.

Section 8 companies have the power to borrow monies although owing to their non-profit nature they are generally kept out of banking institution’s lending portfolios and so there aren’t many cases where a compromise or arrangement would have to be entered into between a Section 8 company and its creditors.

Global Scenario

Japan

Article 33 of the Japanese Law to Promote Specified Non-profit Activities provides that a specified non-profit corporation may only merge with another specified non-profit corporation.

United Kingdom

As per the FAQs issued by the Office of the Regulator of the Community Interest Companies, such companies may only sell its assets subject to the specified conditions which include transferring the assets at full value only i.e. the market value; transfer to an asset locked body specified in the CIC’s articles of association; transfer to any other asset locked body with the consent of the Regulator; or transfer for the benefit of the community.

VIII. Conversion into a non-section 8 company

A company registered under section 8 desirous of converting itself into a company of any other form must not only obtain No-Objection Certificate from every regulatory authority from which it had obtained any benefit owing to its special status, but it must also be able to prove that it has not transferred any part of its income or property to its members.

Moreover, Rule 22(4) of the Companies (Incorporation) Rules, 2014 requires the Board of Directors to “give a declaration to the effect that no portion of the income or property of the company has been or shall be paid or transferred directly or indirectly by way of dividend or bonus or otherwise to persons who are or have been members of the company or to any one or more of them or to any persons claiming through any one or more of them.”

Where any asset or property was acquired free of cost or at a concessional rate by the company, it may be required to pay the difference between the cost at which it acquired such property and the market price of such property at the time of conversion. Any surplus profit/ income left over with the company after repayment of all dues, are to be transferred to the Investor Education and Protection Fund within 30 days of approval of the date of conversion.

IX. Winding up of the company

Sub-section (9) of section 8 provides that if on the winding up or dissolution of a Section 8 company there remains any asset after the satisfaction of its debts and liabilities, they may be transferred to another company registered under this section and having similar objects, subject to such conditions as the Tribunal may impose, or may be sold and proceeds thereof credited to Insolvency and Bankruptcy Fund formed under section 224 of the Insolvency and Bankruptcy Code, 2016.

This is in sharp contrast to winding up provisions for other companies wherein the surplus left off after settlement of all of the company’s debts and liabilities is distributed amongst the equity shareholders of the company.

The points as discussed above prove beyond doubt how the utilization of the income of a Section 8 company is thoroughly governed by the provisions of law, since inception and as a going-concern entity till the dissolution of the company. At any point of time the profits or any other income of a Section 8 company cannot flow back to the members of the company in any form or manner.

Penalty for violating terms of registration under CA

Where a company registered under this section contravenes any of the requirements of this section or any of the conditions subject to which a license is issued or the affairs of the company are conducted fraudulently or in a manner violative of the objects of the company or prejudicial to public interest, the Central government may by order revoke the license granted to the company.

The company may then be directed to convert its status and change its name to add the word “Limited” or the words “Private Limited”, or, if the Central Government is of the view that it is essential in public interest it may even order the company to be wound up or amalgamated with any other company registered under this section.

The company is liable to be punished with a fine of up to ₹1 crore and the directors and every officer of the company who is in default is liable to be punished with a fine which may extend to ₹25 lakh. Further, where it is proved that the affairs of the company were conducted fraudulently, every officer in default shall be liable for action under section 447.

Conclusion

On going through the various operational aspects as per the aforesaid discussion, it becomes clear that a Section 8 company is bound by its charter and nature to execute all actions in a way that contributes to the furtherance of its objectives. In fact, the global scenario also gives similar indications. Any transaction or action of a Section 8 company that is with an intent to pass on the profits to any other non-section 8 entity is likely to attract penal consequences both under CA as well as IT Act. Accordingly, any action on the part of a Section 8 company in variation with its objects can lead to withdrawal of the license and consequently, taking away several exemptions and relaxations being enjoyed by such an entity.

[1] Rajasthan, Karnataka, West Bengal, Madhya Pradesh, Tamil Nadu, Manipur, Meghalaya, Andhra Pradesh and Uttar Pradesh have passed independent Acts [Refer]

Hi,

The promoters/shareholders(100%) of a Section 8 company wish to resign and appoint new share holders/transfer the company.

Query 1: The transfer of shares from previous shareholders to new shareholders will happen at face value or Rule 11UA shall apply? if RUle 11UA will apply then how can a shareholder make profit and derive value out of a section 8 company?

Query 2: Can previous shareholders just resign and appoint new shareholders(at no capital investment)? If yes, can old shareholders reclaim their invested capital in case of resignation?

Query 3: Can section 8 company shareholder be a society or Trust?

for purpose of query, section 8 company and Trust/Society both have 12A and 80G certificate

Hi,

This is regarding Loans from Members mentioned by you in Point No. V under the heading ‘Fetters’, have you considered Chapter V of the Act ?

You have mentioned that, “Section 8 companies may look to its own members for the purpose of borrowing funds and pay interest thereupon and such a transaction is not prohibited by law.”

Would like to know more about this. Any references ? Please refer.

Very nicely presented