Does new CSR Rules suggest activities in “normal course of business” to be covered under CSR?

– Amendment leads to ambiguity

By Megha Saraf

Manager | Corporate Law Division

The world has taken the hit due to the outbreak of the COVID-19 pandemic. The research institutes over the globe have been trying day and night to develop a suitable vaccine to fight against the novel COVID-19 pandemic. Further, various companies or institutes in the country which have also shown positive results towards the development of vaccines and have claimed the success in it by end of the year 2021. Naturally, it is not only large number of human resource that is essential but also a significant proportion of money to produce results. While the intent of corporate social responsibility (CSR) is to make the profit making companies to spend a specific portion for the society, various stakeholders have raised a question on whether such expenditure on the research and development (‘R&D’) for producing vaccines or medical devices should qualify as a CSR expenditure or not? Also, whether the same shall qualify even if it is in the normal course of business of such a company?

The answer to both the questions is in affirmative after the Ministry of Corporate Affairs (“MCA”) issued two Notifications[1][2] dated 24th August, 2020, amending the Companies (Corporate Social Responsibility Policy) Rules, 2014 (‘CSR Rules’). In light of the ongoing impact of the COVID-19 pandemic, the said Notifications have brought in two amendments:

- Bifurcation of clause (ix) under Schedule VII;

- Changes under the CSR Rules.

The Article is a brief snapshot of the amendments.

Highlights of the amendments

The said Notifications have amended the existing list of activities under Schedule VII and also the CSR Policy Rules, 2014 to bring in the following:

- Bifurcation of activities mentioned under clause (ix) of Schedule VII into two:

- (a) Contribution to incubators or research and development (R&D) in various fields of science, technology, medicine etc.

- (b) Types of the Ministry/ Department for collaboration with new addition of Ministry of AYUSH (Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homoeopathy) and Department of Pharmaceuticals;

- Allowance to companies involved in R&D of making vaccines, drugs, medical devices in normal course of business to undertake the same for COVID-19 and to take such cost of R&D till FY 2022-23 as a CSR expenditure upon fulfilment of conditions;

- Omission of the phrase “excluding activities undertaken in pursuance of its normal course of business” from Rule 4 and 6

Conditions to be fulfilled by pharmaceutical companies for qualifying R&D as a CSR expenditure

The companies which are engaged in R&D activity of new vaccine, drugs, medical devices in their normal course of business have now been allowed to take the benefit of such cost incurred under the scope of CSR. However, to claim such benefit, the R&D has to be in relation to the vaccine or medical device for COVID-19 and in the normal course of business. Further, it has also been stated that such companies will be required to fulfil the following conditions:

- The company has to necessarily collaborate with any of the institutes or organisations mentioned under point (ix) of Schedule VII.

- The company has to separately disclose the details of such activity in the Annual Report on CSR

However, the benefit to companies will only be available for three financial years ending in FY 2022-23.

Ambiguity from removal of the phrase “normal course of business”

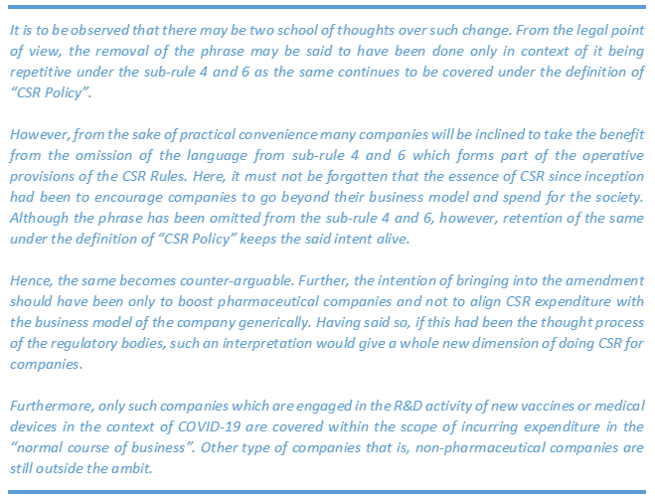

Considering the important role of pharmaceutical companies in the present scenario, while on one side, the MCA Notification has widened the scope of incurring CSR expenditure for such pharmaceutical companies by allowing them to utilize the expenditure incurred on R&D towards preparation of vaccines or medical devices for COVID-19, on the other hand, it had removed the phrase “normal course of business” from Rule 4 and 6 of the CSR Rules.

Conclusion

MCA had already on 23rd March, 2020 vide its Circular[3] clarified that any expenditure on activities relating to COVID-19 can be covered under the existing clauses of Schedule VII w.r.t. promotion of healthcare including preventive healthcare and sanitation and also the clause for disaster management and had also stressed on the liberal interpretation of the list of activities. Therefore, expenditure towards COVID- 19 in accordance with the said activities was already taken as a qualified CSR expenditure long before.

With the recent amendment, it becomes even clearer that the most beneficial sector will be the pharma sector who are allowed to carry on their R&D towards the development of vaccines with the expenditure being covered under the ambit of Section 135. However, an interesting point will be to see the interpretation taken by businesses on the change revolving around “normal course of business” as to whether the same will be practically inclined towards CSR based on business model or legally inclined to go beyond the same.

To read our FAQs on CSR, click here

To read our other Articles, click here

To subscribe to our YouTube channel, click here

[1] http://egazette.nic.in/WriteReadData/2020/221324.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!