NHB softens provisioning norms for HFCs

By Anita Baid, (legal@vinodkothari.com)

The National Housing Bank (NHB) vide its notification no. NHB.HFC.DIR.18/MD&CEO/2017[1] dated 02nd August, 2017 has made certain amendments to the Housing Finance Companies (NHB) Directions, 2010 (‘Directions’). The provisions of the Directions is applicable to every housing finance company (HFC) registered under section 29A of the National Housing Bank Act, 1987. A brief summary of the amendments and the possible impact thereon is provided herein below.

Computation of LTV

NHB had earlier come up with a clarification regarding the computation of Loan to Value (LTV) Ratio vide its notification no NHB (ND)/DRS/Pol-No. 49/2011-12 dated April 09, 2012[2]. By virtue of the said clarification HFCs were advised to compute the LTV ratio as a percentage with total outstanding in the account (viz. “principal + accrued interest + other charges pertaining to the loan” without any netting) in the numerator and the realizable value of the residential property mortgaged to the HFCs in the denominator. The same has now been incorporated in the Directions itself.

HFCs are required to grant loans in accordance with the LTV Ratio. Further, the computation of LTV indirectly affects the calculation of capital adequacy ratio. Capital adequacy ratio is calculated as a percentage of its aggregate risk weighted assets and of risk adjusted value of off-balance sheet items. Since housing loans are linked to LTV Ratio which have to be multiplied by the prescribed risk weights to determine the risk adjusted value of the asset and thereafter the aggregate risk weighted assets.

The said inclusion will however, not have any significant impact as the same was already clarified earlier and required to be complied by the HFCs.

Further, it has also been specified that with respect to valuation of properties and empanelment of valuers the HFCs shall be guided by the circular issued by NHB on the same from time to time

Provisioning of Standard Assets in respect of Individual Housing Loans

NHB has reduced the standard assets provisions on individual housing loans to 0.25% on the total outstanding amount of such loan and also lowered the risk weights on such lending. Earlier, there was no specific provision requirement in case of individual housing loans, a general provision of 0.4% of the total outstanding amount of loans which are standard assets was made.

Pursuant to the amendment HFCs shall be required to make a provision against the Standard Assets in respect of Individual Housing Loans of 0.25% on the total outstanding amount of such loan. Further, it has also been clarified that the revised provisioning norms relating to standard category of individual hosing loans would be effective prospectively but the provisions held at present towards such loans, i.e. under the general provision, shall not be reversed. However, in future, if by applying the revised provisioning norms, any provisions are required over and above the level of provisions currently held for the standard category of such loans, these shall be duly provided for.

Prior to the amendment, only the general provision of 0.4% of the total outstanding amount of loans were not reckoned for arriving at net NPAs. However, the same has now been replaced with the provisions on standard assets.

For the current financial year, the general provision already made shall be sufficient for the HFCs unless the growth of asset size is such that it exceeds the requirement of more than 0.25% of the total outstanding amount of such loan. For instance, if the present size of standard assets in respect of all loans other than those specifically provided for is 100 crore, a general provision of 0.4% shall be made that will be 40 lakhs. Now, till the growth in the asset size is such that the revised provision calculated at 0.25% in respect of individual housing loans is within 40 lakhs, additional provision shall not be required to be made. In such a situation, the HFCs will have better distributable surplus in hand.

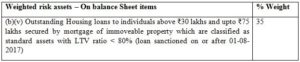

Weighted risk assets – on Balance Sheet items

The risk weights for individual housing loans above Rs 75 lakh has been reduced to 50% from the earlier 75%. Previously, the provisioning requirement was:

Post the amendment the same has been reduced to 50%.

While for loans between Rs 30 and Rs 75 lakh, a single LTV Ratio slab of up to 80% has been introduced with a risk weight of 35%. Post the amendment the following slab has been inserted:

It can be said that the intention of NHB, as a regulator, by reducing the risk weights for home loans over Rs 30 lakh category, is to release capital for the industry. Moreover, the aforesaid amendments are directed towards achieving the mission of “Housing for All by 2022”.

[1] http://nhb.org.in/wp-content/uploads/2016/10/Notification-No.-NHB.HFC_.DIR_.18-MDCEO-2017.pdf

[2] http://test.nhb.org.in/Regulation/polno-49-12-eng.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!