Posts

SEBI extends deadline for June quarter results amid COVID-19

/0 Comments/in Corporate Laws, SEBI, SEBI and listing-related compliances - Covid-19 /by Vinod Kothari ConsultantsCompanies to manage the dual requirement of holding board meetings and submission of financial results

Shaifali Sharma

Vinod Kothari & Company

corplaw@vinodkothari.com

In the wake of the continuing impact of COVID-19 pandemic, SEBI vide circular[1] dated June 24, 2020, granted relaxation to listed entities and extended the timeline for submission of financial results for quarter / half year / financial year ended March 31, 2020 to July 31, 2020.

Since, now the first quarter of the FY 2020-21 has come to an end, companies are expected to finalize, approve and submit their financials to the respective stock exchange(s) within 45 days from the quarter ended June 30, 2020 as per Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) i.e. on or before August 14, 2020.

Considering the shortened time gap of 14 days between the two due dates stated above i.e. July 31 and August 14, SEBI vide its circular[2] dated July 29, 2020, has extended the deadline to submit financial results for the first quarter from August 14 to September 15, 2020 thereby allowing additional 32 days to the listed companies which will in turn provide extra time to companies and its auditors working on reporting the quarterly financial results.

It is pertinent to note here that the board of directors, as per Regulation 17(2) of the Listing Regulations, must meet at least four times a year, with a maximum time gap of 120 days between any two meetings. In this regard, the SEBI vide circular[3] date June 26, 2020 had exempted the listed entities from observing the stipulated time gap between two board meetings for the meetings held/proposed to be held between the period December 01, 2019 and July 31, 2020.

Considering no further extension has been granted by SEBI yet, the board meeting for approving the financial results should be scheduled keeping in mind the maximum time gap of 120 days prescribed under the Listing Regulations. For example, if we take a case of a listed company which held its last board meeting on May 02, 2020, the next board meeting shall be scheduled on or before August 31, 2020 instead of the extended due date of September 14, 2020.

As regards for unlisted companies, the maximum time gap for conducting board meetings had been relaxed vide MCA circular[4] dated March 24, 2020 to 180 days from present 120 days for the first two quarters of FY 2020-2021.

[1] https://www.sebi.gov.in/legal/circulars/jun-2020/further-extension-of-time-for-submission-of-financial-results-for-the-quarter-half-year-financial-year-ending-31st-march-2020-due-to-the-continuing-impact-of-the-covid-19-pandemic_46924.html

[2] https://www.sebi.gov.in/legal/regulations/jun-2009/securities-and-exchange-board-of-india-delisting-of-equity-shares-regulations-2009-last-amended-on-april-17-2020-_34625.html

[3] https://www.sebi.gov.in/legal/circulars/jun-2020/relaxation-of-time-gap-between-two-board-audit-committee-meetings-of-listed-entities-owing-to-the-covid-19-pandemic_46945.html

[4] http://www.mca.gov.in/Ministry/pdf/Circular_25032020.pdf

Other reading materials on the similar topic:

- ‘COVID-19 – Incorporated Responses | Regulatory measures in view of COVID-19’ can be viewed here

- ‘Resources on virtual AGMs’ can be viewed here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Email id for further queries: corplaw@vinodkotahri.com

Our website: www.vinodkothari.com

Our YouTube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

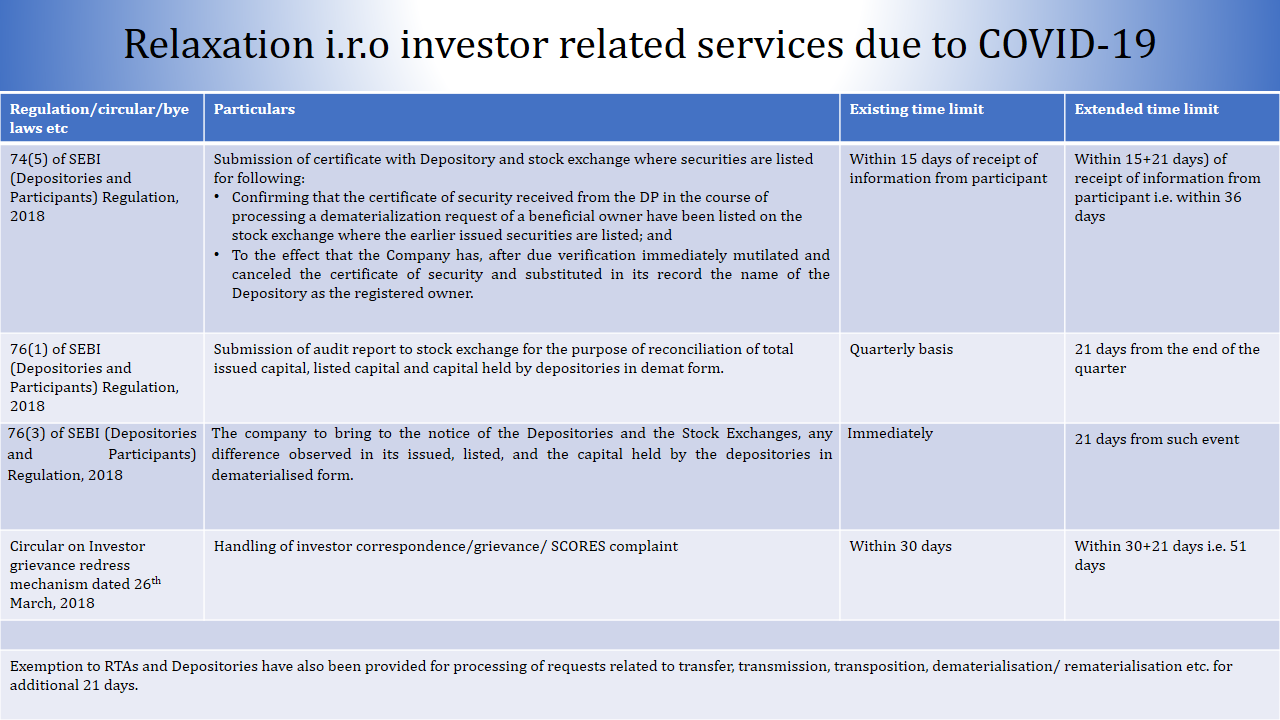

Relaxation i.r.o investor related services due to COVID-19

/0 Comments/in Covid-19, SEBI and listing-related compliances - Covid-19, UPDATES /by Vinod Kothari ConsultantsBelow is a brief snippet of the relaxations provided by SEBI in the wake of the COVID-19 outbreak.

Click here for the Circular dated 13th April, 2020.

Consensual restructuring of debt obligations, due to COVID disruption, not to be taken as default, clarifies SEBI

/1 Comment/in Covid-19, Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, SEBI /by Vinod Kothari ConsultantsVinod Kothari

The global economy, as also that of India, is passing through a systemic disruption due to the COVID crisis. The Reserve Bank of India in its Seventh Bi-monthly Monetary Policy Statement 2019-20 dated March 27, 2020[1] has permitted banks and non-banking financial institutions to provide a moratorium to borrowers for a period of 3 months.

As a result, cashflows of banks and financial institutions from underlying loans will be disrupted, at least for the period of the moratorium. It is a different thing that the disruption may actually prolong, but 3 months as of now is what is explicitly regarded by the RBI has COVID-driven.