CG’s Power to Relax MPS Requirements

– An Unbridled Power?

Pammy Jaiswal, Partner and Sachin Sharma, Executive (corplaw@vinodkothari.com)

Background

The government has been undertaking disinvestment exercise in PSUs since 1991[1] with an intent to overcome various shortcomings including lack of proper management as well as over capitalisation[2]. This exercise has been considered effective to reduce the fiscal burden and raise money to meet public needs and at the same time. Through disinvestment, proceeds are channelized in various ways to strengthen the Indian economy. Since disinvestment gives out a larger share of PSU ownership in the hands of the private sector as well as larger section of the public, it sets the groundwork for India’s firm capital market.

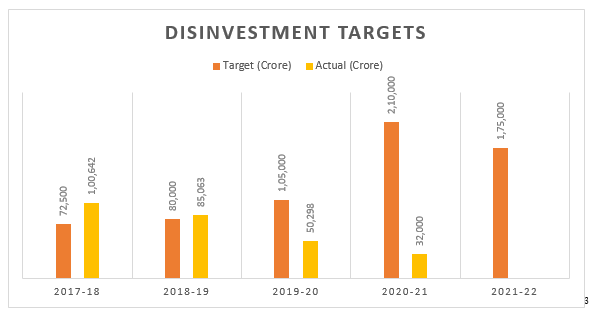

The targets of disinvestment are set in every Union Budget, however the actual level of disinvestment varies from the targets set every year; and while there are various methods of disinvestment like Offer for Sale (OFS), Strategic Sale, IPO, FPO etc., however Offer for Sale (OFS) of shares are extensively used by the Government.

Driven by the intention to involve the private sector and global investors to bring in efficiency and provide much needed cash to help revive the economy hit sharply by the Covid-19 pandemic, the new Public Sector Enterprise (“PSE”) Policy has been unveiled. The new PSE Policy provides a clear roadmap for disinvestment in all non-strategic and strategic sectors and provides that the bare minimum CPSEs will be held on to, and the rest will be privatised. This policy marks a huge shift in the government attitude towards privatisation of state-owned companies.

At this juncture, it is important to note that in addition to the reasons and/ or motivation for disinvestment mentioned above, another reason would be compliance/ alignment with the MPS requirements under Securities Contracts (Regulation) Rules, 1957(“SCR Rules”). Regulation 19A of “SCR Rules”), requires that a listed entity must have at least 25% public shareholding[4] so as to prevent concentration of shares in few hands and enable wider participation of public. Minimum Public Shareholding (MPS) requirement was introduced in the year 2010[5] for listed public sector companies, every listed PSU were required to comply with 10% MPS requirement within timeframe of 3 years.

Extended timelines to comply with MPS for listed PSUs

With the increase in threshold from 10% to 25% in August, 2014, these companies were given 3 years to comply with the 25% MPS requirement, which later got increased to 4 years in July, 2017.

Considering the fact that PSUs were facing difficulty in diluting their shareholdings and they could not comply with the said requirement with given timeframe, the Central Government (CG) allowed fresh timeline of 2 years in August, 2018 i.e. till August 2, 2020. Later, considering the unfavourable market conditions due to Covid-19 outbreak across the world, the Ministry of Finance vide its notification dated July 31, 2020 again extended the time period by 1 year i.e. till August 2, 2021.

Further, SEBI vide its circulars dated November 30, 2015 and February 22, 2018 had prescribed the manner for achieving MPS to comply with the said requirements.

In order to address the cases of non-compliance with MPS norms, structured fine for every day of non-compliance has been prescribed by SEBI vide its circular dated October 10, 2017. Other penalties include freezing of promoter shareholding and compulsory delisting.

Now, Ministry of Finance(MoF) vide notification dated 30th July, 2021 has inserted new sub-rule i.e. sub-rule 6 in Rule 19A in the SCR Rules which has empowered the CG to exempt any listed public sector company in the public interest from complying with any or all of the provisions of this Rule, that is aimed at increasing MPS to 25%.

Probable impact of relaxation

- Optimum Price Discovery

As observed from the foregoing paragraphs, it is clear that the Government has been setting the blue print to privatise the PSUs as a part of its PSE Policy every year. However, looking at the current market situation, where the real price discovery is highly affected due to the COVID era, it seems that the current time may not be smooth and effective for the Government to go on a disinvestment spree.

Accordingly, to pave a concrete path for the achieving the desired intent through disinvestment, the power has now been permanently reserved by the Central Government to relax the MPS requirements in case of listed PSUs. The said power can be instrumental in getting optimum price discovery as well as adequate value for their existing investments held in the strategic and non-strategic sectors.

- Unbridled power to offset a level playing field

Maintenance of a minimum public float helps to attract Indian as well foreign investors. Further, more importantly, while the norms for MPS is for any listed company, the power to relax the MPS requirements have been brought for listed PSUs only. Moreover, the amendment brought this time, unlike the previous amendments, is unbridled. Complying with the MPS requirements is one of the most fundamental requirements that SEBI has laid down so as to help in strengthening the capital market in the long run. However, granting the power to the Central Government to relax the same does not allow a level playing field to all the listed entities.

Conclusion

In the last fiscal, the government has sold its stake via seven offer for sale (OFS) transactions and also tendered shares in buyback offerings by a similar number of CPSEs which includes selling its 15% stake in Rail Vikas Nigam Ltd (PSU) through an Offer for Sale (OFS), reducing the its stake in that PSU to 75.68%. Also PSUs such as Mazagon Dock Shipbuilders Limited and Indian Railway Finance Corporation Limited came out with Initial Public Offerings (IPO).

Further, in last week of July this year, CG has also opened the offer for sale (OFS) for its 8% stake in Housing and Urban Development Corporation (HUDCO) Limited. LIC’s IPO is also in pipeline for the current fiscal. The privatisation of PSUs such as Air India, BPCL, Pawan Hans, BEML, NINL and Shipping Corp has also been planned to be done in the current fiscal[6].

According to the PSUs shareholding data provided by bsepsu.com, there are a total of 68 listed CPSEs in India out of which 24 of them have less than 25% public shareholding as on July 31, 2021.

As discussed above, while the CG has been empowered to relax the MPS requirement and the said list of exempted PSUs may be rolled out soon, however, being an absolute power that has been given, SEBI has given an upper hand to the CG to waive off an essential condition for listed PSUs.

[1] http://www.bsepsu.com/historical-disinvestment.asp

[2] http://www.bsepsu.com/importance-disinvestment.asp

[3] https://www.indiabudget.gov.in/doc/Budget_Speech.pdf

[4] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/jun-2021/1624346958513.pdf#page=1&zoom=page-width,-16,792

[5] https://egazette.nic.in/WriteReadData/2010/E_440_2011_011.pdf

[6] http://www.bsepsu.com/bsepsu_Articles.asp

Read our other articles on the topic here –