SEBI’s Yet Another Move to Ensure Minimum Public Shareholding

By Parul Bansal, (corplaw@vinodkothari.com)

Background

With the development of the economic conditions of the country, various investors including the retail investors are stepping into the securities market with the intention to earn higher return on their investments which has lead to large portion of their income being invested in shares, bonds or securities of listed companies. At this juncture, return on their investment is proportionate to the growth of listed companies. Therefore, their destiny in the stock market lies at the mercy of management and promoters of listed companies.

Stock Exchange Board of India (“SEBI”) with an endeavor to prevent the investors from the monopoly of the listed companies and to debar/prevent the undesirable/illegal transactions has enacted Securities Contract (Regulation) Act, 1956 (“SCRA, 1956”) and Securities Contract (Regulation) Rules, 1957 (“Rules, 1957”) thereof.

Minimum Public Shareholding (“MPS”)

Listed Companies are those companies of which shares are listed on the stock exchange and certain percentage of such shareholding is available for the public to trade in with transparency and liquidity. If large portion of the shareholding of listed companies remain blocked in the hands of the promoters, subsidiary or associate company then the intent of listing such securities is breached and becomes redundant. The promoters will be at liberty to manipulate the price and the market tricking will be easy. This will also reduce the floating capacity of the securities of the company due to less liquidity. Ministry of Finance vide press release dated June 4, 2010 has also stated that:

“A dispersed shareholding structure is essential for the sustenance of a continuous market for listed securities to provide liquidity to the investors and to discover fair prices. Further the larger the number of shareholders, the less is the scope for price manipulation.”

To prevent such abuse, sub-rule 19 of the Rules, 1957 specifies the conditions for initial and continuous listing of a company.

Initial Listing

As per regulation 19(2)(b) of the Rules, 1957, any company proposing to list its securities shall maintain MPS as mentioned below based upon the post issued share capital of the company:

| Post issued share capital at offer price | MPS (minimum) | |

| 1 | Less than or equal to INR 600 crores | 25% of each class or kind of equity shares or

debenture convertible into equity shares issued by the company |

| 2 | More than INR 600 to INR 4000 crores | Such % of each class or kind of equity shares or debentures convertible into equity shares issued by the company equivalent to the value

of four hundred crore rupees |

| 3 | More than INR 4000 crores | 10% of each class or kind of equity shares or debentures convertible into equity shares issued by the company |

| In case of 2 and 3, company shall attain MPS equal to 25% within 3 years from the date of listing its securities | ||

Relaxation by SEBI

SEBI has, vide circular dated March 10, 2017, laid down criteria for Schemes of Arrangement by Listed Entities and relaxation under Rule 19 (7) of the Securities Contracts (Regulation) Rules, 1957 (SCRR). Further, to align with the rules of Rule, 1957, amendments were carried out therein through circular dated September 21, 2017.

Pursuant to aforesaid circulars, any listed issuer may for the purpose of arrangement submit a draft scheme of arrangement under sub-rule 19 of Rules, 1957 for seeking relaxation from the applicability of strict provisions of sub-rule 19(2) of Rules, 1957, for listing of its equity shares on a recognized Stock Exchange without making an initial public offer, on satisfying the conditions as mentioned in para III of Annexure I thereof. In terms of such conditions at least 25% of the post-scheme paid up share capital of the transferee entity shall comprise of shares allotted to the public shareholders in the transferor entity. However, on fulfillment of following condition, requirement to attain such MPS may be waived off:

- The entity has a valuation in excess of INR 1600 crore as per the valuation report;

- The value of post-scheme shareholding of public shareholders of the listed entity in the transferee entity is not less than INR 400 crore;

- At least 10% of the post-scheme paid up share capital of the transferee entity comprises of shares allotted to the public shareholders of the transferor entity; and,

- MPS of 25% shall be attained within a period of one year from the date of listing of its securities and an undertaking to this effect is incorporated in the scheme” .

Continuous Listing

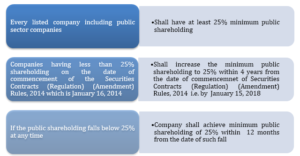

Pursuant to sub-rule 19A of the Rules, 1957 every listed company including the Public Sector Company shall maintain MPS of 25% of the total shareholding of the Company. Initially, limit for the Public Sector Companies was fixed at 10% but later on the same was also increased from 10% to 25% to provide equal footing to listed companies and PSUs.

What if MPS is less than 25% in case of continuous listing?

Pursuant to proviso of sub-rule 19A of Rules, 1957, every listed company which is not meeting the minimum public shareholding specified under sub-rule 19 of the Rules, 1957 shall in accordance with the provision of sub-rule 19A accomplish the same within the stipulated time period which is 4 year from the date of commencement of SCRA Amendment Rules, 2014 i.e. by January 15, 2018. Earlier the time specified was upto January 15, 2017 and listed companies failing to comply with the same has faced severe consequences in past. Albeit, strict steps have been taken by SEBI against such companies, public shareholding of such companies was still below the requirement. Therefore, SEBI has, once again vide circular on July 03, 2017, extended the time limit for achieving the minimum public shareholding by one year i.e. January 15, 2018.

This extension of time yet again by SEBI is a clear indication of the its accommodative and perceptive regulatory approach and takes cognizance of the need for a reasonable timeframe within which non-compliant companies may take remedial action with respect to public holding requirements. SEBI has not only increased the time limit for bringing the public shareholding within specified limits but has also amended various Regulations and Acts thereof for achieving the requirement of minimum public shareholding.

Steps taken by SEBI to achieve minimum public shareholding

SEBI has vide circular dated December 16, 2010 and August 29, 2012 specified the methods for complying with the minimum public shareholdings such as issuance of shares to public through prospectus, offer of shares held by promoters to public, right issues/ bonus issue to public shareholders with promoters or promoter group shareholders forgoing their entitlement, etc.

Subsequently, another circular was issued by SEBI on February 08, 2012 through which listed companies were allowed to achieve minimum public shareholding through institutional placement programme. Along with the aforesaid, SEBI has also specified that listed companies desirous of achieving the minimum public shareholding may approach SEBI with the appropriate details and the same will be entertained by it on the basis of merits.

Result of non-compliance

Despite aforementioned efforts of the SEBI to facilitate achieving minimum shareholding, various companies have not complied with the same. As a result SEBI has taken stern actions like freezing of voting rights, delisting of securities, exclusion of scrips from F&O segments etc.

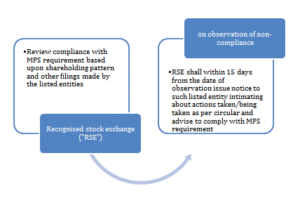

SEBI has once again vide circular dated October 10, 2017[1], in order to bring uniformity of approach in enforcement of MPS norms and to ensure compliance with same, laid down following procedure:

Steps to be taken by RSE on observing non-compliance

- Fine of ₹5,000 per day (₹10,000 per day if non compliance continues for more than 1 year) of non-compliance on the listed entity till the date of compliance. In case the listed entity fails to pay the fine despite receipt of the notice as stated above, the recognized stock exchange may initiate appropriate action.

- Freezing of shareholding of promoter/promoter group till the date of compliance (this shall not be an impediment for the entities complying with MPS norms through the methods specified/approved by SEBI).

Provided that where it is observed that the listed entity has adopted a method for complying with MPS requirements which is not prescribed by SEBI under clauses (2)(i) to (vi) under SEBI circular[1] dated November 30, 2015 and approval for the same has not been obtained from SEBI under clause 2 (vii) of the said circular, the recognized stock exchanges shall refer such cases to SEBI.

- Promoters, promoter group and directors shall not hold any new position as director in any other listed entity till the date of compliance by such entity (listed entity shall give intimation of the same to RSE and promoters, promoter group and directors)

- RSE may consider compulsorily delisting of non-complaint entity in accordance with SCRA, 1956, Rules, 1957 and SEBI (Delisting of Equity Shares) Regulations, 2009.

- RSE may keep in abeyance the action or withdraw the action in specific cases where specific exemption from compliance with MPS requirements under the Listing Regulations/ moratorium on enforcement proceedings has been provided under any Act, Court/Tribunal Orders etc.

Upon intimation of compliance and on being satisfied, RSE shall remove the aforementioned restriction levied on the listed entities, its promoter, promoter group and directors.

Aforementioned actions taken by SEBI are without prejudice to its power to take action under the securities laws for violation of the MPS requirements.

International practice

Colombo Stock Exchange

Pursuant to rule 7.13 of the listing rules[2] of the Colombo Stock Exchange, every company listed on the main Board shall maintain a minimum public shareholding as stipulated therein. Previously, such listed companies were required to comply with this requirement of minimum public shareholding by December 31, 2016. However, likewise SEBI, Stock Exchange Commission in consultation with Colambo Sock Exchange has extended the timeline to June 30, 2017 for the listed companies not complying with the requirement of minimum public shareholding.[3]

Europeon Union (Euronext)

Pursuant to the regulations of Euronext Amsterdam[4], minimum public shareholding maintained by the companies shall be 25% of the issued shares of the company. Unlike, SEBI, Colambo Stock Exchange, Euronext considers the free float/liquidity available for the security of the company. In case a large number of shares of the company are available to public, ensuring enough liquidity for the such shares, irrespective of the percentage, minimum public shareholding may go below 25% subject to the condition that minimum public shareholding shall never be lower than 5% and the free float shall always represent at least EUR 5 million (based on the offering price).

[1] http://www.bseindia.com/downloads/whtsnew/file/Manner%20of%20achieving%20MPS%20301115.pdf

[2] https://cdn.cse.lk/pdf/Section-7.pdf

[3] https://cdn.cse.lk/cmt/upload_cse_report_file/directives_24_18-11-2016.pdf

[4] https://uk.practicallaw.thomsonreuters.com/9-572-8048?transitionType=Default&contextData=(sc.Default)&firstPage=true&bhcp=1

Leave a Reply

Want to join the discussion?Feel free to contribute!