RBI eases norms on loans and advances to directors and its related entities

Payal Agarwal, Executive, Vinod Kothari & Company ( payal@vinodkothari.com )

RBI has recently, vide its notification dated 23rd July, 2021 (hereinafter called the “Amendment Notification”), revised the regulatory restrictions on loans and advances given by banks to directors of other banks and the related entities. The Amendment Notification has brought changes under the Master Circular – Loans and Advances – Statutory and Other Restrictions (hereinafter called “Master Circular”). The Amendment Notification provides for increased limits in the loans and advances permissible to be given by banks to certain parties, thereby allowing the banks to take more prudent decisions in lending.

Statutory restrictions

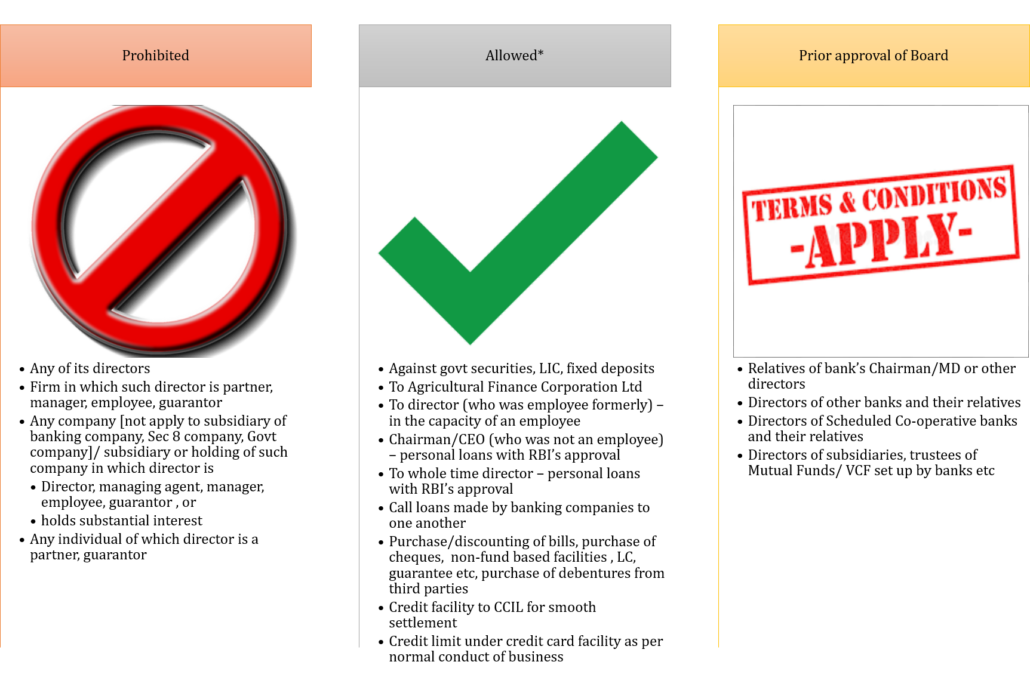

Section 20 of the Banking Regulation Act, 1949 (hereinafter called the “BR Act”) puts complete prohibition on banks from entering into any commitment for granting of loan to or on behalf of any of its directors and specified other parties in which the director is interested. The Master Circular is in furtherance of the same and specifies restrictions and prohibitions as below –

*since the same does not fall within the meaning of loans and advances for this Master Circular

Loans and advances without prior approval of Board

The Master Circular further specifies some persons/ entities that can be given loans and advances upto a specified limit without the approval of Board, subject to disclosures in the Board’s Report of the bank. The Amendment Notification has enhanced the limits for some classes of persons specified.

| Serial No. | Category of person | Existing limits specified under Master Circular | Enhanced limits under Amendment Notification |

| 1 | Directors of other banks | Upto Rs. 25 lacs | Upto Rs. 5 crores for personal loans

(Please note that the enhancement is only in respect of personal loans and not otherwise) |

| 2 | Firm in which directors of other banks interested as partner/ guarantor | Upto Rs. 25 lacs | No change |

| 3 | Companies in which directors of other banks hold substantial interest/ is a director/ guarantor | Upto Rs. 25 lacs | No change |

| 4 | Relative(other than spouse) and minor/ dependent children of Chairman/ MD or other directors | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 5 | Relative(other than spouse) and minor/ dependent children of Chairman/ MD or other directors of other banks | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 6 | Firm in which such relatives (as specified in 4 or 5 above) are partners/ guarantors | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 7 | Companies in which relatives (as specified in 4 or 5 above) are interested as director or guarantor or holds substantial interest if he/she is a major shareholder | Upto Rs. 25 lacs | Upto Rs. 5 crores |

Need for such changes

The Master Circular was released on 1st July, 2015, which is more than 5 years from now. Considering the inflation over time, the limits have become kind of vague and ambiguous and required to be revisited. Moreover, the population all over the world is facing hard times due to the Covid-19 outbreak. At this point of time, such relaxation can be looked upon as the need of the hour.

Impact of the phrase ‘Substantial interest’ vs ‘Major shareholder’

The Master Circular uses the term “substantial interest” to generally regulate in the context of lending to companies in which a director is substantially interested.

The relevant places where the term has been used are as below –

| Completely prohibited | Allowed with conditions | |

| Section 20(1) of the BR Act – for companies in which directors are substantially interested | Para 2.2.1.2. of Master Circular – for companies in which directors of other banks are substantially interested – upto a limit of Rs. 25 lacs without prior approval of Board

|

|

| Para 2.1.2.2. of Master Circular – for companies in which directors are substantially interested | Para 2.2.1.4. of Master Circular – for the companies in which the relatives of directors of any bank are substantially interested – upto Rs. 25 lacs without prior approval of Board | After amendment, the para stands modified as – for the companies in which the relatives of directors of any bank are major shareholders – upto Rs. 5 crores without prior approval of Board |

While the Amendment Notification itself provides for the meaning of “major shareholder”, the meaning of “substantial interest” for the purposes of the Master Circular has to be taken from Section 5(ne) of the BR Act which reads as follows –

- in relation to a company, means the holding of a beneficial interest by an individual or his spouse or minor child, whether singly or taken together, in the shares thereof, the amount paid up on which exceeds five lakhs of rupees or ten percent of the paid-up capital of the company, whichever is less;

- in relation to a firm, means the beneficial interest held therein by an individual or his spouse or minor child, whether singly or taken together, which represents more than ten per cent of the total capital subscribed by all the partners of the said firm;

The above definition provides for a maximum limit of shareholding as Rs. 5 lacs, exceeding which a company falls into the list of a company in which director is substantially interested. The net effect is that a lot of companies fall into the radar of this provision and therefore, ineligible to take loans or advances from banks.

However, the Amendment Notification provides an explanation to the meaning of “major shareholder” as –

“The term “major shareholder” shall mean a person holding 10% or more of the paid-up share capital or five crore rupees in paid-up shares, whichever is less.”

This eases the strict limits because of which several companies may fall outside the periphery of the aforesaid restriction. Having observed the meaning of both the terms it is clear that while ‘substantial interest’ lays down strict limits and therefore, covers several companies under the prohibition list, the term ‘major shareholder’ eases the limit and makes several companies eligible to receive loans and advances from the bank subject to requisite approvals thereby setting a more realistic criteria.

The BR Act was enacted about half a century ago when the amount of Rs. 5 lacs would have been substantial, but not at the present length of time. Keeping this in mind, while RBI has substituted the requirement of “substantial interest” to “major shareholder” in one of the clauses, the other clauses and the principal Act are still required to comply with the “substantial interest” criteria, thereby, keeping a lot of companies into the ambit of restricted/ prohibited class of companies in the matter of loans and advances from banks.

Other petty amendments

Deeming interest of relative –

The Amendment Notification has the effect of inserting a new proviso to the extant Master Circular which specifies as below –

“Provided that a relative of a director shall also be deemed to be interested in a company, being the subsidiary or holding company, if he/she is a major shareholder or is in control of the respective holding or subsidiary company.”

This has the effect of including both holding and subsidiary company as well within the meaning of company by providing that a major shareholder of holding company is deemed to be interested in subsidiary company and vice versa.

Explanations to new terms –

The Amendment Notification allows the banks to lend upto Rs. 5 crores to directors of other banks provided the same is taken as personal loans. The meaning of “personal loans” has to be taken from the RBI circular on harmonisation of banking statistics which provides the meaning of personal loans as below –

Personal loans refers to loans given to individuals and consist of (a) consumer credit, (b) education loan, (c) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), and (d) loans given for investment in financial assets (shares, debentures, etc.).

Other terms used in the Amendment Notification such as “major shareholder” and “control” has also been defined. The meaning of “major shareholder” has already been discussed in the earlier part of this article. The meaning of “control” has been aligned with that under the Companies Act, 2013.

Concluding remarks

Overall, the Amendment Circular is a welcoming move by the financial market regulator. However, as pointed out in this article, several monetary limits under the BR Act have become completely incohesive and therefore, needs revision in the light of the current situation.