Disclosure in financial statements: Relationship with struck off companies

– Himanshu Dubey, Executive | corplaw@vinodkothari.com

The financial statements of a company are not merely meant to show the profit or loss and/or assets and liabilities of the company. The notes to such financial statements also disclose various nuances that the shareholders of the company shall be aware of. Such disclosures may vary from material transactions with related parties to the purpose of inter-corporate loans, guarantee or security. The financial statements are meant to be prepared in accordance with Schedule III (‘Schedule’) to the Companies Act, 2013 (‘Act’). On March 24, 2021, MCA introduced more elaborative disclosure requirements regarding financial statements of companies which are effective from April 1, 2021 i.e. for financial statements prepared for FY 2021-22. One such requirement is disclosure of transactions with companies struck off by Registrar of Companies (‘RoC’) under section 248 of the Act, or under section 560 of the Companies Act, 1956. The following particulars are to be disclosed in such case:

- Name of the struck off company

- Nature of transactions with company

- Balance outstanding and relationship with the struck off the company.

The transaction can be in the nature of investment in securities, receivables, payables, shareholding of the struck-off company in the company and any other outstanding balances.

Before digging deep on the disclosure requirements, it is imperative to understand the provisions for striking off a company by RoC both under the Act as well as the Companies Act, 1956.

Under the Companies Act, 1956

Under the Act

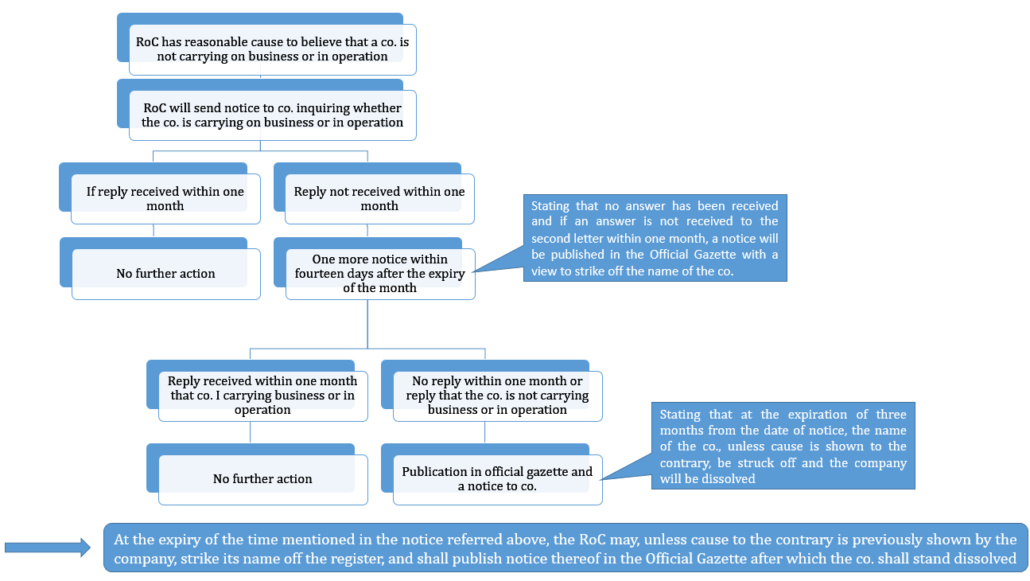

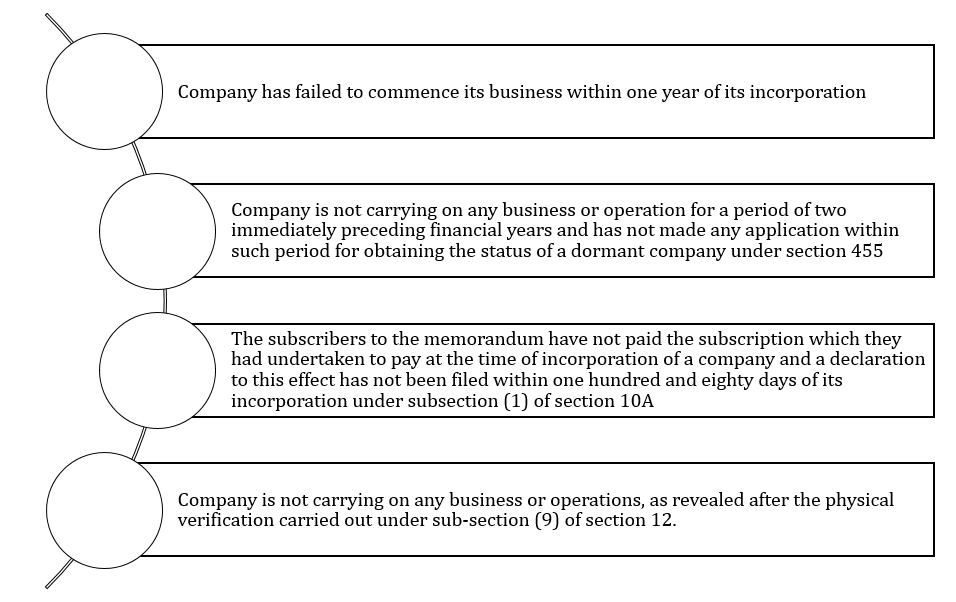

If the RoC has reasons to believe that:

A notice to the company and all the directors of the company, shall be sent by RoC articulating intention to strike off the name of the company and requesting them to send their representations within a period of thirty days from the date of the notice. At the expiry of the time, the RoC may, unless cause to the contrary is shown, strike off its name and shall publish notice thereof in the Official Gazette pursuant to which the company shall stand dissolved.

Further, a company may itself by passing a special resolution or consent of seventy-five per cent members after extinguishing all its liabilities, file an application to the RoC for removing its name on all or any of the grounds specified in the figure above.

Practical difficulties in disclosures

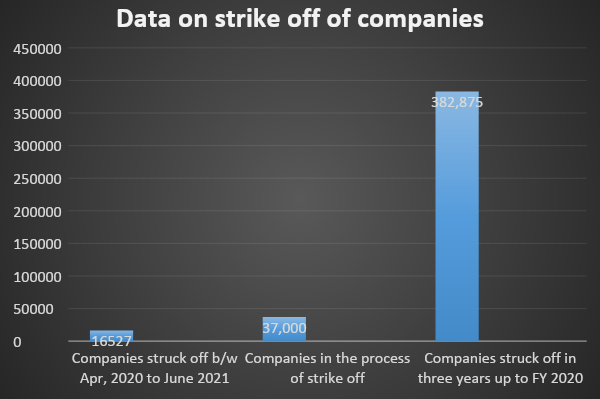

The disclosure requirements of transactions with companies the name of which has been struck off is too vigorous since it requires too much background work to be done on the end of companies. Further, MCA has been issuing circulars containing names of companies which have been struck off. The companies will literally have to struggle through such a cumbersome and tedious task to find out one name among the thousands as issued by MCA.

There are some more practical complications that needs to be highlighted where the name of the company, that has been struck off, as available in records of the company may not match with the one mentioned in MCA’s list:

- Such company has merged with some other company

- Such company has changed its name

- Such company might have converted itself to some other kind of entity like LLP

Going further, even in terms of volumes, there are a bunch of companies with whom a company transacts in its course of business. Tracing each one of them and identifying those which has been struck off seems to be a next to impossible task for a lot of companies.

Recommendations for companies for complying with the requirements

The companies may opt for following systems and procedures depending upon the nature of transaction it has with a company the name of which has been struck off:

| Nature of relationship | Practical way of dealing |

| Debtor | The company might look through debtors periodically, especially those the receivables from whom are due for too longer than the usual time. |

| Creditor | If the payment made by the company has bounced for more than once, they may check if the aforesaid has been struck off. |

| Investment in securities | Unless a co. is an investment company or NBFC, it will not have several investments. Therefore, it will be comparatively easy to track such companies. |

| Shares held by stuck off company | This one might seem like a demon. There are listed companies with lakhs of shareholders. One more point to be noted in this regard is there might be cases of restructuring where a company might have merged or demerged. In such cases, the resulting company will have to carry the baggage of the transferor company (old company) as well in this regard. We might also take into account that there are certain benami shareholders in many companies for which IEPF rules are already in place. Tracking the names of such companies which have been struck off from such a large number of shareholders and collating data is a next to impossible task. |

| Other outstanding balances (to be specified) | This is a residuary field which requires any outstanding balance with a struck off company to be disclosed. Needless to say, this is an open-ended heading and includes in its ambit any transaction that is not covered above. Through this, the reporting company is expected to get into an exercise of identifying all transaction(s) with a struck off company with which the company has outstanding balance as on the last day of reporting period. |

Pursuant to the January 2022 edition of the ICAI Guidance Note on Division II – Ind AS Schedule III to the Companies Act, 2013 and Guidance Note on Division II – Non-Ind AS Schedule III to the Companies Act, 2013, the following guidance is provided with respect to disclosure of information regarding outstanding balances with struck off companies:

| Identification of struck-off company | The names of the companies are required to be searched / authenticated from public notice (STK-7) during the reporting period or any previous year(s), if balances with such companies are outstanding as on the last day of the reporting period.

Further, there should not have been any order for restoration of the name of such companies before the approval of the financial statement. It may be noted that this again is an task to track if the name of the companies have been restored vide order of any NCLT any other adjudicating authority as the orders remain scattered and at times not timely uploaded on the website. |

| Amount of balance outstanding | (1) The gross carrying amount is required to be disclosed without netting any provision for doubtful debts or impairment loss allowance.

(2) Infact the Guidance Note states that even such transaction which might have happened during a financial year and settled/reversed/squared off, etc., during the same financial year such that the balance outstanding is NIL as at the end of the reporting period, even such transactions are required to be disclosed. This adds up to the anyway unending disclosure in this context. There may be a situation where a company is not a struck off company at the time of transaction but eventually becomes one and is a struck off company as on the last day of the reporting period. With the point (2) above, one is left to an endless thought whether the reporting company is required to review all the transactions it had during the previous year(s)? because only then it may be able to track if there is any entry which might come under point (2) above. |

| Relationship with the struck-off company, if any, to be disclosed | In this field, the company is required to disclose its relationship, if any, with the corresponding struck-off companies as per section 2(76) of the Act, as on the balance sheet date. |

| Details not to be included | Companies whose names were struck off during the financial year but the order had been passed by any adjudicating authority (for e.g., NCLT) name before approval of the financial statements. |

Conclusion

In a nutshell, MCA is asking companies to search for the dead man but the dead man isn’t waking up. There might be cases where the name/identity of the dead man would have already been extinguished or changed during its lifetime. We understand that the intent of the Government is to read out all the struck off companies from the database of corporates. However, to effectively meet this purpose, MCA may opt to come out with a digital database of all companies which have been struck off either under the Act or the previous Act since it will facilitate companies to search data at one place. This might not be a complete way out but due to the practical hassles as discussed above in the article, MCA needs to review the requirement considering the practical issue being faced by the companies and introduce systems in place to enable compliance.

[1] https://economictimes.indiatimes.com/news/economy/policy/govt-says-16527-companies-struck-off-during-april-2020-june-2021-period/articleshow/84755626.cms?from=mdr

[2] https://www.livemint.com/news/india/37000-companies-getting-struck-off-from-records-mca-11632313659564.html