Proposed framework for overseas Investments by entities and individuals

Proposes segregation of regulatory and the operational part in rules and regulations respectively

FCS Vinita Nair |Senior Partner, Vinod Kothari & Company

Investments by Indian entities outside India is a very common phenomenon and several companies have presence outside India by virtue of forming a Joint Venture (‘JV’) and Wholly Owned Subsidiaries (‘WOS’)

With the enforcement of amendment proposed in Finance Act, 2015 in October, 2019[1] powers vested with Central Government (CG) and Reserve Bank of India (RBI) with respect to permissible Capital Account Transaction were revisited. Power to frame rules relating to Non-Debt instruments (‘NDI’) were vested with CG and to frame regulations relating to debt instruments were vested with RBI. The scope of NDI inter alia covers all investment in equity instruments in incorporated entities: public, private, listed and unlisted; acquisition, sale or dealing directly in immoveable property.

RBI intends to combine erstwhile FEMA (Transfer or Issue of Foreign Security) Regulations, 2004[2] (‘erstwhile ODI regulations’) and FEMA (Acquisition and Transfer of immoveable property outside India) Regulations, 2015[3] into FEMA (Non-debt Instruments – Overseas Investment) Rules, 2021[4] (‘NDI Rules’) and FEMA (Overseas Investment) Regulations, 2021[5] (‘OI Regulations’) and has rolled out the draft regulations for public comments to be sent by August 23, 2021[6].

NDI Rules v/s OI Regulations

NDI Rules will provide the regulatory framework for making of overseas investment covering the permissions, conditions for making overseas investment, restrictions from making Overseas Direct Investment (‘ODI’), pricing guidelines, transfer, liquidation and restructuring of ODI. While the NDI Rules will be framed by CG, however, the same will be administered by the RBI.

OI Regulations, on the other hand, will provide only the operational part covering conditions for undertaking Financial Commitment (‘FC’), other than investment in equity capital, consideration in case of acquisition or transfer of equity capital of a Foreign Entity (‘FE’), mode of payment, obligations of Persons Resident in India (‘PRII’), reporting requirements, consequence of delay in reporting and restrictions on further FC/ transfer.

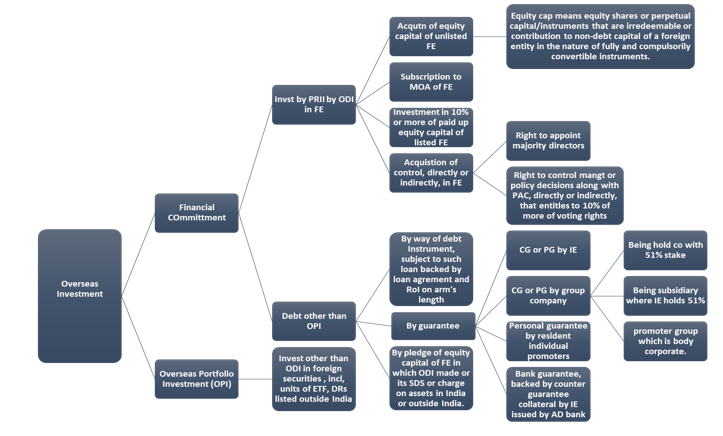

Components of Overseas Investment

Under the erstwhile ODI regulations, currently in force, there is a concept of direct investment outside India in JV and WOS that excludes portfolio investment and FC. NDI Rules combine the two to define FC and separately defines the term Overseas Portfolio Investment (‘OPI’). Overseas Investment (‘OI’) is FC + OPI.

The classification as ODI depends on the nature of instruments in which investment is made, the nature of the entity in which investment is made and whether control has been acquired or not.

The diagram below provides a snapshot of the same.

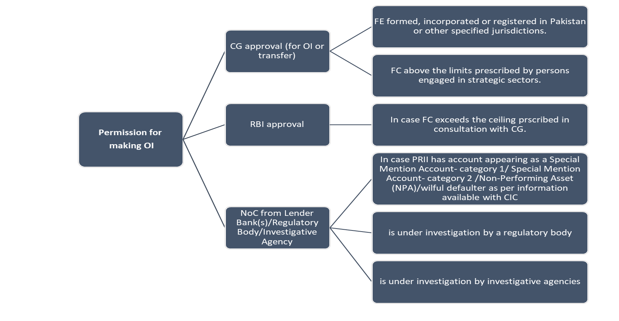

Approval requirement proposed

The NDI Rules provides investments that require prior approval of Central Government, RBI and NOC from lender banks/ regulatory body etc. The Erstwhile ODI Regulations only mandated prior approval of RBI in case eligibility conditions stipulated were not met by the Indian party or resident individual.

Other amendments proposed

- ODI in technology ventures through an Overseas Technology Fund (OTF) permitted for listed IE with minimum net worth of Rs. 500 crore, for the purpose of investing in overseas technology startups engaged in an activity which is in alignment with the core business of such IE.

- Limit of FC upto 400% of networth will not apply to FC made by “Maharatna” PSUs or “Navratna” PSUs or subsidiaries of such PSUs in foreign entities outside India engaged in strategic sectors. Strategic sectors defined to include energy and natural resources sectors such as Oil, Gas, Coal and Mineral Ores or any other sector that may be advised by CG.

- Definition of net worth to be aligned with Companies Act, 2013.

- Sub-limits for determination of FC (50% of performance guarantee, 100% of corporate guarantee) is proposed to be done away with.

- Applicability of provisions in case of investments made in or by units in IFSC clarified.

- Bona fide activity defined to mean such business activities legally permissible both in India and host jurisdiction.

- Permissible range of 5% of the fair value arrived on an arm’s length basis as per any internationally accepted pricing methodology for valuation duly certified by a registered valuer as per the Companies Act 2013; or similar valuer registered with the regulatory authority in the host jurisdiction to the satisfaction of the AD bank provided along with period of validity of valuation certificate upto 6 months before the date of the transaction.

- Reporting of FC and OPI to be done in distinct forms.

- Prohibition on further FC to continue until any delay in reporting is regularized. The erstwhile ODI regulations restricted only in case of non-filing of Form APR.

- Restriction on acquisition of immoveable property outside India will not apply in case the same is acquired on lease by PRII for a period not exceeding 5 years. Manner of transfer of immoveable properties also prescribed.

- Source of funds for acquiring immoveable property outside India to include limit under Liberalised Remittance Scheme (LRS) and out of income/ sale proceeds of the assets, other than ODI.

Our other videos and write-ups may be accessed below:

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

https://vinodkothari.com/category/corporate-laws/fema/

[1] https://egazette.nic.in/WriteReadData/2019/213265.pdf

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=2126&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10257&Mode=0

[4] https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4024

[5] https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4023

[6] https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52026