-Munmi Phukon, Pammy Jaiswal and Richa Saraf (corplaw@vinodkothari.com)

ICRA has published a report on 23.04.2020[1], listing out some 328 entities[2] who have availed or sought a payment relief from the lending institutions or investors. The list also includes names of such entities that have received an in-principle approval from investors in their market instruments (like non-convertible debentures)- prior to the original due date- for shifting the original due date ahead, but where a formal approval from the investors was received either after the original due date or is still pending to be received.

Earlier, Securities and Exchange Board of India (SEBI) had, vide circular no. SEBI/ HO/ MIRSD/ CRADT/ CIR/ P/ 2020/53 dated 30.03.2020[3], addressed to the credit rating agencies (CRAs), granted certain relaxation from compliance with certain provisions of the circulars issued under SEBI (Credit Rating Agencies) Regulations, 1999 due to the COVID-19 pandemic. The circular stipulated that appropriate disclosures in this regard shall be made in the press release, seemingly, the report published by ICRA is a part of the disclosure requirement specified by SEBI.

In view of the COVID crisis, companies in large numbers are approaching investors or will be approaching investors for restructuring of the debentures, therefore, it becomes pertinent to discuss- how the restructuring is carried on? whether a meeting of debenture holders will be required to be convened? what will be the consequences if the restructuring is not done? and other related questions. Below we discuss the same.

Force Majeure– An Excuse to Default?

In financial terms, “default” means failure to pay debts, whether principal or interest. Under ISDA Master Agreement[4], failure by the party to make, when due, any payment is listed as an event of default and one of the termination events. However, the ISDA Master Agreement provides that in case of a force majeure event, payments can be deferred. Most of the standard agreements, contain specific clauses pertaining to force majeure, where the party required to perform any contractual obligation is required to intimate the other party as soon as it becomes aware of happening of any force majeure event. While in some cases, due to impossibility of performance, the agreement itself is frustrated; in some other cases, the obligations are merely deferred till the event persists.

Our article “COVID- 19 and The Shut Down: The Impact of Force Majeure” can be accessed from the link: http://vinodkothari.com/2020/03/covid-19-and-the-shut-down-the-impact-of-force-majeure/

Consequences of default- Rights available to debenture holders:

A debenture holder has several options available in case of default: (a) insolvency proceedings; (b) enforcement of security interest; (c) proceedings for recovery of debt due. Below we discuss the same:

– Right to call for meeting of debenture holders: Rule 18 (4) of the Companies (Share Capital and Debentures) Rules, 2014 stipulates that the meeting of all the debenture holders shall be convened by the debenture trustee on:

- requisition in writing signed by debenture holders holding at least 1/10th in value of the debentures for the time being outstanding; or

- the happening of any event, which constitutes a breach, default or which in the opinion of the debenture trustees affects the interest of the debenture holders.

– Right to make an application before NCLT: Section 71(10) of the Companies Act, 2013 provides that on failure of the company to redeem the debentures on the date of their maturity or failure to pay interest on the debentures when it is due, an application may be filed by any or all of the debenture holders or debenture trustee, seeking redemption of the debentures forthwith on payment of principal and interest due thereon.

– Application under IBC: Section 5(7) of IBC defines a “financial creditor” to mean any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to, and Section 5(8) of IBC defines “financial debt” as a debt along with interest, if any, which is disbursed against the consideration for the time value of money and includes any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument. Thus, debenture holders are treated as financial creditors for the purpose of IBC and may exercise all the rights as available to a financial creditor.

As per Section 6 of IBC-“Where any corporate debtor commits a default, a financial creditor, an operational creditor or the corporate debtor itself may initiate corporate insolvency resolution process in respect of such corporate debtor in the manner as provided under this Chapter”. Accordingly, the debenture holders (whether secured or not) may apply for initiation of corporate insolvency resolution process against the company under Section 7 of IBC. In fact the Central Government has, vide notification no. S.O. 1091(E) dated 27th February, 2019, notified that such right may also be exercised by the debenture holder, through a debenture trustee.

– Right to enforce security interest: The right of foreclosure is a counter-part of right of redemption. Just like a company has a right of redeeming the security after payment of debt amount, a secured debenture holder has a right of foreclosure or sale in case of default in redemption. In the case of Baroda Rayon Corporation Limited vs. ICICI Limited[5] and in Canara Bank vs. Apple Finance Limited[6], Bombay High Court upheld the right of the debenture trustee to sell off the properties of the company for the benefit of the debenture holders.

Here, it is pertinent to understand how the debenture holders shall exercise the right of foreclosure. The law distinguishes between security interests based on the nature of the collateral. For instance, in case of security interests on immovable properties, Chapter IV of Transfer of Property Act, 1882 applies. Further, the security interest, in case of secured debentures, can be enforced in the following manner: (a) In case the debenture holder is a bank/ financial institution, as per the provisions of Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002; and (b) In case the debenture holder is not a bank/ financial institution, as per the common law procedures.

– Other remedies: Any default in the terms of the debentures is a breach of contract, and the debenture holder may sue the company for breach of contract as per the provisions of Contract Act, 1872, and further seek for compensation as per the terms of the debenture, or in absence of specific term in the agreement, compensation may be claimed as per the provisions of Section 73 of the Contract Act, 1872.

Issues cropping up due to COVID- 19 and the resolution thereof:

In view of the COVID pandemic one of the issue that was arising was that the issuers of debt instruments who were not able to fulfil the obligations as per the terms of the debentures or redeem the same on the maturity date were running to courts for seeking interlocutory reliefs, seeking to restrain the debenture holders from exercising any rights against the defaulting issuer. In the case of Indiabulls Housing Finance Ltd. vs. SEBI[7], the petitioner prayed for an ad interim direction to restrain any coercive action against it, with respect to the repayment to be made by it to its non-convertible debenture holders. In the said case, granting the prayer, the Hon’ble Delhi High Court directed maintenance of status quo with respect to the repayments to be made by the petitioner to the NCD holders.

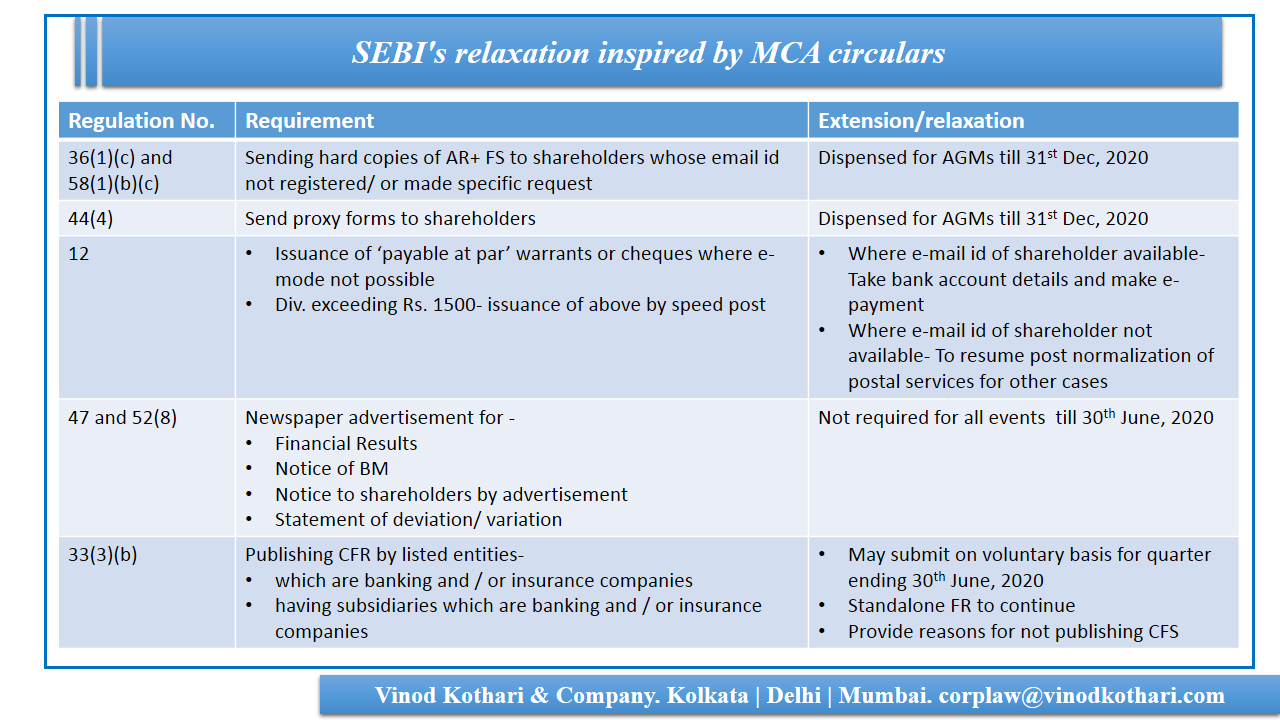

Further, there was a lack of clarity on how rating and valuation of a security would be revised in view of the default or the restructuring? Therefore, SEBI has issued the following circulars:

- SEBI, vide a circular no. SEBI/ HO/ MIRSD/ CRADT/ CIR/ P/ 2020/53 dated March 30, 2020[8], granted certain relaxation from compliance with certain provisions of the circulars issued under SEBI (Credit Rating Agencies) Regulations, 1999 due to the COVID-19 pandemic.

With respect to recognition of default, the circular stipulates that CRAs recognize default based on the guidance issued vide SEBI circular dated May 3, 2010[9] and November 1, 2016[10], however, based on its assessment, if the CRA is of the view that the delay in payment of interest/principle has arisen solely due to the lockdown conditions creating temporary operational challenges in servicing debt, including due to procedural delays in approval of moratorium on loans by the lending institutions, CRAs may not consider the same as a default event and/or recognize default.

- Further, SEBI has, vide its circular no. SEBI/HO/IMD/DF3/CIR/P/2020/70 dated 23.04.2020[11], reviewed certain provisions of the circular dated 09.2019[12] issued under SEBI (Mutual Funds) Regulations, 1996. In the circular, SEBI has stipulated that based on assessment, if the valuation agencies appointed by Association of Mutual Funds in India are of the view that the delay in payment of interest/principal or extension of maturity of a security by the issuer has arisen solely due to COVID-19 pandemic lockdown creating temporary operational challenges in servicing debt, then valuation agencies may not consider the same as a default for the purpose of valuation of money market or debt securities held by mutual funds.

Restructuring Process and the Formalities associated thereto:

In the context of COVID, the restructuring of debentures shall mean nothing but deferral of the date of redemption. The terms of the debentures, including the maturity date, etc is specified in the terms of issuance. The terms of issuance also provides how the variation in terms can be effectuated. Therefore, it is pertinent that to make any changes in terms of debentures, the relevant clauses in the issuance terms are considered.

In terms of Reg. 59 (2) of the SEBI LODR Regulations, 2015, any material modification to the structure of debentures in terms of coupon redemption etc. are required to approved by the Board of Directors and the debenture trustee (DT). Further, in terms of Reg. 59(1), prior approval of the stock exchange(s) shall also be required for such material modification which shall be given by the stock exchange(s) only after obtaining the approval of the Board and the DT.

In addition to the approval as aforesaid, in terms of Regulation 15(2)(b) of SEBI DT Regulations, DT is required to call a meeting of the debenture holders on happening of any event which in the opinion of the DT affects the interest of the holders. Similar provision is there in the Companies (Share Capital and Debenture) Rules, 2014 also [sub- rule (4) of Rule 18].

Unlike the requirements of obtaining shareholders’ consent by way of special/ ordinary resolution for various matters including variation of rights thereof, there is no explicit provision for obtaining of a consent of the debenture holders for restructuring of the debentures under the Companies Act, 2013 (‘CA 13’). However, the provisions of SS 2 being, mutatis mutandis, applicable to a meeting of debenture holders also, all the provisions w.r.t convening/ conducting of general meeting such as, sending of notice, explanatory statement etc. as applicable to general meetings shall apply to the meeting of debenture holders.

However, looking at the current crisis situation, where calling of a physical meeting is not possible, and issuers will be required to hold the meeting of the debenture holders, in case consent by e-mail is not possible due to the large number of debenture holders, through video conferencing mode. The modalities for participation (like voting, two-way communication, recording, etc.) and other compliances related of sending of notices etc. may be in the manner clarified by the MCA Circular dated 13.04.2020[13].

In a nutshell, the procedural requirements to be followed for restructuring of debentures shall be as provided hereunder.

| S. No

|

Relevant Provisions |

Actionable/ Compliance |

Remarks |

| 1. |

Regulation 50 (3) of LODR Regulations |

Prior intimation to the stock exchange (SE) for the meeting board of directors, at which the restructuring is proposed to be considered.

|

2 working days in before the board meeting.

(excl. date of intimation and date of meeting) |

| 2. |

Sec. 173 of CA 13 |

BM to be convened by the Company for proposed restructuring including the revised terms subject to approval of the stock exchanges and the debenture holders.

|

Through VC considering the COVID 19 Guidelines issued by the Govt. Our FAQs in this regard may be found at : https://www.google.com/url?q=http://vinodkothari.com/2020/03/board-meetings-during-shutdown/&sa=D&source=hangouts&ust=1587820272757000&usg=AFQjCNEictCwK_-LNnlH7oiB1GMmdRzO6w

|

| 3. |

Regulation 59(2)(a) of LODR Regulations

|

Obtain approval of the DT |

Before applying to SEs. |

| 4. |

Regulation 59 of the Listing Regulations |

Seek prior approval from the stock exchange

|

After taking the consent of the board of directors and DT.

|

| 5. |

Regulation 15(2) of DT Regulations, 1993 |

Separate meeting of debenture holders to be called for deferment in repayment due to liquidity crunch in the hour of crisis.

|

The meeting may be called by the company itself or through the DT.

Since the scope of SS 2 issued by ICSI includes meetings of debenture holders also, the company will have to observe the requirements of SS 2 in convening the meeting of debenture holders. However, considering the current crisis situation, such meeting may be convened through VC facility as clarified by MCA Circular dated 13th April, 2020. Our FAQs in this regard may be found at http://vinodkothari.com/2020/04/general-meetings-by-video-conferencing-recognising-the-inevitable/

|

| 6. |

Regulation 51 (2) of the Listing Regulations |

Intimation to the stock exchanges being an action that shall affect payment of interest or redemption of NCDs

|

ASAP but not later than 24 hours of Board decision. |

Documentation Requirements:

In usual circumstances, if any variation is carried out in the debenture terms, the parties enter into an addendum, amending the clauses contained in the debenture subscription agreement (and also, in the trust deed/ security documents, if required), however, given the current scenario and the lock down, it is not possible for parties to sign and execute the agreements. Since the restructuring already has the approval of the majority debenture holders, it is deemed that the resolution “overrides the terms of issuance”. Thus, in our view, the resolution passed by the debenture holders approving the restructuring should suffice, and modification in the agreements may not be required.

[1] https://www.icra.in/Rationale/ShowRationaleReport/?Id=94320

[2] The rating agency has stated that the list is not a comprehensive one, as information about some rated entities are not readily available as of now, and separate disclosures will be made w.r.t. such entities.

[3]https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-circulars-issued-under-sebi-credit-rating-agencies-regulations-1999-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi-_46449.html

[4] https://www.sec.gov/Archives/edgar/data/1065696/000119312511118050/dex101.html

[5] 2002 (2) BomCR 608, (2002) 2 BOMLR 915, 2003 113 CompCas 466 Bom, 2002 (2) MhLj 322

[6] AIR 2008 Bom 16, (2007) 77 SCL 92 Bom

[7]https://images.assettype.com/barandbench/2020-04/6ec54849-0188-4fe3-a841-88c2861124d5/Indiabulls_vs_SEBI.pdf

[8]https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-circulars-issued-under-sebi-credit-rating-agencies-regulations-1999-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi-_46449.html

[9] https://www.sebi.gov.in/legal/circulars/may-2010/guidelines-for-credit-rating-agencies_1467.html

[10]https://www.sebi.gov.in/legal/circulars/nov-2016/enhanced-standards-for-credit-rating-agencies-cras-_33585.html

[11]https://www.sebi.gov.in/legal/circulars/apr-2020/review-of-provisions-of-the-circular-dated-september-24-2019-issued-under-sebi-mutual-funds-regulations-1996-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi_46549.html

[12] https://www.sebi.gov.in/legal/circulars/sep-2019/valuation-of-money-market-and-debt-securities_44383.html

[13] http://www.mca.gov.in/Ministry/pdf/Circular17_13042020.pdf

Please click below for youtube presentation on the above topic:

Our other content related to COVID-19 disruption may be referred here: http://vinodkothari.com/covid-19-incorporated-responses/

Our other articles relating to restructuring on account of COVID-19 disruption may also be viewed here:

Our presentation can be viewed here – https://vinodkothari.com/2021/09/structuring-of-debt-instruments/