RBI raises red flag on increasing personal loans

Increased risk weights on bank lending to NBFCs, Sectoral exposure limits among protective measures

– Vinod Kothari | vinod@vinodkothari.com

One may call it insecure about unsecured lending; the central bank has taken what in our view is a bold and timely measure, to rein in unsecured lending.

Identifying a notable surge in specific segments of consumer credit, the RBI had recently met senior bankers. The latter had reportedly assured the central bank that things are under control. However, apparently, these assurances have failed to assuage the RBI’s view. Vide its notification dated November 16, 2023, the RBI has taken several mitigating measures.

Much of the growth in assets under management of NBFCs has been due to personal loans, unsecured loans, and consumer credit. NBFCs registered a growth in AUM of about 25% in FY 23, and are expected to grow at about 12-14% in FY24. Of this, the growth in unsecured loans has been the highest – estimated at about 45%. Likewise, banks’ sectoral exposure on personal loans grew 30.4% in September 23 as compared to 19.4% in September 22, and there again, the growth in personal loans has been significant at 30.4% in September 2023 and that highest in March 2023 at 26.4 % [see Table below]

| Particulars | % Increase in the Credit Growth | |

| Sep 22 vs Sep 21 | Sep 23 vs Sep 22 | |

| Personal Loans (Not Consumer Credit) | 19.4 | 30.4 |

| Vehicle Loan | 19.8 | 21.2 |

| Unsecured loan | 25.1 | 25.5 |

| Housing loan (Not Consumer Credit) | 15.9 | 37.3 |

As per the RBI report on Data on sectoral deployment of bank credit for the month of September 2023, credit to services sector grew by 21.3 per cent (y-o-y) in September 2023 from 20.2 per cent a year ago[2]. Further, there has been a growth in terms of the consumer credit originated on Y-o-Y basis as shown in the table below. However, as per the aforementioned RBI report, personal loans growth decelerated to 18.2 per cent (y-o-y) in September 2023 (19.4 per cent a year ago), due to moderation in credit growth to housing.

| YoY Growth in Originations (3M ended June 2023) | ||

| Product | Volume | Value |

| Home Loan | -12% | -6% |

| LAP | 7% | 12% |

| Auto Loan | -3% | 13% |

| Two- wheeler Loan | 5% | 18% |

| Personal Loan | 22% | 12% |

| Credit Card | 1% | |

| Consumer Durable Loan | 13% | 20% |

Increased risk weight in case of Consumer Credit Exposure

Risk weights are assigned based on the perceived riskiness of the different asset classes, including consumer credit. The significance of risk weights in case of consumer credit exposure is that it determines the regulatory capital that banks are required to hold against such exposures. Higher risk exposures are assigned higher weights which means that lenders must allocate more regulatory capital to cover potential losses associated with such exposures. On the other hand, lower risk exposures are assigned lower weights, requiring less capital.

At present, consumer credit attracts a risk weight of 100%. However, the RBI has now increased the risk weights for commercial banks as well as NBFCs by 25 percentage points to 125% in respect of all outstanding and new consumer credit exposure, including personal loans, but excluding housing loans, education loans, vehicle loans and loans secured by gold and gold jewelry.

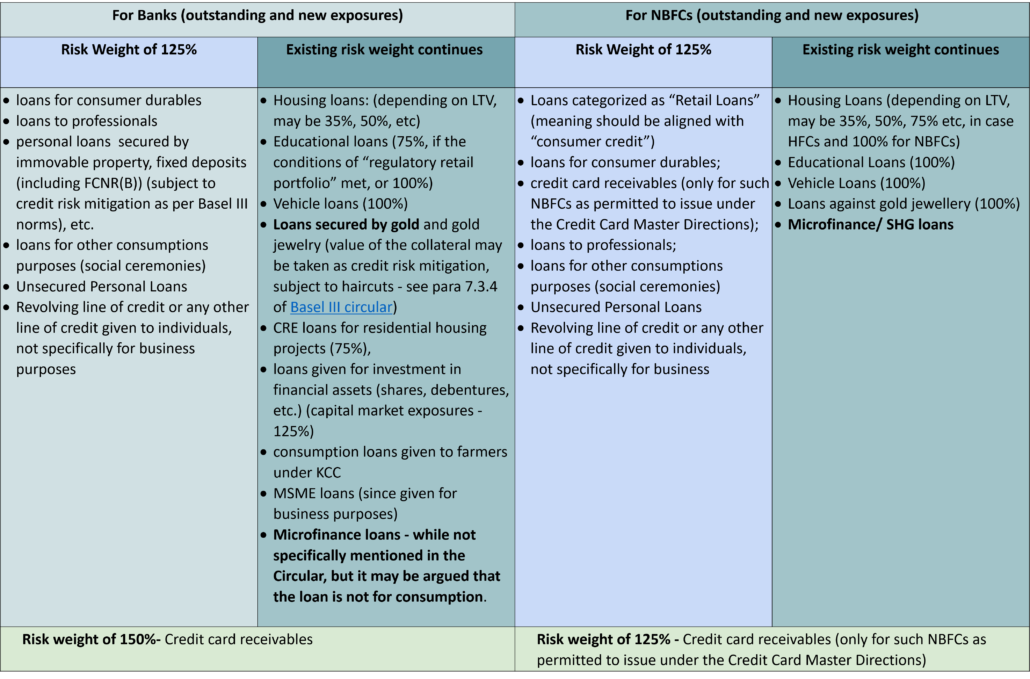

Therefore, the increased risk weight of 125% will apply to:

- All “consumer credit” as per the definition/items given in the table below.

- Unsecured personal loans, loans to individuals for no specific purpose

- Revolving lines of credit or any other line of credit given to individuals, not specifically for business purposes

But will not apply to

- Housing loans

- Educational loans

- Vehicle loans

- Loans secured by gold and gold jewelry (in case of NBFCs, it will only be loan against gold jewelry)

In our view, the increased risk weight will also not apply to:

- Business loans

- MFI loans, as the same may be contended to not be for personal consumption (in case of NBFCs MFI loans have been specifically exempted, however, the exemption has not been provided in case of banks)

Housing loans, it may be noted, are considered quite safe, and depending on the LTV ratios, the risk weight for home loans under Basel norms is as low as 35%. Further, housing loans and educational loans are excluded from the definition of Consumer Credit[4]

Though vehicle loans and gold loans are included under the definition of consumer credit, they would continue to attract a risk weight of 100%.

Also, though credit card receivables are included in the definition of consumer credit, however, the risk weight is specifically provided for. As proposed, the risk weights in case of credit card receivables shall be increased by 25% bringing it to 150% for banks and 125% for NBFCs.

The following table summarises the risk weights to different categories of retail lending:

Increased risk weight on bank lending to NBFCs

Loans given by banks to NBFCs are risk-weighted based on the rating assigned to the borrower NBFC. The ratings may be either external ratings, or internal ratings if the IRB-risk weighting has been applied to the bank. In the case of a AAA NBFC, for example, the risk weight may be as low as 20%.

The risk weights for NBFC borrowers will now be revised up by 25%. Therefore, an AAA NBFC will now attract a risk weight of 45%. The 25% increase in risk weight will be applicable to all NBFCs (other than Core Investment Companies) except those where the risk weight already is 100%.

Notably, loans to HFCs will be spared the increased risk weight – that is, the risk weight for lending to HFCs will continue to be 100%.

Further, the risk weight for lending to NBFCs which is eligible for classification as priority sector lending will continue to attract risk weight of 100%. The lending which so qualifies is lending specifically for on-lending to agriculture (Rs.10 lakhs per borrower) and micro and small businesses (Rs.20 lakhs per borrower). In essence, the lower risk weight of 100% is not applicable for general lines of credit granted to NBFCs, irrespective of the asset focus of the borrower NBFC. The lower risk weight will apply only where the lending qualifies as PSL in the hands of the bank.

The aforesaid changes w.r.t increased risk weights are applicable immediately and hence, necessary steps must be taken to implement the same. Since the risk weights are assigned at the time of preparation of monthly or quarterly returns/financials, the banks and NBFCs may have to ensure considering the revised risk weights for the month of November 2023 onwards.

Sectoral limits on unsecured credits

This part is important and is applicable to all banks and NBFCs. As a measure of strengthening internal strengthening of credit standard, the RBI requires all regulated entities to put in place internal sectoral exposure limits on various segments of consumer credit. In particular, there will be an exposure limit on unsecured consumer credit exposure.

It is important to understand a few terms here.

- First, what is consumer credit? The term is defined in theRBI XBRL Returns – Harmonization of Banking Statistics, as the loans given to individuals, which consist of

(a) loans for consumer durables,

(b) credit card receivables,

(c) auto loans (other than loans for commercial use),

(d) Secured personal loans secured by gold, gold jewelry, immovable property, fixed deposits (including FCNR(B), shares and bonds, etc.,(other than for business / commercial purposes),

(e) personal loans to professionals (excluding loans for business purposes), and

(f) loans given for other consumption purposes (e.g., social ceremonies, etc.).

However, it excludes (a) education loans, (b) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), (c) loans given for investment in financial assets (shares, debentures, etc.), and (d) consumption loans given to farmers under KCC. For risk weighting purposes under the Capital Adequacy Framework, the extant regulatory guidelines will be applicable. Therefore the reference to “segments of consumer credit” may include broadly defined categories of personal loans such as Vehicle Loans, Gold Loans, Consumer Durables Loans and Consumption Loans.

- If a company is, say, in the business of housing finance, that is its core business. Will it be okay for such a company for put a sectoral exposure limit on housing finance? The answer will, arguably, be negative. However, such a company may try to put limits on, say, refinancing of existing properties (where, evidently, the application of the funds is not for acquisition or construction of a house).

- Are the exposure limits absolute, or are they a percentage of the AUM? In our view, it is appropriate to define the exposure limits as a percentage of the AUM.

- Within the overall exposure limit of consumer credit, the regulator has explicitly required a sub-limit for unsecured consumer credit. In fact, that is where the immediate focus of the regulator is.

- Once again, if a company is in the core business of, say, unsecured SME loans, or unsecured personal loans, will it be intuitive for the company to put a limit on what its very business is? Once again, no. But realising the fact that unsecured consumer credit has its own risk, the company may consider the part which is riskier than the usual loan book – say loans to consumers with a bureau score of less than a level, and limit that.

- Notably, the exposure limits are self-regulatory in nature, and are intended to lead to better risk management.

- For the purpose of computing the sub limit on unsecured consumer credit, top up loans against movable property will be regarded as unsecured loans.

- This is a very important prescription and needs to be analysed and understood properly. Take, for instance, a loan given against a vehicle where the value of the vehicle originally was Rs 10 lacs, and the loan was Rs 8 lacs (LTV = 80%). After 2 years of performance, the POS is now Rs 3 lacs, and the vehicle is assessed to have a value of Rs 6 lacs (LTV = 50%). Is it good business for the company to extend a top up loan of, say, Rs 1.80 lacs? As a business proposition, it is absolutely okay to give the top up loan, as the idea is to retain existing customers, and to stop them for running to a competing lender who will be prepared to refinance the loan with a higher amount.

- Is this top-up loan actually secured or unsecured? There is a security interest in the original loan. On the question of whether the top up loan is secured or unsecured, the answer depends on the language of the top up loan agreement. If the said agreement provides that the hypothecation of the vehicle under the original agreement will enure to secure the top up loan, and that the same will not be released until the top up loan has been repaid, the top up loan may be taken as secured.

- However, the regulator now provides that the top up loan shall be regarded as unsecured, as it is against (a) movable property; (b) which is depreciating in nature.

- Note that this regulatory prescription is only for the purpose of monitoring of the exposure limit on unsecured consumer credit. As to whether the top up loan is regarded and reported, say for charge creation or balance sheet purposes, as secured or unsecured will depend on the terms of the top up loan.

- The exposure limits will be monitored by the Risk Management Committee. Note that several REs may not be required to have a risk management committee. In that case, it will be intuitive to say that the limits will be monitored by the board of directors.

- By when do these limits have to be set, and monitored? While the regulator says that the circular is immediately applicable, it provides an implementation timeline of February 29, 2024.

Implications of the Circular

- Though credit spreads charged by a bank are not directly linked with capital requirements, regulatory capital is an important factor in pricing of credit. NBFC borrowers will now attract substantially higher risk weight than similarly-rated non-financial entities. For example, for AAA NBFC, the risk weight is more than almost double the risk weight of a AAA corporate. This will induce banks to increase the cost of lending to NBFCs.

- The increased cost of lending from banks to NBFCs may not only be applicable to new or incremental facilities, but to existing facilities as well.

- Likewise, direct assignment and co-lending transactions where banks partake into portfolios of personal loans originated by NBFCs will also attract higher capital charge, resulting in higher yield expectations.

- If and to the extent the cost of borrowings for NBFCs increases, the same will be passed on to the borrowers.

- The internal risk exposure limits will heighten concerns at board level – there will sharper questions at board level on banks partnering with NBFCs.

- Overall, the party-party syndrome between banks and NBFCs will possibly look less sporty now.

[1]https://www.careratings.com/uploads/newsfiles/1699442655_Personal%20Loans%20and%20NBFCs%20Continue%20to%20Support%20Bank%20Credit%20Offtake.pdf

[2] Sectoral Deployment of Bank Credit – September 2023 (RBI)

[3]https://www.transunioncibil.com/content/dam/transunion-cibil/documents/cmi-report-2023/credit-market-indicator-oct-2023.pdf

[4] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=11199&Mode=0

Leave a Reply

Want to join the discussion?Feel free to contribute!