Silence no more golden: New regulatory regime forces top listed companies to respond to rumours

Vinod Kothari and Nitu Poddar (corplaw@vinodkothari.com)

– Updated February 02, 2024

Come June 1, 2024, top 100 listed companies, and thereafter, effective from December 1, 2024 top 250 listed companies, will have to mandatorily respond to market rumours, and cannot keep a policy of maintaining their own silence. What is the intent and scope of this requirement? Does this requirement expect companies to scan through more than 100000 mainstream media publications, and news channels and innumerable investor influencers, keep searching for the written or spoken word about the company, and then keep responding to all the din about the company? Or, the intent is just to ensure that a false market in the company’s securities is not being created or propped up by the company’s silence? And if the company is to respond to rumours, how and where does it respond?

These are some very pertinent questions bothering the larger of the listed entities. We are trying to address some of these questions below.

Law in other jurisdictions:

Jurisprudence in securities litigation has generally been in favour of companies choosing to remain silent in the face of rumours. An old ruling of the US Second Circuit court in SEC v. Texas Gulf Sulphur Co., 401 F.2d 833, 864 (2d Cir. 1968) puts the argument as follows: “If the only choices open to a corporation are either to remain silent and let false rumors do their work, or to make a communication, not legally required, at the risk that a slip of the pen or failure properly to amass or weigh the facts—all judged in the bright gleam of hindsight—will lead to large judgments, payable in the last analysis by innocent investors, for the benefit of speculators and their lawyers, most corporations would opt for the former.”

The jurisprudence has, since, dwelt on a duty of disclosure based on attribution of the rumour to the company. A commentator’s article states: “Having discussed the situations in which the issuer is the source of the information or the source is unknown, the next step in the continuum is where the issuer is demonstrably not the source of the rumor or publicity. The fault analysis proposed in this article suggests that rumors or publicity generated by others need not be corrected by the issuer because the issuer bore no responsibility for dissemination and, thus, the rumors or publicity are not “attributable” to the issuer. While that is the correct conclusion, its generality may be deceiving. The issuer may share responsibility for the dissemination of inaccuracies, and thereby have a duty to speak, even though it was not the initial source.”[1]

On the contrary, stock exchanges have always maintained that companies have a duty to promptly notify the investing public of material news and developments. The essential principle was incorporated decades ago in a 1981 version of the NYSE Manual. It was built on the following premise: at times, public release of material information may be premature or that the issuer may have legitimate business reasons for temporarily withholding material information from the public. In such event, the rules will permit secreting the information only so long as it truly remains confidential. As soon as the information is disclosed to other than senior management, or if there is any indication that the information has leaked, the rules mandate immediate public release. Consistent with this requirement, the rules specifically require a prompt “frank and explicit” response to rumors.

The requirement of the so-called “frank and explicit” response has remained in the NYSE rulebook ever since. Para 202.03 of NYSE Manual[2] states:

“The market activity of a company’s securities should be closely watched at a time when consideration is being given to significant corporate matters. If rumors or unusual market activity indicate that information on impending developments has leaked out, a frank and explicit announcement is clearly required. If rumors are in fact false or inaccurate, they should be promptly denied or clarified. A statement to the effect that the company knows of no corporate developments to account for the unusual market activity can have a salutary effect. It is obvious that if such a public statement is contemplated, management should be checked prior to any public comment so as to avoid any embarrassment or potential criticism. If rumors are correct or there are developments, an immediate candid statement to the public as to the state of negotiations or of development of corporate plans in the rumored area must be made directly and openly. Such statements are essential despite the business inconvenience which may be caused and even though the matter may not as yet have been presented to the company’s Board of Directors for consideration.

It is very important to understand the context of the company’s expected response to rumours. It is notable that the NYSE Manual is talking about situations where there is a potential leakage of price sensitive information. It also goes to say that even if the appropriate stage of disclosure, based on the maturity level of the information or development may not have been reached, yet disclosure becomes imminent. Considerations such as non-disclosure agreement with a counterparty, or the board of the listed entity not having approved the matter, become irrelevant here. Note that it is referring to an “immediate candid” statement. The fact that the company chooses to make this candid statement does not mean there was a failure on the part of the company to disclose what was disclosable. In fact, the rumour has only preponed the stage of the disclosure.

Similar rules have been a part of NASDAQ rulebook[3]. Disclosure of Material Information Rule 5250(b)(1) of NASDAQ states: “Whenever unusual market activity takes place in a Nasdaq Company’s securities, the Company normally should determine whether there is material information or news which should be disclosed. If rumors or unusual market activity indicate that information on impending developments has become known to the investing public, or if information from a source other than the Company becomes known to the investing public, a clear public announcement may be required as to the state of negotiations or development of Company plans. Such an announcement may be required, even though the Company may not have previously been advised of such information or the matter has not yet been presented to the Company’s Board of Directors for consideration. In certain circumstances, it may also be appropriate to publicly deny false or inaccurate rumors, which are likely to have, or have had, an effect on the trading in its securities or would likely have an influence on investment decisions.”

This also clearly refers to information about impending developments having already become public.

In European Union, the Market Abuse Regulation, para 17.7 states: “Where disclosure of inside information has been delayed in accordance with paragraph 4 or 5 and the confidentiality of that inside information is no longer ensured, the issuer or the emission allowance market participant shall disclose that inside information to the public as soon as possible. This paragraph includes situations where a rumour explicitly relates to inside information the disclosure of which has been delayed in accordance with paragraph 4 or 5, where that rumour is sufficiently accurate to indicate that the confidentiality of that information is no longer ensured.”

Here also, the requirement of responding to rumours comes when the disclosure of some inside information has been delayed in pursuance of para 17.4 (disclosure is likely to prejudice the legitimate business interests of the listed entity, and non-disclosure does not prejudice investors) or 17.5 (a bank/financial institution refrains from disclosing a liquidity strain which is temporary.

Discussions in the Consultation Paper and SEBI Board notes

Para 8.1.2 of the SEBI Board note[4] states: “In recent years, a growing influence on market sentiments is being noticed of not just print media, but also television and digital media which sometimes contribute to sudden price movements of specific scrips based on unverified information about the listed entity. In order to stay contemporary, companies need to keep pace with all forms of media, both print and electronic / digital and ensure prompt verification of such rumours, so that they can respond to such rumors quickly before the market price their scrips get impacted by such rumors, one way or another.”

On the face of it, this seems to be casting the requirement of rumour-responding very wide, and particularly, the reference to “companies keeping pace with all forms of media” seems quite optimistic. It may, contrary to the intent and the global clarity on the issue, seems to suggest that the requirement of rumour responding is as wide as tracking all that is being written about the company and respond to the same, if there is a false market being created.

Similar language is seen in para 3.4.2 of the Consultation Paper[5].

However, it is notable that the requirement has been inserted as a proviso to reg 30 (11). Reg 30 itself is about disclosure of material events or information. The first proviso itself talks about “impending specific material event or information in terms of the provisions of this regulation”. If there is no specific material event or information, there is nothing that the company has to disclose. Therefore, the rumour has to relate to some reportable event or development, which, if true or mature, would have caused a disclosure, or eventual disclosure to the exchanges.

So, what exactly is a rumour?

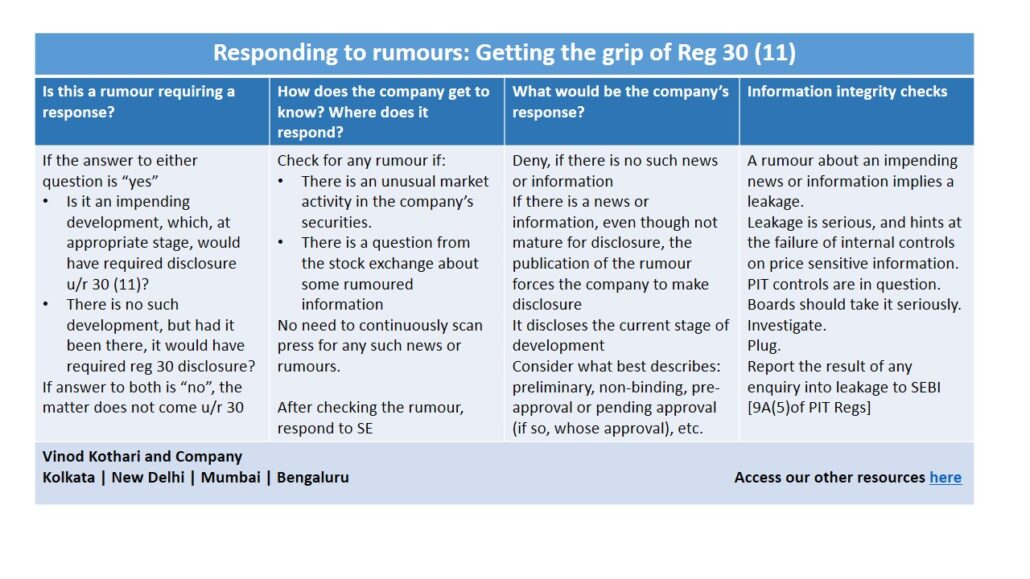

In light of this, a rumour, in order to attract proviso to reg. 30 (11) must satisfy each of the following features:

- There is either (a) some material event or development, which, at a certain stage, would have required disclosure, but the company has currently not disclosed it, or, (b) the rumours have talked about some such material event or development, which does not exist. In either case, the rumour related to some specific information or event which would have required disclosure in terms of reg 30.

- Therefore, analysis, comments, positive or negative sentiments, any comparison of the company’s performance either with its own or that of its peers, etc. do not pertain to a Reg 30 event. To take further examples:

- Press says there is a rift between the company’s promoter family. Mere existence of any rift, even if the press news was correct, would not have been a reportable item. Hence, this is not a rumour within the meaning of reg 30 (11).

- Press says the auditors of the company are considering resigning. Once again, anyone considering a resignation is not a reportable event or information. If the press was to say, the auditors have tendered resignation, that is a different matter.

- Press says the imposition of an anti-dumping duty by the government on a certain material might bring benefit to the company. Once again, this is not something which would have required reporting.

- The rumour is cast in a form and with such details that an uninformed reader is likely to have believed it.

- Hence, a false market is being created by the rumour, as evident from an unusual market activity or market reaction, which, in absence of such rumour, would not have existed.

- Therefore, before considering any response in terms of reg 30 (11), the key question to ask is – would it have been an event or information under reg 30? If not, reg 30 (11) is not an independent disclosure or response requirement. It is merely to strengthen the flow of information under reg 30.

When does the company respond?

Upon determination that the information circulating in the mainstream media is a rumour, as per proviso to reg 30, the same needs to be promptly responded which in any case cannot be later than 24 hours from the reporting of such information.

Considering that the company might detect presence of a rumour through distinctively significant market reaction or market activity, practically the 24 hours timeline should start ticking from the hour the company identified presence of a rumour.

Where the presence of rumour is informed to the company by stock exchange or any other stakeholder by way of a query, the timeline should kick in from the time the company receives such query.

The starting point of a reg 30 (11) response is either a detection by the company of an unusual trading pattern, be it by way of volumes or prices, or a query by a regulatory body. There is absolutely no need for a company to track the myriad articles, whether in mainstream media or elsewhere, for finding what is being written about or against the company. Of course, most companies track their market activity, and it will be useful for the company to have a tool at work which identifies and flags unusual market activity.

What could be the company’s response?

The company is required to confirm, deny or clarify the rumour. Needless to say, if the rumour is false or baseless, the company needs to deny it. This is easy; however, normally this is not the case.

The other possibility is that the press talks about some event or information, which may be emanating from outside the company, but the company is not presently aware. In that also, the company states that it has no knowledge of the event or information.

However, the tricky part is where there is an event or information, but the company has not still disclosed it as the event or information has not reached the stage where it was intended to be disclosed, in terms of SEBI circular no. CIR/CFD/CMD/4/2015 dated September 09, 2015[6]. The company has not disclosed, but the media has. Here, there is a predicament. NYSE, NASDAQ as well as EU regulators require that once the press has put precise details, indicating a leak of information, and the company maintains silence, there may be creation of a false market. This is where, as per global regulations, there is a need to disclose “the current stage of development in the rumoured area” [Para 8.4.5 of SEBI Board note].

While the regulatory requirement may be clear, disclosure of fledgling, developing news, requires the company to keep a delicate balance between disclosing what is still not real, giving false hopes or false pessimism. Therefore, the discussions have invariably talked about the stage where the development presently is. Global regulations say that this disclosure is warranted even if there are non-disclosure agreements to the contrary. The fact that a regulatory requirement overrides a non-disclosure agreement has also been clearly mentioned in SEBI Board notes.

Will it be open for a company to make a vague statement? For example, if the press has rumoured about a potential demerger of a particular unit from the company, can the company make this disclosure:

“The company’s board of directors and senior management are always sensitive to the ways and means to strategically realign the operations of the company. The company wishes to state that the company shall make appropriate disclosures wherever any tangible development of precise nature takes place, requiring the company to make disclosure”.

In our view, this was possible prior to the amendment of reg. 30 (11), but no more possible now. Second proviso to reg. 30 (11) requires the company to disclose the current state of the development. If there is some element of truth about the rumoured event, the company cannot deny it completely. If the company cannot deny, then it cannot stay vague about the event or information.

Also, pursuant to reg 4(1)(e) of the Listing Regulations, the listed entities are bound to ensure that all disseminations made under the Regulations and circulars made thereunder, are adequate, accurate, explicit, timely and presented in a simple language. Notably, SEBI has been issuing show cause for deviation from the same.

How precise will the disclosure about the stage of development be? First of all, the whole purpose of the second proviso to reg. 30 (11) will be lost if it were open for the company to simply say: the development has not reached a stage where it requires disclosure. That would actually be the requirement of reg. 30 (2) and (3) and not reg 30 (11). We need to reiterate that the leakage of information about an impending news or information prepones the stage of disclosure, so as to require the company to break silence upon the rumours having appeared. Thus, the company has to talk about the present stage of development. However, we once again need to note that there is no precise way to mention a stage of development. Therefore, one has to choose what best explains the present stage:

(a) Exploratory stage: Given the fact that all agile companies are always exploring options and possibilities, if the stage is purely exploratory, the company may actually deny the existence of any news or information. The news in question has not even been born.

(b) Preliminary: Discussions are on. Parties have been identified. Parties have begun their due diligence. However, neither party has made any offer yet.

(c) Non-binding: Either party has made a non-binding offer.

(d) Pre-approval stage: The matter is awaiting an approval from one or both the parties at their ultimate approving authority.

(e) Pending approval: The matter is awaiting approval / sanction from one or more authorities. This approval is a prerequisite to proceed with the transaction.

It is also notable that once disclosure, demanded by reg 30 (11) has been made, material developments in the staging will also have to be disclosed – reg 30 (7).

To whom does the company respond?

The response to rumour is required to be made to the exchange. The whole issue with a rumour is that it is an information which is selectively available, and therefore it needs to be made generally available to the investors by verifying the same and sending response thereto to the stock exchange.

If the response to the rumour is done to the one (news reporters, analysts, researchers etc.) putting a query to the company and asking for verification, the rumour will continue to be a rumour and selectively available.

Avoiding rumour

Para 8.4.1(iv) of the SEBI Board note states “The listed entity should take effective measures to ensure that the details of the negotiations / discussions are kept confidential and enveloped until made public to avoid rumours in the market.”

Further para 6.1.2 states: “However, assessment of materiality of an event or information may take time, for example, in case of fire damage. In such scenarios, as a way of caution, companies should disclose the event or information with the best estimate at hand rather than allowing rumours / speculation.”

Largely speaking, symmetry in the disclosure of information will avoid presence / occurrence of rumour in the market. Appropriate sensitisation regarding requirement and intent of law and assisting the employees with suitable guidance / process notes / SOPs should decrease the instance of leakage of UPSI.

Integrity checks

Confirmation of a rumour by the company indicates latches in the internal controls with respect to safeguarding of UPSI in the company. The company is required to detect the reason and / or the person behind the leakage of UPSI and take such curative and deterrent steps as may be required.

Concluding Remarks

The amendments in Reg 30 (11) are in line with global regulations in this regard; the latter are several decades old already. The introduction of the requirement for top listed companies as of now is only a precursor to widening the applicability in course of time.

[1] John M Sheffey: Securities Law Responsibilities of Issuers to Respond to Rumors and Other Publicity: Reexamination of a Continuing Problem, https://scholarship.law.nd.edu/cgi/viewcontent.cgi?article=2477&context=ndlr

[2] https://nyseguide.srorules.com/listed-company-manual/09013e2c8503fca3

[3] https://listingcenter.nasdaq.com/assets/rulebook/nasdaq/rules/marketplace_rules_table.pdf

[4] https://www.sebi.gov.in/sebi_data/meetingfiles/apr-2023/1681703089597_1.pdf

[5] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/nov-2022/1668240795810.pdf#page=1&zoom=page-width,-10,749

[6] https://www.sebi.gov.in/legal/circulars/sep-2015/continuous-disclosure-requirements-for-listed-entities-regulation-30-of-securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-regulations-2015_30634.html

Read our other resources on LODR Second Amendment Regulations, 2023

- SEBI prescribes thresholds for determining material events, stringent approval for sale of undertaking and more

- Stricter framework for sale, lease or disposal of undertaking by a listed entity

- Getting material on “material” events and information

- Powerpoint presentation on SEBI LODR (Second Amendment) Regulations, 2023

- Outline for SOP in the context of Regulation 30 of the Listing Regulations

Leave a Reply

Want to join the discussion?Feel free to contribute!