The future of Loan-loaded Prepaid Payment Instruments

Financial Services Division | finserv@vinodkothari.com

The latest communication from the Reserve Bank of India (‘RBI’), barring issuers of prepaid payment instruments (PPIs) from having the same loaded by credit lines, has created a substantial flutter in the financial sector, particularly among the Fintech lenders. Based on the feedback received from market participants it seems that the RBI has been trying to remove any regulatory arbitrage that a non-bank PPI issuer may have as compared to a bank. Considering the gravity of the matter even the Payment Council of India has approached the Government of India to intervene in this matter[1]. There are reports[2] that many of the issuers of PPIs have reportedly stopped issuing PPIs post receiving the RBI circular.

The trigger for all this is a June 20, 2022 communication from the RBI, addressed to certain NBFCs and Fintech lenders, who have been extending credit facilities for loading prepaid cards, stating that prepaid payment instruments (PPIs) must not be loaded through credit lines. The aforesaid communication has raised questions on the existing business model of several fintech entities and threatens their existence. The relevant extract of the said communication states that:

“A reference is invited to the provisions contained in the paragraph 7.5 of the Master Direction on PPI (PPI-MD) dated August 27, 2021 (updated as on November 12, 2021) – “PPIs shall be permitted to be loaded /reloaded by cash debit to a bank account, credit and debit cards, PPIs (as permitted from time to time) and other payment instruments issued by regulated entities in India and shall be in INR only”

The PPI-MD does not permit loading of PPIs from credit lines. Such practices, if followed, should be stopped immediately. Any non-compliance in this regard may attract penal action under provisions contained in the Payment and Settlement Systems Act, 2007”

In the last few years, several loan-fintech or Lendtech entities have been tying up with banks and NBFCs to issue prepaid cards. Under the tie-up structure, the NBFC would provide a credit line to the customer which was used to load the PPI. Thus, a holder of a PPI with zero or near-zero balance will be able to press a few keys on his device, get an immediate disbursement from a line sanctioned by a lender, which is routed by the lender to the issuer of the PPI by way of reloading of the PPI, and from there the money goes to the merchant or place where the PPI has been used (including, as we get to learn, for drawing cash). All this happens on real time basis in a matter of seconds, such that for the user, the PPI serves as a proxy for a credit card. Of course, no credit history is built by use of PPIs, however, a credit history is built for the utilisation of the credit line backing the PPI.

The RBI’s communication, however, implied that a PPI cannot be used as an alternative for a credit card, since the RBI states that a PPI cannot be loaded by using credit lines.

In this article, we intend to discuss the prevalent structures in the industry, the relevant regulatory guidelines around the same, the concerns of RBI towards such structures and the impact of the aforesaid communication from RBI.

Current Market Scenario

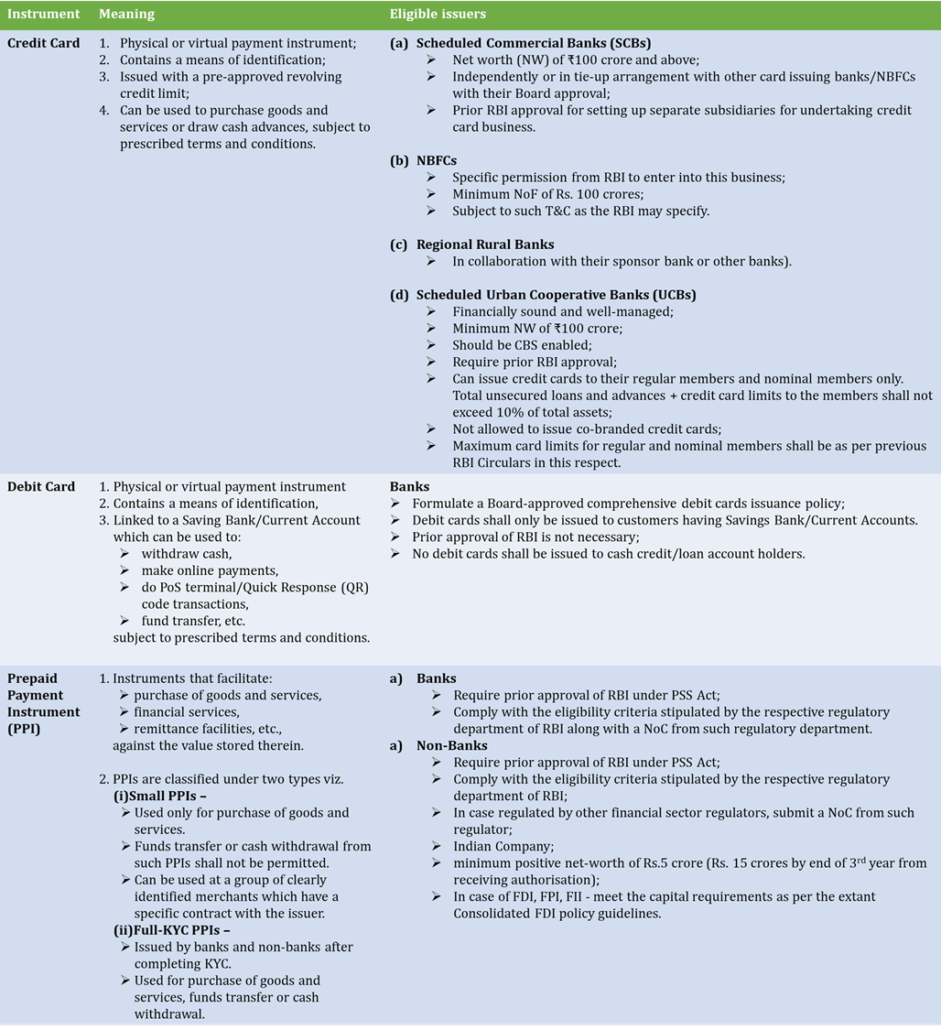

There are three types of instruments which are used to settle payments – credit cards, debit cards and PPIs.

Banks are permitted to issue credit cards. In case of NBFCs, there is a minimum net owned fund condition [Rs 100 crores], and additionally, the NBFCs need to be specifically authorised by the RBI to issue credit card. Para 4(d) of Credit Card and Debit Card – Issuance and Conduct Directions, 2022[3] (Credit Card Directions) provides:

(d) Non-Banking Financial Companies registered with the Reserve Bank shall not undertake credit card business without prior approval of the Reserve Bank. Any company including a non-deposit taking company intending to engage in this activity shall require a Certificate of Registration, apart from specific permission to enter into this business, the pre-requisite for which is a minimum net owned fund of ₹100 crore and subject to such terms and conditions as the Reserve Bank may specify in this regard from time to time. Without obtaining prior approval from the Reserve Bank, NBFCs shall not issue debit cards, credit cards, charge cards, or similar products virtually or physically.”

In essence, for NBFCs, the only way to issue credit cards is to use the approval route. Alternatively, non-banks can also act as a co-branding partner for credit cards, however, even for such, specific approval of RBI will be required (para 19 of the Credit Card Direction). Approval, understandably, is not merely a cakewalk, as the RBI at the time of granting approval is likely to do a complete scan of the activities of the NBFC, any regulatory observations about the NBFC, etc. Further, the role of non-banks in case of co-branding will be limited as provided under para 21 of Credit Card Directions.

As for PPIs, the same may be issued by banks, as well as non-banks, however, based on prior authorisation of the RBI.

Debit cards can only be issued by banks only, and that too, only for customers having Savings Bank/Current Accounts with the relevant bank. NBFCs are not permitted to issue debit cards, as the same would have amounted to acceptance of deposits.

The illustration below summarises the meaning and scope of the payment mechanisms discussed so far, along with the list of eligible issuers for each of them.

| Sr.no. | Type of instrument | Cards issued till May 2022 (Nos. in crores) | Usage Amount (Rs. In crores) |

|---|---|---|---|

| 1 | Credit Card | 7.69 | 1,14,024.09 |

| 2 | Debit Cards | 92.33 | 3,44,243.14 |

| 3 | PPIs through credit line | 1.00 | 3,500.00 |

1. RBI Bankwise Card Statistics for May 2022

2. Economic Times Report dated June 27, 2022: Payments Council seeks government help post RBI’s fintech order

Access to credit cards is understandably limited and PPIs have gained a lot of momentum in recent times. Table above shows the usage for debit cards, credit cards and PPI cards. First of all, credit cards are allowed to customers with full-KYC since the card issuers are required to comply with Know Your Customer (KYC) Norms/Anti-Money Laundering (AML) Standards/Combating of Financing of Terrorism (CFT)/Obligation under the PMLA, 2002[4]. In addition, for a young person, with no credit history, income or financial strength, it will be tough to qualify for a credit card. On the other hand, the Fintech entities are catering to the financial needs, mainly, of the younger generation. Thus, there are swathes of customers who are eligible for loans by Fintech lenders, but have not been eligible for credit cards. Here comes the interesting innovation of a PPI, which embeds the convenience of a credit card on what is effectively a line of credit by a Fintech lender. Disbursing the loan through the PPI also enables the lenders to monitor the end use of such loan proceeds in comparison to an unsecured personal loan where they run the risk of misuse.

Prevalent Structures

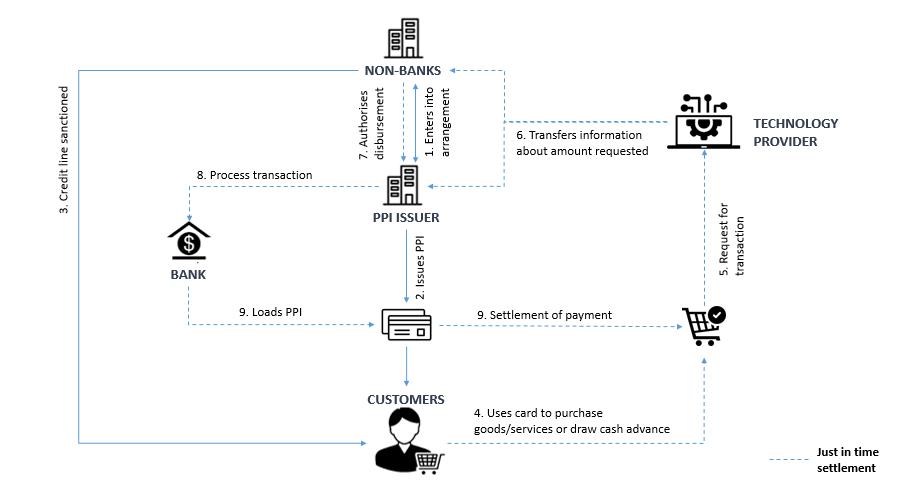

Various alternative structures are prevalent in the Indian market, these structures are intended to mimic or functionally equate with a credit card issued by banks. Under these structures non-banks entities obtain approval of RBI to issue PPI and then enter into tie-ups with other banks or NBFCs to offer customers prepaid instruments backed by the simple credit line or pre-approved revolving credit line.

Commonly these structures work in the following manner:

- The non-banks tie up with the PPI issuer to offer customers the PPIs backed by simple or revolving credit lines. These credit lines are provided by lenders such as banks or NBFCs;

- Customers are allowed to use the said PPI to either make payments and/or withdraw cash depending on the product offered;

- The PPI would initially not carry any balance, that is to say, though a utilisation limit is provided, the card itself does not have any pre-loaded cash rather the card is backed by a credit limit;

- Upon the utilisation by way of swiping the card or otherwise/withdrawal request being made, the credit line would be utilised to load the prepaid card on just in time basis and then the payment would be effectuated;

- The said instrument has similar experience for the customer as that of credit card though at the back end the translation flow is very different;

- The entities contend that though the instrument worked in a manner similar to credit card – in essence there are two different arrangements co-functioning or co-existing- that is issuance of PPI and extending of a credit line;

- These credit lines are either structured as simple term loan or as revolving line of credit, which means the limit of credit gets restored on repayment being made by the customers.

- Repayment structure:

- In case the card is backed by a single credit line- Upon disbursement, the amount is converted into EMIs to be repaid within a specified tenure. There is no reset of limits or balance in the PPI, that is to say customers would not be eligible to take further disbursement to the extent of repayment made by them.

- In case the card is backed by a revolving credit line- Customers would have an option to repay the entire or partial amount, utilised or withdrawn. Such repayment would reset the limit available for disbursement to the extent of repayment made.

One of the most common structures has been depicted through below flowchart:

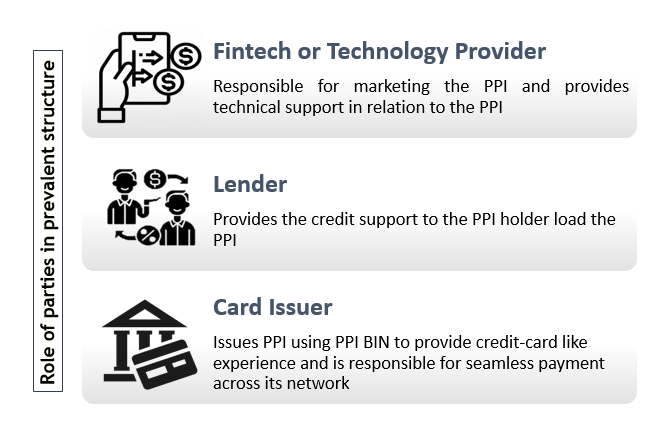

Therefore, there are basically three parties in the prevalent structure who are involved in the issuance of cards which are not categorised as debit/credit cards but are usually prepaid cards. The role of the said three parties are highlighted herein below:

Is PPI loaded with a loan considered a credit card?

In response to the rapid growth and momentum being demonstrated by these prevalent structures in the Indian Fintech space, there were reports that RBI has raised concerns over the same. Following such reports, RBI notified Credit Card Directions which provides the definition of ‘credit card’ [Clause 3 (a) (xii)] as follows-

“a physical or virtual payment instrument containing a means of identification, issued with a pre-approved revolving credit limit, that can be used to purchase goods and services or draw cash advances, subject to prescribed terms and conditions.”

Hence, an instrument shall be treated as a credit card if:

- There is a payment instrument, either physical or virtual, and

- Such payment instrument is issued along with pre-approved revolving line of credit[5] and

- Instrument can be used to purchase goods and services or draw cash advances

The common structures in the market at present necessarily entails 1st and 3rd features, however, there are structures which are not backed by revolving line of credit, but by mere term loans and hence would technically not fall within the ambit of credit card definition though functioning in a similar manner[6].

As already discussed, NBFCs cannot issue credit cards, either physically or virtually, without the prior approval of RBI (Refer para 4 (d) of Credit Card Directions).

Further the definition of PPIs under the PPI-MD is as follows:

“Instruments that facilitate purchase of goods and services, financial services, remittance facilities, etc., against the value stored therein. PPIs that require RBI approval / authorisation prior to issuance are classified under two types viz. (i) Small PPIs, and (ii) Full-KYC PPIs.”

This seems to be a major concern of the RBI, that entities not permitted to issue credit cards are providing these PPIs that resemble the features of a credit card but do not comply with the Credit Card Directions. RBI’s concern is that the main purpose of a PPI license is to act as a payment instrument and not as a credit instrument, however, fintechs have been using this as a channel to load credit. The concern seems to be more directed towards non-bank issuers taking risk in the PPIs. Though non-banks are permitted to co-brand PPIs as well as credit cards, their role under the regulations is limited to marketing and distribution. Such entities are not permitted to take any risk under the instrument[7].

However, the prevalent structures seem to be a way of bypassing the regulatory prescription, hence the RBI communication seeks to address practices that in essence violate the applicable guidelines.

The contention of the regulator seems to be that PPI backed by a revolving line of credit is a de facto credit card, as it would fall within the definition cited above. To allow PPIs to function as credit cards will be to allow room for regulatory arbitrage, which is not good for a sensitive sector such as payment systems.

The RBI has now restricted PPIs backed by credit lines, the steps seems to solidify the fact that RBI considers such instruments akin to credit card and hence only entities permitted[8] to issue credit cards shall be allowed to do the same. Another reason for the RBI to issue such a restriction could be that the KYC guidelines for issuing PPI or wallet are less strict as compared to that of a credit card.

RBI has further mentioned in the notification that if an entity is issuing a card in the name of a prepaid instrument then the same can be loaded only through cash, debit to a bank account, credit and debit cards, PPIs (as permitted from time to time) and other payment instruments issued by regulated entities in India. The reference is given to para 7.5 of MD-PPIs and has been clarified that the direction does not provide loading of PPI through the credit line.

However, the critical issue is – can a PPI be loaded with third party money? A holder of PPI may have the PPI reloaded with money from his own bank account, or from a third-party bank account. The MD-PPI also permits the loading/ reloading of PPI by debit to a bank account. The relevant extract is-

“7.5 PPIs shall be permitted to be loaded / reloaded by cash, debit to a bank account, credit and debit cards, PPIs (as permitted from time to time) and other payment instruments issued by regulated entities in India and shall be in INR only.”

The aforesaid regulation refers to a bank account and not PPI holder’s bank account. As long as the money is coming from a bank account, the concerns as to KYC and money-laundering get addressed. For example, there will be nothing wrong in a father loading his son’s prepaid account from the father’s bank account. In the same vein, there cannot be any regulatory objection if a third party, say, the lender, loads the PPI. The money is moving from the bank account of the lender. Notably, global practices of prepaid cards clearly allow loading of prepaid instruments by third party funds[9]. Hence, the root concern of the regulator seems to be that the loading of the card is being by a revolving line of credit, thereby embedding the features of a credit card into the PPI.

The way ahead

The RBI communication has been issued to all Authorised Non-Bank Prepaid Payment Instrument Issuers who have been loading the PPI through a credit line. As discussed above, the RBI has tried to clarify that such instruments which are issued through credit line will fall within the ambit of credit card and the issuers who are following such practices are required to stop immediately. Though the RBI has not mentioned any specific due date to comply with the said notification, it seems that the instructions would be applicable immediately.

In the view of the authors, it does not seem that the regulator would be concerned about the cardholder loading the PPI, with money borrowed from a lender or any other third party. Hence:

- If the loan amount was to move from the bank account of the lender to the bank acocunt of the card holder, and from there it was to be loaded on the card, there would not have been any issue.

- There would not have been any issue if a line of credit is granted by the NBFC and that line of credit is used to make payment on specified e-commerce sites or other palces. However, that would restrict the use of the loan.

Considering that there is clearly nothing wrong with the uploading of the PPI being done by money received from a third party. However, the line of credit by lender, accessible by use of the card or the app, cannot be a revolving line of credit. If it is a discrete amortising loan, and the loan is availed by the user swiping a card, that should not be a problem.

In the interim while the matter is resolved at the RBI’s end, lenders may route the loan funds through the customer’s bank account. This may increase the transaction time a bit, but that seems to be the only immediate solution. Alternatively, non-banks may act as a co-branding partner for credit cards with the specific approval of RBI.

Conclusion

The step taken by RBI will have a negative impact not just on several fintechs who have been issuing PPI under co-branding arrangements with banks/NBFCs but the customers as well, who will now have to go back to ‘no credit loaded cards’, and some of them might not even qualify for the bank’s credit approval criteria.

The concern of RBI highlighted in the letter seems to be the existence of certain new entities which are conducting financial activities without authorisation or licence, in the name of innovation. Further, the services offered under the same arrangement are often without following proper KYC checks on customers to whom such cards are issued.

According to reports, further discussions are under process to bring about a framework that would address the concerns of both non-banks and RBI. While it might take some time to develop the regulations around it, it will be interesting to see how the market evolves in the meantime.

[1] Reported by The Economic Times on June 27, 2022 <http://www.ecoti.in/hnKx0a60>

[2] Reported by The Economic Times on June 28, 2022 <https://economictimes.indiatimes.com/prime/fintech-and-bfsi/rbi-vs-card-based-fintech-firms-what-the-central-bank-diktat-means-for-the-future-of-ppi-lending/primearticleshow/92499538.cms>

[3] https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12300

[4] Para 29 of the Reserve Bank of India (Credit Card and Debit Card – Issuance and Conduct) Directions, 2022

[5] In our write-up on Personal revolving lines of credit by NBFCs: nuances and issues, a clear distinction was established between revolving lines of credit and credit cards

[6] Our analysis on Credit Card and EMI Card of NBFCs- https://vinodkothari.com/2018/07/credit-cards-and-emi-cards-from-an-nbfc-viewpoint/

[7] Para 21 of Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022 – ‘Role of co-branding partner entity’

[8] Banks and NBFCs having license to issue and co-brand credit cards. Our write-up discussing the same can be accessed here https://vinodkothari.com/wp-content/uploads/2020/12/Credit-card-write-up-1.pdf

[9] See FDIC’s rules on prepaid cards here: https://www.fdic.gov/regulations/laws/rules/6500-580.html

Leave a Reply

Want to join the discussion?Feel free to contribute!